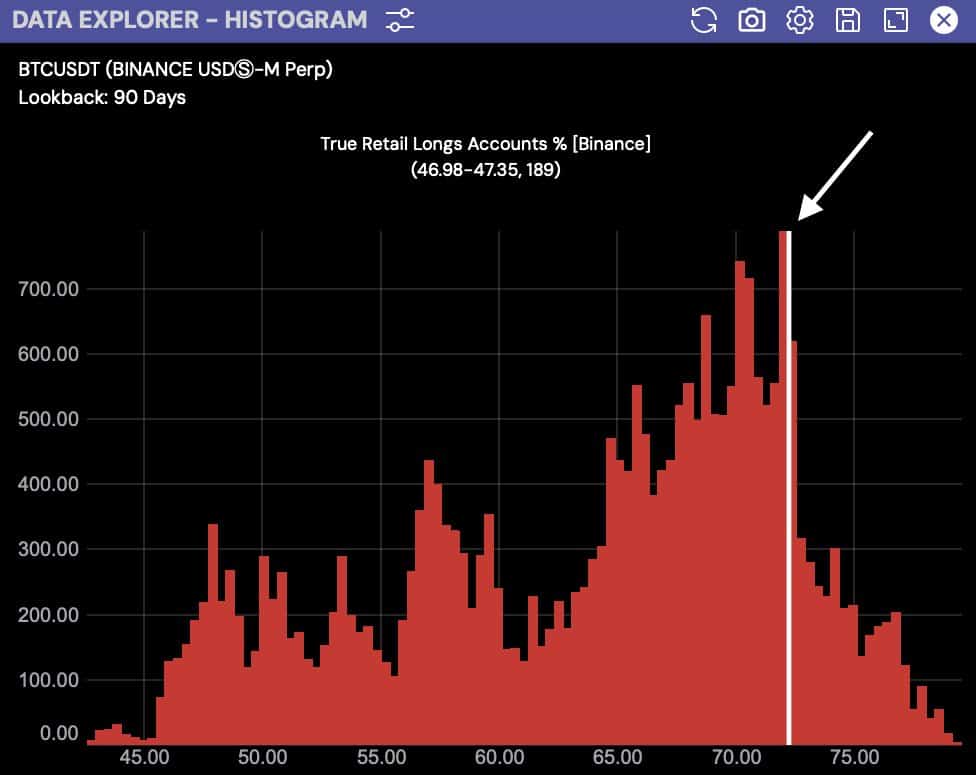

Bitcoin’s present downturn was once “standard,” in step with Michael van de Poppe.

The wider marketplace remained sure for the king coin.

The crypto markets in 2024 had been turbulent, main many to query if an important crash is looming. Some worry a big Bitcoin[BTC] downturn, however analyst Michael van de Poppe firmly disagrees.

In spite of Bitcoin’s 36% correction, bringing its worth to round $54K, he argued that this was once a standard retracement within the present marketplace.

The fears surrounding a “giant crash” had been overblown, and a deeper research instructed there have been promising indicators for a possible restoration, particularly evaluating September 2023 to September 2024.

Retail buyers is also pessimistic, however Bitcoin appears to be putting in place for a leap within the fourth quarter of 2024, because it did in earlier years.

