PEPE hits $2.6 billion buying and selling quantity as technical alerts point out doable bullish breakout alternatives.

73.6% of PEPE holders are in benefit, with key resistance at $0.000022 and robust enhance at $0.000013.

The crypto marketplace has skilled blended developments during the last two weeks, with a pointy shift from bullish sentiment to bearish warning. Some of the affected belongings, meme cash like Pepe [PEPE] have noticed lowered buying and selling hobby as consideration returns to Bitcoin [BTC].

In spite of this, technical signs counsel PEPE may well be poised for a rebound as buying and selling quantity reaches $2.6 billion.

TD sequential purchase sign signifies doable rebound

Technical research equipment are signaling a possible turnaround for PEPE. The TD Sequential indicator has offered a purchase sign at the day by day chart, usually interpreted as an indication of an upcoming value reversal.

Such alerts prior to now have frequently preceded upward value actions, making it a point of interest for buyers expecting a rebound.

Supply: X

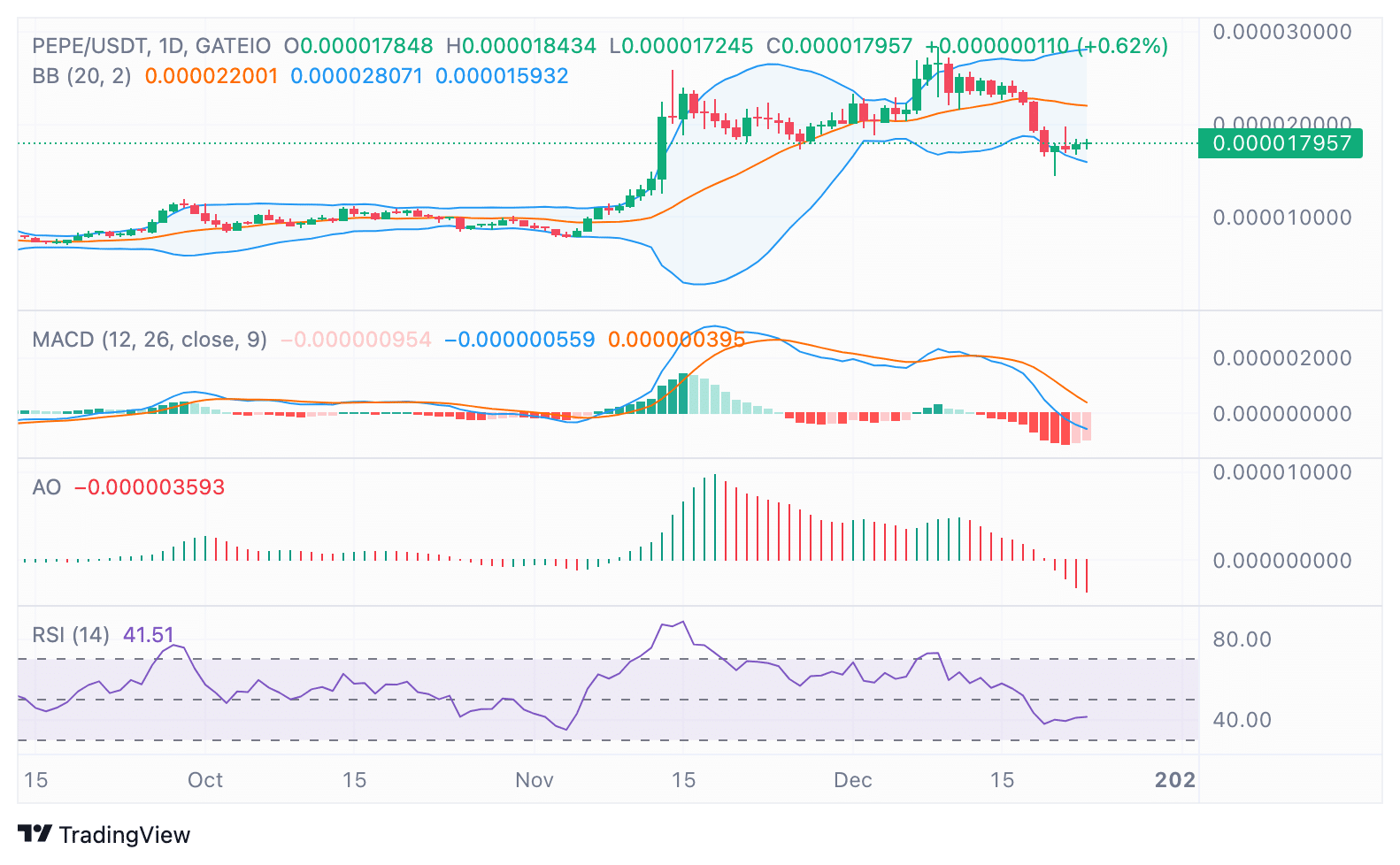

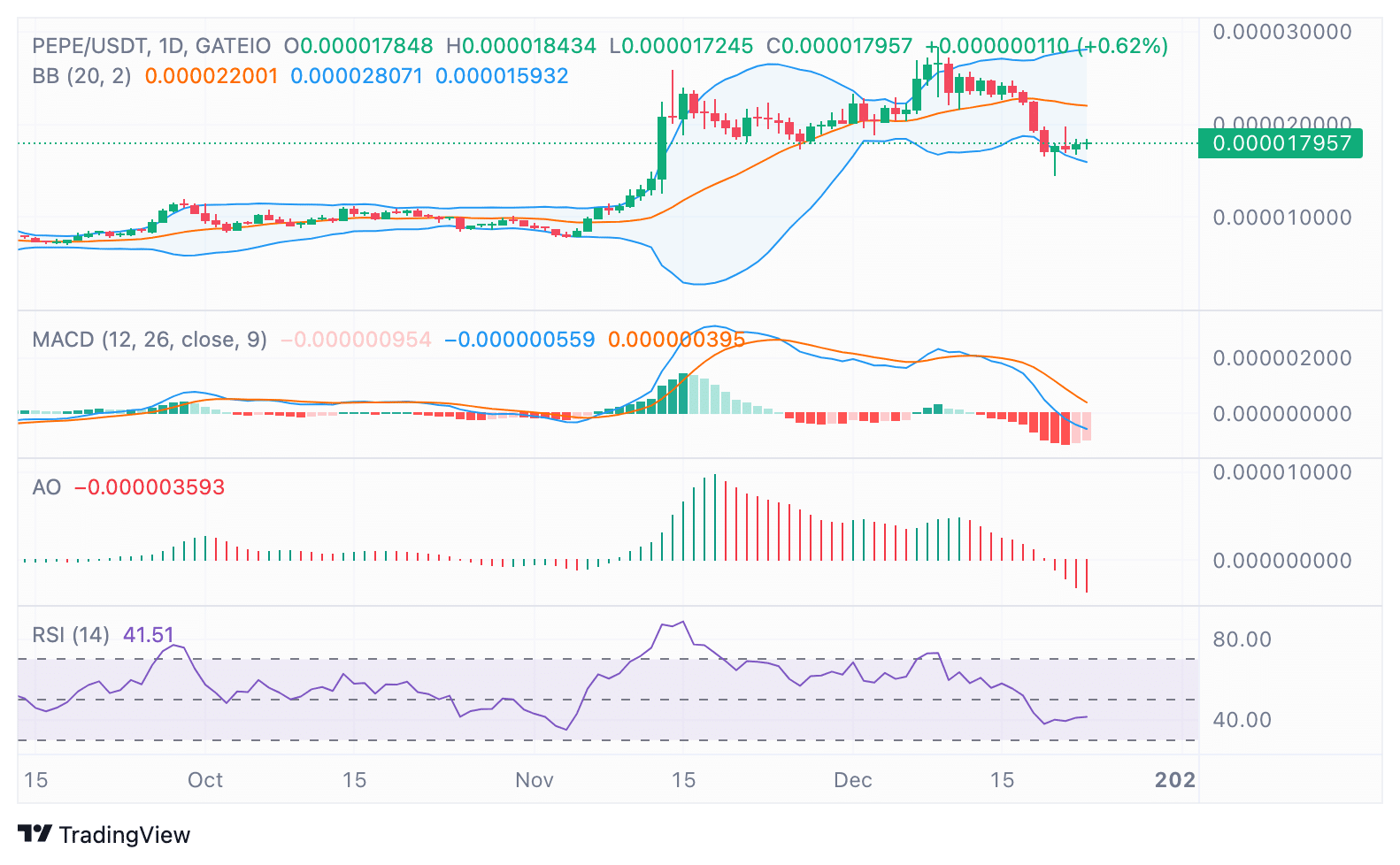

PEPE was once buying and selling at $0.00001791 at press time, appearing a 2% value building up within the closing 24 hours however stays down 25.97% during the last seven days.

With its value vary fluctuating between $0.00001455 and $0.0000242 prior to now week, buyers are intently staring at resistance close to $0.00002201, the place Bollinger Bands additionally sign key ranges to damage for a sustained rally.

