Tesla (NASDAQ:TSLA) stocks had been playing a longer second within the iciness solar following Trump’s election win. Since November 5, the inventory has already surged by means of 38%.Do not Fail to see Analysis Gear:

The momentum persevered this week, reinforced by means of a Bloomberg document pointing out that Trump’s transition workforce has knowledgeable advisors that setting up a federal framework for absolutely independent automobiles can be a concern for the Transportation Division. This construction aligns with Tesla’s independent automobile ambitions and has fueled optimism amongst traders about Elon Musk’s attainable function in influencing insurance policies crucial to the corporate’s expansion.

Morgan Stanley analyst Adam Jonas notes that the hot surge in Tesla’s inventory underscores the kind of catalysts that frequently power volatility in TSLA stocks.

Whilst Jonas believes the possible aid in IRA shopper tax credit might already be factored into the inventory value, he argues that Tesla’s “management in embodied AI and independent generation” together with attainable coverage drivers, would possibly not but be absolutely mirrored within the stocks.

That mentioned, traders must stay a lid on expectancies relating to a fast trail to independent riding getting the go-ahead. Whilst Jonas thinks a reassessment of nationwide self-driving insurance policies is an inevitability, the analyst believes Tesla nonetheless faces “important hurdles to conquer” associated with generation, checking out, and the allowing essential for commercialization. Moreover, Jonas anticipates that particular US states and metropolitan spaces will “proceed to have the best say on ultimate deployment.”

The analyst additionally notes that his TSLA projections via 2030 don’t think about any manufacturing of the Cybercab, and his Community Products and services and Mobility forecasts exclude absolutely unsupervised FSD in “any considerable business scale.”

In Jonas’ SOTP (sum-of-the-parts) style, he values Tesla Mobility (rideshare) at relatively over $50 in keeping with proportion. “We don’t implicitly think mass deployment of independent automobiles in our Tesla Mobility forecast till the mid 2030s,” the analyst additional mentioned.

So, what does this in the end imply for traders? Jonas charges Tesla stocks an Obese (i.e., Purchase), even though his $310 value goal implies the inventory is now overrated by means of 10%. (To look at Jonas’ monitor file, click on right here)

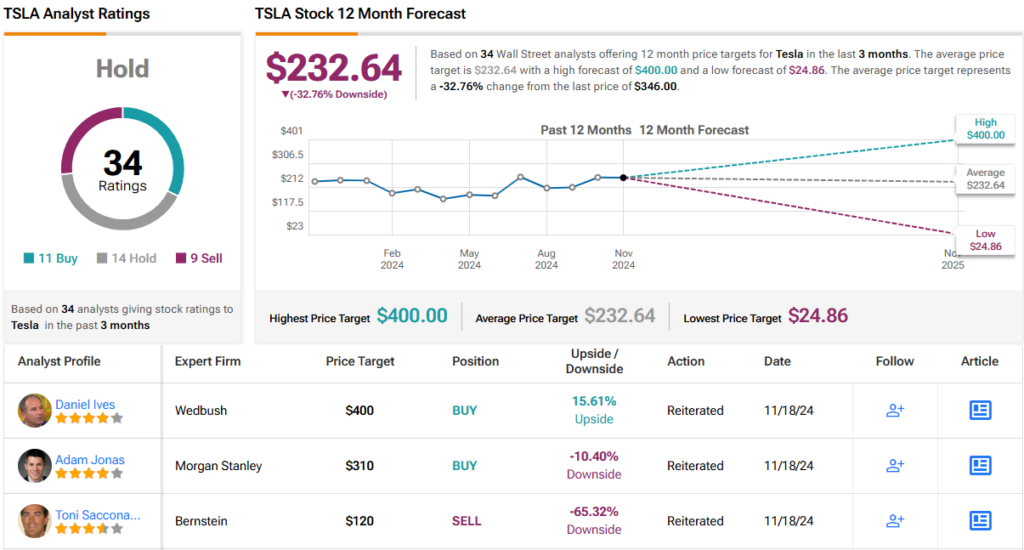

Widely, the analyst consensus provides a combined view. Of 34 analysts overlaying TSLA, 10 price it a Purchase, whilst 16 counsel a Cling, and eight recommend a Promote. This stability leans towards a Cling (i.e. Impartial) consensus score. Maximum analysts imagine the inventory’s contemporary rally has driven it too prime, with the typical value goal of $232.64 sitting ~33% under the present buying and selling value. (See Tesla inventory forecast)

To search out just right concepts for shares buying and selling at horny valuations, discuss with TipRanks’ Absolute best Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The evaluations expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. It is important to to do your individual research sooner than making any funding.

:max_bytes(150000):strip_icc()/BTCUSDChart-183b2dc172664a9290ef2a50c1429900.gif)