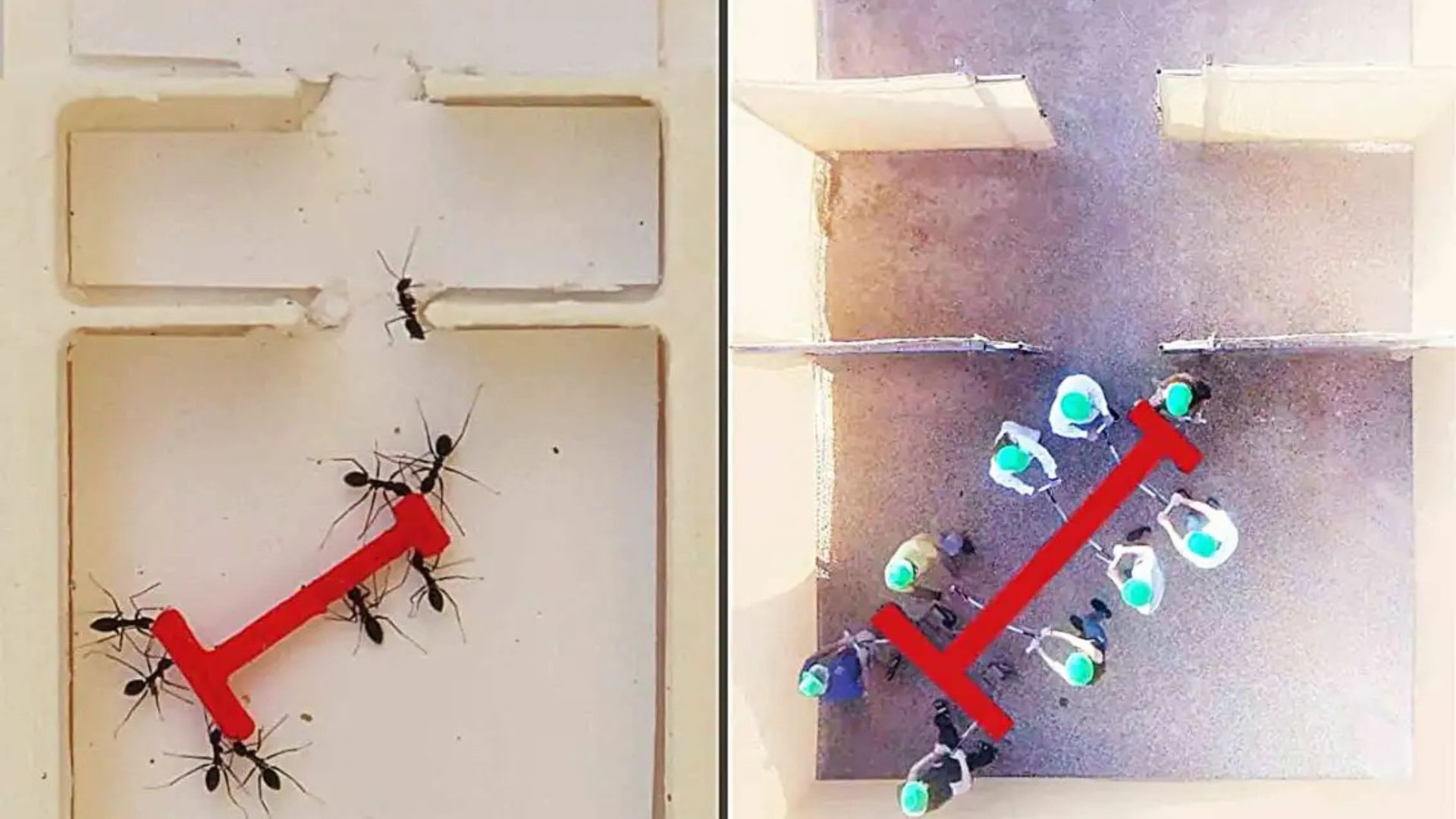

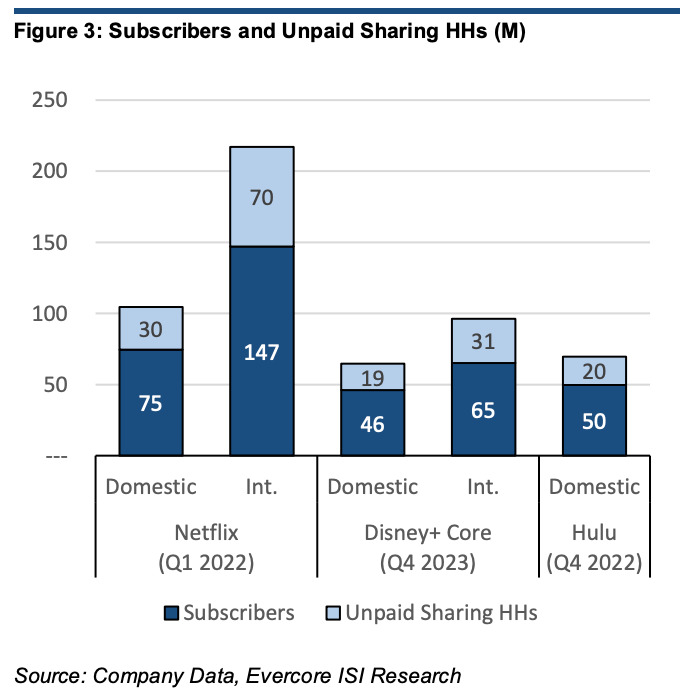

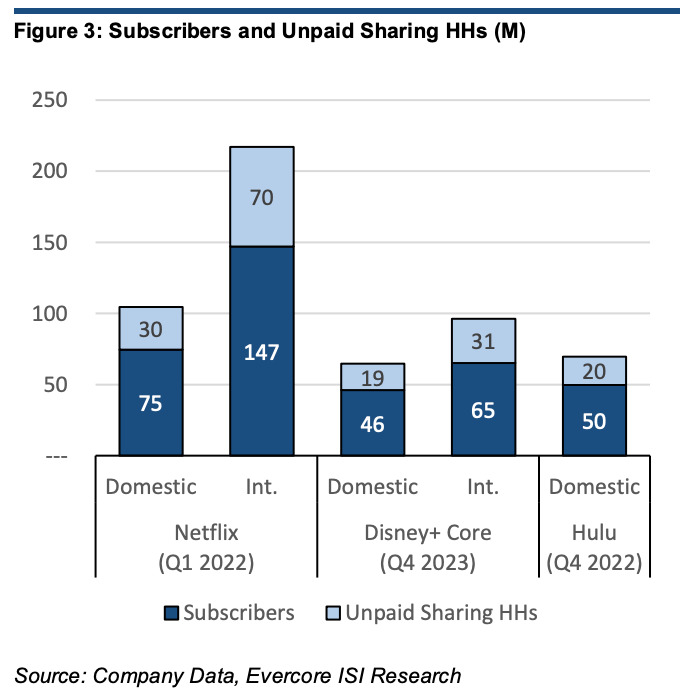

US inventory futures trod water on Monday as buyers regrouped for a packed week forward of a recent inflation knowledge take a look at for rate-cut perspectives and the beginning of first-quarter profits season.Futures at the Dow Jones Business Moderate (^DJI) and the S&P 500 (^GSPC) hugged the flatline. Contracts at the tech-heavy Nasdaq 100 (^NDX) have been additionally little modified.A robust jobs document helped carry shares to beneficial properties on Friday however could not fend off weekly losses as doubts concerning the Federal Reserve’s get to the bottom of for interest-rate cuts preyed on minds.US bonds bought off remaining week amid that uncertainty, and the force persisted Monday with a slight upward push within the 10-year Treasury yield (^TNX) to above 4.45%. That places the benchmark nearer to the important thing 4.5% stage observed by way of some as a possible tipping level for a run-up towards remaining 12 months’s highs.Different considerations added to the unsettled temper: divided perspectives on coverage from Fed audio system, rising noise across the coming US presidential election, and a spike in oil costs from escalating Center East tensions that might fan inflation pressures.All this is polishing focal point at the free up of the Client Value Index on Wednesday, a key enter within the Fed’s determination making and a clue to proceeding resilience in the United States financial system. Buyers will look ahead to indicators that inflation returned to its downward development in March after indicators of stickiness in readings