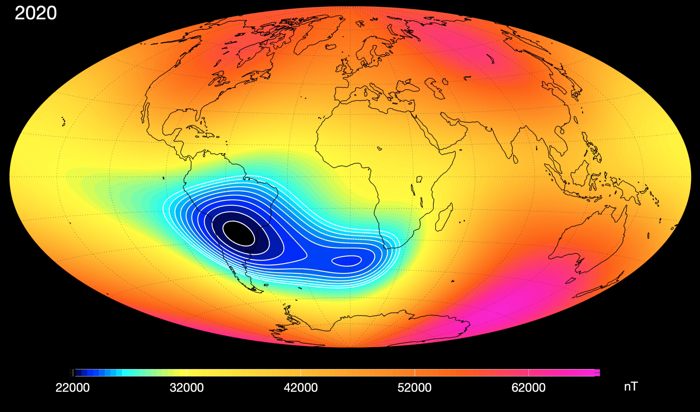

Ethereum gasoline costs declined, however charges paid out to validators rose.

The cost of ETH declined, then again, Community Enlargement surged.

The new marketplace drawdown impacted Ethereum [ETH] considerably as ETH’s costs fell beneath the $3400 degree.

Low Ethereum gasoline, top charges

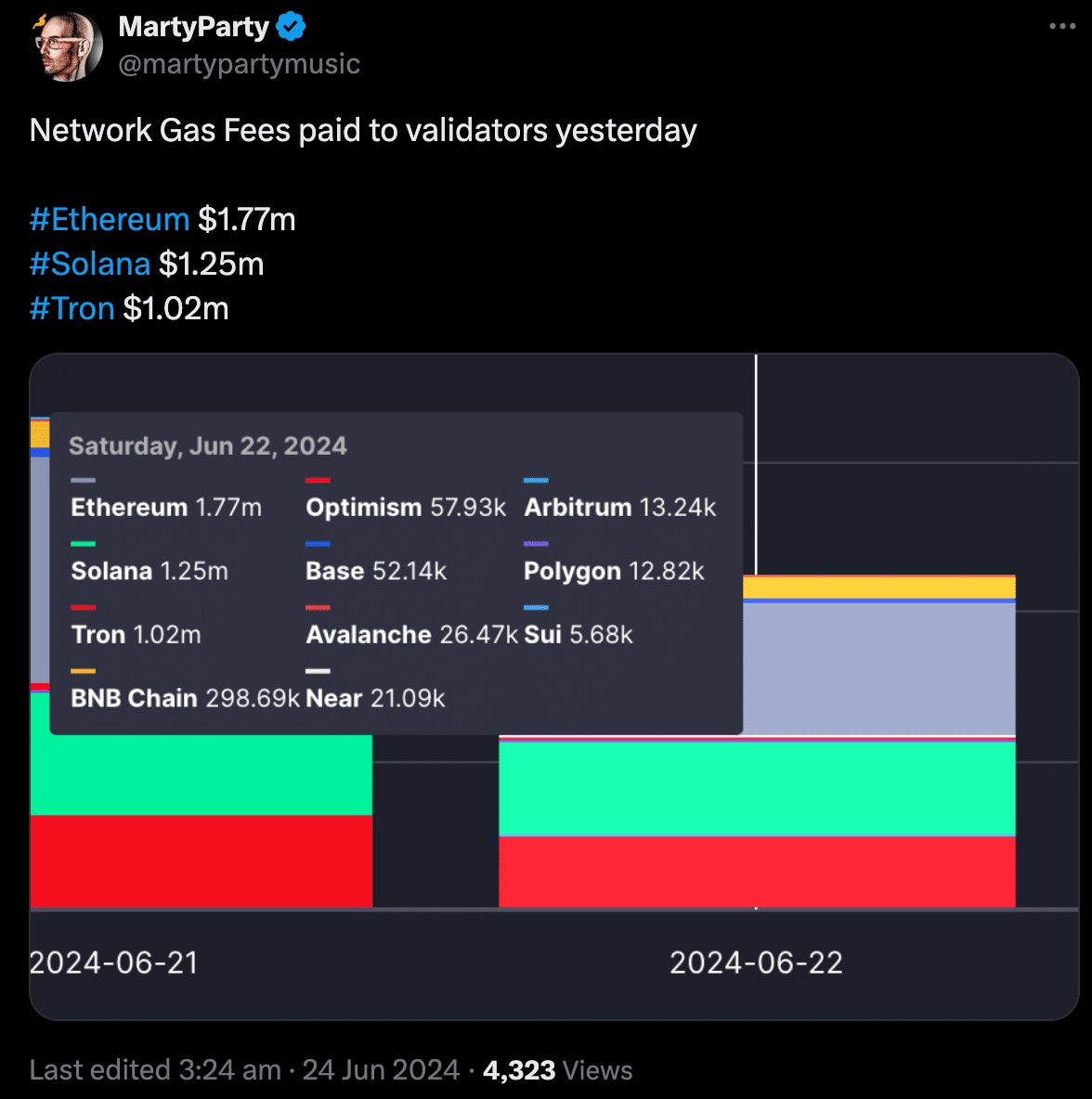

Coupled with that, the Ethereum gasoline worth declined. In spite of the declining gasoline costs, in relation to charges paid out to validators, Ethereum outperformed different networks akin to Solana [SOL] and Tron [TRX] via a big margin.

The upper validator charges, in spite of a gasoline worth drop, may just point out persevered sturdy community utilization on Ethereum.

Even with decrease per-transaction charges, a better quantity of transactions may just generate extra general charges for validators.

Whilst validator charges could be top now, they is probably not sufficient to offset the entire worth decline of Ethereum.

Supply: X

Supply: X

On the time of writing, ETH had fallen via 4.14% within the ultimate 24 hours. One of the vital causes for the decline in ETH’s worth could be its correlation to BTC which additionally fell significantly over the previous few days.

Consistent with AMBCrypto’s research of IntoTheBlock’s knowledge, ETH’s correlation to BTC was once at top 0.78.

