Each investor’s number one function must be successful, and the important thing to luck lies find the shares poised to get pleasure from main tendencies. In as of late’s virtual economic system, two sectors stand out: semiconductors and synthetic intelligence. Semiconductors are indispensable, powering the whole thing from computer systems and capsules to automobiles and ovens. In the meantime, AI, the newest leap forward era, is hastily reworking the tech trade and revolutionizing how we have interaction with machines, unfolding sooner than our eyes in real-time.

Grand View Analysis initiatives the AI trade to develop at a compound annual enlargement price (CAGR) of over 36% via 2030, with its latest marketplace worth exceeding $200 billion. Numbers like the ones let us know the place we’re more likely to to find the most productive inventory alternatives: some of the semiconductor chip firms, in particular the ones dealing in AI.

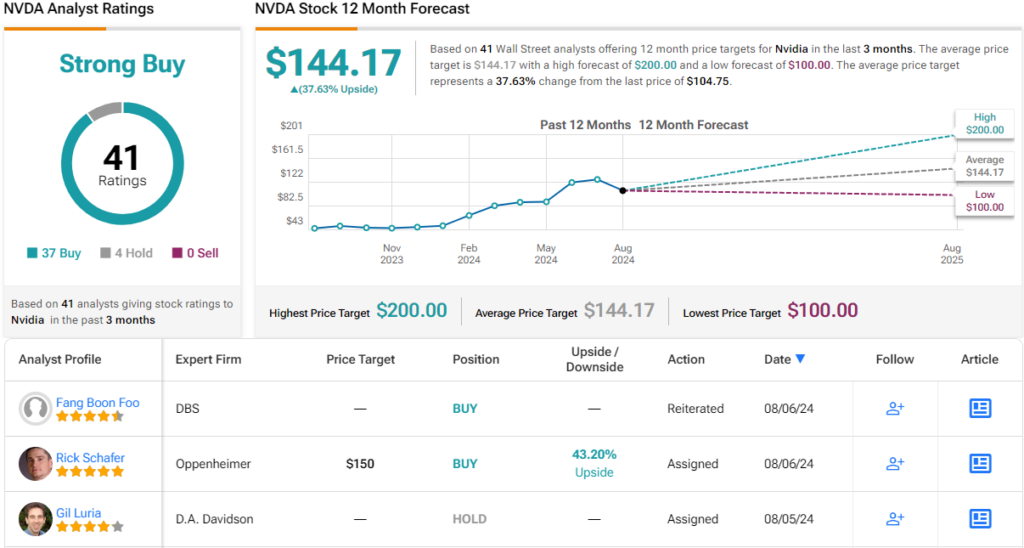

Oppenheimer’s Rick Schafer, observing the tech scene, follows this thesis in a few of his contemporary inventory selections. The analyst, who’s rated through TipRanks at #5 total on Wall Boulevard, has singled out two AI chip shares, Nvidia (NASDAQ:NVDA) and Intel (NASDAQ:INTC), for nearer attention. He provides them a deep dive, and isn’t shy about opting for one because the awesome AI inventory to shop for. Listed here are the main points.

Nvidia

Nvidia is without doubt one of the true giants of the tech international. With its marketplace cap of $2.58 trillion, the corporate is the sector’s third-largest publicly traded company. The corporate has constructed itself to this forged place totally on its dominance of the marketplace for AI-capable, high-capacity processing chips.

Those chips had been a part of Nvidia’s portfolio for many years. The corporate is understood for inventing the GPU chips which might be the ancestors of as of late’s main AI and information heart processors. First evolved for the video gaming area of interest, the era proved adaptable and now underlies quite a lot of server stack, knowledge heart, and AI makes use of, all fields that depend on excessive processing speeds and capacities to allow fast computing.

Previous this 12 months, Nvidia’s percentage value reached an all-time excessive, surpassing $1,100. In reaction, the corporate applied a 10-to-1 inventory break up in June, bringing the percentage value all the way down to ~$110. In spite of additional features pushing it close to $135 through mid-July, the inventory has been on a downward pattern since then.

A number of elements have impacted Nvidia’s percentage value. Marketplace sentiment has became wary, with rising issues about doable recession signs. Tech shares, that have pushed contemporary marketplace features and are on occasion perceived as overrated, have as a result confronted a pullback. Explicit to Nvidia, the corporate not too long ago introduced a three-month lengthen within the liberate of its expected Blackwell B200 collection chips. Whilst Nvidia assures that manufacturing ramp-up is on time table, deliveries are actually anticipated early subsequent 12 months. This lengthen, in spite of important pre-orders from main AI builders like Microsoft, has unsettled traders.

On the identical time, Nvidia’s standard H100 chip traces proceed to turn sturdy gross sales, and are anticipated to pick out up the slack all the way through the lengthen length.

