Nvidia (NASDAQ:NVDA) has been one of the most best-performing shares globally during the last 18 months. The chip producer’s stocks are up just about 7x over the length. This bizarre expansion can for sure flip some buyers off, making them imagine it’s puffed up. On the other hand, it’s value remembering that momentum can if truth be told be one of the most preferrred signs of ahead inventory efficiency, particularly if the corporate has a monitor file of thrashing expectancies.In my opinion, I stay bullish on NVDA inventory, no longer simply on account of momentum however since the corporate is so central to the AI revolution, which has best simply begun.

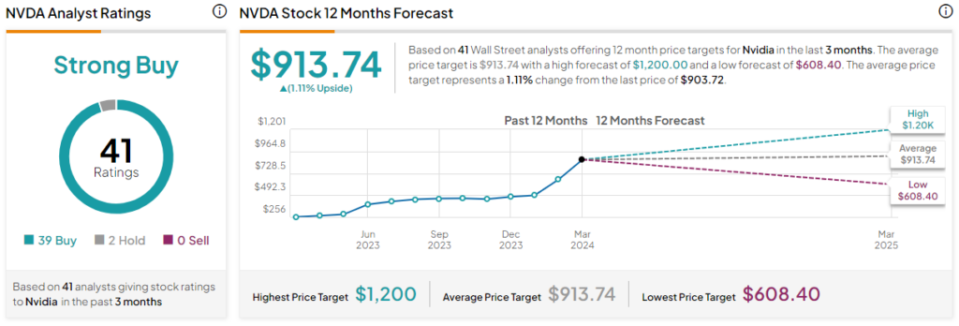

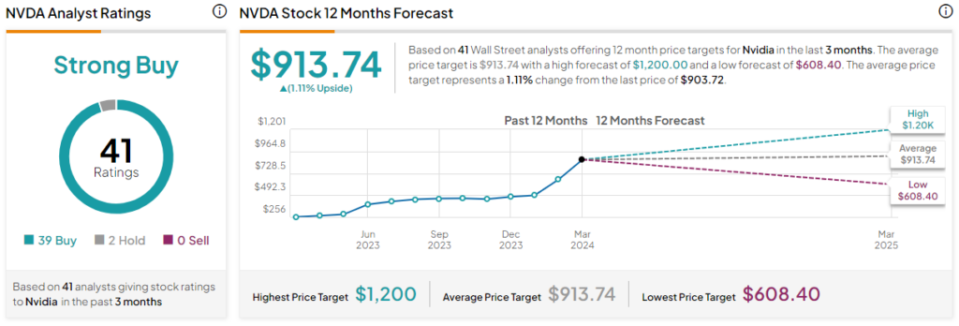

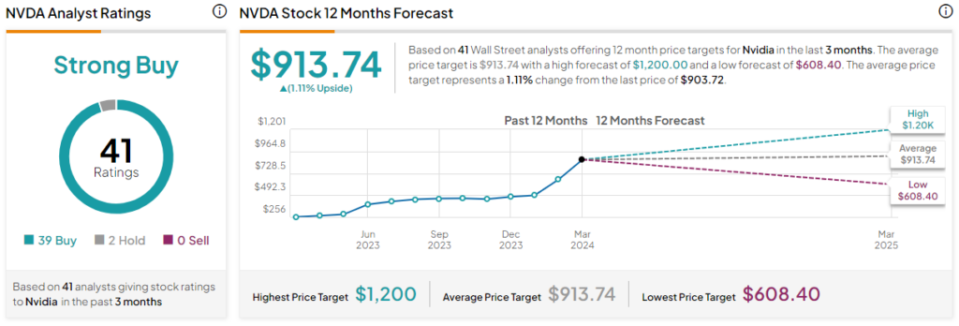

The AI KingpinNvidia, as an organization, is on the very center of the AI revolution because of its graphics processing devices (GPUs), which possess the features required for big AI and big language fashions. The devices had been at first constructed for the gaming sector, however GPUs also are easiest for AI’s large information processing wishes.In contrast to central processing devices (CPUs) that take care of duties one at a time, GPUs excel at parallel processing, permitting them to tackle more than one duties concurrently. With out this generation, the step ahead we’ve noticed in AI, which incorporates traits in facial popularity generation and self-driving automobiles, wouldn’t be conceivable.Nvidia’s dominance stems from the structure of its GPU. In contrast to CPUs with a couple of cores, Nvidia packs an enormous choice of cores onto a unmarried chip. In flip, this permits for top processing energy inside of a smaller area, and that is massively primary for environment friendly AI processing. Additionally, Nvidia has taken with high-bandwidth reminiscence, which permits those cores to get entry to information swiftly, additional accelerating AI computations. As such, Nvidia has earned a vital edge within the AI {hardware} race.On the other hand, within the AI international, it’s no longer near to {hardware}. Nvidia’s CUDA