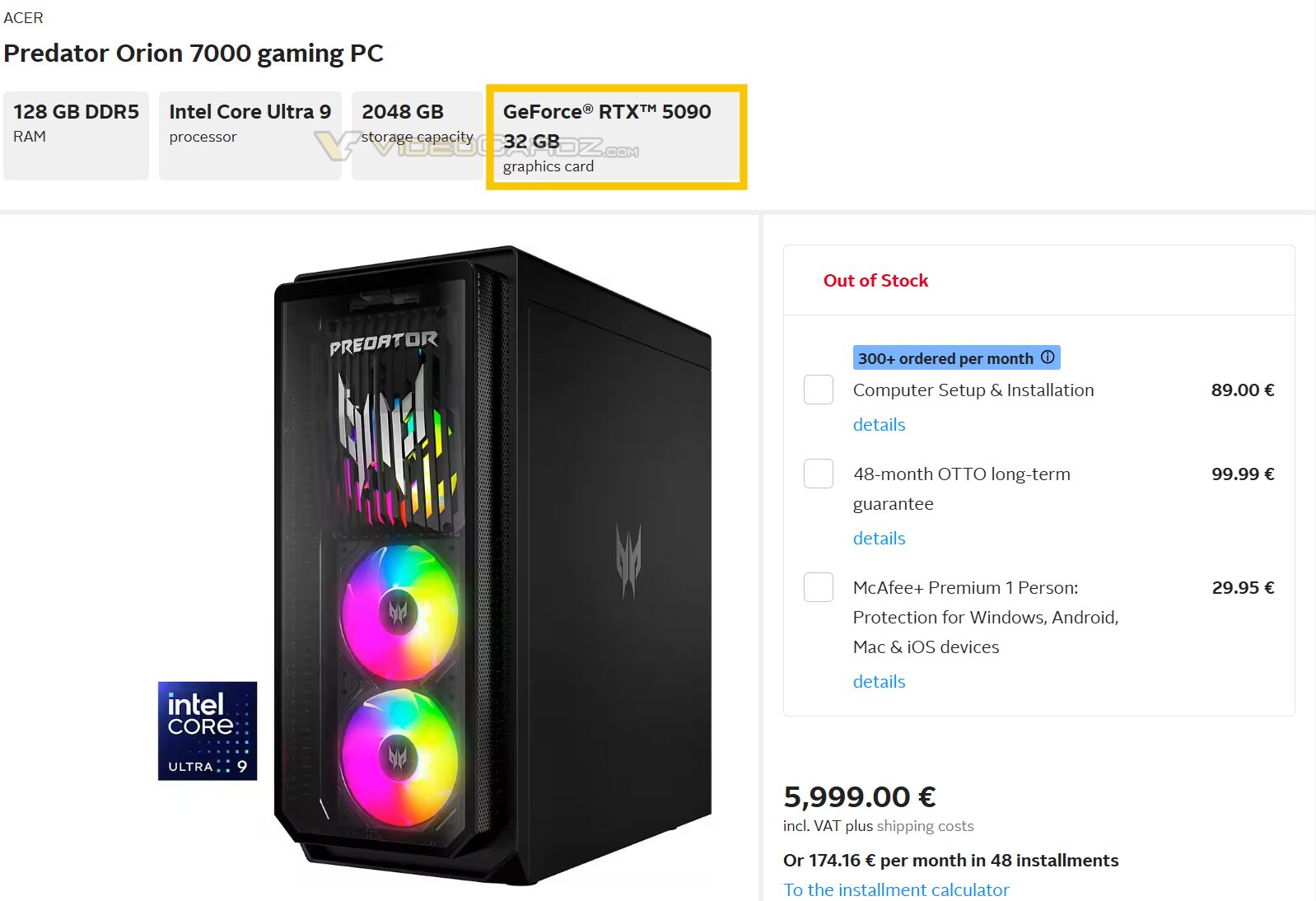

Liberate the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.Investors are bracing for giant swings in Nvidia’s percentage worth and wider monetary markets when the chipmaking massive experiences first-quarter income on Wednesday.Choices task surrounding the inventory has mushroomed amid a ferocious rally that has noticed Nvidia’s marketplace cap building up greater than six-fold to $2.3tn for the reason that get started of 2023, because the chipmaker has emerged because the go-to producer of the graphics processing gadgets that energy generative AI.Present premiums in choices markets suggest that buyers are expecting an 8.6 in line with cent swing within the percentage worth in both route — an identical to a marketplace achieve or lack of greater than $180bn — when markets open on Thursday after the corporate publishes its newest effects, consistent with Bloomberg knowledge.The combo of Nvidia’s huge measurement and the volatility of its inventory has given the corporate outsize significance in figuring out the temper and route of the broader marketplace, analysts say. “It’s Nvidia’s marketplace, we’re all simply buying and selling in it,” mentioned Steve Sosnick, leader strategist at Interactive Agents. “If it even hints [at a slowdown], that may be very harmful for the entire marketplace.”Nvidia’s income have lately develop into market-moving occasions. Analysts at JPMorgan this week ranked an Nvidia income leave out at the back of best “recessionary or stagflationary” financial knowledge and “excessive” investor positioning in a listing of doable eventualities that might drag america inventory marketplace meaningfully decrease.One of the vital inventory’s greatest strikes had come after the corporate reported effects. Nvidia’s percentage worth rose 24.4 in line with cent within the consultation after its income free up closing Might, via 16.4 in line with cent in February and via 14 in line with cent after its effects a 12 months sooner than. Charlie McElligott, managing director of cross-asset technique at Nomura, mentioned a excellent set of effects for Nvidia may just end up as really helpful for fairness markets as benign inflation numbers. Each would “re-engage euphoria”, McElligott wrote in a word to shoppers closing week.Nvidia’s large marketplace clout approach its affect is felt past america fairness marketplace. Metals buyers might be paying “an amazing quantity of consideration” to the corporate’s effects, mentioned Al Munro, a dealer at Marex. One rising marketplace bond dealer at a big US financial institution mentioned Nvidia income had previously moved costs of African sovereign debt. When the inventory rallies, “it strikes the entire marketplace and chance sentiment all over improves”, the individual mentioned. Investors are interested in Nvidia via its volatility — or “implied beta”, within the jargon. The S&P 500, by contrast, has for months been strangely calm.Through buck worth, Nvidia choices now incessantly account for nearly one-third of all US choices