previous this 12 months.On the identical time, the marketplace is bracing for the brand new profits season, with Delta Air Traces (DAL) atmosphere the degree on Wednesday for large banks’ effects on Friday. Widely, Wall Boulevard expects the primary quarter to set the tone for a powerful 12 months of profits expansion amongst S&P 500 corporations, hopes boosted by way of the blowout March hard work figures.In opposition to that backdrop, gold rose above $2,350 an oz. to the touch a recent document ahead of paring beneficial properties. In the meantime, oil pulled again from fresh multimonth highs as geopolitical tensions eased moderately after Israel withdrew extra infantrymen from southern Gaza. Brent crude futures (BZ=F) slipped to $90.40 a barrel, whilst West Texas Intermediate futures (CL=F) traded round $86.20.Live5 updates Mon, April 8, 2024 at 5:51 AM PDTDisney’s attainable carry from password sharing crackdownDisney (DIS) has a large number of password sharers to crack down on.The media massive is predicted to start tightening the grips on password sharing for Disney+ and Hula this June, teased CEO Bob Iger in a Friday TV interview.A brand new chart from EvercoreISI analyst Vivant Jayant (underneath) sheds mild on how impactful a password sharing crackdown might be to the streaming department’s profitability.

Mon, April 8, 2024 at 5:51 AM PDTDisney’s attainable carry from password sharing crackdownDisney (DIS) has a large number of password sharers to crack down on.The media massive is predicted to start tightening the grips on password sharing for Disney+ and Hula this June, teased CEO Bob Iger in a Friday TV interview.A brand new chart from EvercoreISI analyst Vivant Jayant (underneath) sheds mild on how impactful a password sharing crackdown might be to the streaming department’s profitability.

