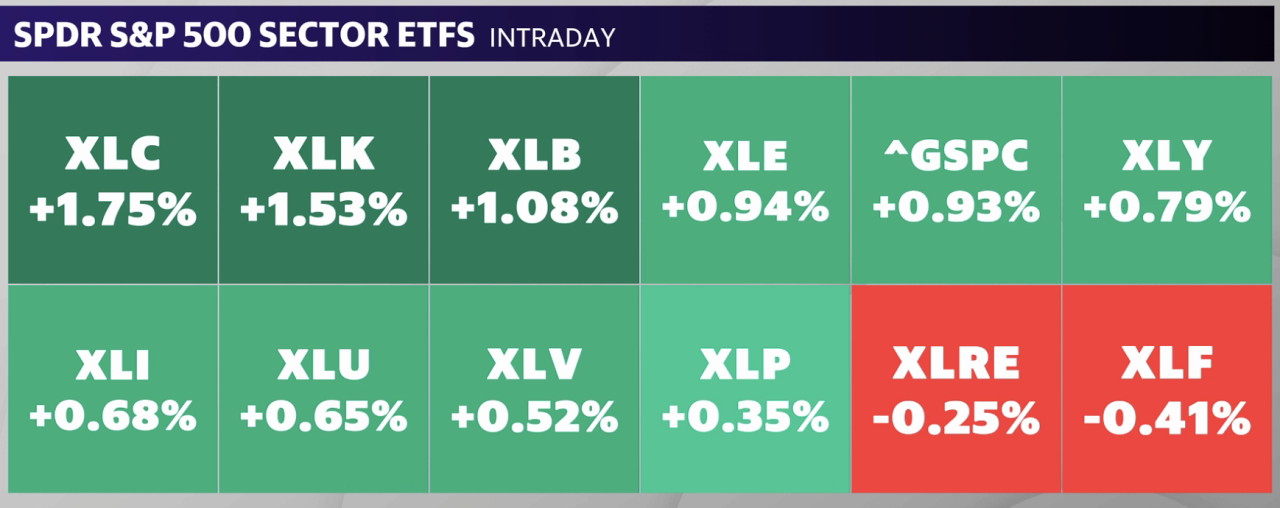

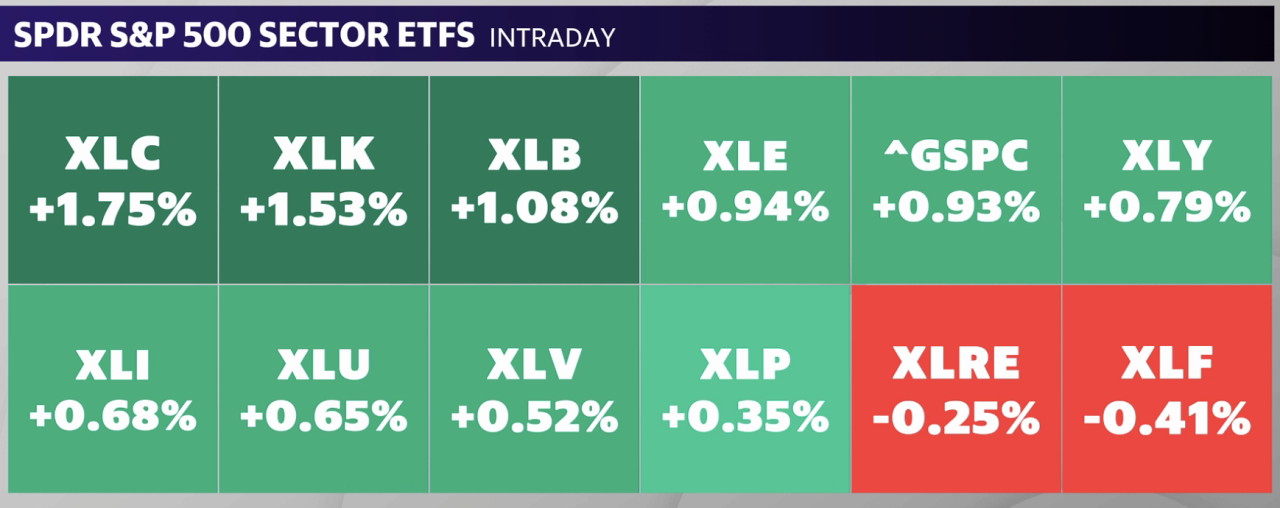

US shares rose on Thursday, staying upbeat forward of a 2nd day of carefully tracked testimony from Federal Reserve Chair Jerome Powell.Techs took the lead once more with the Nasdaq Composite (^IXIC) gaining up to 1.4%, whilst the S&P 500 (^GSPC) added nearly 1% to the touch list highs throughout the consultation. The Dow Jones Business Reasonable (^DJI) received 0.5%.Shares have risen the previous two classes because the marketplace assessed Powell’s wondering via lawmakers at the financial system and fiscal coverage, which has introduced no dangerous information or surprises. The Fed leader caught to repeating the message that the central financial institution is in no hurry to ease coverage, despite the fact that he mentioned fee cuts are more likely to come this 12 months.On Thursday, this time earlier than the Senate Banking Committee, the Fed Chair reiterated the central financial institution’s intentions on fee cuts, supplied inflation information continues to turn persevered cooling.At the financial information entrance Thursday, jobless claims launched got here in unchanged at 217,000 for the week finishing March 2. Proceeding claims registered simply above 1.9 million, about 8,000 upper from its prior print. The a very powerful non-farms payroll document is due for liberate Friday morning.In the meantime, gold (GC=F) rose for the 5th day, hitting a contemporary prime above $2,160 as the possibility of a fee reduce gave contemporary impetus to the record-setting rally.Amongst corporates, stocks of Victoria’s Secret (VSCO) plunged over 25% after the underwear maker’s gross sales steerage fell in need of expectancies.Live10 updates Thu, March 7, 2024 at 9:51 AM PSTCommunication Services and products and Generation lead marketplace rallyStocks have been upper on Thursday, techs took the lead once more with the Nasdaq Composite (^IXIC) gaining up to 1.4%, whilst the S&P 500 (^GSPC) added nearly 1% to the touch list highs throughout the consultation. The Dow Jones Business Reasonable (^DJI) received 0.5%.On a sector bass, the Communications Services and products (XLC), Generation (XLK) and Fabrics (XLB) sectors led the price all emerging over 1%.

