(Bloomberg) — Stocks of Nvidia Corp., the chipmaker on the middle of a synthetic intelligence growth, surged on Thursday after a bullish gross sales forecast confirmed that AI computing spending stays sturdy.Maximum Learn from BloombergSecond-quarter earnings might be about $28 billion, the corporate mentioned Wednesday, topping the $26.8 billion predicted through analysts. Ends up in the fiscal first quarter, which ended April 28, additionally beat projections — lifted through enlargement in Nvidia’s data-center department.The massive query heading into the income record was once whether or not Nvidia’s newest numbers may just justify the dizzying run-up in its inventory. The stocks had received 108% this yr thru Wednesday’s shut, fueled through investor hopes that the corporate would proceed to shatter expectancies.The record didn’t disappoint, and Leader Govt Officer Jensen Huang stoked the thrill through speaking concerning the dawning of a brand new technology. “That is the start of a brand new commercial revolution,” he mentioned in an interview, echoing one in every of his favourite issues. “That is truly thrilling.”The stocks rose up to 9.2% to $1,036.76 on Thursday, including kind of $217 billion to its valuation. That’s more than all the marketplace capitalization of Intel Corp., a chipmaker that after dwarfed Nvidia through each and every measure. And Nvidia’s $28 billion in projected quarterly gross sales could be greater than two times what Intel is predicted to record.The Santa Clara, California-based corporate additionally introduced a 10-for-1 inventory cut up and boosted its quarterly dividend through 150% to ten cents a proportion. The rally helped carry the stocks of different firms related to AI. Tremendous Micro Pc Inc., Complicated Micro Gadgets Inc. and Dell Applied sciences Inc. all received within the wake of the consequences.The upbeat outlook reinforces Nvidia’s standing as the most important beneficiary of AI spending. The corporate’s so-called AI accelerators — chips that lend a hand information facilities expand chatbots and different state of the art equipment — have transform a sizzling commodity up to now two years, sending its gross sales hovering. Nvidia’s marketplace valuation has skyrocketed as properly, topping $2.3 trillion.Within the fiscal first quarter, Nvidia’s earnings greater than tripled to $26 billion. Aside from positive pieces, benefit was once $6.12 a proportion. Analysts had predicted gross sales of about $24.7 billion and income of $5.65 a proportion.Tale continuesHuang, in his signature black leather-based jacket, has transform a star within the AI technology. His corporate, which he co-founded in 1993, began as a supplier of graphics playing cards for laptop players. However he identified that Nvidia’s chips had been well-suited to creating AI instrument and that helped open a brand new marketplace — and gave him a leap on competition.The discharge of OpenAI’s ChatGPT chatbot in 2022 then sparked a race between main generation firms to construct their very own AI infrastructure. The scramble made Nvidia’s H100 accelerators a must have product. They promote for tens of 1000’s of bucks in keeping with chip and are continuously in scarce provide.For