Disney will observe Netflix and crack down on password sharing. (EvercoreISI)

Disney will observe Netflix and crack down on password sharing. (EvercoreISI) Mon, April 8, 2024 at 4:32 AM PDTJamie Dimon on why the choice of public corporations continues to shrinkThe golden nuggets for buyers from Jamie Dimon’s newest annual letter these days continues on web page 35.The JP Morgan (JPM) boss issues out the “diminishing function of public corporations within the American monetary machine”, as observed within the choice of US public corporations sitting at 4,300. In 1996, that quantity stood at 7,300.Conversely, the choice of US personal corporations subsidized by way of personal fairness companies has surged to 11,200 from 1,900 during the last 20 years, notes Dimon.”This development is severe and would possibly rather well build up with extra law and litigation coming. Together with a frank overview of the law panorama, we in reality wish to believe: Is that this the result we would like?,” Dimon writes.Dimon calls out a number of components for this disparity:Intensified reporting necessities (see ESG).Upper litigation bills.Pricey laws.”Cookie-cutter” board governance.Shareholder activism.Much less capital flexibility.Heightened public scrutiny.”Relentless force” of quarterly profits.I do surprise, then again, if much less public corporations has been the motive force of upper inventory costs since Dimon took over as CEO within the early 2000s. Much less provide of belongings, extra festival for the ones belongings — no?