Thu, March 7, 2024 at 9:51 AM PSTCommunication Services and products and Generation lead marketplace rallyStocks have been upper on Thursday, techs took the lead once more with the Nasdaq Composite (^IXIC) gaining up to 1.4%, whilst the S&P 500 (^GSPC) added nearly 1% to the touch list highs throughout the consultation. The Dow Jones Business Reasonable (^DJI) received 0.5%.On a sector bass, the Communications Services and products (XLC), Generation (XLK) and Fabrics (XLB) sectors led the price all emerging over 1%.

Supply: Yahoo Finance

Supply: Yahoo Finance Thu, March 7, 2024 at 9:17 AM PSTTrending tickers on Thursday New York Group Bankcorp (NYCB) The inventory received 7% on Thursday after the regional lender reduce its dividend to at least one penny in step with proportion as a part of its overhaul plan. New York Group Bancorp mentioned it misplaced 7% of its deposits over the past month. The disclosure got here at some point after the lender introduced a brand new CEO and a capital lift from a gaggle led via Steven Mnuchin, the previous US Treasury Secretary and Goldman Sachs spouse.Victoria’s Secret (VSCO) Stocks of the underwear maker sank up to 30% throughout the consultation after the corporate’s gross sales steerage got here in in need of analyst expectancies. Victoria’s Key’s forecasting web gross sales to be about $6 billion this 12 months, or down low-single digits in comparison to remaining 12 months.Meta (META)Stocks of the social media massive used to be some of the best 5 trending tickers on Yahoo Finance on Thursday. The inventory touched new highs. Meta stocks are up about 44% year-to-date. The inventory is the second one very best performer this 12 months some of the “Magnificent 7” workforce, in the back of Nvidia (NVDA), which is up 85% throughout the similar length.

