This metric isolates the fee foundation of older UTXOs (unspent transaction outputs), providing insights into the habits of long-term holders. Those buyers usually gather all over undergo markets and distribute in bull stages.

A emerging long-term learned cap suggests sustains capital inflows and rising conviction, whilst a decline would possibly level to profit-taking or weakening marketplace sentiment.

Traditionally, Bitcoin has reacted sharply every time this metric has approached key ranges – Both launching new rallies or falling into consolidation.

What does the information say?

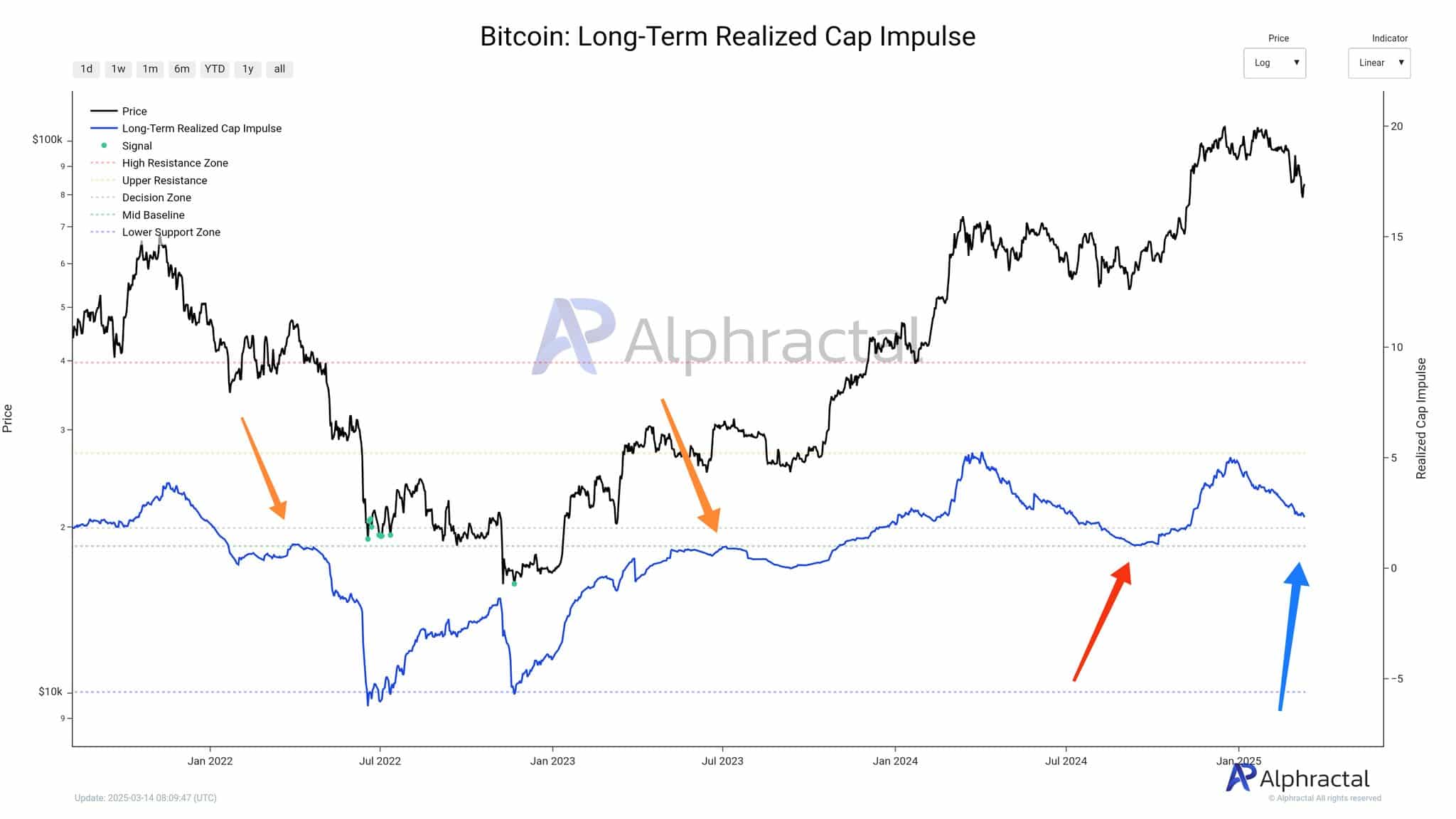

Supply: Alphractal

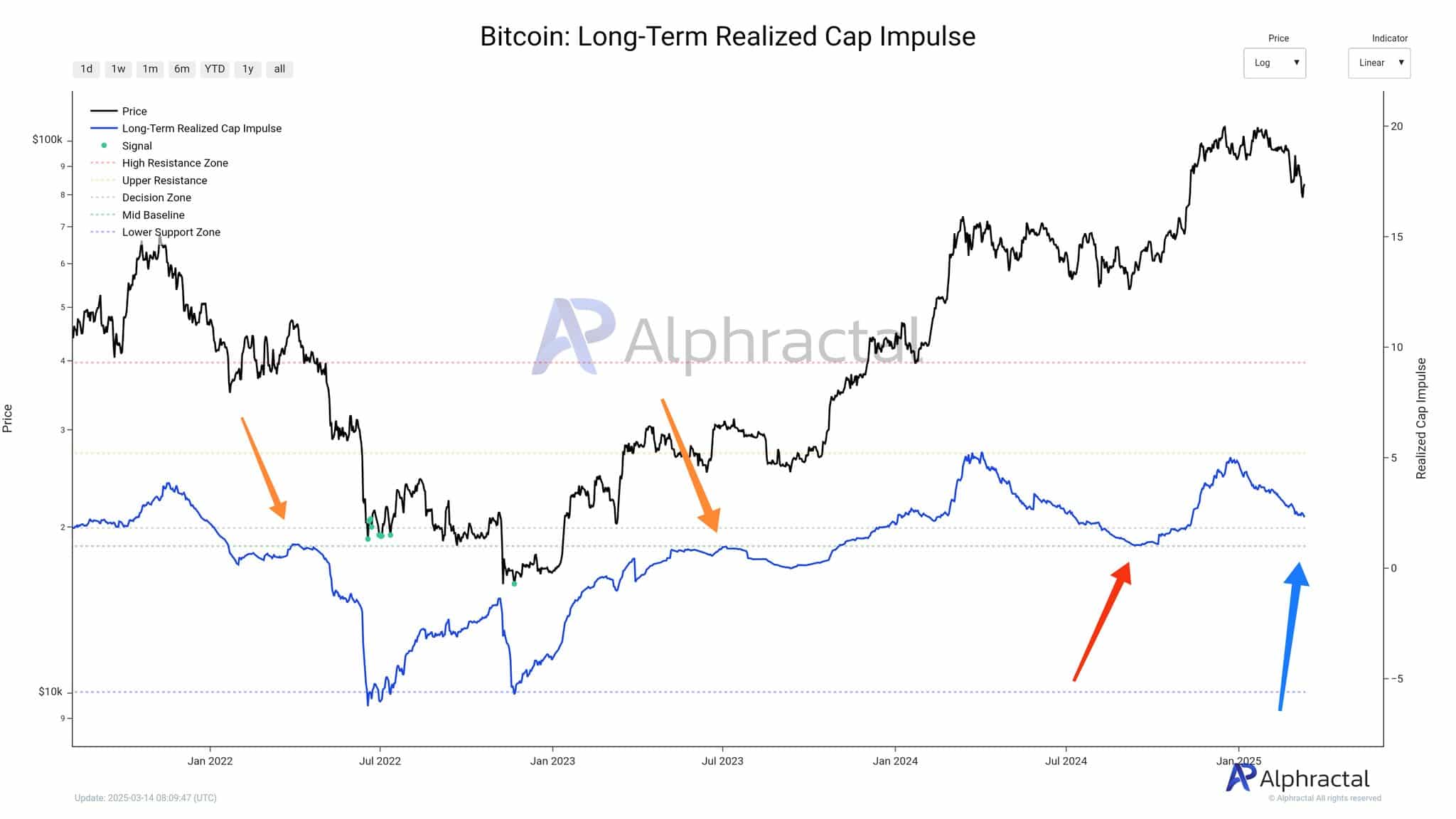

Supply: Alphractal

Newest information printed a decline from native highs, with the metric drifting in opposition to the mid-baseline. This cooling development may point out that the marketplace is also coming into a pause after months of bullish momentum.

