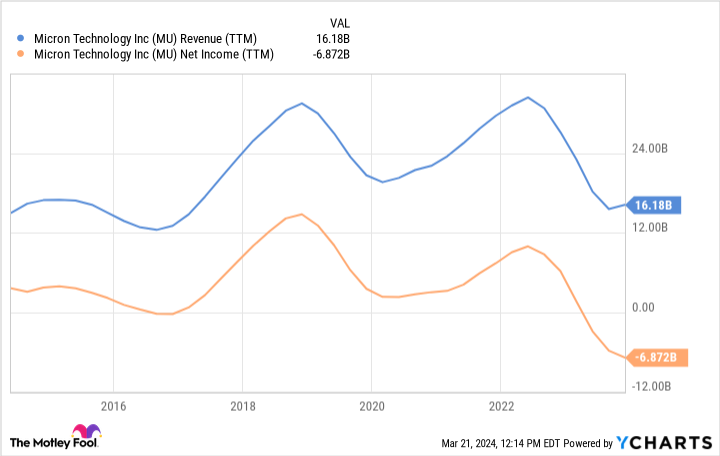

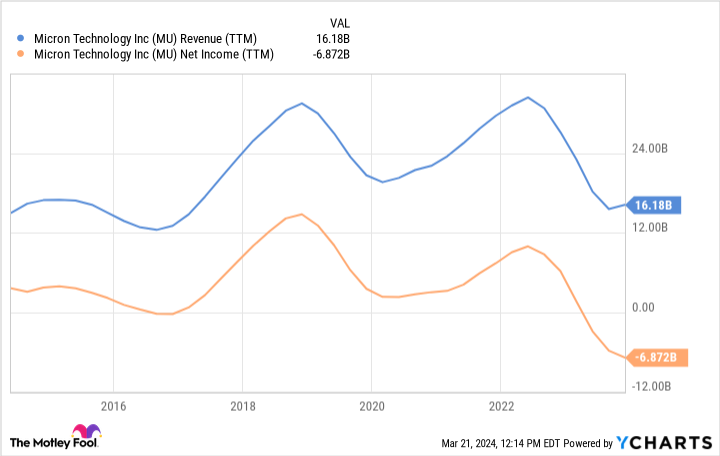

The newest semiconductor business downturn, led via the steep falloff in client electronics (PCs and smartphones) spending after the pandemic, has been completely brutal on U.S. reminiscence chipmaker Micron Era (NASDAQ: MU). Then again, Micron is again in all-out enlargement mode, and it simply grew to become a GAAP benefit once more in its ultimate reported quarter (Q2 fiscal 2024, the 3 months resulted in February 2024). Credit score is going to a go back of standard PC and smartphone buying, however some other key issue is Nvidia’s (NASDAQ: NVDA) generative synthetic intelligence (AI) revolution.Micron’s go back to profitability has large implications for its inventory (in addition to for reminiscence chip production apparatus and repair suppliers like Lam Analysis (NASDAQ: LRCX)). Nevertheless it additionally has probably enormous implications for Nvidia and the already white-hot generative AI infrastructure growth. Here is what buyers want to know.Micron is totally booked and contemporary out of modern memoryAs for high-level stuff, Micron reported a 58% year-over-year build up in gross sales ultimate quarter to $5.82 billion. Its fast go back again to its ultimate height gross sales cycle, which passed off in 2022 on the finish of the pandemic-induced chip scarcity, will proceed in fiscal Q3 2024 (which results in Might). Control is predicting earnings of $6.6 billion on the midpoint of steering, which might equivalent a 76% year-over-year soar.That enlargement is spectacular, however notice that Micron continues to be lapping its horribly depressed monetary effects from the depths of the undergo marketplace a 12 months in the past.

