Meta Platforms, Inc. META has been the second one best-performing Magnificent 7 inventory this yr after synthetic intelligence stalwart Nvidia Corp. NVDA. The inventory rally has nudged its co-founder and CEO, Mark Zuckerberg, to be upper at the listing of the international’s wealthiest folks.

Zuckerberg Pips Previous Bezos: Bloomberg’s up to date billionaire listing displays Zuckerberg emerging in rank and turning into the sector’s second-richest particular person after Tesla, Inc.’s TSLA Elon Musk. The loser used to be Amazon, Inc. AMZN founder Jeff Bezos, who had stepped down from an lively control position within the corporate that he based in 1994. Bezos ceded his moment place to the Meta CEO amid the relative outperformance of the social-media large’s inventory.

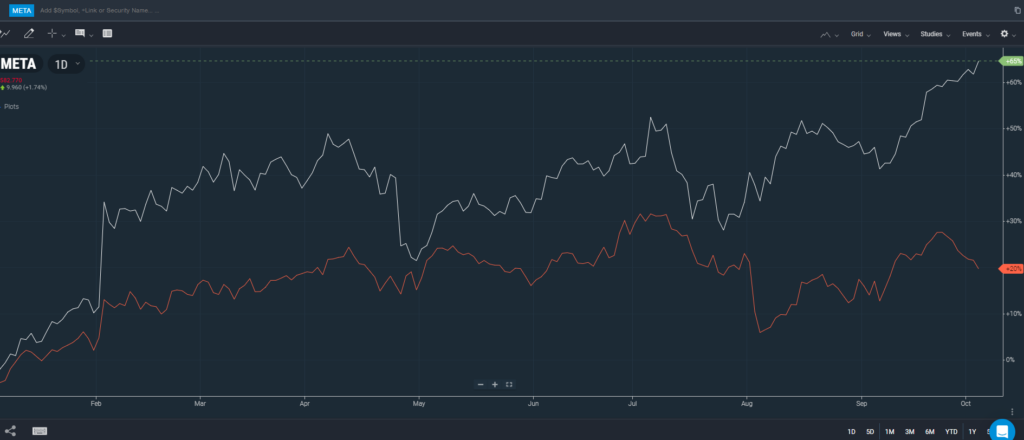

Right here’s how the 2 shares fared this yr:

Chart Courtesy of Benzinga Professional

Meta has won over 64% for the year-to-date length in comparison to Amazon’s kind of 20% acquire. After transferring virtually in tandem with Meta, albeit with a extra modest acquire, for a lot of the yr, Amazon has obviously begun diverging since past due September.

Zuckerberg’s internet price is $206 billion, somewhat upper than Bezos’ $205 billion. Extra importantly, the Meta CEO is handiest $50 billion in deficit as opposed to Musk’s wealth. It would come as no marvel if he quickly takes over the crown from Musk, given Meta’s attainable as opposed to Tesla’s pitfalls. Tesla remains to be suffering to show round its core electric-vehicle industry to trend-like enlargement and promising alternatives equivalent to complete self-driving era and robotaxi are anticipated handiest to be long-term drivers.

Be it Zuckerberg or Bezos, a lot in their wealth is tied to inventory possession within the respective corporations they based. Inventory vagaries may subsequently play a key position in deciding their fortunes.

See Additionally: How To Purchase Meta (Previously Fb) Inventory

What’s Firing Up Fb Dad or mum: Meta used to be a number of the COVID-19 play that benefited from the work-from-home and lockdown restrictions that have been in position then. The pandemic rally stalled in Sept. 2021, and the inventory started a year-long secular downtrend till early November 2022. Declines in each best and bottom-line figures amid an advert spending slowdown, funding into the loss-making Truth Labs department, Apple‘s privateness projects, and a aggressive risk from TikTok all served as drags.

Meta’s control although used to be fast with resuscitation measures and unveiled strategic plans to streamline operations and navigate thru opposed prerequisites. In Nov. 2022, the corporate introduced a vital group of workers relief, getting rid of 11,000 workers because the preliminary step.

In a letter to workers detailing the layoffs, CEO Mark Zuckerberg defined further measures, together with table sharing for far off employees, infrastructure evaluate for spending cuts, and a hiring freeze till the primary quarter of 2023. The marketplace replied undoubtedly to those resuscitation measures, resulting in a rebound in Meta’s inventory from its six-year low.

Meta’s AI pivot and the Metaverse challenge additionally helped re-ignite investor passion within the inventory. After bottoming in Oct. 2022, the inventory has been on a broader stable uptrend. The Meta Attach 2024 held in past due September has proved salubrious for the inventory. The corporate introduced AI-driven chatbots, an replace to its Llama large-language type, the most recent Ray-Ban sensible glasses with stepped forward digicam capability, voice controls, and deeper integration with AI, Meta Quest 4, the next-generation digital fact headset, and the Orion augmented fact glasses.

Amazon’s Lags: Amazon, although running in a couple of era spaces, nonetheless derives the majority of its income from its core e-commerce industry, with a lot of the income accumulated from North The us. The possibilities of the industry are strongly tied to client spending, which has remained unsure within the present financial cycle.

The corporate has constructed up, or built-in rankings of different companies, together with its AWS cloud computing industry, Zoox, a self-driving automobile department, Kuiper Techniques, a satellite tv for pc Web supplier, and Amazon Lab126, a pc {hardware} R&D supplier. Its subsidiaries come with Ring, Twitch, IMDb, and brick-and-mortar grocery store Complete Meals Marketplace.

In a be aware launched on Thursday, Morgan Stanley analyst Brian Nowak sounded out near-term dangers. “We nonetheless see tactical chance to 4Q EBIT information as AMZN invests to force its faster-growing, lower-margin necessities industry thru a aggressive vacation,” the analyst mentioned.

Nowak, on the other hand, dedicated to the inventory medium- and long-term. He mentioned he would purchase any weak spot as he believes the corporate will make low-priced necessities successful and can pursue a value construction that gives visibility right into a trail to $8-$9 of loose money drift.

Meta closed Thursday’s consultation 1.74% upper at $582.77, whilst Amazon fell 1.52% to $181.96, in line with Benzinga Professional information. Amazon inventory has been on a seven-session shedding streak amid worries regarding the vacation season after the corporate’s brief vacation hiring plan published a flattish style.

Learn Subsequent:

Symbol by the use of Shutterstock© 2024 Benzinga.com. Benzinga does no longer supply funding recommendation. All rights reserved.

![Ottocast elevates the hooked up vehicle enjoy with wi-fi CarPlay AI Field, CloudSIM, Automotive TV Mate Professional, extra [20% off] – 9to5Mac Ottocast elevates the hooked up vehicle enjoy with wi-fi CarPlay AI Field, CloudSIM, Automotive TV Mate Professional, extra [20% off] – 9to5Mac](https://9to5mac.com/wp-content/uploads/sites/6/2024/12/ottocast2.jpg?quality=82&strip=all&w=1500)