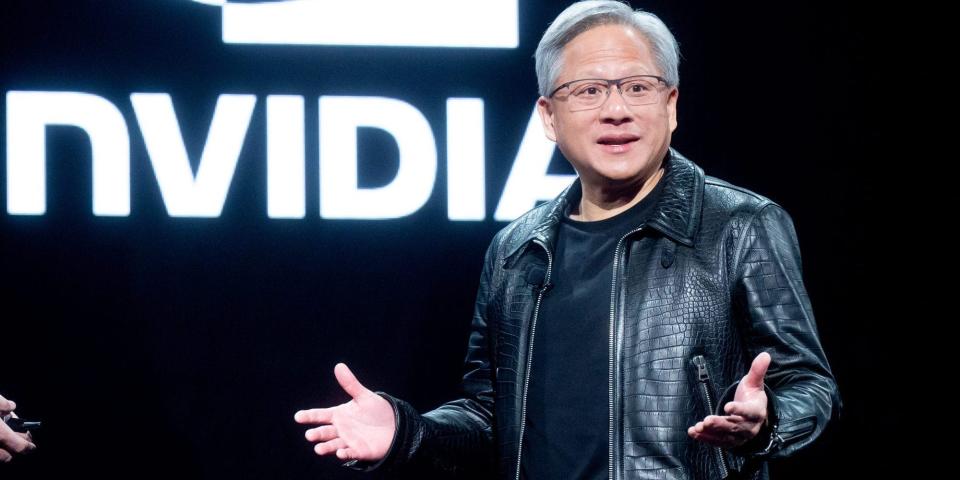

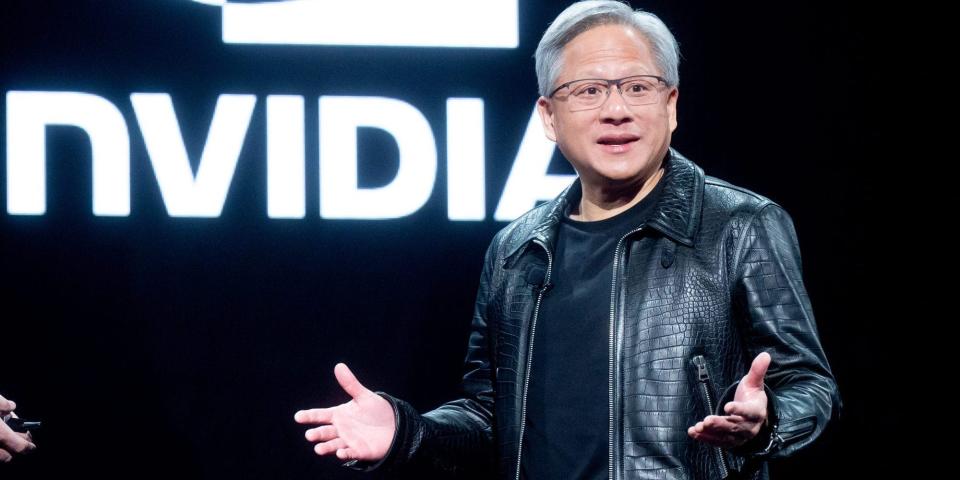

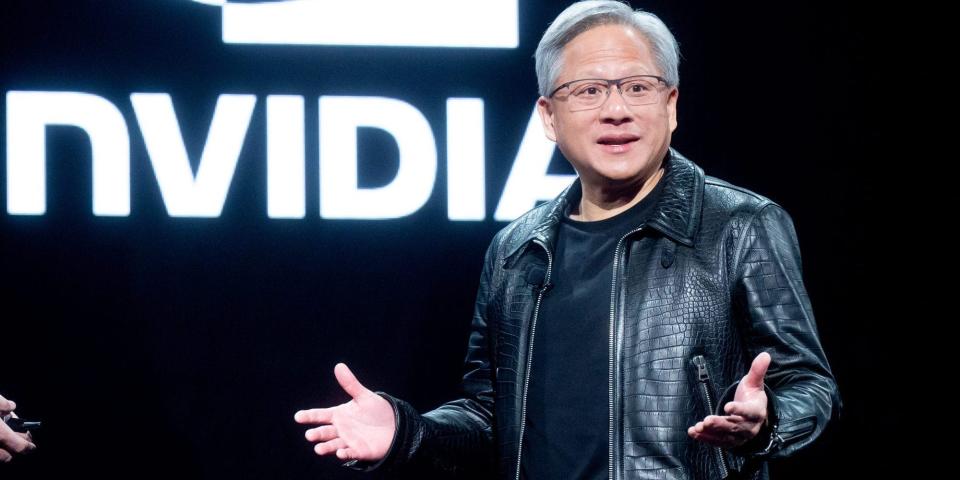

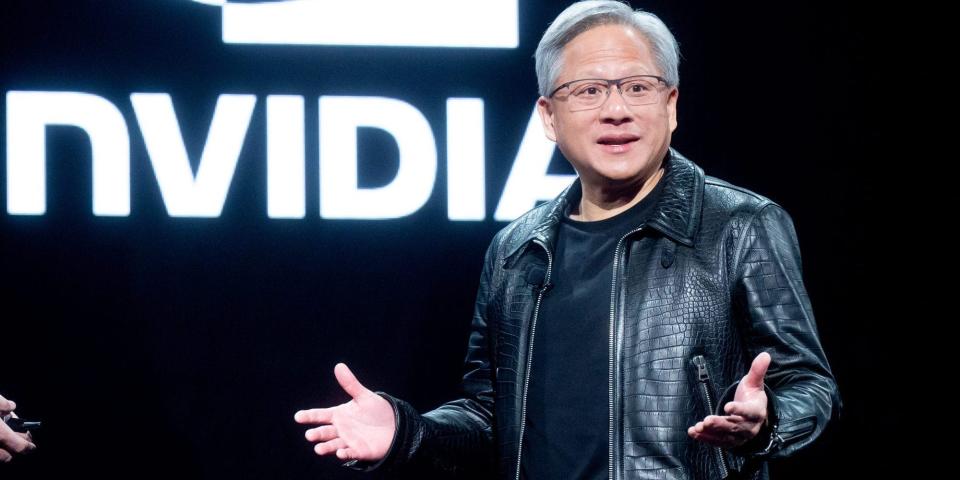

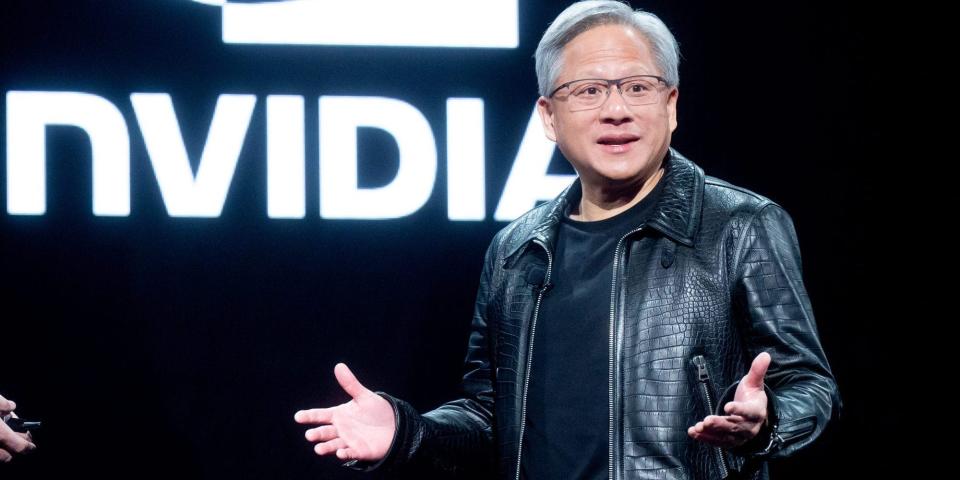

Noah Berger/Getty ImagesNvidia inventory does not glance pricey even at a $2 trillion valuation, in step with Financial institution of The us.The financial institution larger its Nvidia charge goal to $1,100 forward of its “AI Woodstock” match, implying 24% upside.BofA mentioned Nvidia is buying and selling at a decrease ahead P/E ratio than it used to be in November 2022.Even at a $2.2 trillion valuation, Nvidia inventory nonetheless is not pricey, Financial institution of The us mentioned in a be aware on Wednesday.The financial institution reiterated its “Purchase” ranking and larger its charge goal to $1,100 from $925, representing attainable upside of 24% from present ranges.”In spite of YTD outperformance, NVDA valuation and possession horny in comparison to semis/infotech friends,” Financial institution of The us analyst Vivek Arya mentioned.Stocks of Nvidia have surged 80% year-to-date and are up 287% over the last 12 months as call for for its AI-enabling graphic playing cards stays insatiable. However amid the beautiful good fortune of Nvidia’s underlying trade, the corporate’s inventory remains to be buying and selling at valuations not up to when ChatGPT used to be first introduced in 2022.”NVDA buying and selling decrease lately at 37x NTM PE vs. 44x PE when ChatGPT used to be introduced in November 2022,” Arya mentioned, including that the inventory is buying and selling neatly inside of its ancient ahead price-to-earnings vary of 26x to 69x.In the meantime, whilst maximum buyers personal Nvidia inventory, they are nonetheless underweight the inventory relative to its weight within the S&P 500.”Valuation, possession ranges