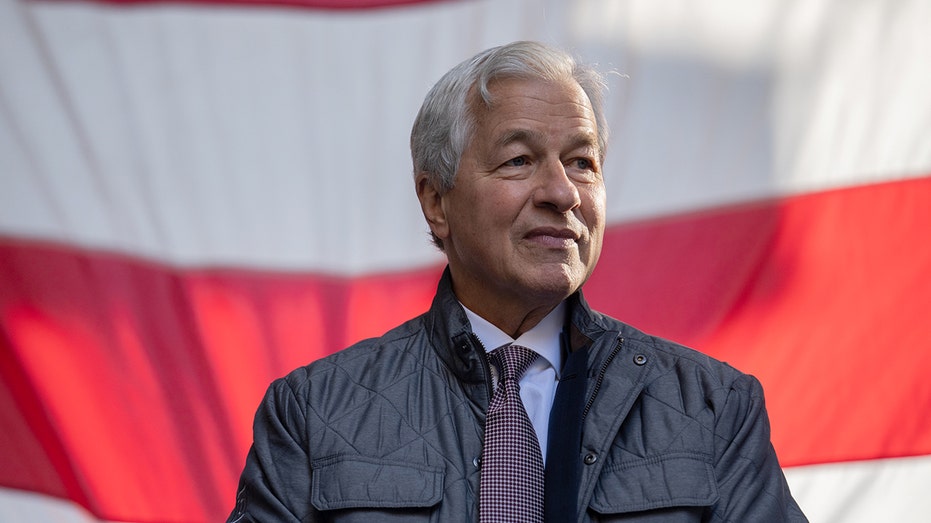

The Claman Countdown panelists Kenny Polcari and Joseph Lavorgna smash down the Federal Reserves strikes. JPMorgan Chase CEO Jamie Dimon mentioned the marketplace sentiment is bettering for equities in addition to mergers and acquisitions, at the same time as he maintained a wary outlook concerning the economic system at huge in an interview on Monday. “Self belief is up, there’s extra M&A chatter,” fairness markets are strengthening and high-yield markets are open, Dimon mentioned in an interview on CNBC. “Markets are excessive, folks really feel it, up to now so excellent.”Dimon added that “there are issues available in the market which might be relating to,” and solid doubt at the likelihood of a cushy touchdown for the U.S. economic system. Whilst marketplace individuals are pricing in 70% to 80% odds of a cushy touchdown, Dimon mentioned he thinks the possibility is “part of that.” The U.S. economic system has up to now have shyed away from sinking right into a recession amid the Federal Reserve’s effort to tamp down stubbornly excessive inflation. Dimon has in the past warned that geopolitical tensions, reminiscent of Russia’s ongoing battle in opposition to Ukraine and the struggle between Hamas and Israel, may just weigh on world enlargement. In October, he mentioned that “this can be essentially the most unhealthy time the sector has noticed in many years.” JPMORGAN CEO JAMIE DIMON WARNS US DRIVING TOWARD A CLIFF AS DEBT SNOWBALLS  JPMorgan Chase CEO Jamie Dimon mentioned marketplace sentiment is bettering however he stays wary concerning the potentialities for a cushy touchdown. (Jeenah Moon/Bloomberg by the use of Getty Pictures / Getty Pictures)Dimon, the CEO of the most important financial institution within the U.S., welcomed extra regulatory scrutiny of personal marketplace individuals competing with banks for offers. Ticker Safety Final Alternate Alternate % JPM JPMORGAN CHASE & CO. 183.36 -0.63 -0.34% Wall Boulevard lenders had been elevating billions of greenbacks to regain flooring in lending to firms in debt-backed offers as festival from large personal fairness and asset control companies has risen within the remaining two years.JPMorgan has put aside $10 billion of its capital for personal credit score, however that might develop considerably relying on call for, assets instructed Reuters previous this month.CAPITAL ONE’S PURCHASE OF DISCOVER FACES POLITICAL AND REGULATORY HURDLES

