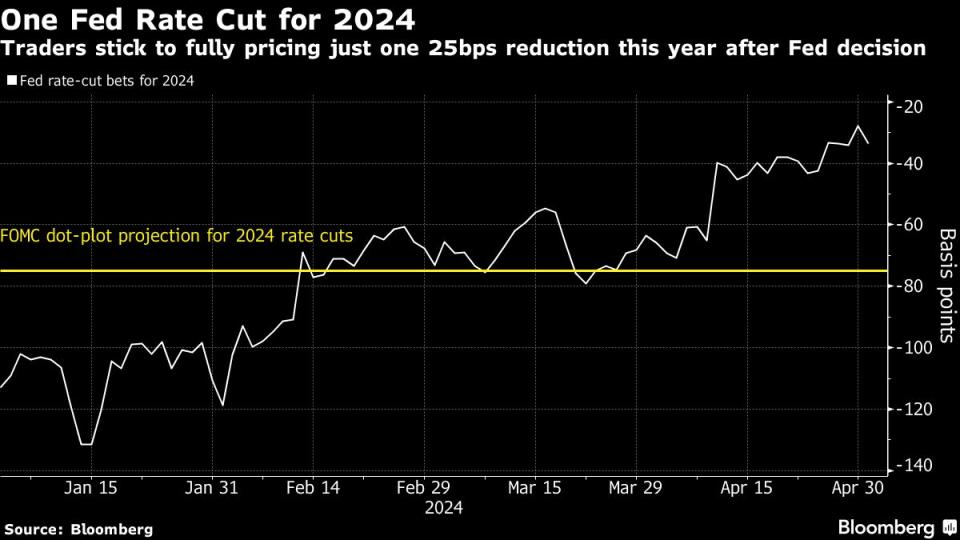

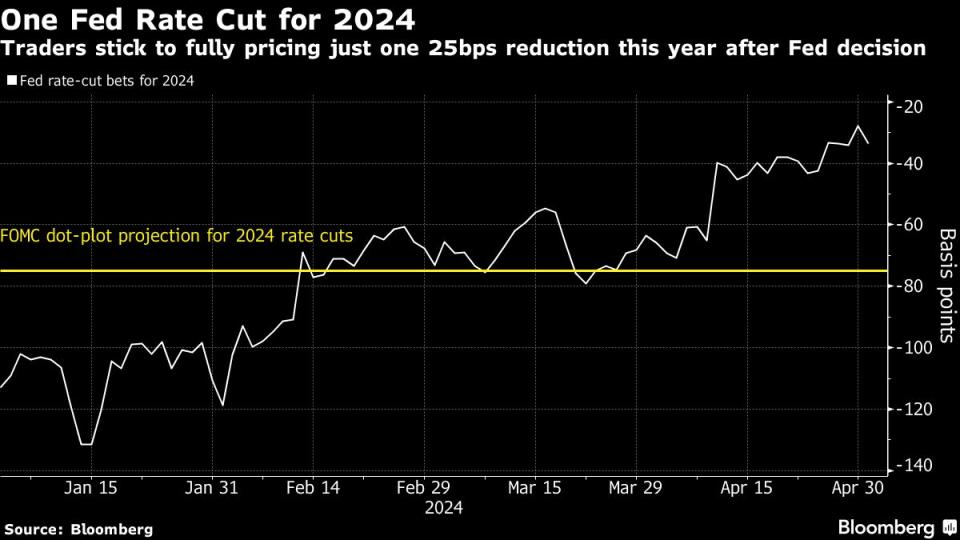

(Bloomberg) — Investors on Wall Boulevard cheered on Wednesday when Federal Reserve Chair Jerome Powell signaled he didn’t see oncoming interest-rate hikes in spite of inflationary pressures. The birthday party didn’t final lengthy.Maximum Learn from BloombergFor a temporary length, US shares popped to unharness the largest post-policy assembly rally since December, whilst Treasury yields tumbled greater than 10 foundation issues throughout maturities. The comfort business kicked in when Powell informed journalists “it’s not going that the following price transfer will likely be a hike.”Drawback is, Powell didn’t explicitly sign a price minimize used to be coming this yr both, and stated it’s going to almost certainly take longer for central bankers to achieve sufficient self belief within the downward trajectory of inflation to imagine easing coverage. That truth test prompted an abrupt reversal in equities, which ended decrease at the day. Treasury yields trimmed a few of their decline, with the policy-sensitive two-year yield maintaining under the 5% threshold — however now not by way of a lot.“Powell made it transparent that the hurdle for hikes is amazingly top,” stated Michael de Move, world head of charges buying and selling at Fortress Securities. “They in the end view the extent of charges as being restrictive, that’s plain. Are they restrictive sufficient and the way lengthy does it take to filter out via to the financial system are the questions now.”

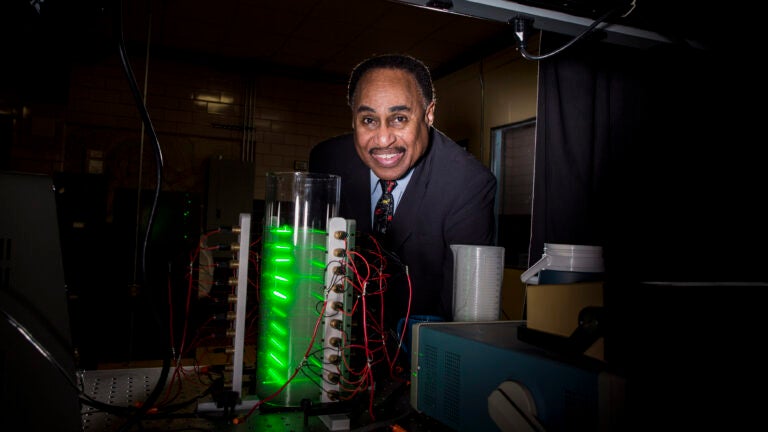

Federal Reserve Board Chair Jerome Powell speaks right through a information convention on the Federal Reserve in Washington, Wednesday, Would possibly 1, 2024. (AP Picture/Susan Walsh) (ASSOCIATED PRESS)“The FOMC appeared intent on now not letting the marketplace run too some distance from its base case of cast expansion, sticky