Palantir (NASDAQ:PLTR) inventory has skilled a exceptional 343% expansion in 2024, propelling its valuation to lovely excessive multiples from as regards to each attitude.Pick out the most efficient shares and maximize your portfolio:

With PLTR now buying and selling at 49x EV/FY25 revenues, one might be forgiven for wondering whether or not the high-flying inventory is hovering too with reference to the solar.

At the turn aspect, Palantir bulls would argue that the corporate’s robust and reasonably unpredictable expansion patterns make conventional valuations for the AI information corporate much less related.

Best investor Gary Alexander is firmly in that camp, believing Palantir performs by way of its personal algorithm – ones that don’t have compatibility the standard company mould.

“I don’t assume near-term valuation multiples are altogether significant for a instrument corporate whose expansion itself has confirmed relatively unpredictable (and in all the time unexpected to the upside),” writes the 5-star investor, who sits within the most sensible 1% of TipRanks’ inventory execs.

Mentioning Palantir’s 30% year-over-year earnings expansion in Q3, Alexander concedes that lofty valuations provide a possibility. Nonetheless, he argues that temporary multiples fail to seize the entire scope of Palantir’s possible, as the corporate is nowhere close to navigating a “‘customary’ decelerating expansion curver.”

Additionally, in relation to expansion, in keeping with the investor, Palantir has quite a few runway up forward, each at house and in another country. That is in particular true for U.S. executive contracts, as protection spending is anticipated to be a concern beneath GOP management.

“I firmly consider a Trump presidency will get advantages Palantir’s The united states-first ethos and its longstanding partnership with U.S. protection entities,” Alexander opined. “Its possible to land massive executive offers with the brand new management is vast.”

At the business aspect of the ledger, the investor additionally issues to quite a few alternatives for Palantir to amplify its buyer base.

“The corporate has slightly ~500 consumers and is solely getting began,” notes Alexander. As kind of two-thirds of those non-public sector shoppers are within the U.S., the investor argues that Palantir has the prospective to very much building up its trade out of the country.

Alexander admits his outlook may just shift if Palantir’s expansion slows to the low 20% vary or if its margins stop to make stronger. For now, alternatively, he’s sticking together with his bullish stance, concluding that the most efficient transfer is to “keep lengthy right here and hang out for additional good points.” As such, he provides PLTR stocks a Purchase score. (To observe Alexander’s observe file, click on right here)

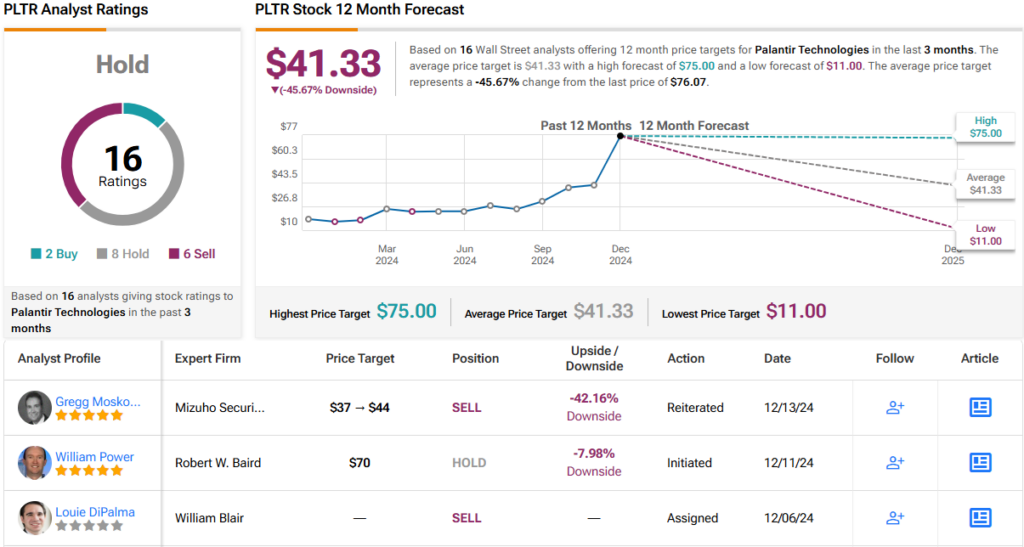

Wall Boulevard, alternatively, turns out to consider that the speedy expansion has long past too a ways. With 2 Purchase, 8 Hang, and six Promote suggestions, PLTR has a Hang (i.e. Impartial) consensus score. Its 12-month reasonable worth goal of $41.33 implies a ~46% drawback from present ranges. (See PLTR inventory forecast)

To search out just right concepts for shares buying and selling at sexy valuations, seek advice from TipRanks’ Perfect Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured investor. The content material is meant for use for informational functions handiest. It is important to to do your individual research prior to making any funding.