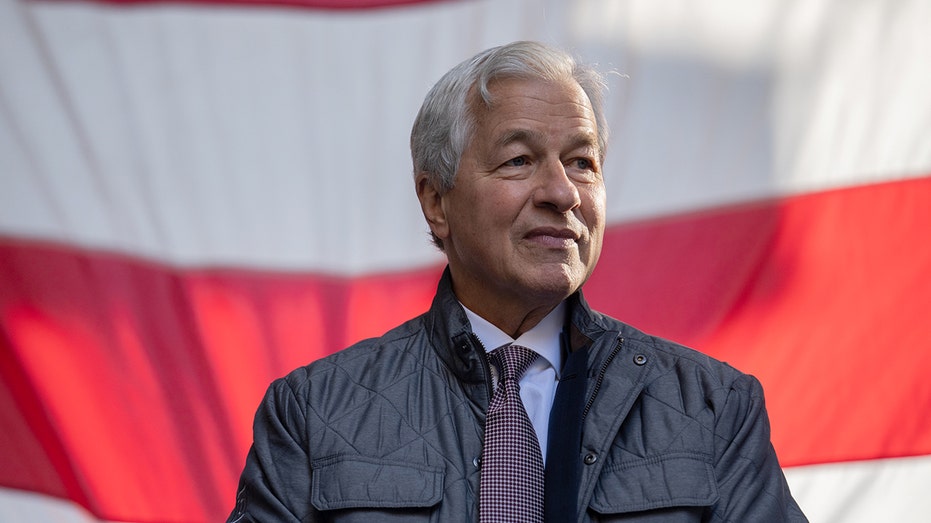

JPMorgan Chase CEO Jamie Dimon mentioned marketplace sentiment is bettering however he stays wary concerning the potentialities for a cushy touchdown. (Jeenah Moon/Bloomberg by the use of Getty Pictures / Getty Pictures)Dimon, the CEO of the most important financial institution within the U.S., welcomed extra regulatory scrutiny of personal marketplace individuals competing with banks for offers. Ticker Safety Final Alternate Alternate % JPM JPMORGAN CHASE & CO. 183.36 -0.63 -0.34% Wall Boulevard lenders had been elevating billions of greenbacks to regain flooring in lending to firms in debt-backed offers as festival from large personal fairness and asset control companies has risen within the remaining two years.JPMorgan has put aside $10 billion of its capital for personal credit score, however that might develop considerably relying on call for, assets instructed Reuters previous this month.CAPITAL ONE’S PURCHASE OF DISCOVER FACES POLITICAL AND REGULATORY HURDLES  JPMorgan Chase will face new festival if Capital One’s acquisition of Uncover is licensed. ( Michael M. Santiago/Getty Pictures / Getty Pictures)Dimon additionally weighed in at the deal introduced remaining week that can see Capital One achieve Uncover for $35.3 billion, pronouncing that businesses must be allowed to develop, merge and innovate.The pending merger would create the most important U.S. bank card issuer with $250 billion in card balances and a marketplace percentage of twenty-two% — an quantity higher than JPMorgan’s.”I’m really not fearful about it,” Dimon mentioned. Alternatively, he famous that Capital One’s debit community will have an unfair merit following the merger.GET FOX BUSINESS ON THE GO BY CLICKING HEREDimon said other pricing requirements for playing cards supplied by way of banks as opposed to the ones from automotive issuers and mentioned, “After all I’ve an issue with that.”Reuters contributed to this file.

JPMorgan Chase will face new festival if Capital One’s acquisition of Uncover is licensed. ( Michael M. Santiago/Getty Pictures / Getty Pictures)Dimon additionally weighed in at the deal introduced remaining week that can see Capital One achieve Uncover for $35.3 billion, pronouncing that businesses must be allowed to develop, merge and innovate.The pending merger would create the most important U.S. bank card issuer with $250 billion in card balances and a marketplace percentage of twenty-two% — an quantity higher than JPMorgan’s.”I’m really not fearful about it,” Dimon mentioned. Alternatively, he famous that Capital One’s debit community will have an unfair merit following the merger.GET FOX BUSINESS ON THE GO BY CLICKING HEREDimon said other pricing requirements for playing cards supplied by way of banks as opposed to the ones from automotive issuers and mentioned, “After all I’ve an issue with that.”Reuters contributed to this file.

JPMorgan CEO Dimon wary about cushy touchdown for economic system