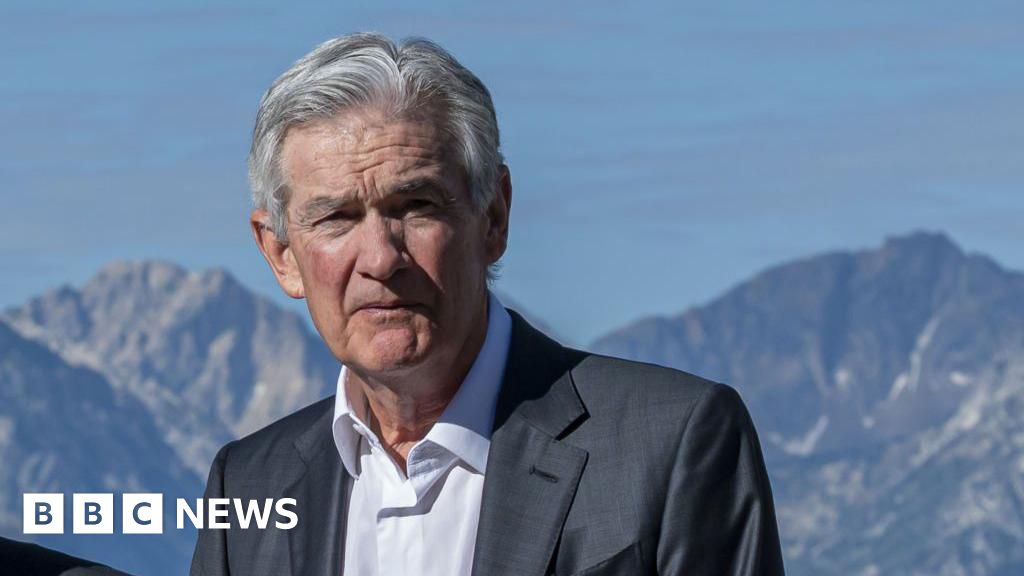

The pinnacle of the USA central financial institution has mentioned “the time has come” for officers to chop rates of interest, however he introduced few clues as to how briefly or how a long way borrowing prices would possibly come down. The speech from Federal Reserve chairman Jerome Powell was once being carefully watched, as growing unemployment has revived considerations about how the USA economic system is protecting up below upper rates of interest.Mr Powell mentioned the financial institution was once more and more centered at the task marketplace, because it features self belief that the USA was once shifting previous the surging costs that began all over the pandemic.Inflation, which tracks the tempo of worth rises, fell to two.9% in the USA remaining month, its lowest price since March 2021.”The time has come for coverage to regulate,” Mr Powell mentioned, talking from a convention in Jackson Hollow, Wyoming, whilst including that the timing and tempo of cuts would rely on information.The remarks signalled the beginning of a brand new struggle for the Fed, after greater than two years inquisitive about stabilising costs. In his personal speech on Friday, Financial institution of England Governor Andrew Bailey mentioned it was once “too early” to claim victory over inflation in the United Kingdom, in spite of the Financial institution’s choice to chop charges at its most up-to-date assembly. “We want to be wary since the task isn’t finished – we don’t seem to be but again to focus on on a sustained foundation,” he mentioned. “The direction will due to this fact be a gradual one.”In the USA, the Fed has stored its key lending price at kind of 5.3% – a two-decade prime – since remaining July, protecting off on cuts pursued by means of central banks in different nations, together with the United Kingdom. Mr Powell has argued the USA economic system was once wholesome sufficient to maintain the prime rates of interest, pointing to a gradual streak of task features, which has helped families climate the leap in costs and uptick in borrowing prices.However the ones features have slowed considerably since remaining 12 months and the jobless price has ticked as much as 4.3%, reviving fears that the Fed’s insurance policies will knock the growth off direction and throw thousands and thousands of other people out of labor. The United States has skilled financial recession after lots of the Fed’s earlier rate-rising campaigns. In his speech, Mr Powell stated an important slowdown within the task marketplace, announcing the Fed didn’t “search or welcome additional cooling”.However he driven again in opposition to considerations about any other recession within the close to long term, arguing that the upward push in unemployment was once in line with a slowdown in hiring, now not a surprising spike in task cuts. “There may be excellent reason why to assume that the economic system gets again to two% inflation whilst keeping up a powerful labour marketplace,” he mentioned, including later that the “pandemic economic system” had confirmed to be “in contrast to some other”.Inventory markets rose after Mr Powell’s feedback, which despatched the Dow, S&P 500 and Nasdaq all up greater than 0.5%.Analysts mentioned the speech had made all of it however sure that the financial institution would narrow charges by means of no less than 0.25 proportion issues at its assembly subsequent month as is these days anticipated – or possibly by means of extra.”The loss of any steering means that Powell is retaining his choices open,” mentioned Stephen Brown, deputy leader North American economist at Capital Economics, after the speech.

Jerome Powell: Time has come for rate of interest reduce, says Fed boss

![Pixel 6 vs. Pixel 9: Is now the time to improve? [Video] Pixel 6 vs. Pixel 9: Is now the time to improve? [Video]](https://9to5google.com/wp-content/uploads/sites/4/2024/11/Pixle-6-and-Pixel-9-cameras-2.jpg?quality=82&strip=all&w=1600)