inflation and intent to chop later this yr,” Citigroup Inc. strategists led by way of Stuart Kaiser wrote in a notice, relating to the policy-setting Federal Open Marketplace Committee. “The outcome used to be a big round-trip buying and selling day.”The stakes for buyers had been highlighted by way of Powell when he stated that whilst he believes present price coverage “is restrictive, and we consider, over the years, it’s going to be sufficiently restrictive,” it “will likely be a query that the information must resolution.”Whilst Powell said the loss of fresh growth towards the Fed’s 2% inflation function this yr, his signaling that cuts are much more likely than hikes used to be sufficient to appease the marketplace, no less than to begin with. Whether or not it warrants a sustained inventory rally is every other subject.What Bloomberg Strategists Say …“Powell: Charge cuts earlier than the yr is out are nonetheless at the desk. Takeaway: Charges are capped however the Fed will ease if the unemployment price rises a lot farther from right here. The Fed has an easing bias.”— Edward Harrison, Markets Are living weblog contributor“I used to be extra confused making an attempt to determine what Powell stated to make shares rally so sharply,” stated Steve Sosnick, leader strategist at Interactive Agents. “Certain, he stated no hikes are essential and downplayed fears about stagflation, however that wasn’t price a large speculative rally.”As for the longevity of the most recent bond reduction rally, Fortress’s de Move cautioned that whilst the soar “is sensible,” the marketplace used to be nearing its limits.“It has already run out of steam with the marketplace neatly off the lows in yield,” he stated. “The marketplace almost certainly struggles to run a lot more given we’re in a spot of data-dependency.”Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Jerome Powell introduced markets a reprieve. It vanished in a blink.