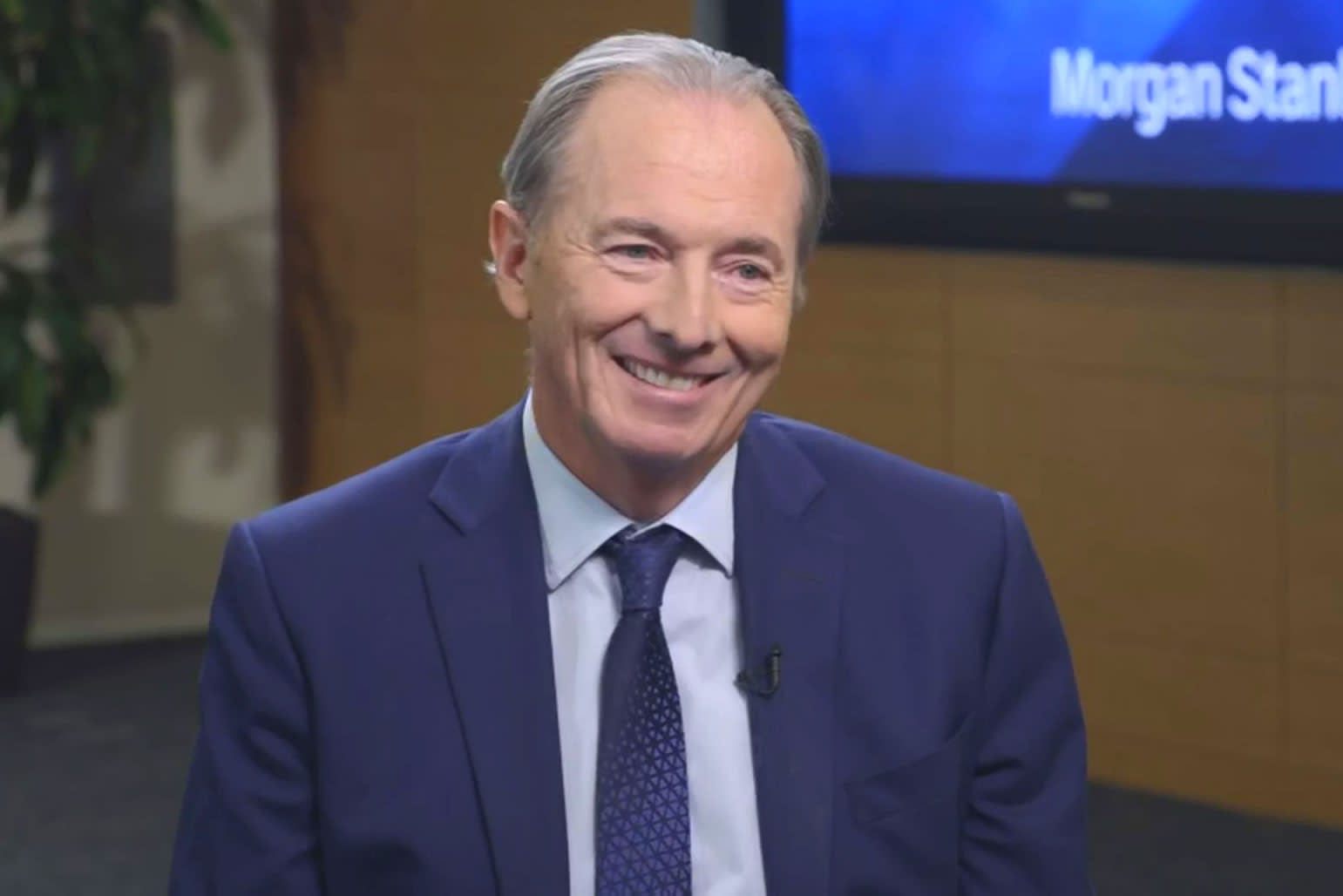

James Gorman, Morgan Stanley CEO, July 18, 2023.CNBCMorgan Stanley posted third-quarter effects that crowned benefit estimates on better-than-expected buying and selling earnings.Here is what the corporate reported:Profits in keeping with proportion: $1.38, vs. anticipated $1.28 estimate from LSEG, previously referred to as Refinitiv Earnings: $13.27 billion, vs. anticipated $13.23 billionProfit fell 9% to $2.41 billion, or $1.35 a proportion, from a 12 months in the past, the New York-based financial institution stated in a observation. Earnings grew 2% to $13.27 billion, necessarily matching expectancies.Morgan Stanley’s buying and selling operations helped offset earnings misses in other places on the company. The financial institution’s bond investors produced $1.95 billion in earnings, kind of $200 million greater than the StreetAccount estimate, whilst fairness investors made $2.51 billion in earnings, $100 million greater than anticipated.However the financial institution’s all-important wealth control department generated $6.4 billion in earnings, underneath the $6.63 billion estimate via greater than $200 million, as repayment prices within the department rose.Funding banking accounted for any other pass over within the quarter, generating $938 million in earnings, underneath the $1.11 billion estimate, as the corporate cited weak spot in mergers and IPO listings. The financial institution’s funding control department necessarily met expectancies with $1.34 billion in earnings. Stocks of Morgan Stanley dipped 2.9% in premarket buying and selling. Led via CEO James Gorman since 2010, Morgan Stanley has controlled to keep away from the turbulence afflicting some opponents. Whilst Goldman Sachs was once compelled to pivot after a poorly achieved foray into retail banking and as Citigroup struggles to raise its inventory value, the primary query at Morgan Stanley is ready an orderly CEO succession.In Would possibly, Gorman introduced his plan to renounce inside of a 12 months, capping a a success tenure marked via huge acquisitions in wealth and asset control. Morgan Stanley’s board has narrowed the seek for his alternative to 3 interior executives, he stated on the time.Analysts shall be prepared to listen to any updates Gorman has at the seek procedure.Ultimate week, JPMorgan Chase, Wells Fargo and Citigroup each and every crowned expectancies for third-quarter benefit, helped via a bad credit score prices. Goldman Sachs and Financial institution of The usa additionally beat estimates on stronger-than-expected bond buying and selling effects.This tale is creating. Please test again for updates.

Morgan Stanley tops benefit estimates on better-than-expected buying and selling effects