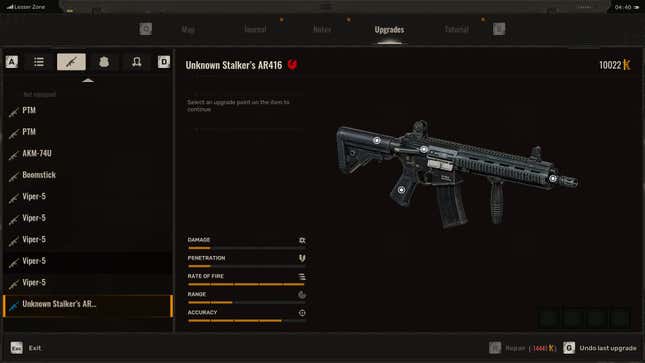

New knowledge has printed that Bitcoin (BTC) mining would possibly not be as profitable because it was once. Bloomberg has reported that the profitability of Bitcoin mining is nearing a file low, now not noticed because the days following the cave in of FTX, posing vital demanding situations for the ones securing the community.

The knowledge signifies that the “hashprice,” a metric that gauges the earnings a miner earns day by day for each and every petahash of computing energy, has dipped alarmingly as regards to its rock bottom.

This lower is notable, taking into consideration it got here after the hot Bitcoin halving match on April 20, which historically boosted the cryptocurrency’s price however, this time, did not counteract the bearish pressures from international financial uncertainties.

Significantly, the time period “hashprice,” coined by means of Luxor Applied sciences, displays the ‘harsh’ realities dealing with miners post-Halving. The development, which happens each and every 4 years, reduces the block praise for miners by means of part, aspiring to take care of a deflationary time table for Bitcoin’s issuance.

Working out Bitcoin Hashprice Dynamics

On April 20, instantly following the halving, the BItocin hash value spiked to $139, however this used to be short-lived. The surge used to be basically because of larger transaction charges associated with the Rune protocol actions on Bitcoin’s blockchain.

On the other hand, as those charges normalized and mining issue larger, hashprice values plummeted to $57, perilously as regards to the November 2022 low of $55. This price represents miners’ stark decline in profitability, forcing them to rely extra on transaction charges and the prospective appreciation in Bitcoin’s value.

Bitcoin Mining is nearing file lows. | Supply: Bloomberg

Bitcoin Mining is nearing file lows. | Supply: Bloomberg

Decreasing mining profitability additionally indicators tricky instances forward, in particular for smaller mining operations.

In keeping with Bloomberg, higher mining corporations like Marathon Virtual Holdings Inc. and Rebel Platforms Inc. have proactively invested in in depth mining infrastructure and complex apparatus to resist the profitability crunch.

Conversely, smaller entities would possibly battle to stay viable in an business this is turning into increasingly more aggressive and capital-intensive.

Marathon Virtual’s Strategic Growth

In line with the difficult setting, Marathon Virtual has raised its hash charge enlargement goal for 2024, aiming to evolve to the brand new mining praise baseline of three.125 BTC post-halving.

The corporate began the yr with a hash charge capability of 24.7 exahash in line with 2nd and deliberate a 46% build up. Following strategic acquisitions and larger apparatus orders, Marathon anticipates achieving a hash charge of fifty EH/s by means of yr’s finish.

Fred Thiel, Marathon’s Chairman and CEO, expressed self assurance in assembly those enlargement goals with out further capital infusion, bringing up the company’s cast liquidity place. Thiel famous:

Given the quantity of capability we’ve got to be had following our fresh acquisitions and the quantity of hash charge we’ve got get right of entry to to thru present gadget orders and choices, we now consider it’s imaginable for us to double the size of Marathon’s mining operations in 2024 and succeed in 50 exahash by means of the tip of the yr.

The corporate’s developments in mining generation and potency additionally goal to achieve an operational potency of 21 joules in line with terahash, additional solidifying its foothold as a pace-setter within the sector.

BTC value is shifting sideways at the 4-hour chart. Supply: BTC/USDT on TradingView.com

Featured symbol from Unsplash, Chart from TradingView