Thu, March 7, 2024 at 9:17 AM PSTTrending tickers on Thursday New York Group Bankcorp (NYCB) The inventory received 7% on Thursday after the regional lender reduce its dividend to at least one penny in step with proportion as a part of its overhaul plan. New York Group Bancorp mentioned it misplaced 7% of its deposits over the past month. The disclosure got here at some point after the lender introduced a brand new CEO and a capital lift from a gaggle led via Steven Mnuchin, the previous US Treasury Secretary and Goldman Sachs spouse.Victoria’s Secret (VSCO) Stocks of the underwear maker sank up to 30% throughout the consultation after the corporate’s gross sales steerage got here in in need of analyst expectancies. Victoria’s Key’s forecasting web gross sales to be about $6 billion this 12 months, or down low-single digits in comparison to remaining 12 months.Meta (META)Stocks of the social media massive used to be some of the best 5 trending tickers on Yahoo Finance on Thursday. The inventory touched new highs. Meta stocks are up about 44% year-to-date. The inventory is the second one very best performer this 12 months some of the “Magnificent 7” workforce, in the back of Nvidia (NVDA), which is up 85% throughout the similar length. Thu, March 7, 2024 at 8:45 AM PSTMore properties are up on the market this spring, however emerging charges may stay consumers on sidelinesYahoo Finance’s Dani Romero experiences the housing marketplace’s spring promoting season may well be extra powerful this 12 months as stock alternatives up steam. On the other hand emerging charges reduce stay consumers at the sidelines.New analysis from Realtor.com displays that the choice of properties actively on the market in February jumped 14.8% in comparison to the similar month remaining 12 months. That’s the fourth consecutive month of will increase for properties indexed on the market in the marketplace.”The truth that we are beginning the 12 months with extra properties on the market than now we have noticed in the marketplace since 2020 is a in reality just right step,” Danielle Hale, leader economist of Realtor.com, advised Yahoo Finance in an interview.Stock continues to be down just about 40% in comparison to pre-pandemic ranges. In the meantime borrowing prices are ticking again up. The typical for a 30-year mounted mortgage used to be 6.94% as of remaining Thursday, up from 6.9% the prior week, consistent with Freddie Mac information.Learn extra right here.

Thu, March 7, 2024 at 8:45 AM PSTMore properties are up on the market this spring, however emerging charges may stay consumers on sidelinesYahoo Finance’s Dani Romero experiences the housing marketplace’s spring promoting season may well be extra powerful this 12 months as stock alternatives up steam. On the other hand emerging charges reduce stay consumers at the sidelines.New analysis from Realtor.com displays that the choice of properties actively on the market in February jumped 14.8% in comparison to the similar month remaining 12 months. That’s the fourth consecutive month of will increase for properties indexed on the market in the marketplace.”The truth that we are beginning the 12 months with extra properties on the market than now we have noticed in the marketplace since 2020 is a in reality just right step,” Danielle Hale, leader economist of Realtor.com, advised Yahoo Finance in an interview.Stock continues to be down just about 40% in comparison to pre-pandemic ranges. In the meantime borrowing prices are ticking again up. The typical for a 30-year mounted mortgage used to be 6.94% as of remaining Thursday, up from 6.9% the prior week, consistent with Freddie Mac information.Learn extra right here.  Thu, March 7, 2024 at 8:03 AM PSTGold extends rally as Powell reiterates most probably fee this yearGold (GC=F) prolonged its rally soaring close to its all time prime as Fed Chair Jerome Powell reiterated policymaker’s goal to chop charges this 12 months, supplied inflation information is available in as anticipated.The dear steel rose for the 5th day, touching a list previous $2,170 in step with ounce earlier than pairing positive factors. Futures have been buying and selling simply round $1,162 via 11:00 AM Japanese.The dear steel has a tendency to upward thrust when rates of interest head south and the USA buck eases. On Thursday morning Fed Chair Jerome Powell reiterated to lawmakers the central financial institution’s goal to decrease charges later this 12 months, supplied inflation information is available in as anticipated.The dollar edged decrease on Thursday, supporting the next worth for the commodity invoiced in US greenbacks.

Thu, March 7, 2024 at 8:03 AM PSTGold extends rally as Powell reiterates most probably fee this yearGold (GC=F) prolonged its rally soaring close to its all time prime as Fed Chair Jerome Powell reiterated policymaker’s goal to chop charges this 12 months, supplied inflation information is available in as anticipated.The dear steel rose for the 5th day, touching a list previous $2,170 in step with ounce earlier than pairing positive factors. Futures have been buying and selling simply round $1,162 via 11:00 AM Japanese.The dear steel has a tendency to upward thrust when rates of interest head south and the USA buck eases. On Thursday morning Fed Chair Jerome Powell reiterated to lawmakers the central financial institution’s goal to decrease charges later this 12 months, supplied inflation information is available in as anticipated.The dollar edged decrease on Thursday, supporting the next worth for the commodity invoiced in US greenbacks. Thu, March 7, 2024 at 7:15 AM PSTNvidia inventory touches new list, surpasses $900 stage Nvidia (NVDA) inventory received greater than 2% on Thursday, touching new all-time highs. Stocks of the AI darling surpassed the $900 stage to hit a top of $909.92 each and every throughout the morning consultation.Nvidia is up 88% year-to-date. The semiconductor massive has been the most efficient performer some of the “Magnificent 7” shares this 12 months.Social media massive Meta (META) additionally hit new highs on Thursday. The inventory is up 46% year-to-date.

