Some Nvidia workers are thought to be to be millionairesSOPA ImagesNvidia inventory nonetheless has 22% upside, even after its near-doubling this yr, in keeping with Goldman Sachs.The financial institution argued that Nvidia’s valuation remains to be rather affordable given its speedy expansion fee.Goldman was once inspired via sturdy spending developments on AI infrastructure via mega-cap tech giants.Nvidia inventory nonetheless has a variety of upside even after its year-to-date rally of 81%, in keeping with a Tuesday be aware from Goldman Sachs.The financial institution raised its Nvidia worth goal to $1,100 from $1,000, representing possible upside of twenty-two% from present ranges.In line with Goldman, Nvidia inventory nonetheless trades at a rather sexy valuation in comparison to its friends given how temporarily it’s rising and the way sturdy the ones expansion developments glance within the coming years.”We see certain EPS revisions using every other leg up within the inventory, particularly with NVDA buying and selling at 35x or just a 36% top rate to our protection universe vs. its previous 3-year median top rate of 160%,” Goldman Sachs analyst Toshiya Hari mentioned.Hari was once particularly inspired via fresh feedback from the mega-cap tech giants, which steered on their income name that they’re going to be spending much more cash on AI infrastructure in 2025, following an increased yr of funding in 2024.

Some Nvidia workers are thought to be to be millionairesSOPA ImagesNvidia inventory nonetheless has 22% upside, even after its near-doubling this yr, in keeping with Goldman Sachs.The financial institution argued that Nvidia’s valuation remains to be rather affordable given its speedy expansion fee.Goldman was once inspired via sturdy spending developments on AI infrastructure via mega-cap tech giants.Nvidia inventory nonetheless has a variety of upside even after its year-to-date rally of 81%, in keeping with a Tuesday be aware from Goldman Sachs.The financial institution raised its Nvidia worth goal to $1,100 from $1,000, representing possible upside of twenty-two% from present ranges.In line with Goldman, Nvidia inventory nonetheless trades at a rather sexy valuation in comparison to its friends given how temporarily it’s rising and the way sturdy the ones expansion developments glance within the coming years.”We see certain EPS revisions using every other leg up within the inventory, particularly with NVDA buying and selling at 35x or just a 36% top rate to our protection universe vs. its previous 3-year median top rate of 160%,” Goldman Sachs analyst Toshiya Hari mentioned.Hari was once particularly inspired via fresh feedback from the mega-cap tech giants, which steered on their income name that they’re going to be spending much more cash on AI infrastructure in 2025, following an increased yr of funding in 2024.