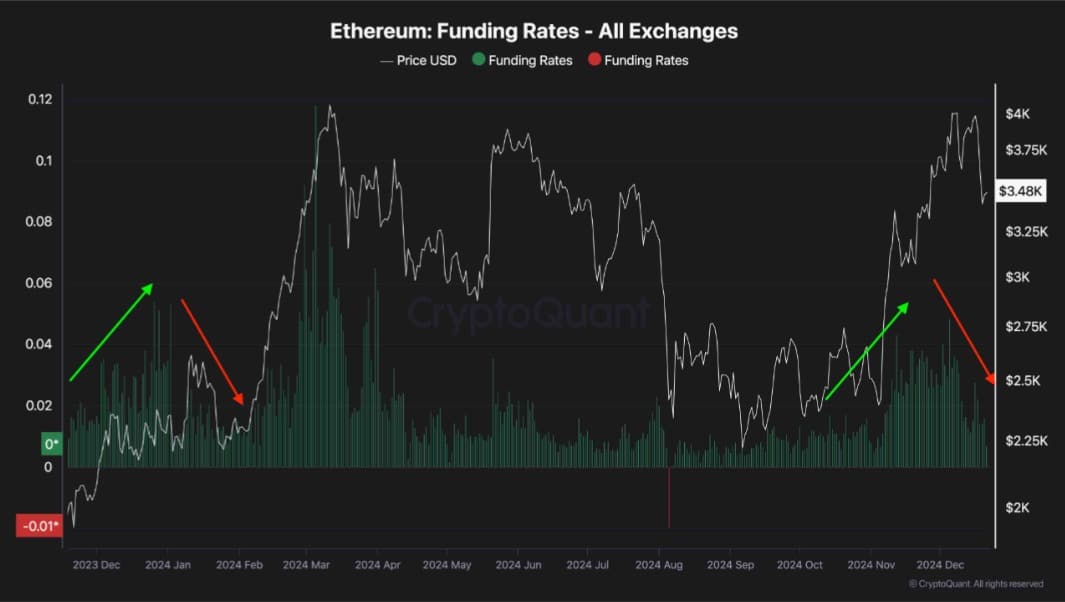

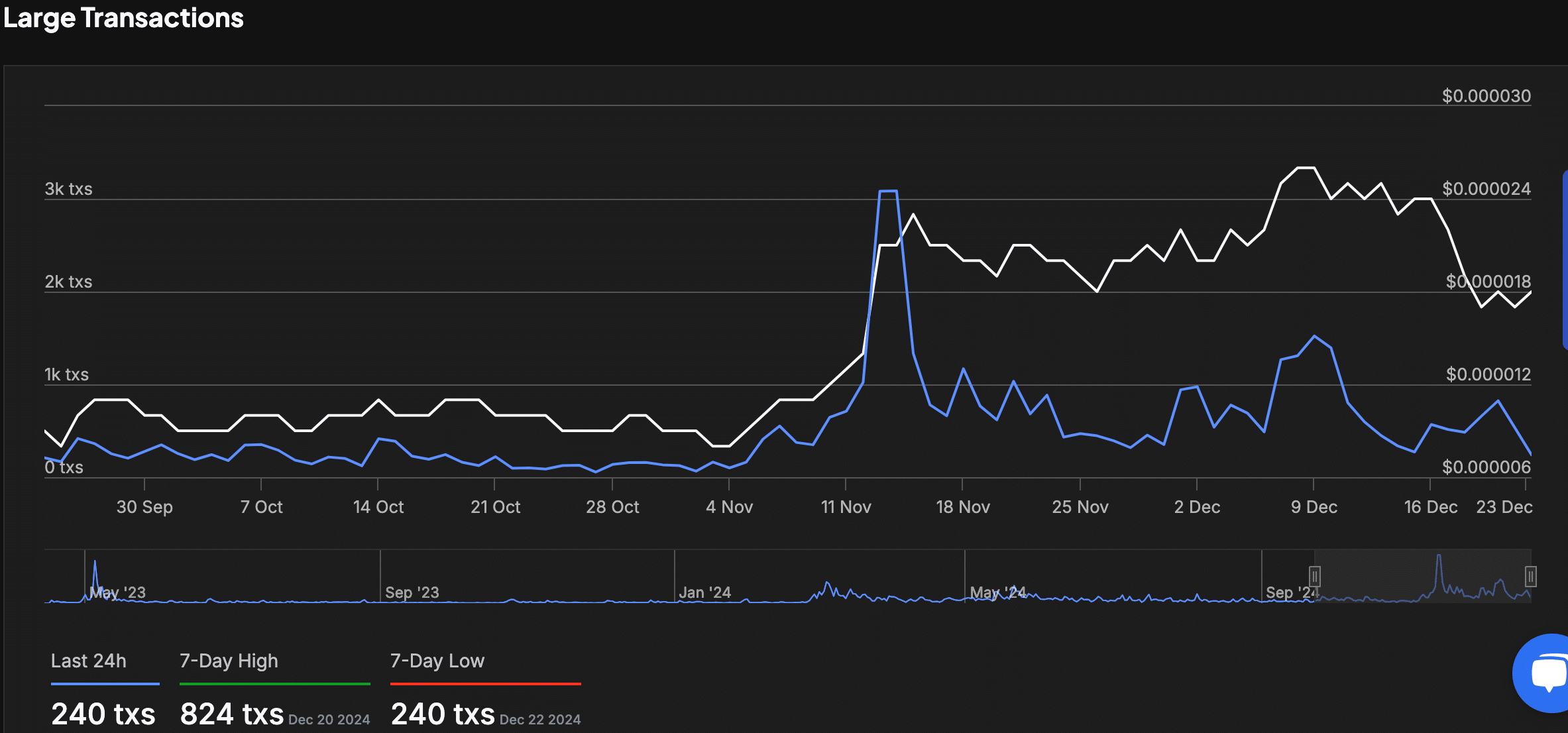

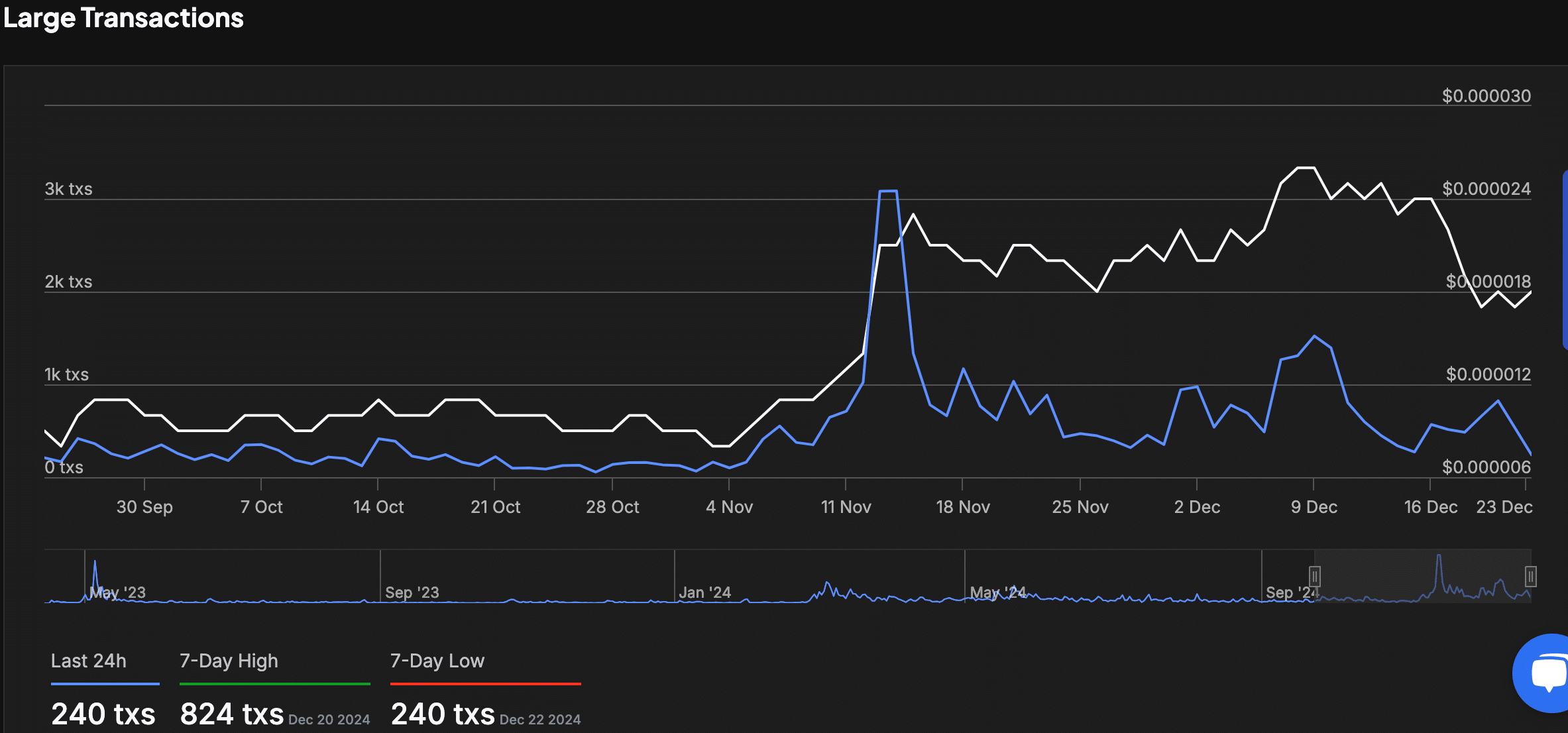

Whale task slows after November spike

Knowledge from IntoTheBlock finds a marked decline in massive transaction task for PEPE. Mid-November noticed a spike in massive transactions as the fee reached $0.000024, hinting at whale or institutional task.

Since then, transactions have dropped, with most effective 240 massive transactions recorded prior to now 24 hours, the bottom within the closing week.

Supply: IntoTheBlock

The lowered task aligns with the fee’s consolidation round $0.00001791, suggesting that accumulation or lowered buying and selling hobby is happening.

Analysts point out that tracking massive transaction task may supply insights into any doable breakout or additional downward motion.