Mon, April 8, 2024 at 4:32 AM PDTJamie Dimon on why the choice of public corporations continues to shrinkThe golden nuggets for buyers from Jamie Dimon’s newest annual letter these days continues on web page 35.The JP Morgan (JPM) boss issues out the “diminishing function of public corporations within the American monetary machine”, as observed within the choice of US public corporations sitting at 4,300. In 1996, that quantity stood at 7,300.Conversely, the choice of US personal corporations subsidized by way of personal fairness companies has surged to 11,200 from 1,900 during the last 20 years, notes Dimon.”This development is severe and would possibly rather well build up with extra law and litigation coming. Together with a frank overview of the law panorama, we in reality wish to believe: Is that this the result we would like?,” Dimon writes.Dimon calls out a number of components for this disparity:Intensified reporting necessities (see ESG).Upper litigation bills.Pricey laws.”Cookie-cutter” board governance.Shareholder activism.Much less capital flexibility.Heightened public scrutiny.”Relentless force” of quarterly profits.I do surprise, then again, if much less public corporations has been the motive force of upper inventory costs since Dimon took over as CEO within the early 2000s. Much less provide of belongings, extra festival for the ones belongings — no? Mon, April 8, 2024 at 4:05 AM PDTDimon succession watchers would possibly banquet in this oneCount me as very eager about what JP Morgan (JPM) is operating on within the box of synthetic intelligence.Dimon says in his annual letter these days the corporate now has 2,000 AI/device finding out professionals and information scientists. He provides the corporate has 400 use circumstances in manufacturing in spaces reminiscent of advertising and marketing, fraud and chance — and they’re “more and more riding retail trade price throughout our companies and purposes.”I’m similarly eager about Dimon shedding COO Daniel Pinto’s identify (who has lengthy been observed as a Dimon successor) into his vital feedback on AI. Dimon perspectives AI as so undertaking important to JPM’s long term luck, he has created a brand new function referred to as the manager knowledge and analytics officer. This function sits at the corporate’s running committee and experiences at once to Dimon and Pinto.Says Dimon:”Raising this new function to the running committee stage — reporting at once to Daniel Pinto and me — displays how important this serve as will likely be going ahead and the way severely we think AI to persuade our trade. This may occasionally embed knowledge and analytics into our determination making at each and every stage of the corporate. The main focal point is not only at the technical facets of AI but in addition on how all control can — and must — use it. Every of our traces of commercial has corresponding knowledge and analytics roles so we will be able to proportion easiest practices, expand reusable answers that resolve more than one trade issues, and frequently be informed and toughen as the way forward for AI unfolds.”