nonetheless counsel room for upside,” Arya mentioned. “Our fresh possession research means that whilst NVDA is widely owned (67% of finances in our survey), relative weighting (NVDA possession focus vs. focus in SPX) is under huge cap infotech friends (1.01x vs. 1.13x friends) regardless of just about 9x quicker enlargement attainable,” Arya mentioned.Additional upside in Nvidia inventory may well be sparked through its “AI Woodstock” match on March 18, when it hosts its GPU Tech Convention and is about to unveil the successor to its wildly well-liked H100 chip.”We predict GTC to exhibit: 1) Emerging affect of genAI, omniverse/virtual twins throughout quite a lot of end-markets, 2) Alternative to re-architect just about $1-$2Tn of world computing infrastructure with accelerators, leading to a $250-$500bn annual marketplace (vs $250bn prior) over the following 3-5 years, 3) Pipeline replace throughout accelerators (B100, N100), Ethernet switches, DPU, and edge AI,” Arya mentioned.Learn the unique article on Industry Insider

Noah Berger/Getty ImagesNvidia inventory does not glance pricey even at a $2 trillion valuation, in step with Financial institution of The us.The financial institution larger its Nvidia charge goal to $1,100 forward of its “AI Woodstock” match, implying 24% upside.BofA mentioned Nvidia is buying and selling at a decrease ahead P/E ratio than it used to be in November 2022.Even at a $2.2 trillion valuation, Nvidia inventory nonetheless is not pricey, Financial institution of The us mentioned in a be aware on Wednesday.The financial institution reiterated its “Purchase” ranking and larger its charge goal to $1,100 from $925, representing attainable upside of 24% from present ranges.”In spite of YTD outperformance, NVDA valuation and possession horny in comparison to semis/infotech friends,” Financial institution of The