tied to a unmarried corporate, and on some days accounted for nearer to part, consistent with knowledge amassed via analysis team Asym500. Within the first quarter, its $115bn moderate notional possibility quantity used to be greater than double second-place Tesla’s.Nvidia’s stocks “are dear and risky, however the choices are liquid. The ones are the precise issues you wish to have to look as an choices dealer,” Sosnick mentioned.For the reason that AI growth started in 2023, Nvidia’s implied beta has usually ranged between 3 and four, indicating that for each 1 in line with cent transfer within the S&P 500, Nvidia will upward push or fall via up to 4 in line with cent. This makes it one of the most easiest beta securities in america, consistent with Garrett DeSimone, head of quantitative analysis at OptionMetrics.Really helpful In contemporary days, choices buyers seem to have develop into extra bullish about Nvidia’s upcoming effects. Bloomberg knowledge presentations there was an building up in purchases of calls — which confer the fitting to shop for a inventory at an agreed worth — with a $1,000 strike worth, a big top rate to Nvidia’s present percentage worth of $947.That used to be bolstered via 3 Wall Side road teams — Stifel, Susquehanna and Barclays — all upgrading their goal forecasts days sooner than the consequences.But most of the international’s biggest traders seem to have erred at the facet of warning. Stanley Druckenmiller’s Duquesne circle of relatives workplace slashed its Nvidia publicity via 72 in line with cent within the first quarter and Cathie Picket’s Ark Funding Control lower its place in February.Hedge price range together with Coatue Control, DE Shaw, Fort Advisors, Two Sigma, Renaissance Applied sciences and Millennium additionally took some benefit right through the primary 3 months of the 12 months, consistent with filings to the Securities and Change Fee closing week.

In contemporary days, choices buyers seem to have develop into extra bullish about Nvidia’s upcoming effects. Bloomberg knowledge presentations there was an building up in purchases of calls — which confer the fitting to shop for a inventory at an agreed worth — with a $1,000 strike worth, a big top rate to Nvidia’s present percentage worth of $947.That used to be bolstered via 3 Wall Side road teams — Stifel, Susquehanna and Barclays — all upgrading their goal forecasts days sooner than the consequences.But most of the international’s biggest traders seem to have erred at the facet of warning. Stanley Druckenmiller’s Duquesne circle of relatives workplace slashed its Nvidia publicity via 72 in line with cent within the first quarter and Cathie Picket’s Ark Funding Control lower its place in February.Hedge price range together with Coatue Control, DE Shaw, Fort Advisors, Two Sigma, Renaissance Applied sciences and Millennium additionally took some benefit right through the primary 3 months of the 12 months, consistent with filings to the Securities and Change Fee closing week.

Investors brace for giant swings in Nvidia stocks