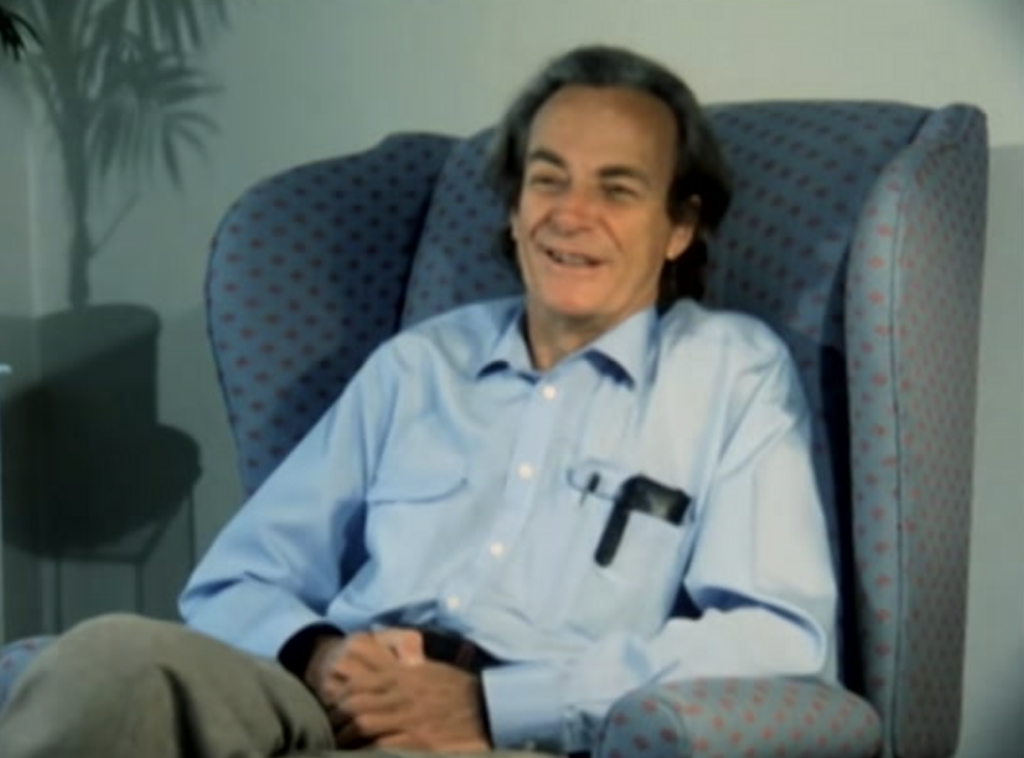

Virgin Galactic founder Richard Branson.Eric Berger

Sir Richard Branson has dominated out striking more cash into his lossmaking house commute corporate Virgin Galactic, announcing his trade empire “does no longer have the inner most wallet” any longer.

Virgin Galactic, which was once based through Branson in 2004, remaining month introduced it was once reducing jobs and postponing industrial flights for 18 months from subsequent yr, in a bid to maintain money for the advance of a bigger aircraft that might elevate passengers to the threshold of house.

The crowd has stated it has sufficient investment to hold it thru to 2026, when the larger Delta automobile is predicted to go into provider. However some analysts predict Galactic to invite buyers for more cash in about 2025.

Requested whether or not he would imagine striking extra money into the trade if wanted, Branson informed the Monetary Occasions: “We don’t have the inner most wallet after Covid, and Virgin Galactic has were given $ 1 billion, or just about. It will have to, I imagine, have enough price range to do its activity by itself.”

Branson stated he was once “nonetheless loving” the Virgin Galactic venture and that it had “in reality proved itself and the generation” of business house flight. Galactic has simply finished its 6th industrial flight in six months, with tickets beginning at $450,000 a seat on its rocket-powered Harmony house aircraft.

Virgin Workforce remains to be one in all Galactic’s greatest shareholders, in spite of promoting greater than $1 billion of stocks in 2020 and 2021, lowering its stake to 7.7 p.c and the usage of the price range to offer protection to different portions of its sprawling recreational and commute trade all over the pandemic.

Commercial

Branson’s rocket start-up, Virgin Orbit, collapsed 8 months in the past after a failed release from the United Kingdom, its first in 5 missions. The beginning-up, 75 p.c owned through Branson, ran out of money as its UK challenge encountered repeated delays.

Analysts stated Galactic had realized the lesson of Orbit and was once no longer ready to spend all of its money on lossmaking flights. “This trade is constructed to be operated at scale and through having flights on simply Harmony you knew it wouldn’t succeed in the dimensions wanted and canopy its prices,” stated Greg Konrad, analyst at funding financial institution Jefferies. Delta is predicted to hold six passengers, towards Harmony’s 4, and can release extra steadily.

Galactic, which has but to make a benefit, was once valued at $2.3 billion when it debuted at the New York Inventory Alternate in 2019. The corporate was once valued at $935 million as of the shut of buying and selling on Friday.

Branson, who spent many years burnishing the picture of his trade with high-profile adventures and stunts, stated he now spends 90 p.c of his time on philanthropic paintings, however that there was once nonetheless “a hell of so much happening” at Virgin Workforce.

The crowd owns an funding portfolio that comes with stakes in a variety of companies together with in commute, leisure and telecoms.

Branson additionally stated the trade may get interested in UK rail services and products once more. Its involvement led to 2019 after Virgin Trains misplaced the West Coast franchise. “I’d no longer be shocked if sooner or later Virgin isn’t again in trains,” he stated.

Branson talked to the FT on a Virgin Atlantic flight that was once the primary to fly from London to New York on reused cooking and animal fat.

He stated the United Kingdom will have to strengthen the sustainable fuels business, partially to scale back its reliance on imported oil.

“It wishes the federal government to take a seat down with the business simply to open the books and notice how we will be able to make this paintings,” he stated.

© 2023 The Monetary Occasions Ltd. All rights reserved. To not be redistributed, copied, or changed by any means.