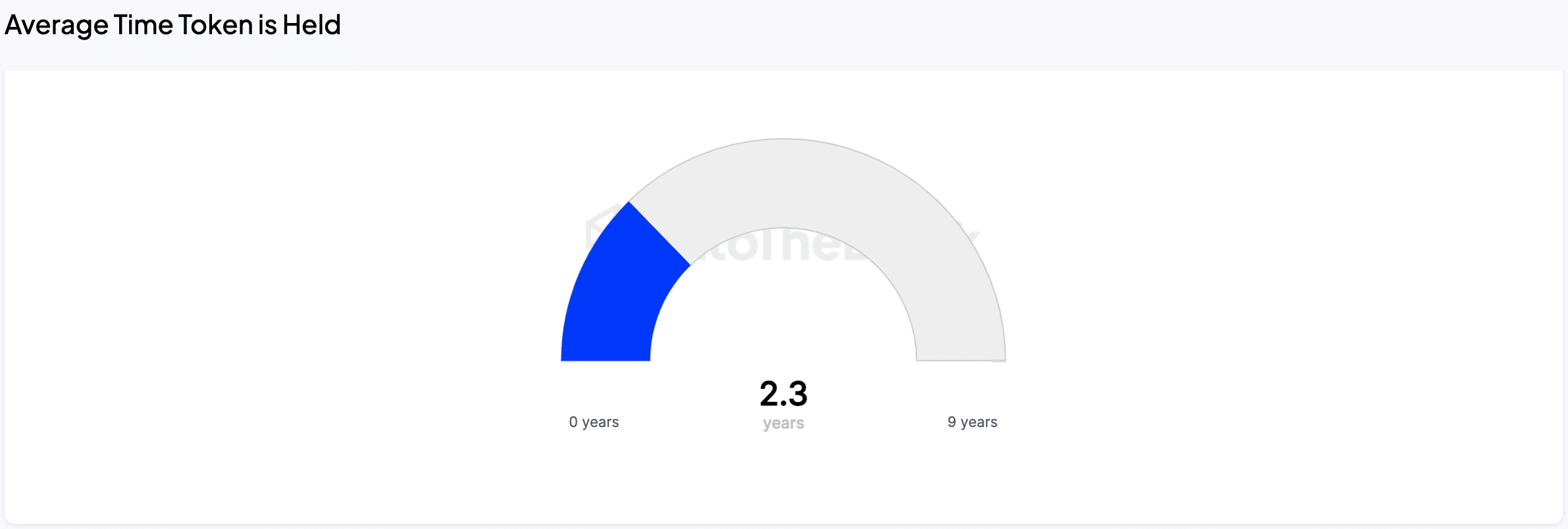

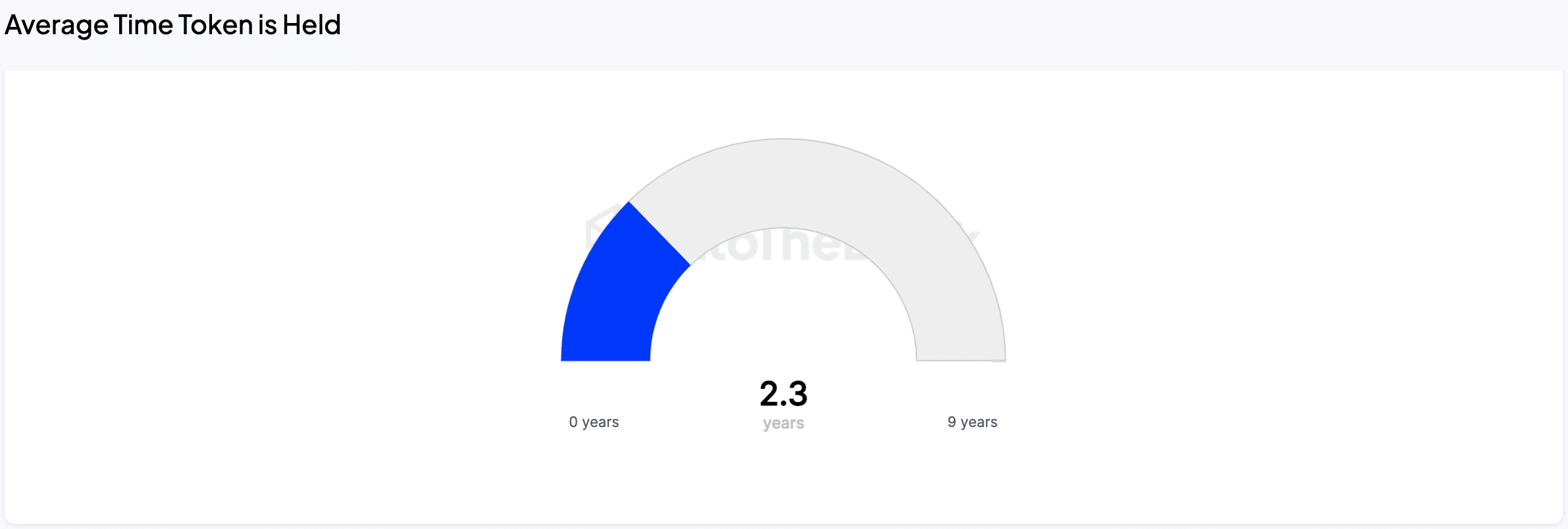

Even with an important decline in Ethereum’s (ETH) worth, a big portion of holders appear to be in it for the lengthy haul. On moderate, buyers are conserving onto their ETH for a whopping 2.3 years.

This long-term view is additional supported via the truth that cash being actively traded are nonetheless held for a mean of two months, indicating a reluctance to promote.

The typical conserving time of traded cash gives treasured insights into investor self belief.

When cash are held for longer sessions, it suggests buyers imagine within the long-term possible of Ethereum and are comfy conserving onto their belongings.

Conversely, common buying and selling process might point out a focal point on temporary earnings and not more religion sooner or later of the marketplace.

