Broadcom’s (AVGO 1.13%) stocks surged via just about 25% after the corporate posted an excellent monetary efficiency for the fourth quarter of fiscal 2024 (ended Nov. 3). This main customized chip fashion designer and infrastructure instrument maker has emerged as a significant beneficiary of the continuing synthetic intelligence (AI) development, particularly since hyperscalers search specialised choices to beef up productiveness and scale back prices.

Whilst Nvidia’s (NVDA 3.08%) general-purpose Hopper and Blackwell structure AI chips are extremely sought-after within the AI marketplace, Broadcom has effectively created its area of interest. Broadcom works carefully with consumers to increase customized AI accelerators (XPUs) and networking infrastructure adapted to their AI wishes.

Nvidia’s AI chip dominance has been pivotal in propelling its inventory via just about 163% in 2024. Broadcom’s stocks also are up via nearly 115% in 2024. Can this AI inventory change into the following Wall Side road favourite and take Nvidia’s place? Let’s to find out.

Customized AI accelerators and networking services and products

Fiscal 2024 has been rather remarkable for Broadcom. Income soared 44% yr over yr to a file degree of $51.6 billion in Q4. AI industry, which incorporates customized AI accelerators and AI-optimized networking answers, was once without a doubt a significant enlargement catalyst, with earnings emerging 220% yr over yr to $12.2 billion in fiscal 2024.

