For the previous a number of months, buyers had been questioning if Nvidia (NASDAQ: NVDA) would release a inventory break up. That is after the era large’s inventory soared lately, achieving just about $1,000. And it in fact did achieve $1,000 this week within the buying and selling consultation following Nvidia’s profits document and announcement of a inventory break up. After the break up, the chip fashion designer’s stocks will probably be buying and selling at a miles decrease stage.However this transfer may not exchange Nvidia’s $2.3 trillion marketplace price. As an alternative, a inventory break up comes to issuing extra stocks to present shareholders and this may lead to extra stocks buying and selling at a lower cost; present shareholders will finally end up with the similar buck price of inventory as they’d ahead of the break up. The drop in value will make the inventory obtainable to a broader vary of buyers, and Nvidia even stated as a part of its announcement that this used to be its motivation for making the transfer.So, nowadays, as Nvidia takes the step many buyers had been looking forward to, is it time to shop for the stocks?

Symbol supply: Getty Pictures.Why are buyers inquisitive about inventory splits?It’s a must to word that it isn’t a good suggestion to shop for a inventory simply since the corporate introduced a break up — it is merely a mechanical operation. A inventory break up itself may not push a inventory’s price upper or decrease. So now you could ask, if that is the case, why are buyers so inquisitive about whether or not an organization will break up its inventory?In lots of instances, the transfer suggests an organization is positive about its long term and believes that its stocks have what it takes to take off as soon as once more. In most cases, the corporate has carried out neatly from an profits point of view lately, and this has triggered the inventory value positive aspects we have now already noticed. Now, by way of splitting its stocks, an organization is implying that the ones positive aspects don’t seem to be over, and from the inventory’s lower cost it as soon as once more would possibly leap or even sooner or later go back to its pre-split stage.Now let’s believe the Nvidia operation, a 10-for-1 inventory break up, efficient June 7. Which means in case you cling one Nvidia proportion nowadays, post-split you’ll be able to personal 10, however the price of your protecting will stay the similar. And if you are going to buy stocks of Nvidia after the break up, if they are nonetheless buying and selling at $1,000 ahead of the break up, they would drop to $100 in step with proportion after the break up.This maneuver will make it more uncomplicated for buyers who would not have get admission to to fractional stocks or those that choose purchasing complete stocks to take a position. And the $1,000 mark represents a mental barrier for some buyers, who would routinely hesitate to shop for even supposing valuation is affordable. Nvidia’s inventory break up will take away this roadblock and pave the best way for them to get in in this tech large.Tale continuesNvidia’s 5 inventory splitsNvidia isn’t any stranger to inventory splits, having finished 5 up to now 24 years. And each and every time Nvidia introduced a break up, the inventory value used to be significantly not up to it’s nowadays, so I am not too stunned that Nvidia determined in this transfer at the moment.Let’s get again to our query: Is it time to shop for the stocks? It’s — however now not as a result of Nvidia’s upcoming inventory break up. Nvidia’s stocks have climbed after its previous inventory splits, however this motion is because of the corporate’s expanding income and insist for its merchandise.