device supplies direct get entry to to the GPU’s digital directions. This device ecosystem empowers builders to construct and refine AI initiatives and has made Nvidia a one-stop store for all issues AI.Tale continuesIsn’t Nvidia Actually Pricey?Nvidia inventory is costly in that it’s turning into much less inexpensive for lots of buyers. Buying and selling round $900 a proportion, some buyers might battle to buy a unmarried Nvidia proportion as a part of a various portfolio of holdings. On the other hand, from a valuation standpoint, I don’t assume Nvidia inventory is costly or overpriced. If truth be told, it is going to nonetheless constitute just right price.Nvidia recently trades at 35.4x ahead income, making it costlier than the S&P 500 (SPX), however it’s not at all too dear for the tech sector. Additionally, the corporate is predicted to proceed handing over stellar expansion during the medium time period. If truth be told, Nvidia’s income are forecasted to develop through 34.78% every year during the medium time period.Because of this Nvidia’s all-important PEG ratio is 1.02. Whilst 1.0 could also be regarded as the benchmark for honest price, I nonetheless assume this represents just right price, noting long-term developments within the AI business and the marketplace’s bullishness on U.S. tech.In flip, which means that Nvidia is buying and selling at 29.77x income for 2026, 25.26x income for 2027, and 21.49x income for 2028. Additionally, it’s value spotting that Nvidia simply assists in keeping on beating analysts’ maximum bullish forecasts. That’s all the time a just right signal, and possibly it might proceed to overcome expectancies, going ahead.Is NVDA Inventory a Purchase, Consistent with Analysts?Because of its enabling place within the AI revolution and its horny valuation metrics, Nvidia inventory earns a Sturdy Purchase from analysts. Lately, Nvidia has 39 Buys, two Cling scores, and nil Promote scores. The typical Nvidia inventory goal value is $913.74, inferring 1.1% upside possible. The absolute best proportion value goal is $1,200, and the bottom proportion value goal is $608.40.