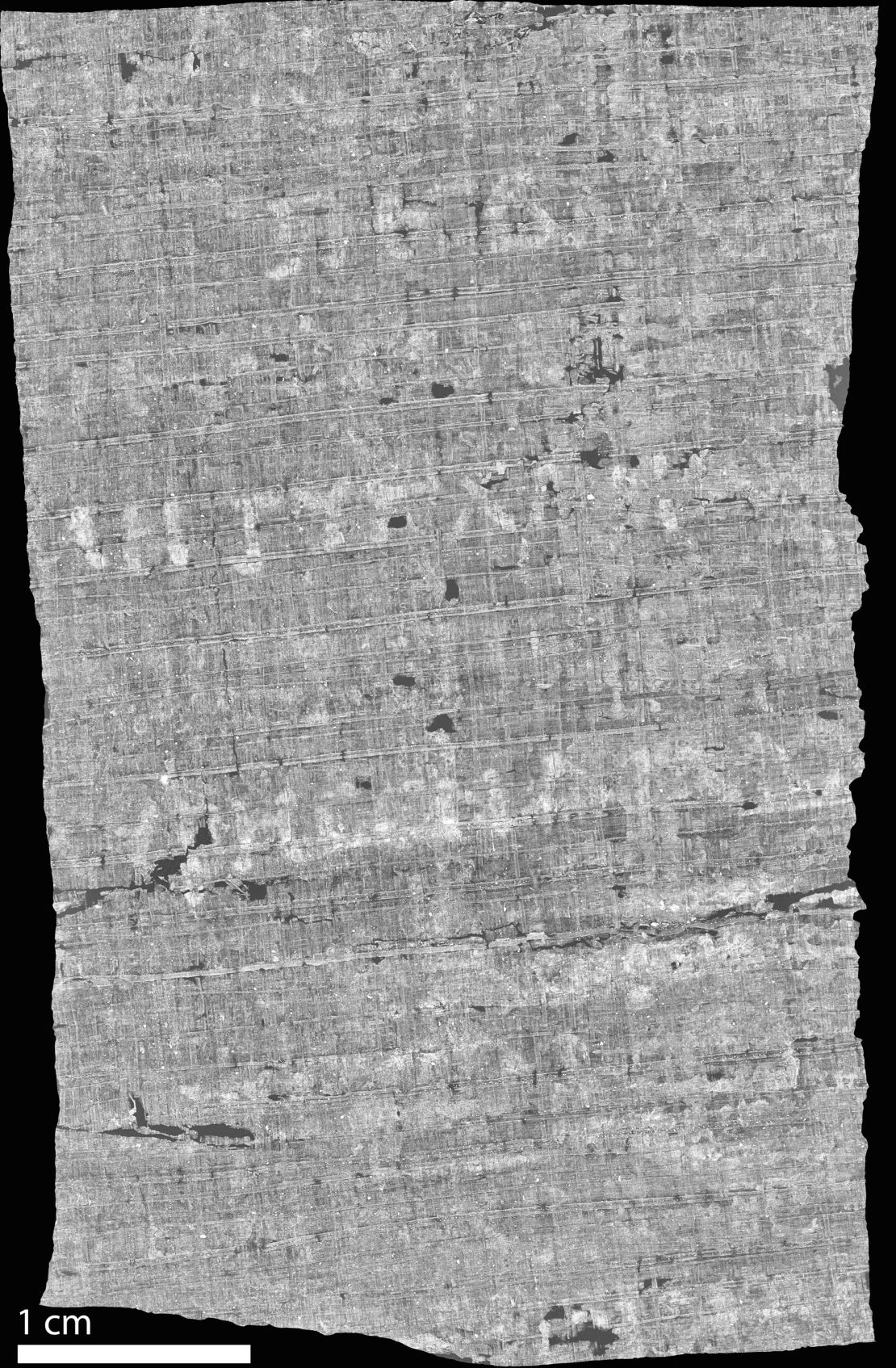

Broadcom has demonstrated spectacular technological power via growing next-generation XPUs the use of 3-nanometer (nm) procedure era. The corporate is specializing in each computing and networking alternatives.

Present AI infrastructure setups with 500,000 XPUs allocate 5% to ten% of the assets to networking content material ({hardware} and instrument) in comparison to computation content material. Then again, with the corporate’s 3 best hyperscale consumers making plans to deploy just about 1 million XPUs in 2027, 15% to twenty% of assets can be allotted to networking content material. Broadcom is easily located to capitalize in this alternative, because of its experience in scaling AI infrastructure (connecting XPUs inside and throughout information racks) and deep engagement with consumers.

Broadcom estimates its AI serviceable addressable marketplace (SAM) for XPUs and networking infrastructure to be price $60 billion to $90 billion via 2027. Moreover, Broadcom has been decided on via two further hyperscale consumers for his or her next-generation XPUs. The corporate expects those consumers to begin producing earnings earlier than 2027, thereby leading to additional growth of its AI SAM.

VMware acquisition

Broadcom has effectively progressed VMware’s running margin from 30% earlier than acquisition to a staggering 70%, inside twelve months of ultimate the deal. The corporate lowered VMware’s quarterly bills from a median of $2.4 billion pre-acquisition to $1.2 billion within the fourth quarter. Therefore, the corporate is not off course to ship incremental adjusted profits earlier than hobby, taxes, depreciation, and amortization (EBITDA) way over $8.5 billion and previous than the preliminary goal of 3 years post-deal closure.

Broadcom has additionally reinforced VMware’s information heart virtualization industry. Knowledge heart virtualization comes to developing digital information facilities on a unmarried bodily server to optimize useful resource usage.

Because the acquisition, the corporate has signed up greater than 4,500 of its greatest 10,000 consumers for VMware Cloud Basis (VCF), enabling them to deploy non-public cloud environments on their on-premise IT infrastructures. Therefore, the annualized reserving worth (ABV) for VMware is anticipated to develop from $2.7 billion within the fourth quarter to greater than $3 billion within the first quarter of fiscal 2025.

These kind of projects helped scale back Broadcom’s overreliance at the semiconductor industry via strengthening its place within the undertaking instrument marketplace.

Valuation

Broadcom is buying and selling at about 20.6 instances the trailing-12-month gross sales, considerably upper than its historic five-year reasonable price-to-sales (P/S) a couple of of eleven.68. The wealthy valuation, then again, is justified making an allowance for that the corporate is profiting from powerful AI-powered tailwinds. Moreover, Broadcom’s valuation is a long way less than Nvidia’s P/S a couple of of 27.75.

Can Broadcom be the following Nvidia?

Regardless of being a semiconductor participant focused on the similar AI infrastructure marketplace, Broadcom has a lot catching as much as do earlier than it dethrones Nvidia.

Nvidia accounts for 70% to 95% of the AI chips used to coach and deploy massive language fashions. Nvidia has been effectively transitioning its massive GPU-installed base from coaching to inferencing (executing fashions within the manufacturing setting) with the assistance of instrument frameworks, libraries, and algorithms.

With hyperscalers and enterprises occupied with optimizing their AI spend, many would select to stay with Nvidia as a substitute of switching to Broadcom. Moreover, Nvidia has constructed a vast ecosystem of {hardware}, instrument, and toughen services and products. Therefore, the corporate is easily located to seize the incremental proportion within the AI marketplace.

Bearing in mind those elements, I consider that it is going to take a couple of extra years for Broadcom to change into the following Nvidia.