Thu, March 7, 2024 at 7:15 AM PSTNvidia inventory touches new list, surpasses $900 stage Nvidia (NVDA) inventory received greater than 2% on Thursday, touching new all-time highs. Stocks of the AI darling surpassed the $900 stage to hit a top of $909.92 each and every throughout the morning consultation.Nvidia is up 88% year-to-date. The semiconductor massive has been the most efficient performer some of the “Magnificent 7” shares this 12 months.Social media massive Meta (META) additionally hit new highs on Thursday. The inventory is up 46% year-to-date. Thu, March 7, 2024 at 6:36 AM PSTStocks open upper forward of Fed Chair’s 2nd day of testimonyThe primary averages received on Thursday forward of Fed Chair Jerome Powell’s 2nd day of testimony earlier than congress.The Nasdaq Composite (^IXIC) rose 0.7%, whilst the S&P 500 (^GSPC) received 0.6%. The Dow Jones Business Reasonable (^DJI) additionally ticked up 0.5%.The upward push comes an afternoon after Jerome Powell used to be puzzled via lawmakers at the financial system and fiscal coverage. Powell reiterated that policymakers are in no rush to ease coverage, however fee cuts are more likely to come this 12 months. Friday’s jobs document will supply buyers with clues at the timeline for when fee reduce may come.In the meantime bitcoin (BTC-USD) hovered above $67,000 on Thursday after hitting contemporary highs previous this week.

Thu, March 7, 2024 at 6:36 AM PSTStocks open upper forward of Fed Chair’s 2nd day of testimonyThe primary averages received on Thursday forward of Fed Chair Jerome Powell’s 2nd day of testimony earlier than congress.The Nasdaq Composite (^IXIC) rose 0.7%, whilst the S&P 500 (^GSPC) received 0.6%. The Dow Jones Business Reasonable (^DJI) additionally ticked up 0.5%.The upward push comes an afternoon after Jerome Powell used to be puzzled via lawmakers at the financial system and fiscal coverage. Powell reiterated that policymakers are in no rush to ease coverage, however fee cuts are more likely to come this 12 months. Friday’s jobs document will supply buyers with clues at the timeline for when fee reduce may come.In the meantime bitcoin (BTC-USD) hovered above $67,000 on Thursday after hitting contemporary highs previous this week. Thu, March 7, 2024 at 6:00 AM PSTNYCB misplaced 7% of deposits in a single month, highlighting demanding situations of recent rescueNew York Group Bancorp (NYCB) misplaced 7% of its deposits over the span of a month, underscoring the demanding situations going through a brand new investor workforce led via Steve Mnuchin because it defined its turnaround technique Thursday.Yahoo Finance’s David Hollerith experiences the financial institution’s disclosure in an investor presentation displays general deposits had dropped to $77.2 billion as of March 5, in comparison with $83 billion that it had on Feb. 5.Kind of 80% of its deposits are these days backstopped via insurance coverage from the Federal Deposit Insurance coverage Company, whilst 20% are uninsured. It misplaced a $7.8 billion in uninsured deposits over the past month.The disclosure got here at some point after NYCB made a dramatic try to regain investor self belief via pronouncing a brand new CEO and a $1 billion infusion from a gaggle led via Mnuchin, a former US Treasury Secretary and Goldman Sachs spouse.NYCB stocks have been slightly flat in pre-market on Thursday after popping greater than 7% within the prior consultation.Learn extra right here.Thu, March 7, 2024 at 5:30 AM PSTIn the penalty field for a very long time: Victoria’s SecretThe Amazon (AMZN) bra-buying business.Victoria’s Secret (VSCO) really had a disastrous profits day remaining night time, no longer not like what took place at fellow mall dweller Foot Locker (FL) only a few hours previous. Stocks of the intimate attire participant are crashing nearly 30% within the pre-market, and it is the proper transfer.Control cited no development in gross sales traits in February from the fourth quarter’s 6% decline.JP Morgan analyst Matt Boss — who downgraded VSCO these days — added the under phase into his analysis word to purchasers that stuck my consideration. Apparently VSCO is dropping additional marketplace proportion to Amazon, a combat the corporate is not going to win. The issue is structural, personally.”Value noting at the intimates trade information, control cited the Sports activities Bra class outpacing Non-Game (i.e. Structured Bras), with the wider Intimates general addressable marketplace cut up 30% Sports activities Bras vs. 70% Non-Game (relative to VSCO over-indexing to Non-Game bras these days). To that finish, control famous the full intimates marketplace down mid-single-digits in 4Q mirrored a shift in opposition to Price/Amazon because of a challenged shopper, along with sports wear gamers comparable to Lululemon (LULU) taking proportion within the Sports activities Bra class.”In spite of the horrible quarters from VSCO/FL, there are outlets within the mall which can be profitable.Have a look under at what Abercrombie & Fitch (ANF) CEO Fran Horowitz advised me after some other quarter of double-digit gross sales positive factors on Wednesday.