Supply: IntoTheBlock

Supply: IntoTheBlock

On-chain knowledge

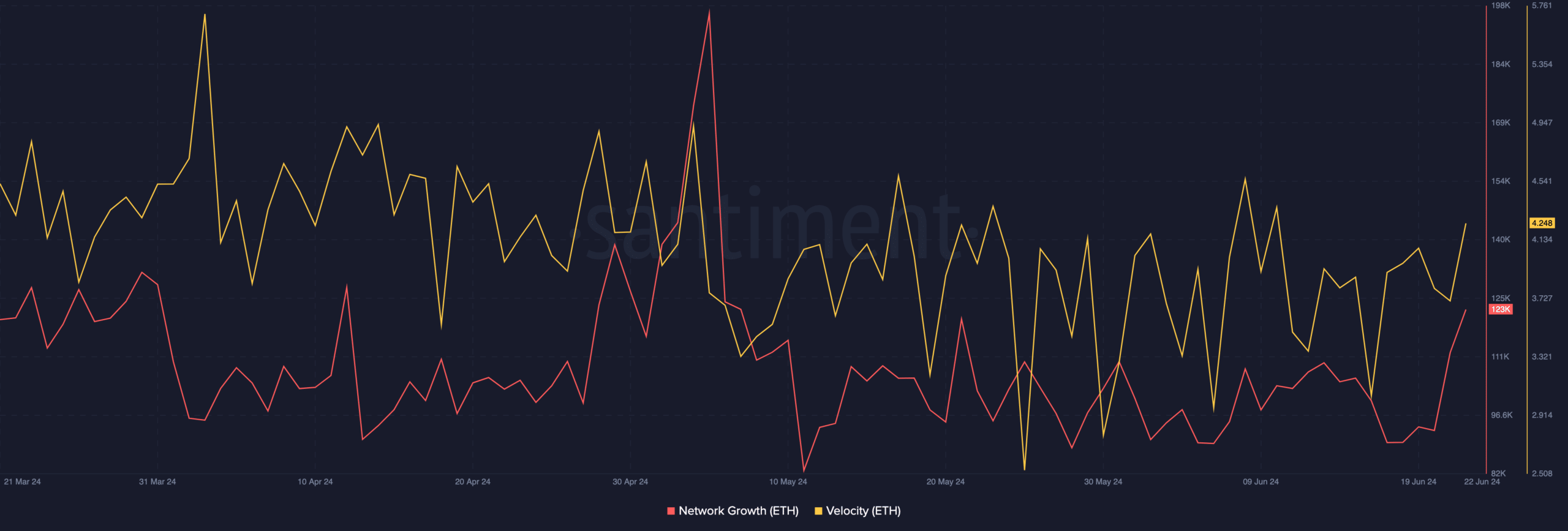

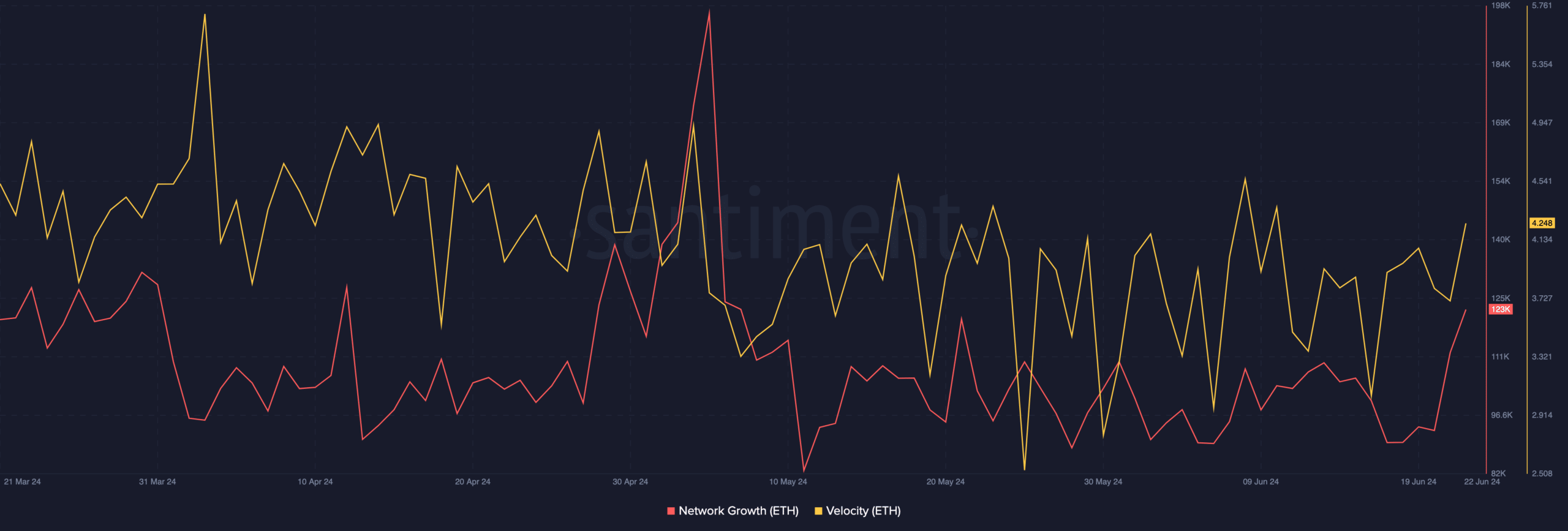

Community Enlargement for ETH surged materially over the previous few days.

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

So, many new addresses had been interacting with ETH on the time of writing, implying that a considerable amount of addresses had been fascinated about purchasing ETH on the present discounted charges.

Additionally, the speed at which ETH was once buying and selling had additionally grown, suggesting that the frequency at which ETH was once being transacted had surged.

Supply: Santiment

Supply: Santiment

Subsequent: Odds of Solana falling beneath $100 are…