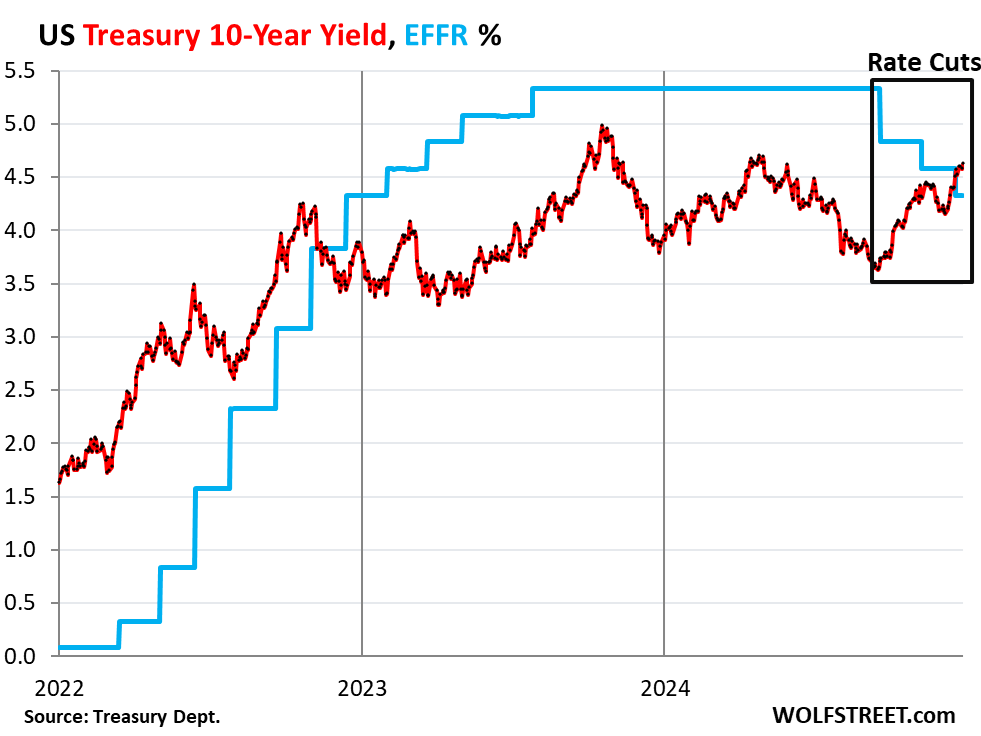

Election Day is nearly right here. The looming query stays how a Donald Trump or Kamala Harris victory will form the marketplace narrative for the remainder of the yr and past. Traders will have to quickly be told the solution, with American citizens heading to the polls subsequent Tuesday. Within the week ahead of the election, the S&P 500 (^GSPC) fell about 1.37% whilst the tech-heavy Nasdaq Composite (^IXIC) shed 1.5% regardless of hitting its first report shut since June throughout the week. In the meantime, the Dow Jones Business Reasonable (^DJI) dropped simply over 0.1%. It isn’t the one giant tournament of the week forward. On Thursday the Federal Reserve will announce its newest coverage determination, with markets in large part expecting that the central financial institution will lower rates of interest via 1 / 4 share level. Income season rolls on with every week headlined via reviews from Palantir (PLTR), Tremendous Micro Laptop (SMCI), Arm (ARM), Qualcomm (QCOM), and Moderna (MRNA). One of the vital most sensible doubtlessly market-moving occasions that strategists have mentioned all the way through the yr has in the end arrived with the 2024 presidential election slated for Tuesday, Nov. 5. However it is been an strange election yr for markets. When inspecting the S&P 500’s moderate intraday buying and selling vary, Carson Team leader markets strategist Ryan Detrick discovered that this previous October used to be the second-least unstable month main into an election prior to now 50 years. Zooming out additional, analysis from Bespoke Funding Team presentations the S&P 500 had its perfect begin to an election yr since 1932, with a 20% year-to-date go back for the benchmark index throughout the finish of October. Nonetheless, Election Day itself is thought of as a possibility tournament for markets. Hypothesis has constructed {that a} “Trump Industry” has been forming in markets because the making a bet odds of the previous president profitable the election have risen. However some marketplace strategists are not satisfied there is a transparent learn on what end result traders shall be rooting for come Tuesday. “I believe the marketplace would do positive with Harris,” Yardeni Analysis leader markets strategist Eric Wallerstein advised Yahoo Finance. “I believe the marketplace would do positive with Trump. I don’t believe the inventory marketplace is truly pricing any presidential odds.” Franklin Templeton leader markets strategist Stephen Dover advised Yahoo Finance that the important thing for markets may merely be getting previous the development itself. “Simply having the ones elections settled, whichever approach it is going, could be certain,” Dover stated. Baird marketplace strategist Michael Antonelli agreed, telling Yahoo Finance that the riskiest situation from the election is “one the place we simply do not know the winner.” Tale Continues US Flags at the entrance of the New York Inventory Trade dangle in the back of the road indicators making the nook of Wall and Wide Streets on Oct. 24, 2024, in New York Town. (J. David Ake/Getty Pictures) · J. David Ake by means of Getty Pictures Markets are broadly anticipating the Federal Reserve to chop rates of interest via 25 foundation issues when it declares its subsequent coverage determination on Nov. 7. The important thing query coming into the assembly is what the Federal Reserve will (or would possibly not) sign about its plans for long term conferences. For the reason that records has persisted to turn an financial system pacing for cast enlargement whilst inflation’s trail right down to the Fed’s 2% function stays bumpy, markets have moved to value in fewer rate of interest cuts over the following yr than to begin with concept when the Fed lower charges via part a share level on Sept. 18. As of Friday, markets see about 3 much less fee cuts throughout the finish of subsequent yr than prior to now