“Purchase low, promote prime” is going the well known making an investment mantra. Judging via this good judgment, Nvidia (NASDAQ:NVDA), which has been on a reasonably a run this yr, must no longer be such an attractive funding at this time.

Pushed via the explosive expansion of the AI business, NVDA has noticed its proportion costs acquire 138% in worth in 2024 on my own.

Taking into consideration this fast expansion, is it time for traders to promote NVDA? Consistent with At the Pulse investor, the solution is a powerful no.

“Nvidia’s valuation is if truth be told no longer over the top in any respect,” argues the investor.

Even though acknowledging the white-hot expansion, the investor stays bullish about NVDA’s long term possibilities and its knowledge middle industry particularly.

“I believe traders are nonetheless underestimating Nvidia’s gross sales attainable, specifically as the growth of the knowledge middle marketplace and the AI cluster upscaling alternative are involved,” writes At the Pulse.

NVDA’s place because the undisputed chief within the AI processor marketplace supplies a possibility for endured positive factors smartly into the long run, argues the investor, who believes “Nvidia’s AI expansion curve is solely getting began.”

Having a look on the broader system finding out sector, At the Pulse notes that this promising box is “poised to peer skyrocketing expansion till the top of the last decade,” with NVDA main the fee.

Relating to valuation, At the Pulse compares NVDA to its closest competitor, AMD, which is priced at a more than one of 33x long term income, with regards to NVDA’s 35x more than one. This comparability means that NVDA’s valuation is affordable and no longer excessively prime.

“With a just about an identical income more than one, I’d make a selection Nvidia any day of the week given its commanding marketplace proportion within the GPU marketplace,” writes At the Pulse, who concludes that “the 35x income more than one in addition to the potential of considerable gross sales estimate beats within the knowledge middle section shifting ahead make Nvidia a cast expansion funding.”

In consequence, At the Pulse is optimistically score Nvidia stocks a Purchase. (To observe At the Pulse’s monitor document, click on right here)

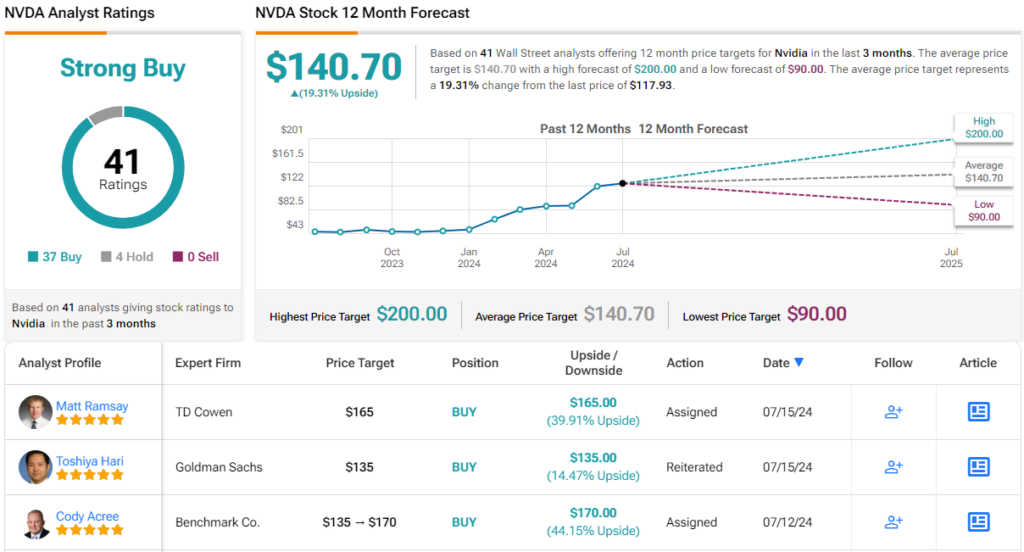

Over on Wall Side road, analysts generally tend to believe the investor. The closely coated inventory has had 41 analyst exams over the last 3 months, which wreck down into 37 Purchase and four Grasp scores. That’s naturally culminating in a Robust Purchase consensus score. In the meantime, the typical 12-month value goal of $140.70 implies an upside of ~19% for the following twelve months. (See NVDA inventory forecast)

To seek out just right concepts for shares buying and selling at sexy valuations, seek advice from TipRanks’ Highest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The reviews expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. It is important to to do your individual research sooner than making any funding.