Traditionally, a impartial or unfavorable learned cap impulse has preceded consolidation stages – or, in some circumstances, marketplace corrections. Within the connected chart, the most recent purple arrow pointed to this chance, regardless that a blue arrow hinted at the opportunity of a restoration.

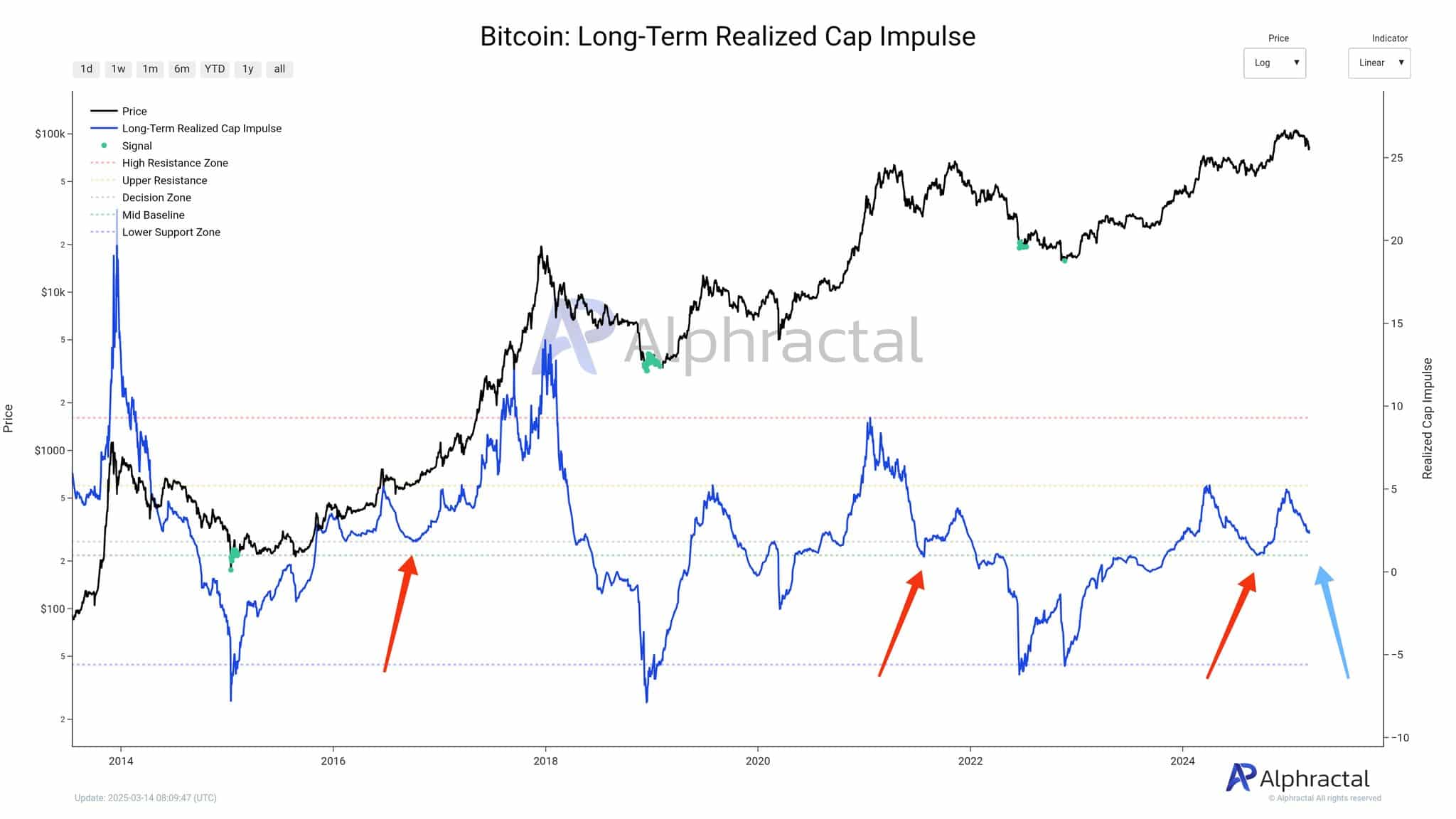