Symbol supply: Getty Pictures.Why are buyers inquisitive about inventory splits?It’s a must to word that it isn’t a good suggestion to shop for a inventory simply since the corporate introduced a break up — it is merely a mechanical operation. A inventory break up itself may not push a inventory’s price upper or decrease. So now you could ask, if that is the case, why are buyers so inquisitive about whether or not an organization will break up its inventory?In lots of instances, the transfer suggests an organization is positive about its long term and believes that its stocks have what it takes to take off as soon as once more. In most cases, the corporate has carried out neatly from an profits point of view lately, and this has triggered the inventory value positive aspects we have now already noticed. Now, by way of splitting its stocks, an organization is implying that the ones positive aspects don’t seem to be over, and from the inventory’s lower cost it as soon as once more would possibly leap or even sooner or later go back to its pre-split stage.Now let’s believe the Nvidia operation, a 10-for-1 inventory break up, efficient June 7. Which means in case you cling one Nvidia proportion nowadays, post-split you’ll be able to personal 10, however the price of your protecting will stay the similar. And if you are going to buy stocks of Nvidia after the break up, if they are nonetheless buying and selling at $1,000 ahead of the break up, they would drop to $100 in step with proportion after the break up.This maneuver will make it more uncomplicated for buyers who would not have get admission to to fractional stocks or those that choose purchasing complete stocks to take a position. And the $1,000 mark represents a mental barrier for some buyers, who would routinely hesitate to shop for even supposing valuation is affordable. Nvidia’s inventory break up will take away this roadblock and pave the best way for them to get in in this tech large.Tale continuesNvidia’s 5 inventory splitsNvidia isn’t any stranger to inventory splits, having finished 5 up to now 24 years. And each and every time Nvidia introduced a break up, the inventory value used to be significantly not up to it’s nowadays, so I am not too stunned that Nvidia determined in this transfer at the moment.Let’s get again to our query: Is it time to shop for the stocks? It’s — however now not as a result of Nvidia’s upcoming inventory break up. Nvidia’s stocks have climbed after its previous inventory splits, however this motion is because of the corporate’s expanding income and insist for its merchandise.