Supply: TradingView

Supply: TradingView

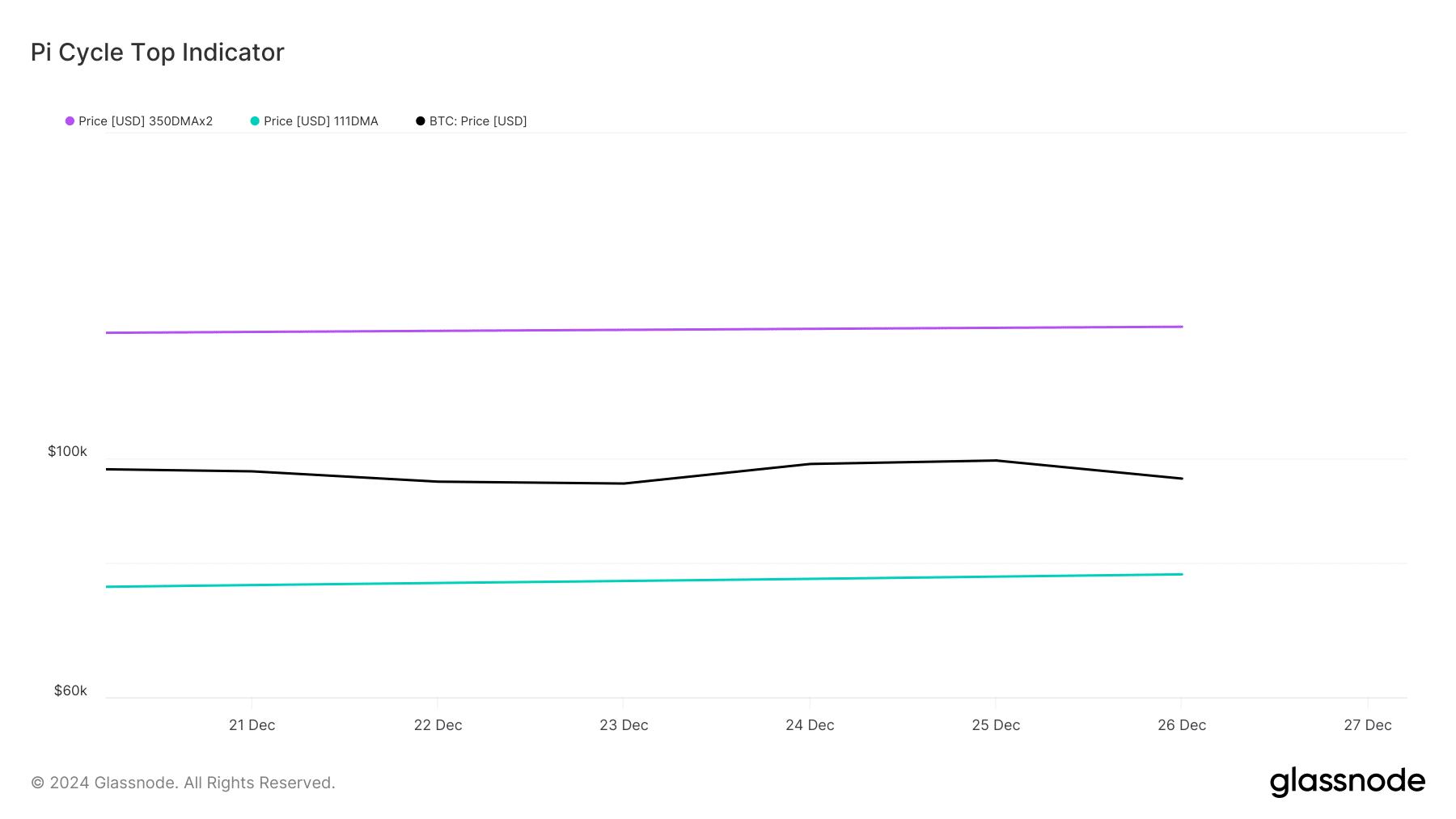

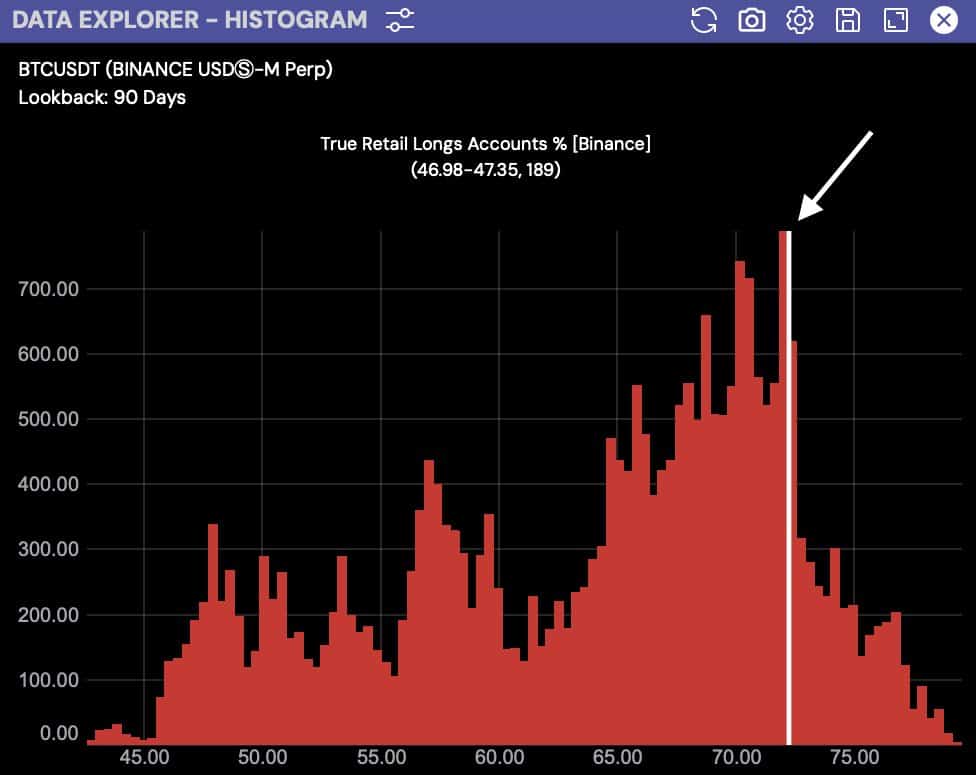

True retail longs accounts

Examining the conduct of retail buyers additional helps this outlook. Information confirmed that 72% of retail lengthy positions on Bitcoin remained intact, which indicated bullish sentiment regardless of the new worth consolidation.

This development contradicted the theory of an impending crash, as retail buyers held onto their lengthy positions, suggesting self belief in Bitcoin’s long run worth restoration.

Supply: Hyblock Capital

Supply: Hyblock Capital

Michael Poppe’s research emphasised that those components improve the view {that a} crash is not likely.