Supply: Alphractal

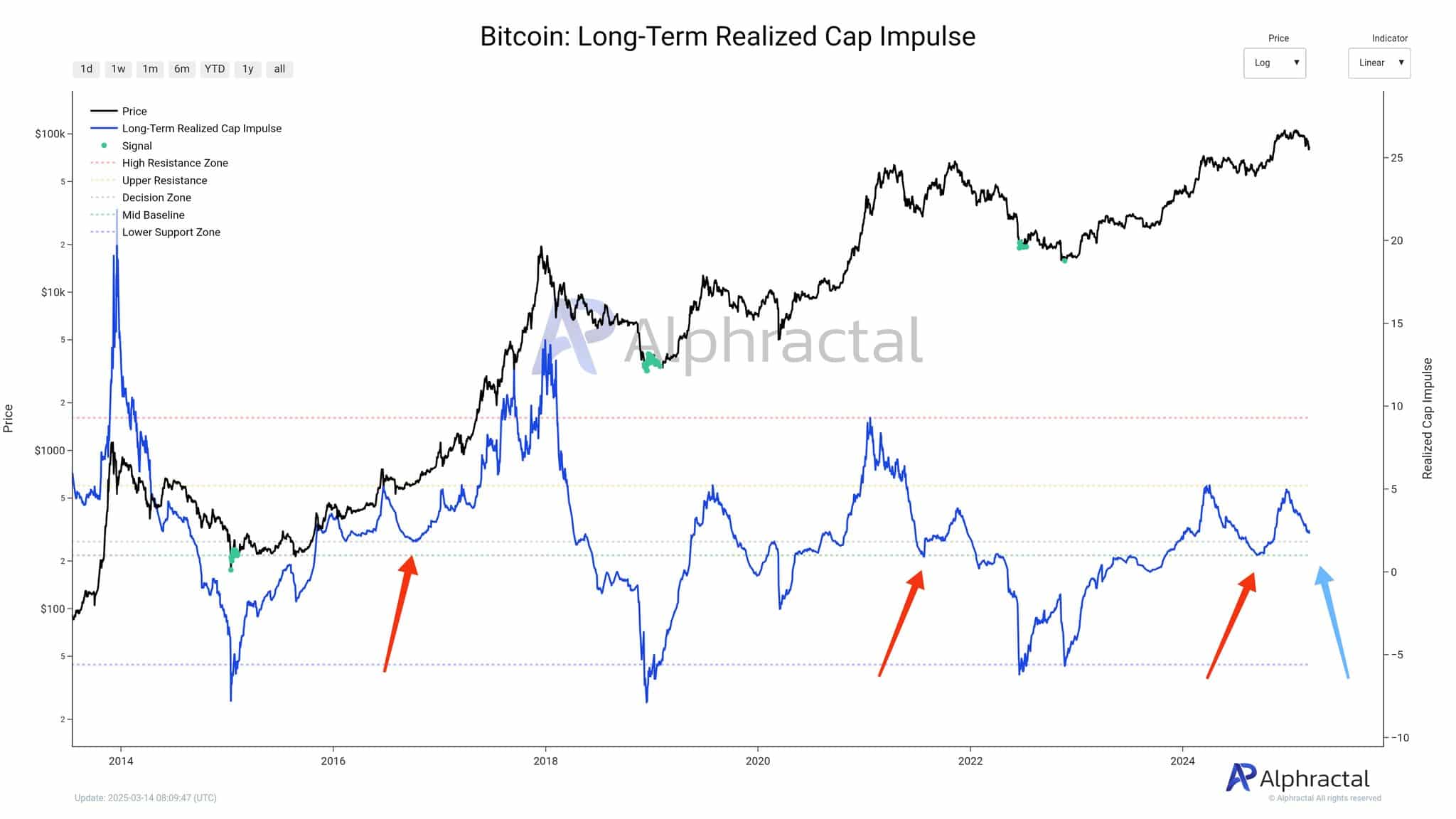

Supply: Alphractal

Particularly, in each 2016 and 2020, dips on this metric have been adopted through renewed bullish momentum and eventual all-time highs. If this trend holds, Bitcoin may quickly shift into an accumulation segment forward of some other breakout.