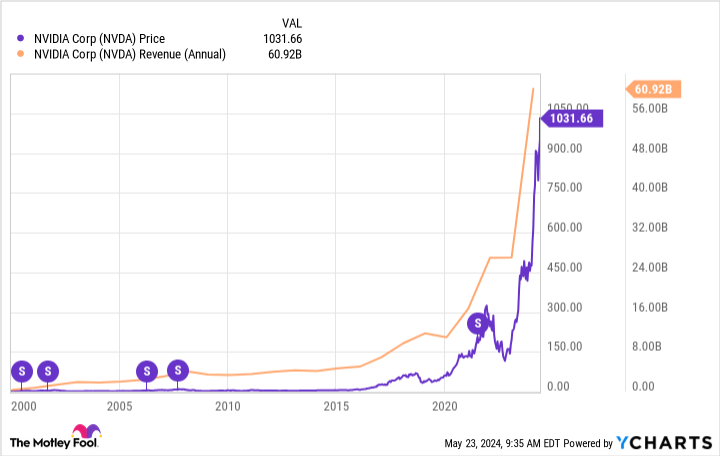

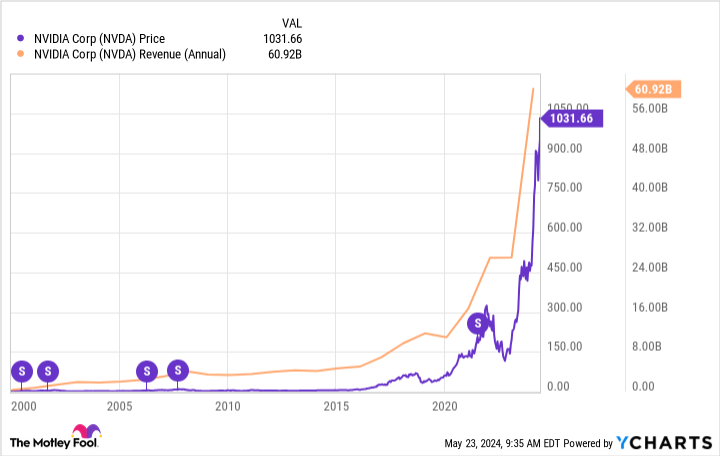

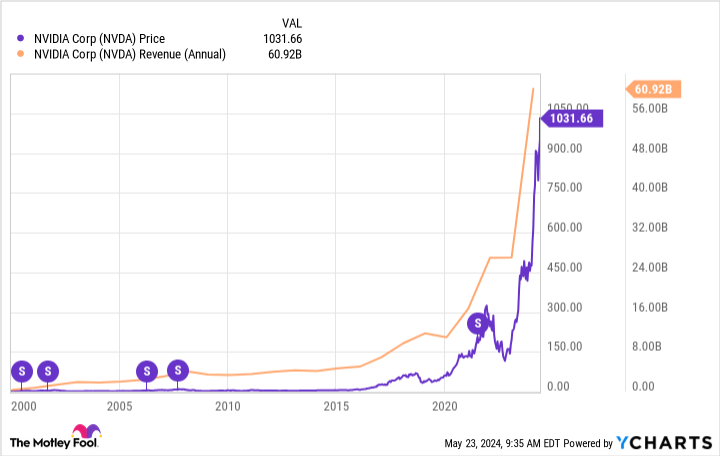

NVDA ChartAnd a take a look at Nvidia’s contemporary profits document and the overall AI marketplace be offering us explanation why to be positive concerning the long term. The corporate reported triple-digit expansion in income and web source of revenue within the fiscal 2025 first quarter, with income achieving file ranges. On the similar time, gross margin is on the upward thrust, widening to greater than 78%, so Nvidia is changing into an increasing number of winning.The corporate says call for for its services and products is surpassing provide, and as Nvidia prepares to release its new Blackwell structure and maximum tough chip ever, it is smooth to consider call for last sturdy. Particularly taking into account AI marketplace forecasts. Analysts are expecting the marketplace will achieve greater than $1 trillion by way of the tip of the last decade. All of this helps the theory of extra expansion forward for Nvidia.In the meantime, Nvidia stocks business for approximately 34 occasions ahead profits estimates, which seems to be very fair taking into account long-term potentialities. That makes Nvidia a purchase — whether or not you’re making the transfer ahead of or after the inventory break up.Will have to you make investments $1,000 in Nvidia at the moment?Before you purchase inventory in Nvidia, believe this:The Motley Idiot Inventory Consultant analyst staff simply known what they imagine are the 10 best possible shares for buyers to shop for now… and Nvidia wasn’t one among them. The ten shares that made the lower may just produce monster returns within the coming years.Believe when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $652,342!*Inventory Consultant supplies buyers with an easy-to-follow blueprint for luck, together with steering on development a portfolio, common updates from analysts, and two new inventory selections each and every month. The Inventory Consultant provider has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Consultant returns as of Might 13, 2024Adria Cimino has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.Nvidia Simply Introduced a Inventory Break up. Time to Purchase? used to be firstly printed by way of The Motley Idiot

NVDA ChartAnd a take a look at Nvidia’s contemporary profits document and the overall AI marketplace be offering us explanation why to be positive concerning the long term. The corporate reported triple-digit expansion in income and web source of revenue within the fiscal 2025 first quarter, with income achieving file ranges. On the similar time, gross margin is on the upward thrust, widening to greater than 78%, so Nvidia is changing into an increasing number of winning.The corporate says call for for its services and products is surpassing provide, and as Nvidia prepares to release its new Blackwell structure and maximum tough chip ever, it is smooth to consider call for last sturdy. Particularly taking into account AI marketplace forecasts. Analysts are expecting the marketplace will achieve greater than $1 trillion by way of the tip of the last decade. All of this helps the theory of extra expansion forward for Nvidia.In the meantime, Nvidia stocks business for approximately 34 occasions ahead profits estimates, which seems to be very fair taking into account long-term potentialities. That makes Nvidia a purchase — whether or not you’re making the transfer ahead of or after the inventory break up.Will have to you make investments $1,000 in Nvidia at the moment?Before you purchase inventory in Nvidia, believe this:The Motley Idiot Inventory Consultant analyst staff simply known what they imagine are the 10 best possible shares for buyers to shop for now… and Nvidia wasn’t one among them. The ten shares that made the lower may just produce monster returns within the coming years.Believe when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $652,342!*Inventory Consultant supplies buyers with an easy-to-follow blueprint for luck, together with steering on development a portfolio, common updates from analysts, and two new inventory selections each and every month. The Inventory Consultant provider has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Consultant returns as of Might 13, 2024Adria Cimino has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.Nvidia Simply Introduced a Inventory Break up. Time to Purchase? used to be firstly printed by way of The Motley Idiot