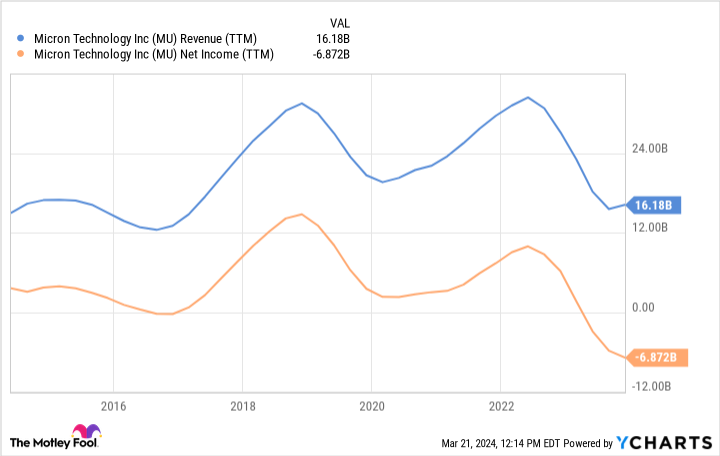

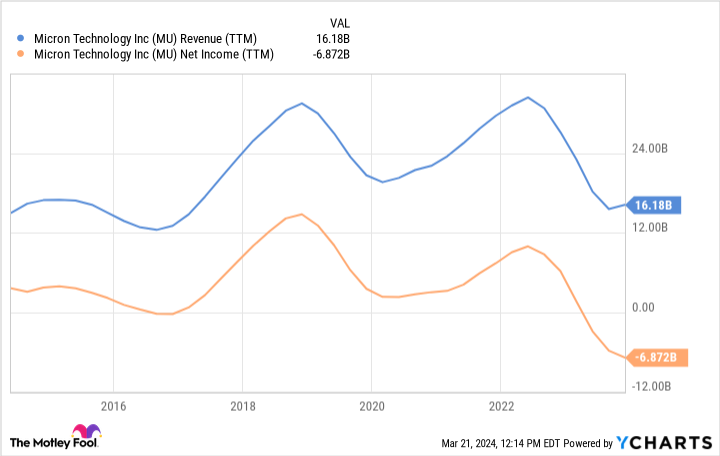

MU Earnings (TTM) ChartThis is all nonetheless incredible information for Micron, which after all reported a GAAP web benefit once more of $793 million (or $476 million on an adjusted foundation). The corporate has so much to achieve because it assists in keeping ramping up production of HBM3e, the newest iteration of third-generation high-bandwidth reminiscence. HBM3e is utilized in speeded up computing and AI — like Nvidia’s new techniques simply introduced at its annual GTC match ultimate week.Tale continuesThe marketplace has been going wild over a trade that up till simply this quarter has been running deep within the pink. However buyers have been vindicated via this quote from Micron CEO Sanjay Mehrotra: “We’re on target to generate a number of hundred million bucks of earnings from HBM in fiscal 2024 and be expecting HBM revenues to be accretive to our DRAM and general gross margins beginning within the fiscal 1/3 quarter. Our HBM is bought out for calendar 2024, and the vast majority of our 2025 provide has already been allotted.”In different phrases, it seems like the great instances will stay rolling for no less than some other 12 months, if now not longer.Does Nvidia’s inventory run have legs?All eyes were on Nvidia’s ancient run, with its stocks up neatly over 500% because the get started of 2023. Even after this melt-up, even though, the inventory trades for 37 instances Wall Side road analysts’ current-year expectancies for income according to proportion.Underpinning this expectation is that Nvidia income will double from ultimate 12 months. Simply as Micron expects AI computing enlargement to proceed nearly unabated via 2025, so do Nvidia buyers. The truth that Micron’s HBM production capability is nearly totally booked out via 2025 is a cast indication of Nvidia’s call for for extra high-end reminiscence chips.Then again, and that is the $2.3 trillion query (truly, that is Nvidia’s approximate marketplace cap as of this writing), Nvidia’s call for for those HBM chips is dependent upon its shoppers proceeding to gobble up as many speeded up compute techniques it could possibly crank out with companions like Micron.However the semiconductor production area is very collaborative. It prices a substantial amount of cash to design, construct, and promote those techniques. Nvidia is not prone to be reserving large orders from Micron if it wasn’t getting advance orders from its large tech knowledge heart shoppers.To make certain, this birthday party will come to an finish one day. However as of at this time, apparently Nvidia has quite a few runway forward of it. Micron up to mentioned so in its newest income replace.Must you make investments $1,000 in Micron Era at this time?Before you purchase inventory in Micron Era, imagine this:The Motley Idiot Inventory Guide analyst workforce simply known what they consider are the 10 highest shares for buyers to shop for now… and Micron Era wasn’t certainly one of them. The ten shares that made the reduce may just produce monster returns within the coming years.Inventory Guide supplies buyers with an easy-to-follow blueprint for luck, together with steering on construction a portfolio, common updates from analysts, and two new inventory selections each and every month. The Inventory Guide provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Guide returns as of March 21, 2024Nicholas Rossolillo and his purchasers have positions in Lam Analysis, Micron Era, and Nvidia. The Motley Idiot has positions in and recommends Lam Analysis and Nvidia. The Motley Idiot has a disclosure coverage.Micron Is Bought Out of Prime-Bandwidth Reminiscence Chips — What Does That Imply for Nvidia’s AI Dominance? used to be firstly revealed via The Motley Idiot