Nonetheless, whilst on-chain alerts stay cautiously positive, macro and market-specific components will closely affect the street forward.

Bitcoin’s worth outlook

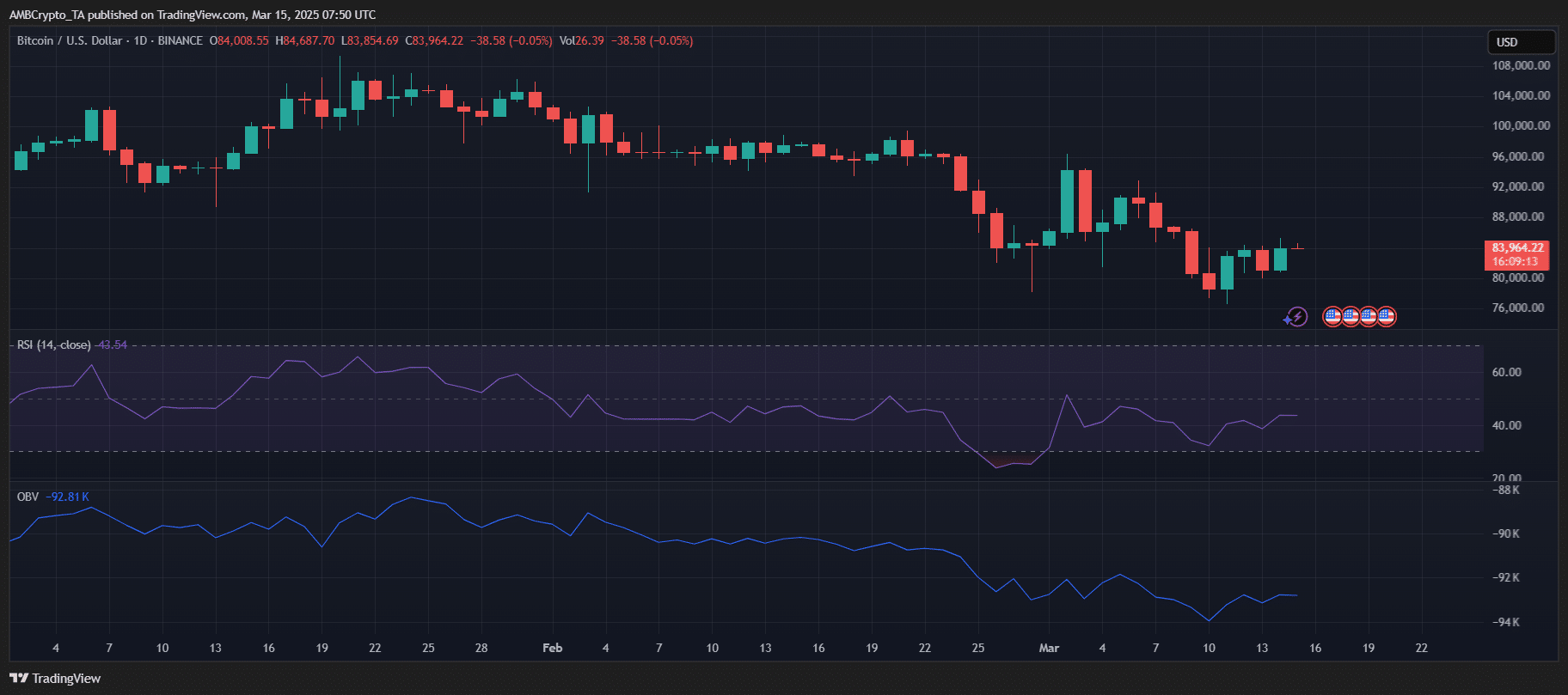

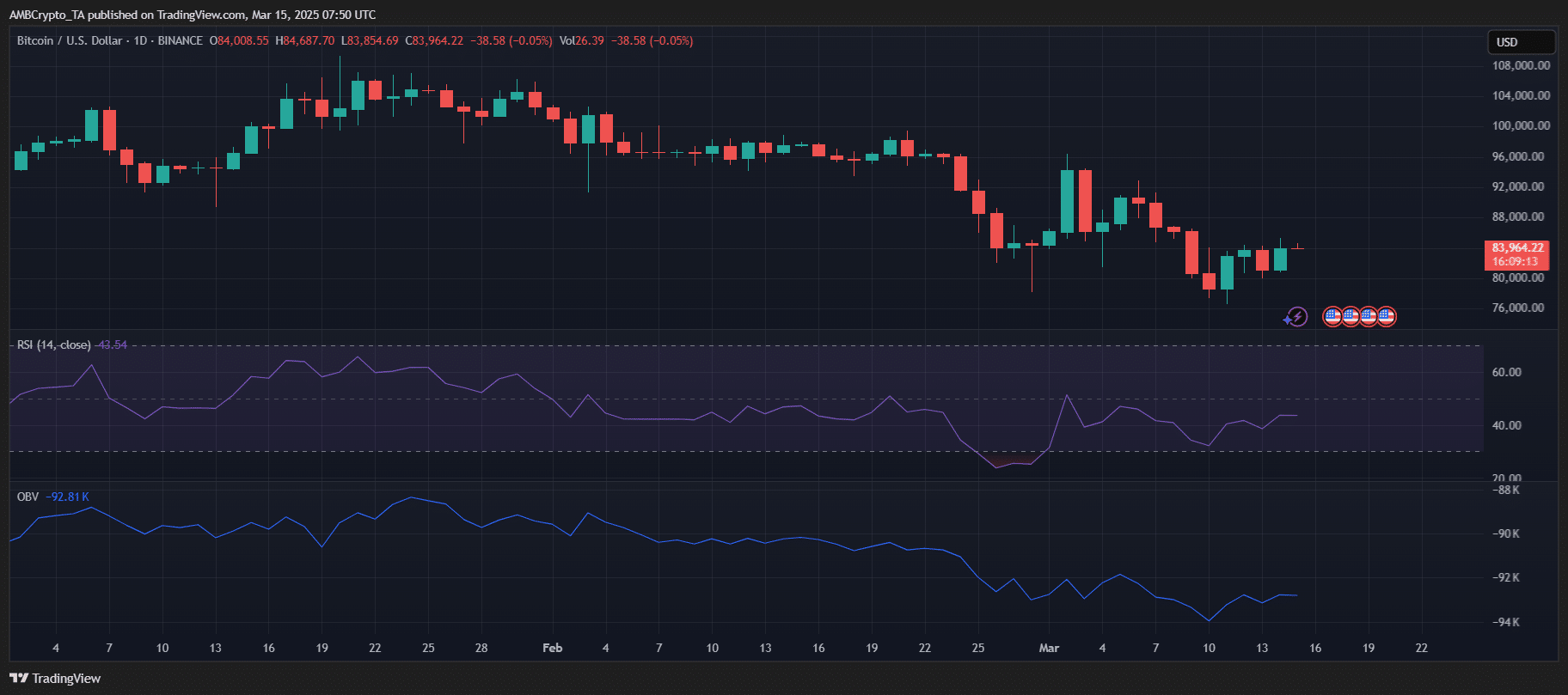

Supply: TradingView

Supply: TradingView

Bitcoin was once buying and selling at $83,964 at press time, following a minor decline of 0.05%. The RSI sat at 43.54, beneath the impartial 50 degree – Suggesting dealers nonetheless cling the higher hand. OBV additionally persevered its downtrend, reflecting fading buy-side drive.

The wider worth construction has been bearish too, with a constant trend of decrease highs and decrease lows since February. A decisive smash above $88,000 is had to opposite this development. Conversely, a drop beneath $82,000 may open the door to additional drawback.

Till consumers regain regulate, Bitcoin could be more likely to stay range-bound. Or worse, development decrease within the quick time period.

![Galaxy Z Fold 7 proves thinner than the ‘international’s slimmest foldable’ in side-by-side comparability [Video] Galaxy Z Fold 7 proves thinner than the ‘international’s slimmest foldable’ in side-by-side comparability [Video]](https://9to5google.com/wp-content/uploads/sites/4/2025/07/galaxy-z-fold-7-35.jpg?quality=82&strip=all&w=1600)