Thu, March 7, 2024 at 6:00 AM PSTNYCB misplaced 7% of deposits in a single month, highlighting demanding situations of recent rescueNew York Group Bancorp (NYCB) misplaced 7% of its deposits over the span of a month, underscoring the demanding situations going through a brand new investor workforce led via Steve Mnuchin because it defined its turnaround technique Thursday.Yahoo Finance’s David Hollerith experiences the financial institution’s disclosure in an investor presentation displays general deposits had dropped to $77.2 billion as of March 5, in comparison with $83 billion that it had on Feb. 5.Kind of 80% of its deposits are these days backstopped via insurance coverage from the Federal Deposit Insurance coverage Company, whilst 20% are uninsured. It misplaced a $7.8 billion in uninsured deposits over the past month.The disclosure got here at some point after NYCB made a dramatic try to regain investor self belief via pronouncing a brand new CEO and a $1 billion infusion from a gaggle led via Mnuchin, a former US Treasury Secretary and Goldman Sachs spouse.NYCB stocks have been slightly flat in pre-market on Thursday after popping greater than 7% within the prior consultation.Learn extra right here.Thu, March 7, 2024 at 5:30 AM PSTIn the penalty field for a very long time: Victoria’s SecretThe Amazon (AMZN) bra-buying business.Victoria’s Secret (VSCO) really had a disastrous profits day remaining night time, no longer not like what took place at fellow mall dweller Foot Locker (FL) only a few hours previous. Stocks of the intimate attire participant are crashing nearly 30% within the pre-market, and it is the proper transfer.Control cited no development in gross sales traits in February from the fourth quarter’s 6% decline.JP Morgan analyst Matt Boss — who downgraded VSCO these days — added the under phase into his analysis word to purchasers that stuck my consideration. Apparently VSCO is dropping additional marketplace proportion to Amazon, a combat the corporate is not going to win. The issue is structural, personally.”Value noting at the intimates trade information, control cited the Sports activities Bra class outpacing Non-Game (i.e. Structured Bras), with the wider Intimates general addressable marketplace cut up 30% Sports activities Bras vs. 70% Non-Game (relative to VSCO over-indexing to Non-Game bras these days). To that finish, control famous the full intimates marketplace down mid-single-digits in 4Q mirrored a shift in opposition to Price/Amazon because of a challenged shopper, along with sports wear gamers comparable to Lululemon (LULU) taking proportion within the Sports activities Bra class.”In spite of the horrible quarters from VSCO/FL, there are outlets within the mall which can be profitable.Have a look under at what Abercrombie & Fitch (ANF) CEO Fran Horowitz advised me after some other quarter of double-digit gross sales positive factors on Wednesday. Thu, March 7, 2024 at 5:00 AM PSTToday’s eye-popping research of the day…Perhaps it is time to revisit the Microsoft (MSFT) sell-off.During the last 25 buying and selling days, Microsoft stocks are off via 0.4% in comparison to a 4% advance for the S&P 500. The wider Magazine 7 has been buying and selling at the shaky facet of past due, and Microsoft hasn’t been immune.Some new projections from EvercoreISI analyst Kirk Materne on Microsoft’s AI alternative may reawaken the bull case.Here is what he mentioned in a brand new word to purchasers these days:”When aggregating our bottoms up Gen AI research and taking a 5 12 months view, we now estimate Gen AI may power ~$82.5 billion in incremental income in CY28 for Microsoft in response to our ‘base case’ state of affairs, which represents a 24% uplift to our CY28 income estimate (assuming a 9% income CAGR from ’23-’28 for ‘core’ Microsoft). This could additionally constitute $5.10 in incremental EPS assuming a forty five% incremental web margin – slightly under incremental margins in prior years. Our ‘bull case’ state of affairs signifies an incremental income alternative of $142.8 billion and $12.07 in incremental EPS. Our up to date CY27 incremental AI income estimate of $54.6 billion is $4.2 billion upper than our prior ‘base case’ forecast from June 2023. Base line: The AI monetization alternative is off to a just right get started however we’re nonetheless within the very profits and in response to our research, we think Gen AI will stay an upward bias on Microsoft’s income and EPS estimates for the foreseeable long term.”Materne charges Microsoft at out-perform with a $475 worth goal, 17% above present ranges.