MU Earnings (TTM) ChartThis is all nonetheless incredible information for Micron, which after all reported a GAAP web benefit once more of $793 million (or $476 million on an adjusted foundation). The corporate has so much to achieve because it assists in keeping ramping up production of HBM3e, the newest iteration of third-generation high-bandwidth reminiscence. HBM3e is utilized in speeded up computing and AI — like Nvidia’s new techniques simply introduced at its annual GTC match ultimate week.Tale continuesThe marketplace has been going wild over a trade that up till simply this quarter has been running deep within the pink. However buyers have been vindicated via this quote from Micron CEO Sanjay Mehrotra: “We’re on target to generate a number of hundred million bucks of earnings from HBM in fiscal 2024 and be expecting HBM revenues to be accretive to our DRAM and general gross margins beginning within the fiscal 1/3 quarter. Our HBM is bought out for calendar 2024, and the vast majority of our 2025 provide has already been allotted.”In different phrases, it seems like the great instances will stay rolling for no less than some other 12 months, if now not longer.Does Nvidia’s inventory run have legs?All eyes were on Nvidia’s ancient run, with its stocks up neatly over 500% because the get started of 2023. Even after this melt-up, even though, the inventory trades for 37 instances Wall Side road analysts’ current-year expectancies for income according to proportion.Underpinning this expectation is that Nvidia income will double from ultimate 12 months. Simply as Micron expects AI computing enlargement to proceed nearly unabated via 2025, so do Nvidia buyers. The truth that Micron’s HBM production capability is nearly totally booked out via 2025 is a cast indication of Nvidia’s call for for extra high-end reminiscence chips.Then again, and that is the $2.3 trillion query (truly, that is Nvidia’s approximate marketplace cap as of this writing), Nvidia’s call for for those HBM chips is dependent upon its shoppers proceeding to gobble up as many speeded up compute techniques it could possibly crank out with companions like Micron.However the semiconductor production area is very collaborative. It prices a substantial amount of cash to design, construct, and promote those techniques. Nvidia is not prone to be reserving large orders from Micron if it wasn’t getting advance orders from its large tech knowledge heart shoppers.To make certain, this birthday party will come to an finish one day. However as of at this time, apparently Nvidia has quite a few runway forward of it. Micron up to mentioned so in its newest income replace.Must you make investments $1,000 in Micron Era at this time?Before you purchase inventory in Micron Era, imagine this:The Motley Idiot Inventory Guide analyst workforce simply known what they consider are the 10 highest shares for buyers to shop for now… and Micron Era wasn’t certainly one of them. The ten shares that made the reduce may just produce monster returns within the coming years.Inventory Guide supplies buyers with an easy-to-follow blueprint for luck, together with steering on construction a portfolio, common updates from analysts, and two new inventory selections each and every month. The Inventory Guide provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Guide returns as of March 21, 2024Nicholas Rossolillo and his purchasers have positions in Lam Analysis, Micron Era, and Nvidia. The Motley Idiot has positions in and recommends Lam Analysis and Nvidia. The Motley Idiot has a disclosure coverage.Micron Is Bought Out of Prime-Bandwidth Reminiscence Chips — What Does That Imply for Nvidia’s AI Dominance? used to be firstly revealed via The Motley Idiot