Nvidia (NASDAQ:NVDA) has confronted a headwind of types with delays to its Blackwell GPU structure. Then again, the chip large stays on the right track to ramp up shipments of the next-gen GPU platform within the January quarter (FQ4).

This perception comes from J.P. Morgan’s Harlan Sur, an analyst ranked within the best 1% of Boulevard inventory execs, who shared the replace after an investor assembly with Nvidia’s Senior Director of IR and Strategic Finance, Stewart Stecker.

In keeping with Stecker, the preliminary product yield problems have been now resolved following a masks correction at the B200 GPU chip. Nvidia stays on agenda to send “a number of billion bucks” price of Blackwell GPU platforms in fiscal This fall (January quarter), with a “endured sturdy ramp” into calendar 12 months 2025.

Stecker additionally recommends no longer paying an excessive amount of consideration to a few noises being made round rackscale portfolio adjustments. This in particular relates to fresh experiences on a discontinuation of the GB200 dual-rack 36×2 NVL72 rackscale resolution. The corporate emphasised the Blackwell GPU platform’s talent to reinforce greater than 100 other gadget configurations, together with the NVL72 and NVL36 answers, in comparison to simply 19-20 configurations for the former gen Hopper GPU platform.

Stecker additionally struck a assured tone at the “sustainability” of XPU (i.e., AI-capable processing devices) infrastructure spending over a higher a number of years. This can be pushed through the exponential scaling of GenAI and foundational fashions, which call for greater coaching compute capability. Nvidia additionally highlighted the rising adoption of inferencing throughout markets, the early phases of endeavor and sovereign AI tasks, and the “sturdy push” towards accelerating current workloads – equivalent to information processing, databases, and analytics – inside conventional CPU-centric datacenter infrastructure. Total, Nvidia estimates a $500 billion annual infrastructure funding can be had to reinforce each new AI workloads and the acceleration of current ones.

Summing up, Sur famous, “We imagine NVIDIA continues to execute throughout all segments… We predict the information middle section to develop strongly as hyperscale shoppers proceed to include GPU-accelerated deep finding out for processing massive information units.”

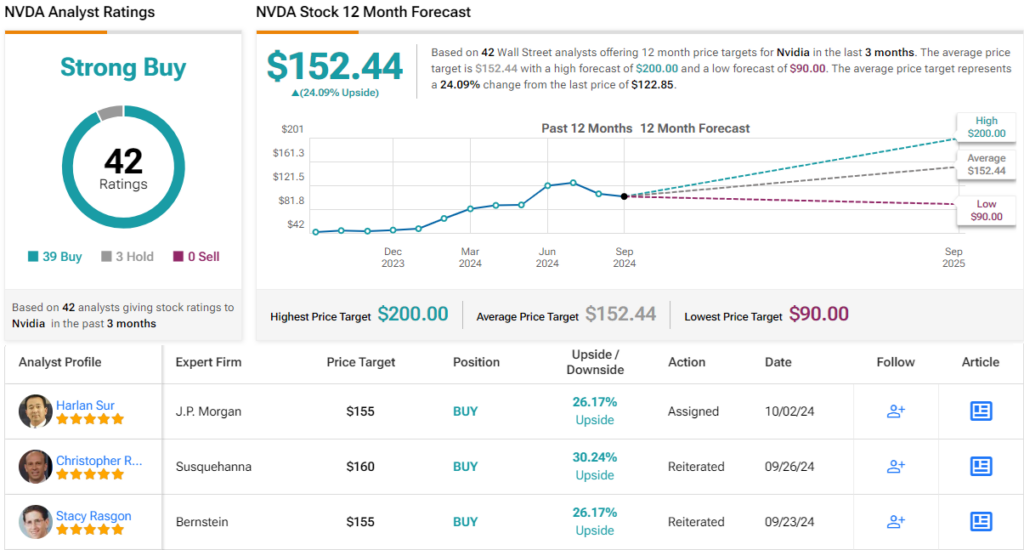

To this finish, Sur charges NVDA stocks an Obese (i.e., Purchase) with a $155 value goal, suggesting the inventory will achieve 26% over the approaching months. (To look at Sur’s monitor document, click on right here)

That take chimes smartly with normal Boulevard sentiment. In keeping with a lopsided mixture of 39 Buys vs. 3 Holds, the analyst consensus charges the inventory a Robust Purchase. The $152.44 moderate value goal is most effective relatively less than Sur’s function and implies returns of 24% are within the playing cards for a higher 12 months. (See NVDA inventory forecast)

To search out excellent concepts for shares buying and selling at sexy valuations, consult with TipRanks’ Perfect Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The reviews expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. It is important to to do your personal research prior to making any funding.