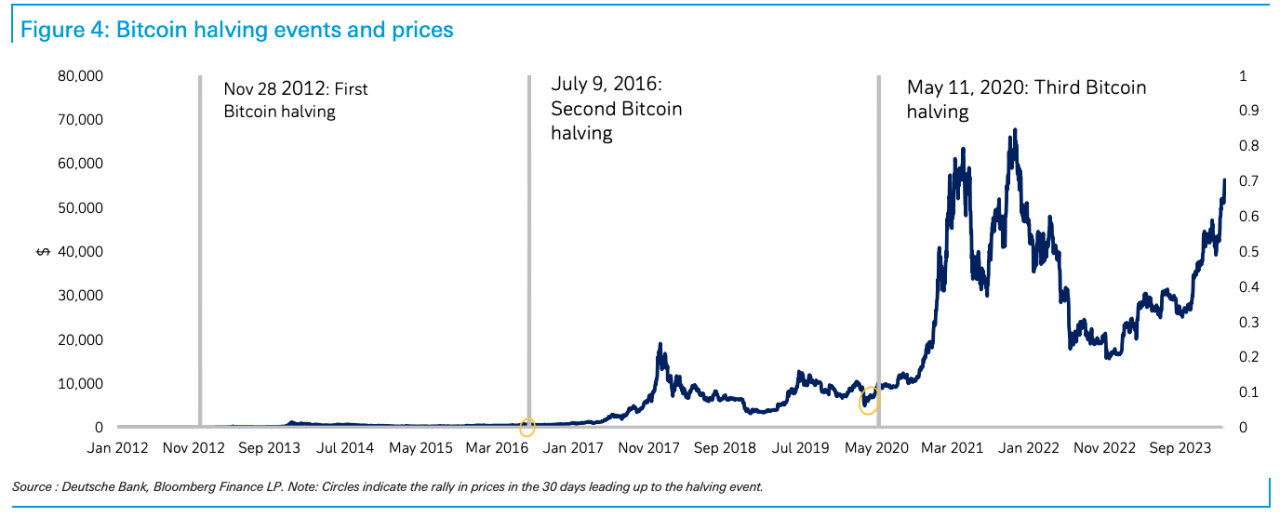

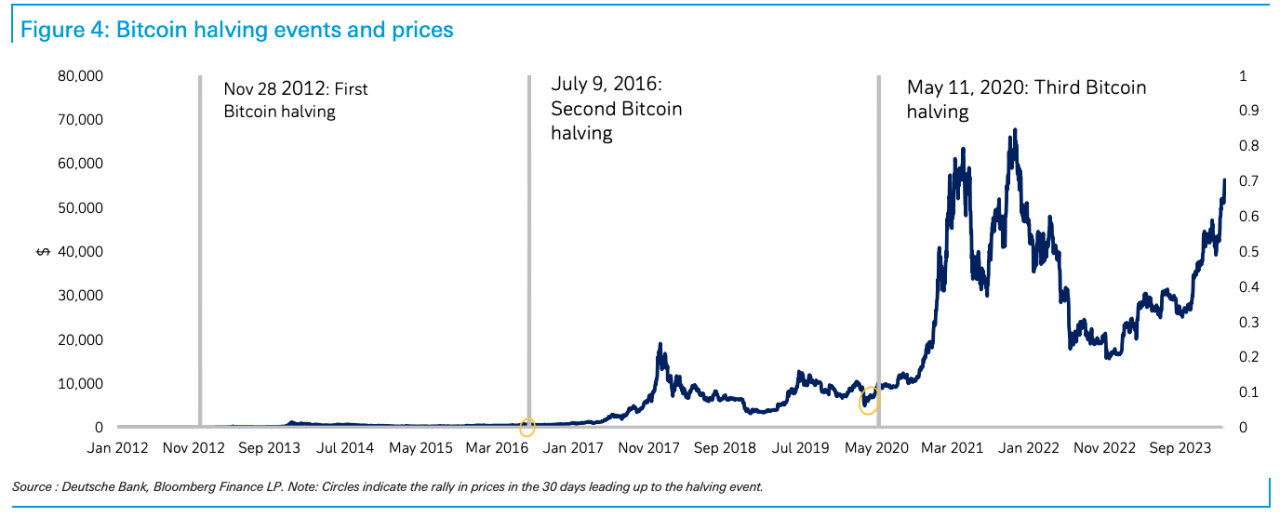

Thu, March 7, 2024 at 5:00 AM PSTToday’s eye-popping research of the day…Perhaps it is time to revisit the Microsoft (MSFT) sell-off.During the last 25 buying and selling days, Microsoft stocks are off via 0.4% in comparison to a 4% advance for the S&P 500. The wider Magazine 7 has been buying and selling at the shaky facet of past due, and Microsoft hasn’t been immune.Some new projections from EvercoreISI analyst Kirk Materne on Microsoft’s AI alternative may reawaken the bull case.Here is what he mentioned in a brand new word to purchasers these days:”When aggregating our bottoms up Gen AI research and taking a 5 12 months view, we now estimate Gen AI may power ~$82.5 billion in incremental income in CY28 for Microsoft in response to our ‘base case’ state of affairs, which represents a 24% uplift to our CY28 income estimate (assuming a 9% income CAGR from ’23-’28 for ‘core’ Microsoft). This could additionally constitute $5.10 in incremental EPS assuming a forty five% incremental web margin – slightly under incremental margins in prior years. Our ‘bull case’ state of affairs signifies an incremental income alternative of $142.8 billion and $12.07 in incremental EPS. Our up to date CY27 incremental AI income estimate of $54.6 billion is $4.2 billion upper than our prior ‘base case’ forecast from June 2023. Base line: The AI monetization alternative is off to a just right get started however we’re nonetheless within the very profits and in response to our research, we think Gen AI will stay an upward bias on Microsoft’s income and EPS estimates for the foreseeable long term.”Materne charges Microsoft at out-perform with a $475 worth goal, 17% above present ranges. Thu, March 7, 2024 at 4:30 AM PSTDeutsche Financial institution will get on board the bitcoin rocket shipAll aboard.The Deutsche Financial institution workforce is out with a word these