now, a lot of this new earnings comes from a small handful of consumers. A gaggle of 4 firms — Amazon.com Inc., Meta Platforms Inc., Microsoft Corp. and Alphabet Inc.’s Google — are Nvidia’s greatest consumers and feature accounted for approximately 40% of gross sales. Huang, 61, is making an attempt to unfold his bets through generating entire computer systems, instrument and services and products — aimed toward serving to extra companies and govt businesses deploy their very own AI programs.Nvidia’s data-center department — now through a long way its greatest supply of gross sales — generated $22.6 billion of earnings remaining quarter. Gaming chips supplied $2.6 billion. Analysts had given goals of $21 billion for the data-center unit and $2.6 billion for gaming.Nvidia emphasised Wednesday that it needs to promote its generation to a much wider marketplace — increasing past the enormous cloud-computing suppliers referred to as hyperscalers. Huang mentioned that AI is shifting to shopper web firms, carmakers, biotechnology and health-care consumers. International locations are also creating their very own programs — a development known as sovereign AI.Those alternatives are developing a couple of multibillion-dollar markets past cloud carrier suppliers, he mentioned.The huge-scale deployment of Nvidia chips through Elon Musk’s Tesla Inc. is one signal of that growth. The automaker is the usage of Nvidia equipment to expand instrument that may perform self-driving automobiles.Nonetheless, hyperscalers remained a crucial enlargement driving force for Nvidia remaining quarter. They generated roughly 45% of the corporate’s data-center earnings. That means Nvidia is within the early phases of diversifying the trade.The corporate’s new chip platform, referred to as Blackwell, is now in complete manufacturing, Huang mentioned. And it lays the groundwork for generative AI that may take care of trillions of parameters. “We’re poised for our subsequent wave of enlargement,” he mentioned.The corporate gets “so much” of its 2024 earnings from the brand new Blackwell chips, Huang mentioned. However consumers aren’t easing up on orders for its current merchandise — a priority amongst some analysts. The ones consumers want the present era to lend a hand them construct out their infrastructure as temporarily as conceivable, he mentioned.Call for for Nvidia’s merchandise has outpaced provide, and Huang expects that to stay the case into subsequent yr. The corporate may be contending with different demanding situations: The expanding complexity of its generation, which now contains entire laptop programs, implies that its provide chain has transform a lot more sophisticated, he mentioned. That makes it tougher to extend output.“No one has ever manufactured supercomputers at quantity,” he mentioned within the interview. “We’re doing the most efficient we will be able to.”(Updates with proportion value and marketplace cap within the first and 5th paragraphs.)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Nvidia Inventory Surges as Gross sales Forecast Delivers on AI Hopes

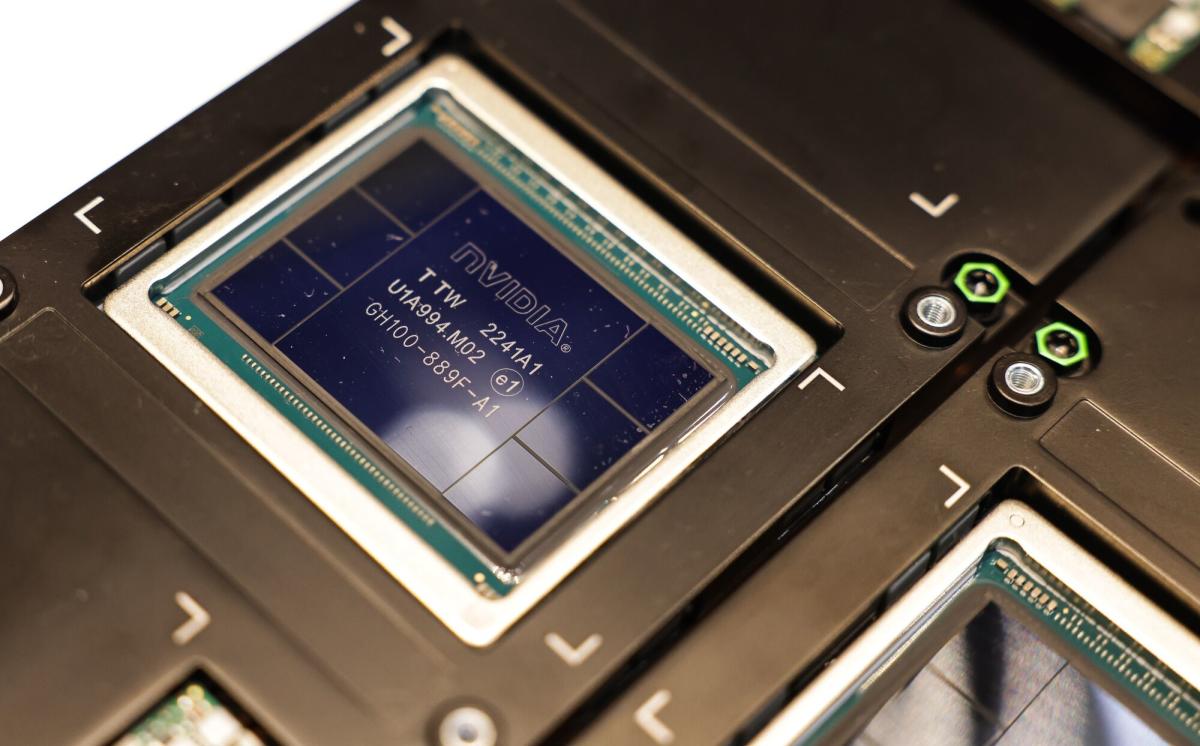

:max_bytes(150000):strip_icc()/GettyImages-2190848732-e82ca8b164c74252a2f47b0e20fee915.jpg)