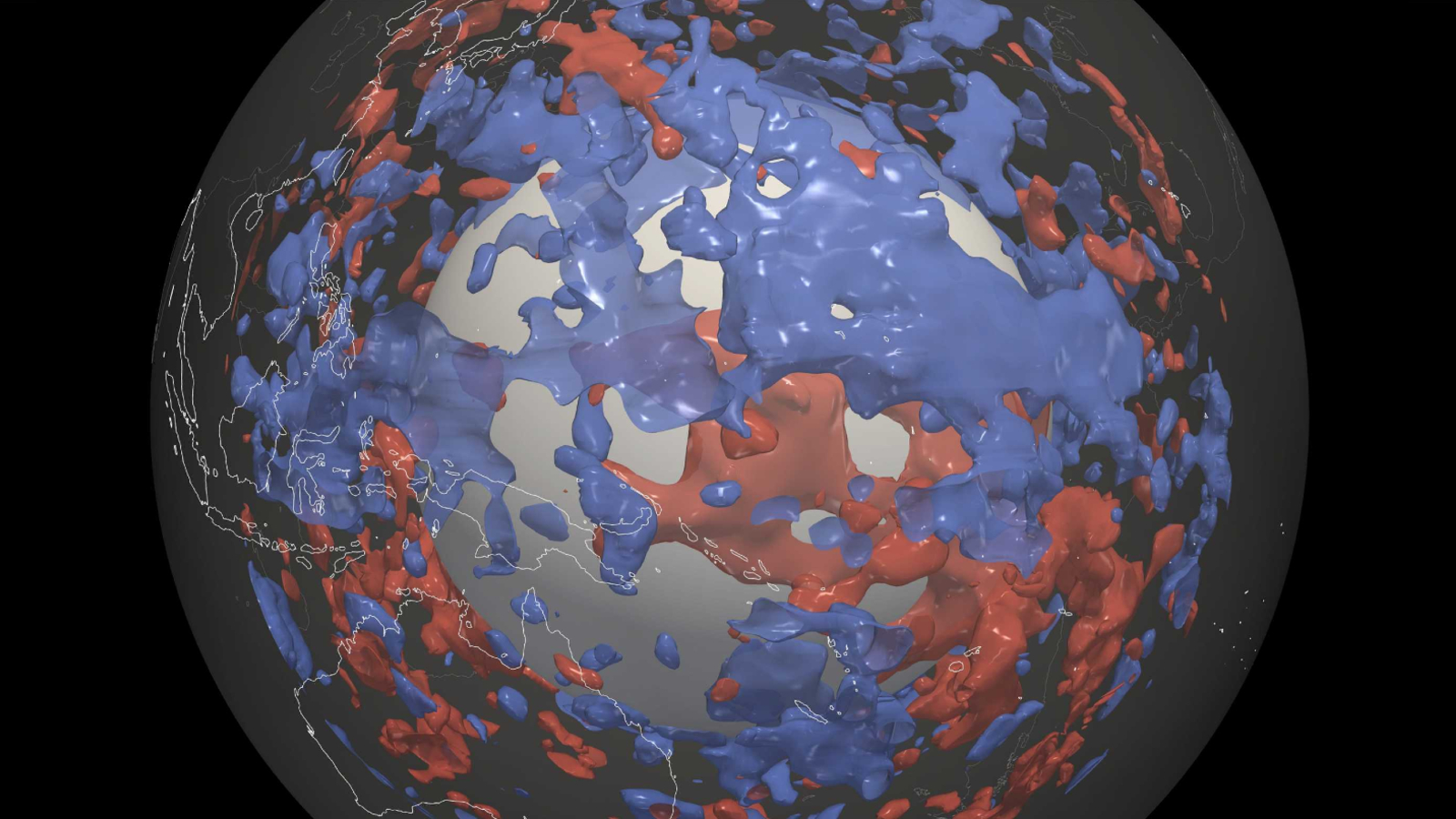

That is The Takeaway from lately’s Morning Temporary, which you’ll signal as much as obtain for your inbox each morning along side:Tesla (TSLA) and Alphabet (GOOGL) kicked off Large Tech income on Tuesday with blended effects. Every fell in after-hours buying and selling.However for all of the hand-wringing concerning the focus of oversized beneficial properties within the arms of a powerful few, inventory bulls have two causes to cheer as income season intensifies.First, markets simply finished a violent rotation that shifted winnings from the seven biggest US shares — Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Meta (META), Nvidia (NVDA), Tesla, and Alphabet — to small-cap shares and passion rate-sensitive names.Sectors like actual property, homebuilders, and regional banks are amongst the ones now main the best way.The severity of the transfer — which speeded up with the most recent susceptible inflation numbers — should not be discounted.Liz Ann Sonders, leader funding strategist at Charles Schwab, wrote that June used to be the Russell 2000’s worst month as opposed to the Nasdaq in over a yr. But, she notes that July is already monitoring the most efficient since 2016.In the meantime, within the land of giants, the Magnificent Seven misplaced $1.25 trillion in marketplace cap price over seven periods just lately — simply because the small-cap shares began saying power.The trillion-plus drop in valuation via the Magazine Seven represented an 8% fall in value — but the entire marketplace (the S&P 500) used to be off handiest 2% over the similar time. Timing is the whole lot.The opposite tailwind favoring bulls is a sport of income catch-up.The S&P 493 (the S&P 500 minus the Magazine Seven) is in spite of everything mountain climbing out of an income recession, as famous via the BofA US Fairness & Quant Technique group.S&P 493 EARNINGS GROWTH TURNING POSITIVE Income according to percentage (EPS) for the S&P 493 had been “flat to down for the previous 5 quarters,” wrote BofA, at the same time as EPS expansion for all 500 names grew to become sure 3 quarters in the past.This newfound power for the remainder of the marketplace comes simply as income expansion is “anticipated to gradual for the Magnificent Seven for the second one instantly quarter and once more within the [third quarter].”Apparently that even income expansion is rotating on the next period of time.The actual fact that general marketplace volatility stays subdued in spite of those tectonic shifts happening below the marketplace’s hood is a testomony to the resilience of the bull marketplace itself.And BofA expects the rally to proceed via breadth growth.”Given the top correlation between Tech’s outperformance in shares vs. income,” the financial institution wrote, “we think the narrowing expansion differential to be the catalyst for the marketplace to expand out.”Tale continues

morning temporary imageClick right here for the most recent inventory marketplace information and in-depth research, together with occasions that transfer stocksRead the most recent monetary and trade information from Yahoo Finance

:max_bytes(150000):strip_icc()/MRNAChart-c5223cae0f10466ca6ac62cdc51b2654.jpg)