Nvidia will record its fiscal 2Q25 effects later this month, and is predicted to record revenues of $28.54 billion – an building up of 111% year-over-year – and a non-GAAP base line of 64 cents in step with percentage.

In spite of the hot lengthen, Schafer stays firmly bullish on Nvidia, believing the inventory is well-positioned for endured enlargement.

“Contemporary studies point out NVDA notified MSFT of delays in upcoming Blackwell manufacturing ramp, now anticipated 1Q (vs. prior 4Q)… In our view, affect most probably minimum and short-lived (1-2Qs) as current-gen Hopper (30-40% decrease ASP) lifestyles cycle most probably extends to plug the distance… NVDA’s aggressive place stays sound, and we don’t be expecting any percentage loss from a minor lengthen. Rising pains to be anticipated with >5x building up in DC gross sales Y/Y and shift to annual liberate cadence. We see NVDA as easiest placed in AI, making the most of complete stack AI {hardware}/device answers,” Schafer opined.

Those feedback make stronger Schafer’s Outperform (i.e. Purchase) ranking on NVDA stocks, whilst his value goal of $150 implies a one-year doable upside of greater than 43%. (To look at Schafer’s observe file, click on right here)

General, Nvidia’s inventory will get a Robust Purchase ranking from Wall Boulevard, in accordance with 41 contemporary analyst opinions that come with 37 Buys to simply 4 Holds. The stocks are priced at $104.75 and their $144.17 reasonable value goal issues towards a achieve of just about 38% within the 12 months forward. (See NVDA inventory forecast)

Intel

Subsequent up is Intel, a reputation you’ll virtually surely acknowledge from the little stickers at the entrance of your house laptop or computer. Intel’s iCore collection chips have lengthy been marketplace leaders within the PC processor phase and are regarded as the trade same old. That phase management has helped make stronger Intel lately, at the same time as AI has moved to the leading edge of the tech international. Whilst Intel is not some of the best ten chip makers through marketplace cap, the corporate nonetheless ranks #4 through income – and within the closing 4 quarters generated over $55 billion in gross sales.

Intel desires to stay a pace-setter, alternatively, and that can require a shift in its construction and product traces towards AI-capable chipsets – and with out shedding its sturdy dangle on PC processors. The corporate has begun to liberate new AI-capable merchandise, together with PC chips able to supporting AI non-public laptop packages. Intel brings a very powerful merit to this projected shift, in that the corporate is without doubt one of the few main chip corporations that still handles its personal manufacturing – and so it has larger regulate over product traces and lead instances and is used to generating semiconductors at an commercial scale and high quality.

As well as, Intel has been making a powerful dedication to foundry building. The Federal CHIPS Act made large-scale subsidization to be had within the chip trade, and Intel has tapped into that to the song of $8.5 billion. That is supplemented through Federally subsidized loans totaling $11 billion. That is cash on a grand scale, and Intel is the usage of it to construct and release foundry initiatives in america – with an emphasis on generating AI-capable CPUs.

Shifts like this don’t seem to be affordable, and the cost isn’t all the time measured without delay through income. In its 2Q24 record, Intel neglected on revenues and income. The highest line of $12.83 billion used to be down virtually a complete % from the prior 12 months and got here $150 million in need of expectancies, whilst the bottom-line non-GAAP EPS determine of two cents in step with percentage used to be 8 cents lower than the forecasts. The corporate stocks tumbled consequently, and are nonetheless rebounding; INTC is down greater than 31% for the reason that income liberate.

Oppenheimer’s Schafer sums up the investor reticence on Intel in transparent prose, pronouncing of the corporate, “After competitive capital builds, control is pivoting to shore up profitability pronouncing COGS/Opex/Capex discounts to save lots of $10B in 2025. Headcount lowering through 15%. Percentage loss and structural shift from conventional CPU-centric compute to AI-accelerated continues to weigh on INTC. Node/foundry investments power margins. We stay sidelined as turnaround efforts take root.”

That sideline place equals a Carry out (i.e. Grasp) ranking from the highest analyst, and he declines to position a value goal on Intel inventory till he sees how those tea leaves fall.

The Boulevard basically is of the same opinion with the Grasp in this inventory, as proven through the 31 contemporary analyst opinions that damage down to one Purchase, 25 Holds, and 5 Sells – a Grasp consensus. However the analyst may as properly have mentioned “purchase” — as a result of, on reasonable, they suspect the inventory, recently at $19.71, may just zoom forward to $27.82 inside a 12 months, handing over 41% earnings to new traders. (See INTC inventory forecast)

For prime-ranked analyst Rick Schafer, the selection is apparent: Purchase Nvidia. It’s obviously the awesome AI inventory selection right now.

To search out just right concepts for shares buying and selling at horny valuations, consult with TipRanks’ Very best Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. It is important to to do your individual research sooner than making any funding.