As synthetic intelligence (AI) call for soars, Nvidia (NASDAQ: NVDA) and Palantir (NYSE: PLTR) have emerged as most sensible avid gamers within the AI-driven inventory rally, with stocks up 206% and 252%, respectively, in 2024.

Recently, Nvidia’s inventory is priced at $147.63, whilst Palantir trades at $58.39. Each shares are a few of the most sensible performers at the S&P 500, reflecting robust investor enthusiasm for AI-focused firms.

PLTR and NVDA year-to-date inventory charge chart. Supply: Finbold

PLTR and NVDA year-to-date inventory charge chart. Supply: Finbold

Then again, regardless of their spectacular positive aspects, Nvidia and Palantir have distinctly other industry fashions and valuation profiles, making the selection between them advanced for traders taking a look towards 2025.

To offer readability, Finbold consulted ChatGPT-4 for insights on which inventory is prone to outperform within the yr forward.

Nvidia: The spine of AI {hardware} with confirmed profitability

Nvidia is widely known for its dominance in AI {hardware}, in particular with its graphics processing gadgets (GPUs) which might be vital to coaching and working large-scale AI fashions.

Its Information Heart phase, powered by way of those GPUs, generated $26.3 billion in Q2 2024, marking a 154% year-over-year building up and strengthening its vital function in AI infrastructure.

Nvidia’s development possibilities stay powerful, with its Information Heart industry, the impending Blackwell chips, and persevered call for for the Hopper structure riding long term possible.

The complicated Blackwell B200 GPUs, first of all not on time because of a design flaw, are actually set to renew shipments by way of year-end, following a design repair in collaboration with Taiwan Semiconductor Production Corporate (NYSE: TSM), as Reuters reported.

Past Blackwell, Nvidia’s H100 chips are vital to powering generative AI platforms like ChatGPT, additional solidifying its dominance within the AI panorama.

Nvidia’s stronghold in gaming and automobile provides additional steadiness, diversifying its income streams and supporting long-term monetary well being.

The corporate’s financials are similarly spectacular. Nvidia holds a considerable marketplace cap of $3.6 trillion, with a ahead price-to-earnings (P/E) ratio of 43.41, reflecting excessive expectancies that align with its confirmed profitability and development trajectory.

Analysts await Nvidia’s revenue in line with proportion (EPS) to develop by way of 37.36% over the following 5 years, due to robust call for in its Information Heart and AI segments.

Moreover, Nvidia is scheduled to free up its revenue document on November 20, 2024, which might additional form investor sentiment and probably function a catalyst for additional positive aspects.

Palantir: Top-growth AI device chief with valuation demanding situations

In contrast to Nvidia’s {hardware} focal point, Palantir makes a speciality of AI device, in particular information analytics and device finding out answers for presidency and business shoppers.

Its flagship Synthetic Intelligence Platform (AIP) has observed considerable adoption in 2024, particularly amongst U.S. business shoppers, contributing to a 30% year-over-year income building up in Q3.

Palantir’s inventory has been on a notable upward trajectory, mountaineering 252% year-to-date. Then again, it trades at a steep valuation, with a price-to-sales (P/S) ratio of 49 and a ahead P/E of 128, making it extremely dear by way of business requirements.

Analysts have expressed worry over this excessive valuation, with maximum issuing a “cling” advice because of Palantir’s reliance on excessive development expectancies, which makes it extra at risk of setbacks as its profitability metrics proceed to broaden.

Regardless of those valuation issues, Palantir’s development in sectors like protection and finance continues to draw traders. In Q3 2024, Palantir posted its highest-ever quarterly benefit, with a web source of revenue of $144 million and an adjusted running margin of 38%, up from 29% the prior yr.

Moreover, the corporate closed 104 offers value over $1 million each and every, elevating its overall contract worth (TCV) to $1.1 billion, a 33% year-over-year building up.

That being stated, Palantir’s long term in large part hinges at the luck of AIP, as the corporate seeks to place itself as an indispensable AI device supplier throughout industries.

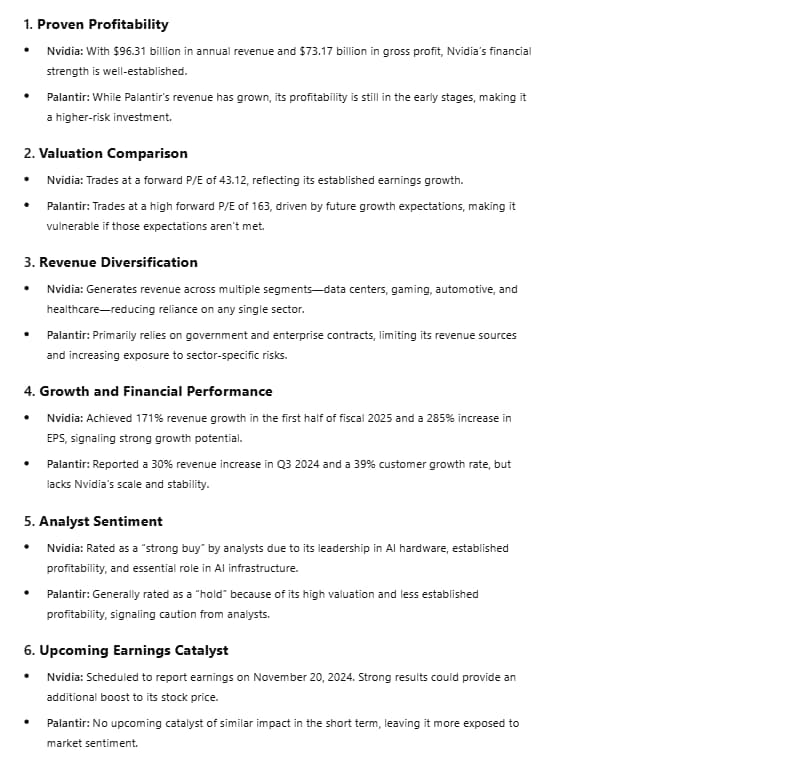

ChatGPT-4o verdict: Nvidia or Palantir for 2025?

Whilst each firms cling robust possible amid emerging AI call for, AI fashions recommend that Nvidia may be the more secure and probably extra rewarding long-term funding.

Moreover, analysts await that Nvidia’s marketplace cap may just continue to grow, probably achieving $4 trillion or extra if AI call for stays powerful, in line with Fortune. Nvidia’s crucial function in AI building additional solidifies its edge within the AI revolution.

ChatGPT-4 on NVDA and PLTR inventory outlook. Supply: ChatGPT-4o/Finbold

ChatGPT-4 on NVDA and PLTR inventory outlook. Supply: ChatGPT-4o/Finbold

Against this, Palantir provides compelling development possible however comes with upper volatility because of its increased valuation and early-stage profitability.

Then again, taking a look towards 2025, Nvidia seems to be the preferable possibility for risk-averse traders, whilst Palantir would possibly attraction extra to these in quest of competitive, high-growth alternatives.

Featured symbol by means of Shutterstock