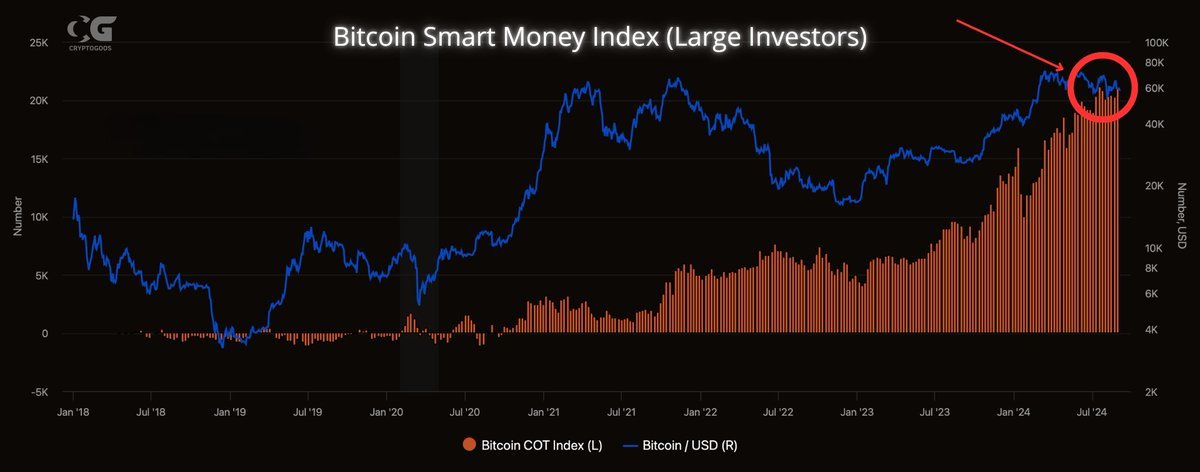

Good cash index

The Good Cash Index additionally painted a favorable image for Bitcoin. Whilst the wider marketplace sentiment was once stuffed with worry, massive buyers had been benefiting from this pessimism to amass extra Bitcoin.

This conduct additional negated the potential for a big crash, as establishments and massive holders persevered to give a boost to the cryptocurrency.

Their job, mixed with the present worth consolidation, pointed towards Bitcoin’s attainable to rebound reasonably than plummet.

Supply: X

Supply: X

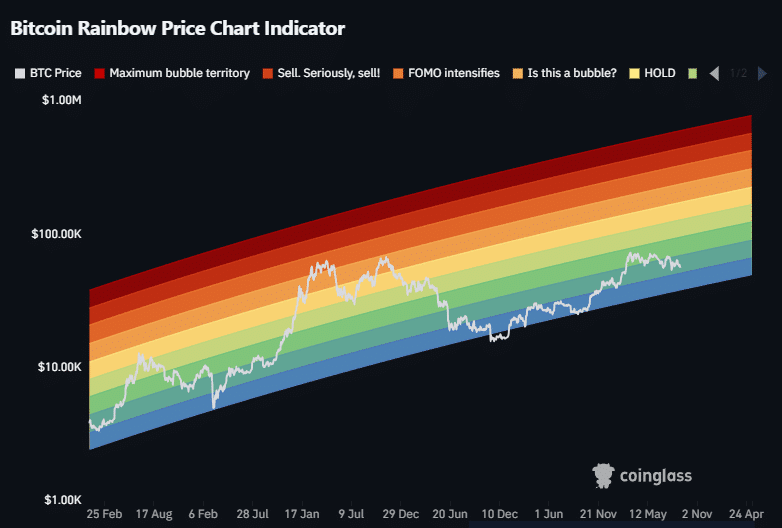

Bitcoin rainbow chart

Additionally, the Bitcoin Rainbow Chart introduced further proof of balance. Bitcoin was once buying and selling throughout the darkish inexperienced zone at press time, indicating that it was once nearing a cast accumulation section.

Traditionally, this house has confirmed to be a treasured purchasing alternative on upper timeframes.

If Bitcoin maintains its present trajectory and respects this indicator, the possibilities of a marketplace cave in stay minimum.

Supply: X

Supply: X

A drop underneath $51K may transfer BTC right into a more potent accumulation section, however this nonetheless helps long-term upward motion.

Bitcoin Investment Fee

Finally, inspecting Bitcoin’s Investment Fee published every other bullish sign. The velocity was once beginning to flip sure, indicating that lengthy buyers had been starting to pay brief buyers.

This shift instructed that extra buyers had been turning into assured in Bitcoin’s upward momentum and had been positioning themselves for attainable worth features.

As shorts proceed to near their positions, it creates additional purchasing alternatives, pushing Bitcoin’s worth upper.

Supply: Coinglass

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

In spite of contemporary marketplace volatility and popular bearish sentiment, the proof suggests Bitcoin isn’t headed for an important crash.

As a substitute, key signs level towards a possible restoration and better worth actions as we input the general quarter of 2024.

Subsequent: Altcoins can go through a big rally quickly, however on THIS situation

![2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other? 2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other?](https://ambcrypto.com/wp-content/uploads/2024/12/om-2024.jpeg)