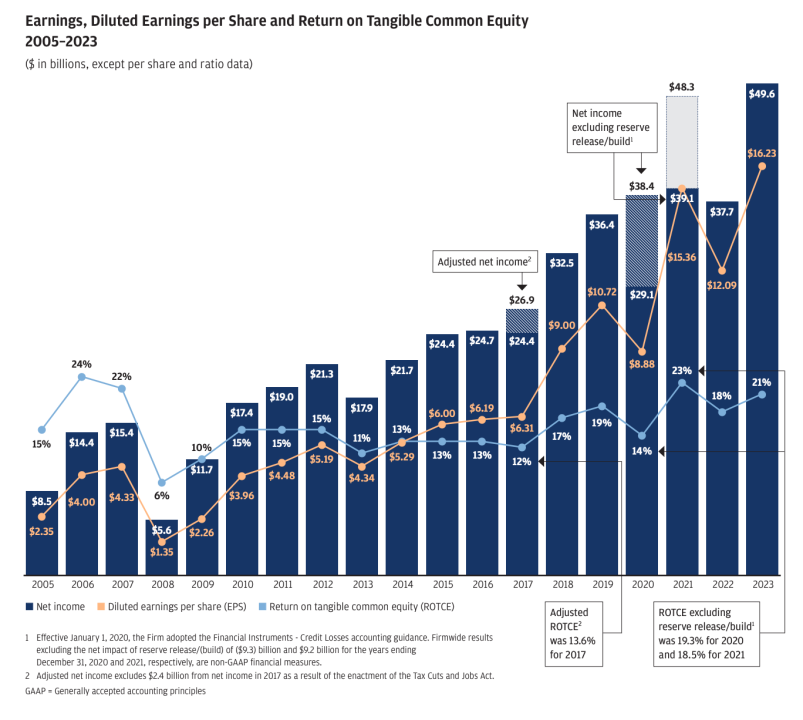

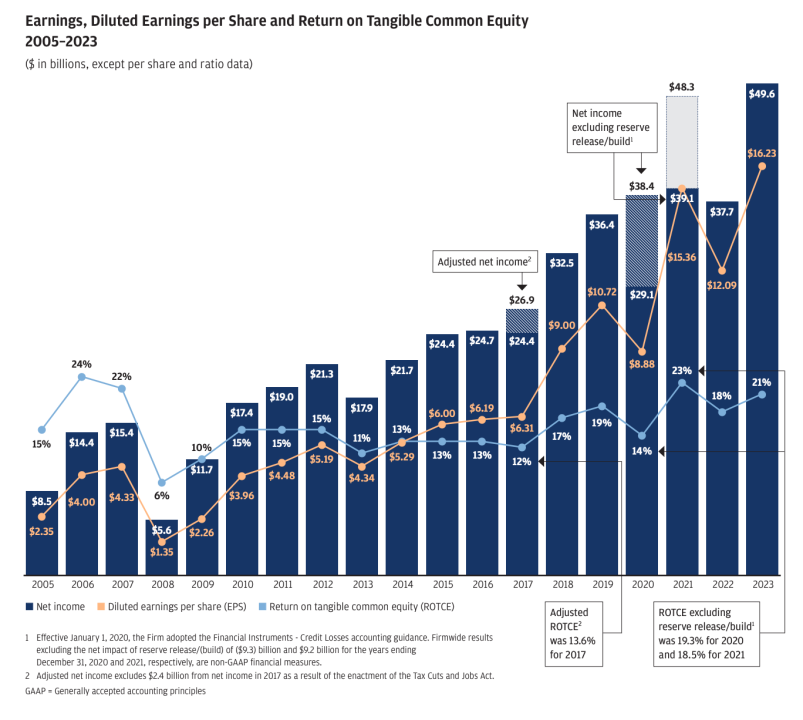

Mon, April 8, 2024 at 4:05 AM PDTDimon succession watchers would possibly banquet in this oneCount me as very eager about what JP Morgan (JPM) is operating on within the box of synthetic intelligence.Dimon says in his annual letter these days the corporate now has 2,000 AI/device finding out professionals and information scientists. He provides the corporate has 400 use circumstances in manufacturing in spaces reminiscent of advertising and marketing, fraud and chance — and they’re “more and more riding retail trade price throughout our companies and purposes.”I’m similarly eager about Dimon shedding COO Daniel Pinto’s identify (who has lengthy been observed as a Dimon successor) into his vital feedback on AI. Dimon perspectives AI as so undertaking important to JPM’s long term luck, he has created a brand new function referred to as the manager knowledge and analytics officer. This function sits at the corporate’s running committee and experiences at once to Dimon and Pinto.Says Dimon:”Raising this new function to the running committee stage — reporting at once to Daniel Pinto and me — displays how important this serve as will likely be going ahead and the way severely we think AI to persuade our trade. This may occasionally embed knowledge and analytics into our determination making at each and every stage of the corporate. The main focal point is not only at the technical facets of AI but in addition on how all control can — and must — use it. Every of our traces of commercial has corresponding knowledge and analytics roles so we will be able to proportion easiest practices, expand reusable answers that resolve more than one trade issues, and frequently be informed and toughen as the way forward for AI unfolds.” Mon, April 8, 2024 at 3:50 AM PDTJP Morgan CEO Jamie Dimon’s masterclass in getting cash, in a single chartWant to understand why JP Morgan (JPM) buyers hope Jamie Dimon remains CEO for fifty extra years?Positive the man is the face of banking with the most efficient relationships within the recreation, however on the finish of the day — he simply is aware of learn how to make jobs of cash for shareholders.That is completely captured in Dimon’s annual letter out this morning. Take a look at this chart on web page 8, appearing how JP Morgan’s internet source of revenue has grown by way of about six instances since 2005.

Mon, April 8, 2024 at 3:50 AM PDTJP Morgan CEO Jamie Dimon’s masterclass in getting cash, in a single chartWant to understand why JP Morgan (JPM) buyers hope Jamie Dimon remains CEO for fifty extra years?Positive the man is the face of banking with the most efficient relationships within the recreation, however on the finish of the day — he simply is aware of learn how to make jobs of cash for shareholders.That is completely captured in Dimon’s annual letter out this morning. Take a look at this chart on web page 8, appearing how JP Morgan’s internet source of revenue has grown by way of about six instances since 2005.