The AI KingpinNvidia, as an organization, is on the very center of the AI revolution because of its graphics processing devices (GPUs), which possess the features required for big AI and big language fashions. The devices had been at first constructed for the gaming sector, however GPUs also are easiest for AI’s large information processing wishes.In contrast to central processing devices (CPUs) that take care of duties one at a time, GPUs excel at parallel processing, permitting them to tackle more than one duties concurrently. With out this generation, the step ahead we’ve noticed in AI, which incorporates traits in facial popularity generation and self-driving automobiles, wouldn’t be conceivable.Nvidia’s dominance stems from the structure of its GPU. In contrast to CPUs with a couple of cores, Nvidia packs an enormous choice of cores onto a unmarried chip. In flip, this permits for top processing energy inside of a smaller area, and that is massively primary for environment friendly AI processing. Additionally, Nvidia has taken with high-bandwidth reminiscence, which permits those cores to get entry to information swiftly, additional accelerating AI computations. As such, Nvidia has earned a vital edge within the AI {hardware} race.On the other hand, within the AI international, it’s no longer near to {hardware}. Nvidia’s CUDA device supplies direct get entry to to the GPU’s digital directions. This device ecosystem empowers builders to construct and refine AI initiatives and has made Nvidia a one-stop store for all issues AI.Tale continuesIsn’t Nvidia Actually Pricey?Nvidia inventory is costly in that it’s turning into much less inexpensive for lots of buyers. Buying and selling round $900 a proportion, some buyers might battle to buy a unmarried Nvidia proportion as a part of a various portfolio of holdings. On the other hand, from a valuation standpoint, I don’t assume Nvidia inventory is costly or overpriced. If truth be told, it is going to nonetheless constitute just right price.Nvidia recently trades at 35.4x ahead income, making it costlier than the S&P 500 (SPX), however it’s not at all too dear for the tech sector. Additionally, the corporate is predicted to proceed handing over stellar expansion during the medium time period. If truth be told, Nvidia’s income are forecasted to develop through 34.78% every year during the medium time period.Because of this Nvidia’s all-important PEG ratio is 1.02. Whilst 1.0 could also be regarded as the benchmark for honest price, I nonetheless assume this represents just right price, noting long-term developments within the AI business and the marketplace’s bullishness on U.S. tech.In flip, which means that Nvidia is buying and selling at 29.77x income for 2026, 25.26x income for 2027, and 21.49x income for 2028. Additionally, it’s value spotting that Nvidia simply assists in keeping on beating analysts’ maximum bullish forecasts. That’s all the time a just right signal, and possibly it might proceed to overcome expectancies, going ahead.Is NVDA Inventory a Purchase, Consistent with Analysts?Because of its enabling place within the AI revolution and its horny valuation metrics, Nvidia inventory earns a Sturdy Purchase from analysts. Lately, Nvidia has 39 Buys, two Cling scores, and nil Promote scores. The typical Nvidia inventory goal value is $913.74, inferring 1.1% upside possible. The absolute best proportion value goal is $1,200, and the bottom proportion value goal is $608.40.

The Backside LineNvidia has been central to the AI revolution, however there are two primary issues to believe shifting ahead: Nvidia’s aggressive merit within the all-important generative AI marketplace and the truth that the AI revolution has best simply begun.Over the last 18 months, Nvidia has discovered itself with a powerful moat, which it has effectively constructed upon. Different firms, together with Intel (NASDAQ:INTC), have eyes on Nvidia’s crown, however it’s no longer transparent how they’ll catch up. The Santa Clara-based company’s new H200 chipset is the must-have for generative AI and big language fashions. The H200 is considered between 1.4 and 1.9 instances sooner than the H100 on the subject of massive language fashion inference. That’s an excellent bounce in only one 12 months.Additionally, the marketplace is rising and has the prospective to develop a lot sooner. SoftBank’s (OTC:SFTBY) Masayoshi Son is thinking about a $100 billion mission within the AI chip area, and OpenAI’s Sam Altman is reportedly in search of $7 trillion for a string of AI chip factories that may reply to burgeoning call for and restructure the arena’s semiconductor sector.Given the near-term momentum within the sector, the truth that call for for GPUs nonetheless outstrips provide, and the truth that we actually are simply at the beginning of the AI revolution, I stay bullish on Nvidia.Disclosure

The Backside LineNvidia has been central to the AI revolution, however there are two primary issues to believe shifting ahead: Nvidia’s aggressive merit within the all-important generative AI marketplace and the truth that the AI revolution has best simply begun.Over the last 18 months, Nvidia has discovered itself with a powerful moat, which it has effectively constructed upon. Different firms, together with Intel (NASDAQ:INTC), have eyes on Nvidia’s crown, however it’s no longer transparent how they’ll catch up. The Santa Clara-based company’s new H200 chipset is the must-have for generative AI and big language fashions. The H200 is considered between 1.4 and 1.9 instances sooner than the H100 on the subject of massive language fashion inference. That’s an excellent bounce in only one 12 months.Additionally, the marketplace is rising and has the prospective to develop a lot sooner. SoftBank’s (OTC:SFTBY) Masayoshi Son is thinking about a $100 billion mission within the AI chip area, and OpenAI’s Sam Altman is reportedly in search of $7 trillion for a string of AI chip factories that may reply to burgeoning call for and restructure the arena’s semiconductor sector.Given the near-term momentum within the sector, the truth that call for for GPUs nonetheless outstrips provide, and the truth that we actually are simply at the beginning of the AI revolution, I stay bullish on Nvidia.Disclosure