days having a look at 5 the reason why bitcoin costs have much more room to run. It is too early within the day to position you again to sleep via detailing all 5 causes, so let me 0 in on one: April’s doable bitcoin halving tournament.The funding financial institution is asking consideration to the bullish motion in bitcoin round prior halving occasions:”Within the 30 days previous to the November 2012 halving, costs rose via 5%. A extra considerable 13% acquire used to be noticed forward of the July 2016 tournament. Maximum just lately, there used to be a large 27% worth building up within the month earlier than the Would possibly 2020 halving.”A useful timeline chart to look how this has traditionally performed out:

Thu, March 7, 2024 at 4:30 AM PSTDeutsche Financial institution will get on board the bitcoin rocket shipAll aboard.The Deutsche Financial institution workforce is out with a word these days having a look at 5 the reason why bitcoin costs have much more room to run. It is too early within the day to position you again to sleep via detailing all 5 causes, so let me 0 in on one: April’s doable bitcoin halving tournament.The funding financial institution is asking consideration to the bullish motion in bitcoin round prior halving occasions:”Within the 30 days previous to the November 2012 halving, costs rose via 5%. A extra considerable 13% acquire used to be noticed forward of the July 2016 tournament. Maximum just lately, there used to be a large 27% worth building up within the month earlier than the Would possibly 2020 halving.”A useful timeline chart to look how this has traditionally performed out:

The bitcoin bulls look forward to some other halving in April. (Deutsche Financial institution)

The bitcoin bulls look forward to some other halving in April. (Deutsche Financial institution)

Supply: Yahoo Finance

The bitcoin bulls look forward to some other halving in April. (Deutsche Financial institution)

)