The cash device this is JP Morgan. (JP Morgan)

The cash device this is JP Morgan. (JP Morgan) Mon, April 8, 2024 at 3:28 AM PDTHere’s Jamie Dimon’s newest pondering on the place rates of interest would possibly goJP Morgan (JPM) CEO Jamie Dimon simply dropped his newest annual letter to shareholders. You’ll learn it right here in complete. Yahoo Finance’s David Hollerith supplies research of the letter right here.Dimon does not waste anytime weighing in at the outlook for rates of interest, apparently echoing what now we have heard from some hawkish FOMC individuals (which has confused shares) in fresh weeks:”Despite the unsettling panorama, together with remaining 12 months’s regional financial institution turmoil, the U.S. financial system is still resilient, with customers nonetheless spending, and the markets these days be expecting a cushy touchdown. You will need to word that the financial system is being fueled by way of massive quantities of presidency deficit spending and previous stimulus. There could also be a rising want for larger spending as we proceed transitioning to a greener financial system, restructuring world provide chains, boosting army expenditure and struggling with emerging healthcare prices. This will likely result in stickier inflation and better charges than markets be expecting. Moreover, there are problem dangers to observe. Quantitative tightening is draining greater than $900 billion in liquidity from the machine yearly — and now we have by no means in point of fact skilled the total impact of quantitative tightening in this scale. Plus the continued wars in Ukraine and the Center East proceed to have the possible to disrupt power and meals markets, migration, and armed forces and financial relationships, along with their dreadful human price. Those important and moderately extraordinary forces motive us to stay wary.”Curiously, JP Morgan strategists mentioned this morning they see bond yields going decrease:“With appreciate to bond yields’ route, our name remaining October was once to move lengthy period, that bond yields have most likely peaked. After the 12 months up to now bounceback, we predict that yields will resume transferring decrease. Our fastened source of revenue group forecasts that US and German 10-year yields will likely be underneath present on 3-, 6- and 9-month horizons. We basically accept as true with this, particularly given the increased geopolitical dangers at the present, however word the hazards of inflation staying too sizzling.”

Mon, April 8, 2024 at 3:28 AM PDTHere’s Jamie Dimon’s newest pondering on the place rates of interest would possibly goJP Morgan (JPM) CEO Jamie Dimon simply dropped his newest annual letter to shareholders. You’ll learn it right here in complete. Yahoo Finance’s David Hollerith supplies research of the letter right here.Dimon does not waste anytime weighing in at the outlook for rates of interest, apparently echoing what now we have heard from some hawkish FOMC individuals (which has confused shares) in fresh weeks:”Despite the unsettling panorama, together with remaining 12 months’s regional financial institution turmoil, the U.S. financial system is still resilient, with customers nonetheless spending, and the markets these days be expecting a cushy touchdown. You will need to word that the financial system is being fueled by way of massive quantities of presidency deficit spending and previous stimulus. There could also be a rising want for larger spending as we proceed transitioning to a greener financial system, restructuring world provide chains, boosting army expenditure and struggling with emerging healthcare prices. This will likely result in stickier inflation and better charges than markets be expecting. Moreover, there are problem dangers to observe. Quantitative tightening is draining greater than $900 billion in liquidity from the machine yearly — and now we have by no means in point of fact skilled the total impact of quantitative tightening in this scale. Plus the continued wars in Ukraine and the Center East proceed to have the possible to disrupt power and meals markets, migration, and armed forces and financial relationships, along with their dreadful human price. Those important and moderately extraordinary forces motive us to stay wary.”Curiously, JP Morgan strategists mentioned this morning they see bond yields going decrease:“With appreciate to bond yields’ route, our name remaining October was once to move lengthy period, that bond yields have most likely peaked. After the 12 months up to now bounceback, we predict that yields will resume transferring decrease. Our fastened source of revenue group forecasts that US and German 10-year yields will likely be underneath present on 3-, 6- and 9-month horizons. We basically accept as true with this, particularly given the increased geopolitical dangers at the present, however word the hazards of inflation staying too sizzling.”

Disney will observe Netflix and crack down on password sharing. (EvercoreISI)

The cash device this is JP Morgan. (JP Morgan)