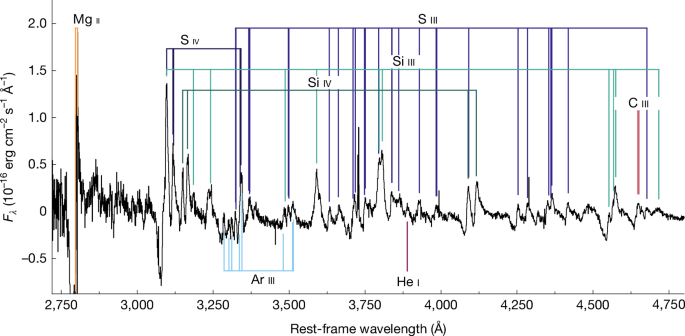

Emerging bond yields had been a key catalyst for inventory drawdowns over the last 12 months. However because the marketplace shifts to be expecting that rates of interest might stay upper than the former decade for longer than many to begin with was hoping, BMO leader funding strategist Brian Belski notes that upper charges have not at all times been a nasty arena for shares.In an research spanning again to 1990, Belski discovered the the S&P 500’s per 30 days go back has if truth be told delivered its absolute best annualized reasonable returns when the 10-Yr treasury yield (^TNX) used to be upper.Belski’s paintings displays the benchmark reasonable delivered a median annual go back of seven.7% in months the place the 10-year Treasury yield used to be lower than 4%, in comparison to a median annual go back of 14.5% in months when the 10-year used to be 6%.”In a better rate of interest setting, undoubtedly upper than 0% to at least one% or 0% to two%, shares historically do really well,” Belski mentioned. “So I believe we are recalibrating that, we nonetheless assume from those ranges shares are upper at 12 months finish.”Belski’s analysis displays that on reasonable, shares have carried out higher in a emerging price arena than in a falling price setting, too. The common annual rolling 1-year go back for the S&P 500 all through a falling price arena is 6.5%, whilst it is 13.9% in a emerging price regime.He argued this is sensible for the reason that one explanation why the Fed would stay charges decrease, or lower them, can be a slow financial enlargement outlook. Given the present backdrop is one the place the Fed feels the financial system is in a robust place to maintain upper borrowing prices, greater charges will not be so unhealthy for shares, Belski mentioned.”If we will hover between this 4% and 5% vary [at the 10-Yr Treasury yieldand nonetheless have sturdy employment, however most significantly, have very sturdy profits, and oh by means of the best way money drift, I believe the marketplace can do really well,” he added.