concept. Learn extra: What the Fed fee lower way for financial institution accounts, CDs, loans, and bank cards Morgan Stanley leader world economist Seth Wood worker does not suppose markets gets a lot more readability at the Fed’s trail subsequent week. “The energy in enlargement provides the Fed persistence because it permits coverage easing to be slow,” Wood worker wrote in a notice to shoppers on Friday. “Neither inflation nor unemployment is forcing the Fed’s hand. We don’t be expecting Powell to present particular steerage at the measurement or cadence of long term cuts. Coverage stays data-dependent, and neither the September 50 [basis point] lower nor the November 25 [basis point] lower signifies the longer term tempo.” The marketplace’s debate over how a lot easing the Fed will enact over the following yr has despatched the 10-year Treasury yield (^TNX) hovering because the closing Fed assembly in September. The ten-year added about 7 foundation issues on Friday to near close to 4.36%, its absolute best stage since early July. Baird funding strategist Ross Mayfield advised Yahoo Finance that the transfer in charges, and the entire center of attention at the financial records riding them upper, is overshadowing what is shaping as much as be some other cast quarter of company effects. With 70% of the S&P 500 having reported quarterly effects, the benchmark index is pacing for year-over-year profits enlargement of five.1%. This might mark the 5th immediately quarter of profits enlargement because the index continues to rebound from the profits recession observed in 2023. “We went thru a two-year length the place profits have been flat,” Mayfield stated. “They have been unstable. Now we now have profits on the upward thrust once more. They are beating analyst expectancies at a sexy cast clip. Benefit margins are increasing. So the large image is issues glance beautiful excellent.” And that tale seems to be staying intact for the fourth quarter too. Because the length started initially of October, analysts have lower estimates via 1.8%, in line with FactSet records. That is in keeping with the typical lower to profits observed over the last 10 years. “At a definite level, profits must take the baton,” Mayfield stated. “I believe we are in a excellent place for profits to try this.” Weekly Calendar Monday Financial records: Manufacturing facility orders, September (-0.5% anticipated, -0.2% prior), Sturdy items orders, September (-0.8% anticipated, -0.8% prior) Income: Berkshire Hathaway (BRK-A, BRK-B), Cleveland-Cliffs (CLF), Constellation Power (CEG), Goodyear (GT), Hims & Hers (HIMS), Marriott Global (MAR), Palantir (PLTR), Wynn (WYNN) Tuesday (Election Day) Financial records: ISM services and products index, October (53.8 anticipated, 54.9 prior) Income: Apollo International Control (APO), Devon Power (DVN), Ferrari (RACE), Tremendous Micro Laptop (SMCI) Wednesday Financial records: MBA Loan Programs, the week ended Nov. 1 (-0.1% prior); S&P International US services and products PMI, October ultimate (55.3 anticipated, 55.3 prior); S&P International US composite PMI, October ultimate (54.3 prior) Income: Arm Holdings (ARM), AMC (AMC), Aurora Hashish (ACB), Celsius Holdings (CELH), CVS (CVS), Elf (ELF), Novo Nordisk (NVO), Qualcomm (QCOM), Toyota (TM) Thursday Financial records: Federal Reserve rate of interest determination (0.25% rate of interest lower anticipated) Preliminary jobless claims, week finishing Nov. 2 (221,000 anticipated, 216,00 prior) Income: Confirm (AFRM), Airbnb (ABNB) Block (SQ), Datadog (DDOG), DraftKings (DKNG), Halliburton (HAL), Hershey (HSY), Moderna (MRNA), Pinterest (PINS), Rivian (RIVN), The Industry Table (TTD) Friday Financial calendar: College of Michigan shopper sentiment, November initial (71 anticipated, 70.5 prior) Income: Cover Enlargement (CGC), Icahn Enterprises (IEP), Sony (SONY)

:max_bytes(150000):strip_icc()/GettyImages-2190848732-e82ca8b164c74252a2f47b0e20fee915.jpg)