us analyst Vivek Arya mentioned.Stocks of Nvidia have surged 80% year-to-date and are up 287% over the last 12 months as call for for its AI-enabling graphic playing cards stays insatiable. However amid the beautiful good fortune of Nvidia’s underlying trade, the corporate’s inventory remains to be buying and selling at valuations not up to when ChatGPT used to be first introduced in 2022.”NVDA buying and selling decrease lately at 37x NTM PE vs. 44x PE when ChatGPT used to be introduced in November 2022,” Arya mentioned, including that the inventory is buying and selling neatly inside of its ancient ahead price-to-earnings vary of 26x to 69x.In the meantime, whilst maximum buyers personal Nvidia inventory, they are nonetheless underweight the inventory relative to its weight within the S&P 500.”Valuation, possession ranges nonetheless counsel room for upside,” Arya mentioned. “Our fresh possession research means that whilst NVDA is widely owned (67% of finances in our survey), relative weighting (NVDA possession focus vs. focus in SPX) is under huge cap infotech friends (1.01x vs. 1.13x friends) regardless of just about 9x quicker enlargement attainable,” Arya mentioned.Additional upside in Nvidia inventory may well be sparked through its “AI Woodstock” match on March 18, when it hosts its GPU Tech Convention and is about to unveil the successor to its wildly well-liked H100 chip.”We predict GTC to exhibit: 1) Emerging affect of genAI, omniverse/virtual twins throughout quite a lot of end-markets, 2) Alternative to re-architect just about $1-$2Tn of world computing infrastructure with accelerators, leading to a $250-$500bn annual marketplace (vs $250bn prior) over the following 3-5 years, 3) Pipeline replace throughout accelerators (B100, N100), Ethernet switches, DPU, and edge AI,” Arya mentioned.Learn the unique article on Industry Insider