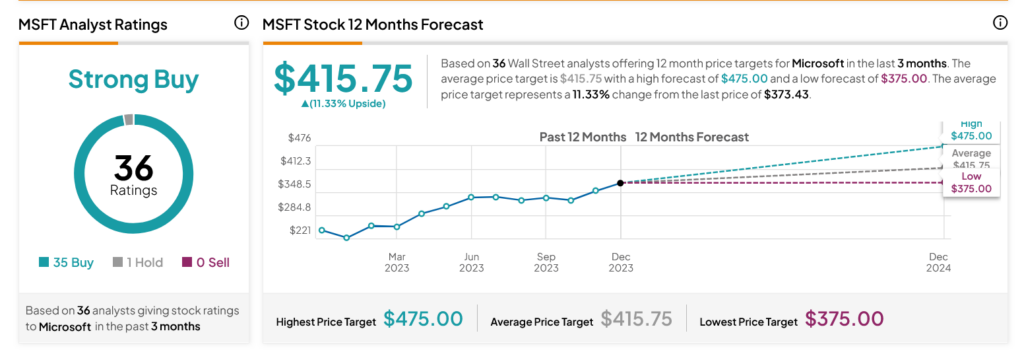

Tech massive Microsoft (NASDAQ:MSFT) has made nice strides in synthetic intelligence, and now not simply by supporting OpenAI. There were a number of iterations of it, and new reviews have emerged about how tough its newest construction, the Phi-2, is. Buyers, too, have been modestly inspired and despatched stocks down within the ultimate mins of Tuesday’s buying and selling consultation. Microsoft weighed in, revealing that the Phi-2 was once now not simplest appropriate for working on a couple of gadgets but additionally tough sufficient to tackle – and beat – a number of fashions of its competition. As an example, Microsoft discovered it will take Meta Platforms’ (NASDAQ:META) AI and beat it. Additional, Microsoft printed that Phi-2 used 2.7 billion devices, which was once sufficient to overcome Mistral and Llama-2 the usage of a number of “benchmarks”. The Phi-2 was once large enough to tackle Google (NASDAQ: GOOG ) (NASDAQ: GOOGL ) and its Gemini Nano 2, despite the fact that the Phi-2 wasn’t rather the similar measurement because the Nano 2. However Will AI Take Over Our Jobs? Microsoft, in all probability understanding that limitless get admission to to AI may just result in the transformation of a number of industries to the purpose the place they not want employees, determined to unravel the issues via setting up cooperation with hard work teams. The partnership goals to offer details about AI era, and to make use of “the information and experience of the staff” in construction AI era. Despite the fact that many are nonetheless skeptical – and no “running settlement” will repair this – the transfer may well be observed as a just right one for Microsoft. What’s the Goal Worth for Microsoft Inventory? Turning to Wall Boulevard, analysts have a Robust Purchase consensus on MSFT inventory in accordance with 35 Buys and one Grasp issued up to now 3 months, as proven within the chart underneath. After a 46.32% rally within the proportion worth during the last 12 months, MSFT’s moderate worth of $415.75 in keeping with proportion implies 11.33% upside attainable.

Disclosure