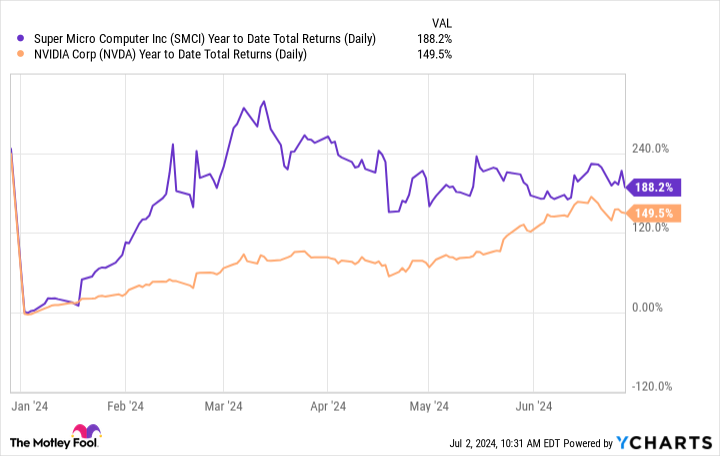

A an important week of work marketplace information will greet buyers all through a holiday-shortened buying and selling week that starts the month of July, the 1/3 quarter, and 2d part of 2024.The S&P 500 (^GSPC) enters Q3 up 14.5% thus far this yr, whilst the Nasdaq Composite (^IXIC) rallied greater than 18%. The Dow Jones Commercial Reasonable (^DJI) received a extra modest 3.8% within the first six months of the yr.With shares sitting close to document highs and up to date inflation traits proving extra certain, all eyes have became to the exertions marketplace for indicators of weak point because the Fed maintains its restrictive rate of interest stance.The June Jobs record will supply a powerful take a look at the exertions marketplace on Friday, whilst updates on personal payrolls and activity openings can be in focal point during the week. Updates on process within the production and products and services sectors can be scattered during the time table.Constellation Manufacturers (STZ) is anticipated to be the focal point of the lone notable company income record all through an differently quiet week sooner than large banks formally kick off 2d quarter income season the next week.Markets in america will shut early on July 3 (1 p.m. ET) and can stay closed on July 4 for Independence Day.A take a look at the exertions marketThe June Jobs record is due for free up on Friday morning and is anticipated to turn additional cooling within the activity marketplace.The record is anticipated to turn that 188,000 nonfarm payroll jobs had been added to america financial system remaining month, with unemployment protecting secure at 4%, in step with information from Bloomberg. In Might, america financial system added 272,000 jobs whilst the unemployment charge ticked up somewhat to 4%.Financial institution of The us US economist Michael Gapen reasoned a record alongside those strains would proceed to turn a exertions marketplace this is “cooling however no longer cool.”On Friday, the newest studying of the Fed’s most popular inflation gauge confirmed inflation eased in Might as costs higher at their slowest tempo since March 2021.The print used to be considered as a step in the best course for the Federal Reserve’s combat towards inflation.Certain traits in inflation, blended with indicators of slowing in financial process, have economists arguing the Fed will have to be leaning towards reducing rates of interest faster relatively than later.”Rising indicators of softness within the exertions marketplace display [Fed] officers additionally want to be responsive to dangers to the total employment facet in their mandate,” Oxford Economics deputy leader US economist Michael Pearce wrote in a word to purchasers.Development staff paintings on a brand new development partially coated with a big US flag on Sept. 25, 2013, in Los Angeles. (FREDERIC J. BROWN/AFP by way of Getty Pictures) (FREDERIC J. BROWN by way of Getty Pictures)Halftime reportJust like 2023, maximum of 2024’s inventory marketplace rally has been pushed by means of a couple of huge tech shares. Tale continuesMidway during the yr, greater than two thirds of the S&P 500’s features for the yr have come from Nvidia (NVDA), Apple (AAPL), Alphabet (GOOG, GOOGL), Microsoft (MSFT), Amazon (AMZN), Meta (META), and Broadcom (AVGO). Nvidia by myself has pushed just about one-third of those features.In spite of some short-lived rallies during the yr, simply two sectors have outperformed the S&P 500 this yr: Communications Services and products and Data Era. Each are up greater than 18% in comparison to the S&P 500’s kind of 15% acquire.This has saved the controversy going over whether or not the second one part of the yr will carry a broadening of the inventory marketplace rally, a hot-button factor on Wall Boulevard.Morgan Stanley’s leader funding officer Mike Wilson not too long ago argued in a analysis word that given weakening financial information and top rates of interest, a real broadening wherein sectors unrelated to tech pick out up the slack is not going to occur.”Slender breadth can persist however it isn’t essentially a headwind to ahead returns in and of itself,” Wilson stated. “We consider broadening may be restricted to prime quality/huge cap wallet for now.”Extra megacap exceptionalismMost strategists have reasoned that megacap tech firms have led the rally for excellent explanation why, given their income proceed to outperform the marketplace. That is anticipated to be the case all through 2d quarter income as smartly.Nvidia, Apple, Alphabet, Microsoft, Amazon, and Meta are anticipated to develop income by means of a blended 31.7% in the second one quarter, in step with UBS Funding Financial institution US fairness strategist Jonathan Golub.The S&P 500 itself is anticipated to develop income by means of a extra modest 7.8%.Which means the lion’s proportion of income expansion is as soon as once more anticipated to return from Large Tech. And a identical development has been observed in income revisions for the second one quarter.Since March 31, Golub’s paintings presentations income estimates for the S&P 500 have fallen simply 0.1%, a long way not up to the standard 3.3% drop observed on reasonable. That is due largely to a three.9% revision upward for the aforementioned six greatest tech firms.Coming into the second one part of the yr, the controversy over whether or not those Large Tech firms’ constant income beats will fall off will stay at heart degree.Weekly CalendarMondayEconomic information: S&P International US production, June ultimate (51.7 anticipated, 51.7 prior); Development spending, month-over-month, Might (0.3% anticipated, -0.1% prior); ISM Production, June (49.2 anticipated, 48.7 prior)Profits: No notable income.TuesdayEconomic information: Activity openings, Might (7.86 million anticipated, 8.06 million prior)Profits: No notable income.WednesdayEconomic information: MBA Loan Packages, week ended June 28 (0.8%); ADP personal payrolls, June (+158,000 anticipated, +152,000 prior); S&P world US Services and products PMI, June ultimate (52.3 anticipated, 55.1 prior), S&P International US composite PMI, June ultimate (54.6 prior); ISM products and services index, June (52.5 anticipated, 53.8 prior); ISM products and services costs paid, June (58.1); Manufacturing unit orders, Might (0.3% anticipated, 0.7% prior); Sturdy items orders, Might ultimate (0.1%)Profits: Constellation Manufacturers (STZ)ThursdayMarkets are closed for the July Fourth vacation.FridayEconomic calendar: Nonfarm payrolls, June (+188,000 anticipated, +272,000 prior); Unemployment charge, June (4% anticipated, 4% in the past); Reasonable hourly income, month-over-month, June (+0.3% anticipated, +0.4% prior); Reasonable hourly income, year-over-year, June (+3.9% anticipated, +4.1% prior); Reasonable weekly hours labored, June (34.3 anticipated, 34.3 prior); Exertions pressure participation charge, June (62.6% anticipated, 62.5% prior)Profits: No notable income.Josh Schafer is a reporter for Yahoo Finance. Apply him on X @_joshschafer.Click on right here for in-depth research of the newest inventory marketplace information and occasions transferring inventory costs.Learn the newest monetary and trade information from Yahoo Finance

)