Nvidia (NASDAQ:NVDA) isn’t simply any corporate – it’s a powerhouse that drives the marketplace. As a pacesetter in AI chips and probably the most treasured corporate on Wall Side road, Nvidia has solidified its dominance within the profitable information middle marketplace, making it a go-to title for traders.Do not Fail to spot Analysis Equipment:

As Nvidia prepares to free up its third-quarter profits on Wednesday after the marketplace closes, traders are longing for clues in regards to the corporate’s outlook, the path of the AI business, and doable shifts around the broader marketplace.

Then again, given the sky-high expectancies surrounding Nvidia’s efficiency, one may ponder whether the corporate’s huge scale may ultimately weigh on its spectacular streak of development.

If truth be told, even the corporate’s projected Q3 earnings of $32.5 billion – a powerful 80% year-over-year build up – marks a slowdown from the triple-digit development charges the marketplace has come to be expecting. Will have to this be a sign to believe new alternatives?

Now not simply but, says most sensible investor Yiannis Zourmpanos, who stays assured that Nvidia’s unusual development tale is some distance from over.

“This high-growth trajectory is underpinned by means of expanding AI and data-intensive programs, maintaining Nvidia’s management and doable for long-term price appreciation,” argues the 5-star investor, who sits within the most sensible 1% of TipRanks’ inventory professionals.

Zourmpanos issues to NVDA’s Blackwell GPU manufacturing, which is ramping up this quarter and subsequent. With a thirsty marketplace longing for Nvidia’s newest and largest, the investor believes that Nvidia is well-placed to make the most of the excessive call for for Blackwell.

“With Blackwell chips by myself, Nvidia would possibly hit a possible earnings of over $30 billion in simply two quarters,” Zourmpanos initiatives.

Past the rise in revenues, the investor issues out that Nvidia has succeeded in making marketplace enhancements in its working margins, rising from 34% in FY2020 to 68% in FY2024.

“This development of earnings and margin development helps long-term valuation for the inventory,” Zourmpanos opines, including that “this permits Nvidia to maximise profitability as earnings scales up.”

Zourmpanos is subsequently bullish in this “interesting funding alternative,” score NVDA a Robust Purchase. (To observe Zourmpanos’ observe report, click on right here)

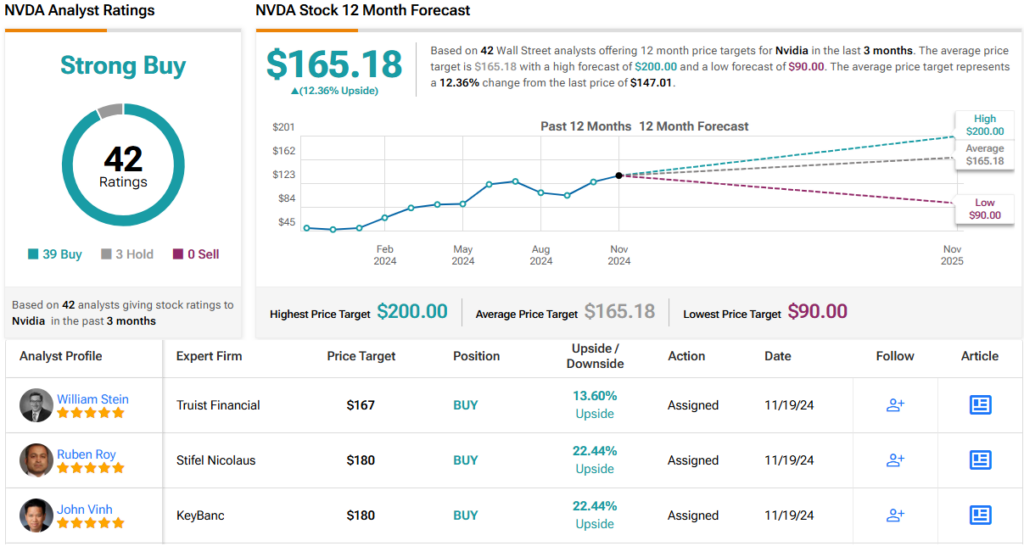

Wall Side road is similarly constructive referring to NVDA’s potentialities. With 39 Purchase and three Cling suggestions, NVDA boasts a Robust Purchase consensus score. (See NVDA inventory forecast)

To seek out excellent concepts for shares buying and selling at sexy valuations, consult with TipRanks’ Easiest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The evaluations expressed on this article are only the ones of the featured investor. The content material is meant for use for informational functions most effective. It is important to to do your individual research sooner than making any funding.