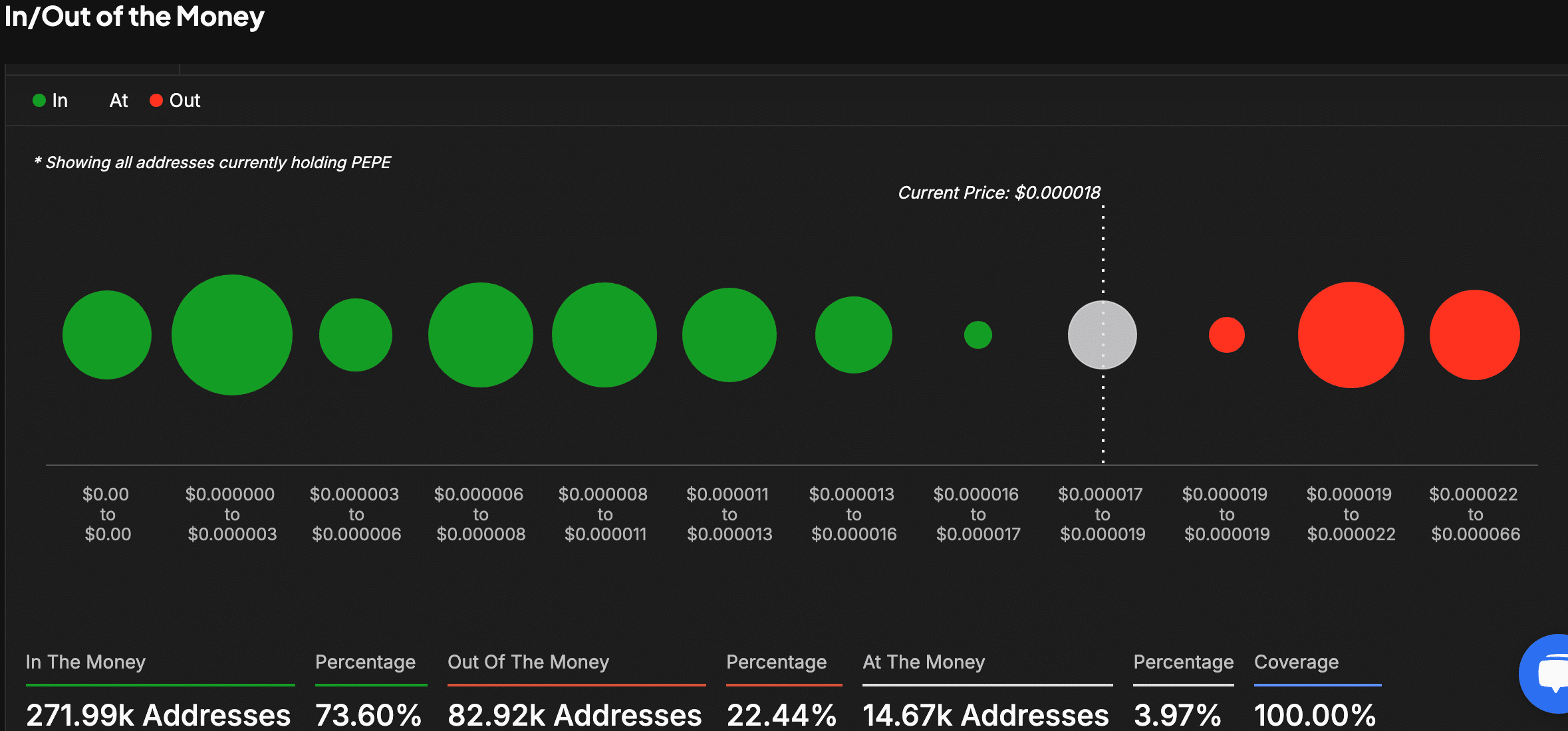

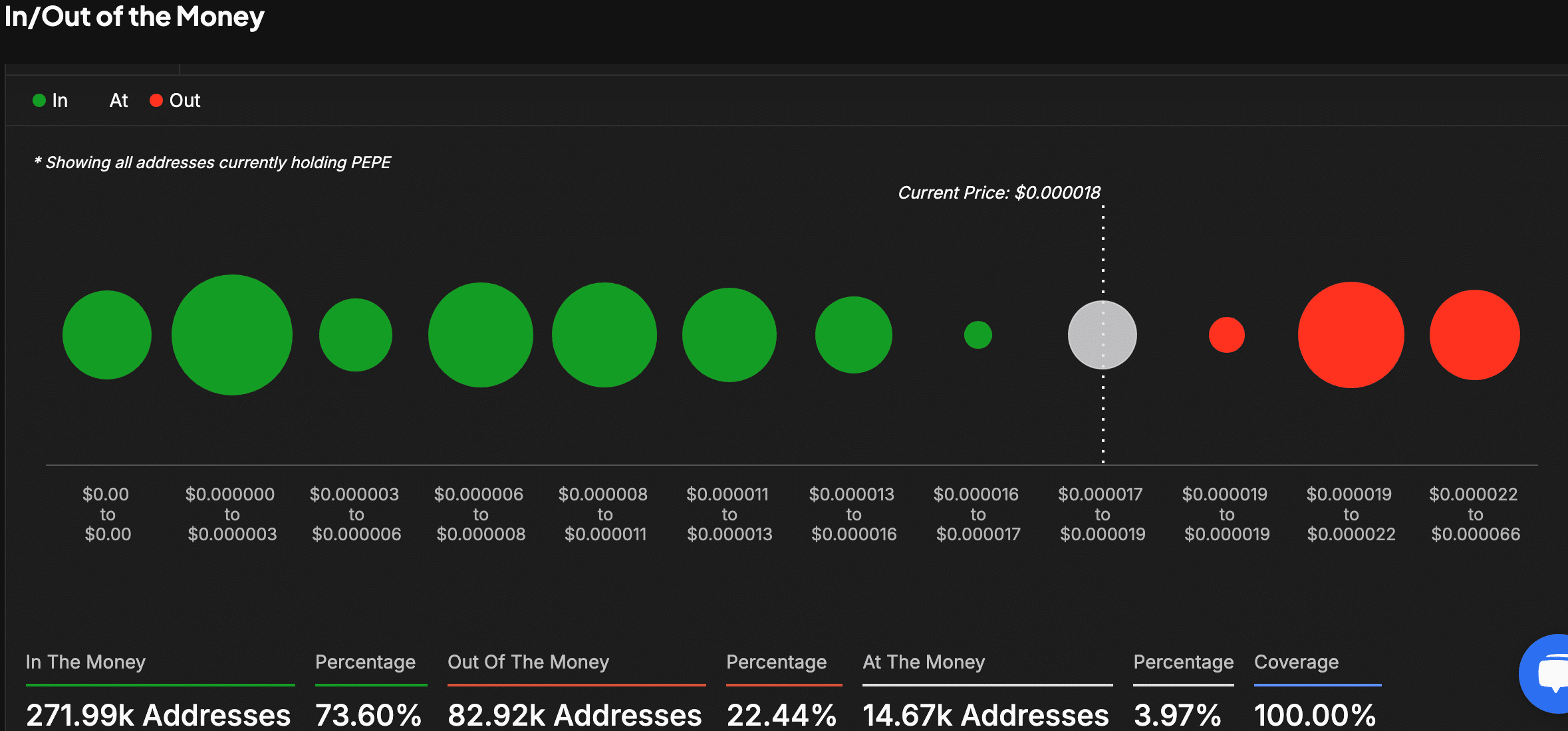

On-chain metrics counsel essential value zones

On-chain research displays 73.60% of PEPE wallets are successful, with robust enhance established between $0.000011 and $0.000013, the place maximum holders accrued the token.

Then again, roughly 22.44% of wallets stay unprofitable, with doable resistance anticipated between $0.000019 and $0.000022, as those holders would possibly promote to recoup losses.

Supply: IntoTheBlock

Bollinger Bands additional spotlight essential ranges, with the decrease band at $0.00001593 performing as a enhance zone and the higher band at $0.00002201 signaling resistance.

A ruin above the higher band may just catalyze upward momentum, whilst a drop under the decrease band would possibly result in additional value corrections.

Signs display weakening bearish momentum

Momentum signs counsel that the downtrend may well be weakening. The MACD histogram displays contraction, pointing towards a possible bullish crossover.

Learn Pepe’s [PEPE] Value Prediction 2024–2025

In the meantime, the RSI lately sits at 41.51, under the impartial 50 degree however no longer in oversold territory. A transfer above 50 may just sign renewed purchasing hobby.

Supply: TradingView

Because the marketplace stabilizes, the mix of a TD Sequential purchase sign, on-chain metrics, and technical signs means that PEPE is also making ready for its subsequent transfer.

Subsequent: Is now the easiest time to load up on Ethereum (ETH) because it eyes a $3,300 comeback?