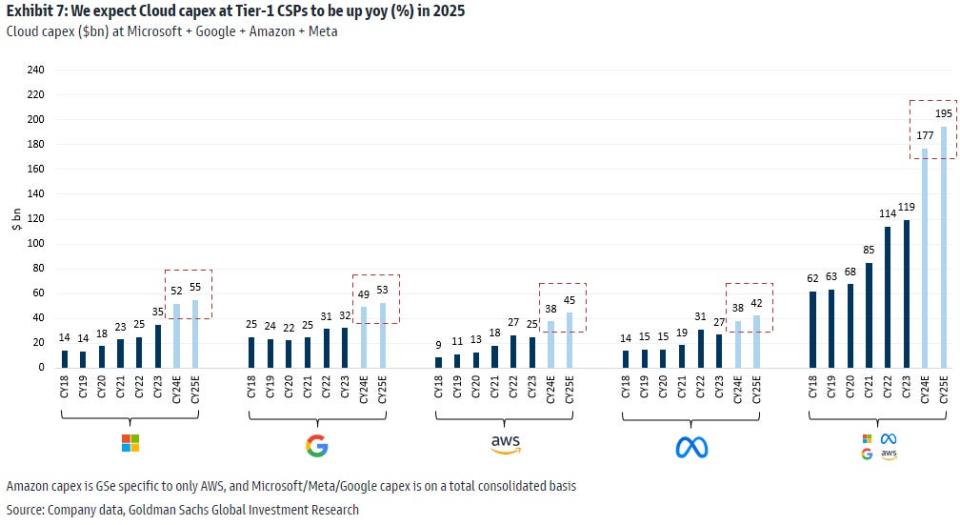

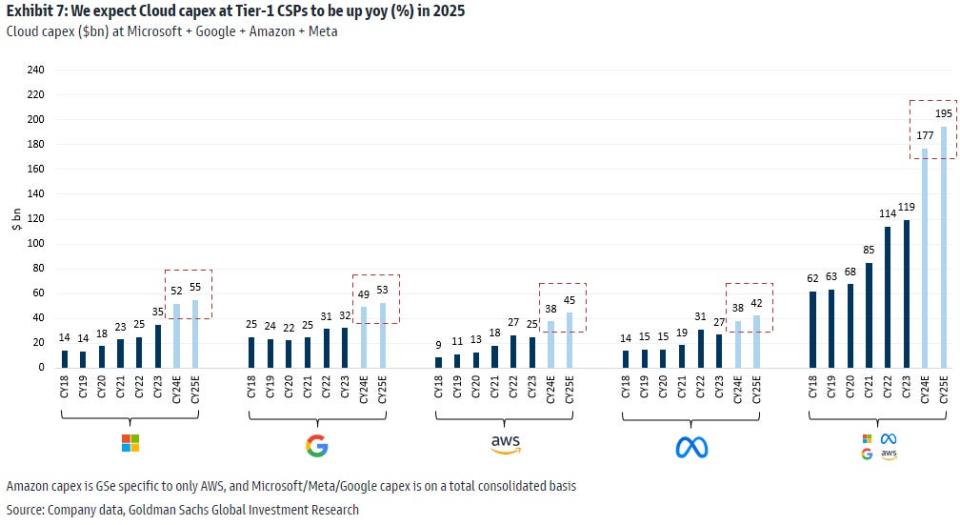

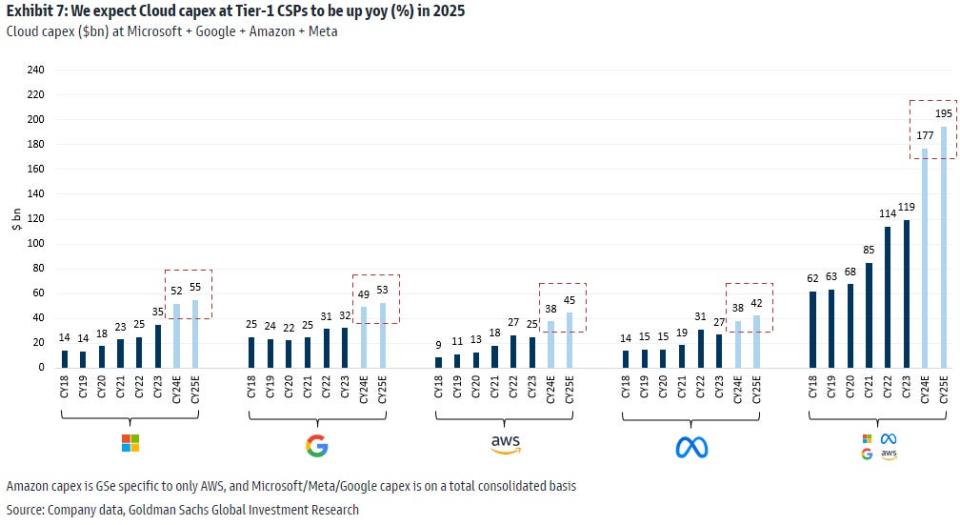

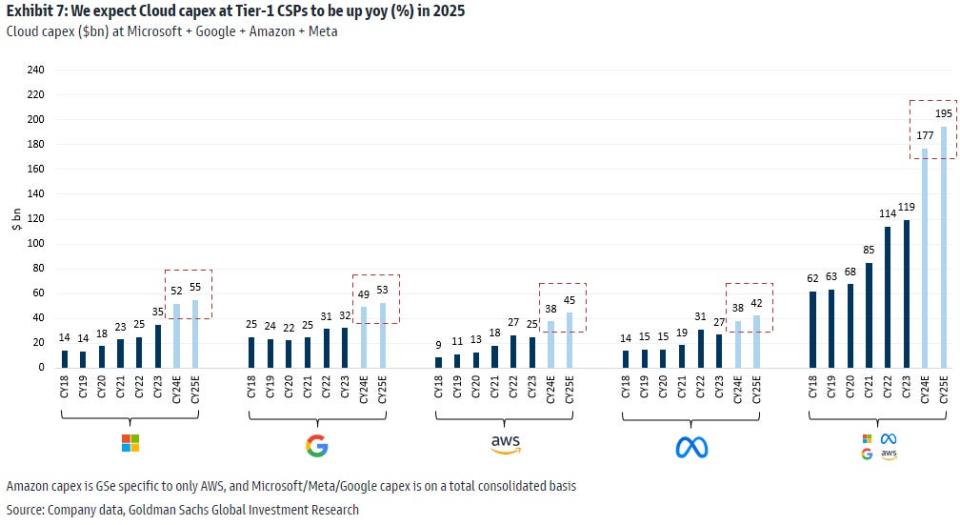

Goldman SachsThose investments must energy endured earnings and benefit expansion at Nvidia, particularly with its next-generation Blackwell AI chip set to be launched later this yr. Nvidia will document its income effects on Might 22 after the marketplace shut.”Notable intra-quarter knowledge issues that strengthen the view that AI spending is more likely to proceed past 2024 come with” statement from tech-focused corporations, Hari mentioned.1. TSMC reiterated its near- and long-term outlooks for the AI marketplace, and expects server AI processor earnings to greater than double year-over-year.2. Tier-1 hyperscalers like Amazon and Meta Platforms mentioned or implied that AI-related capital investments are more likely to build up in 2025 from an already increased base in 2024.3. Some AI hyperscalers and undertaking tool corporations highlighted early indicators of AI monetization.4. AMD raised its 2024 earnings steering for its AI-focused GPU chip, the Mi300 to $4 billion from $3.5 billion.5. Tremendous Micro Pc reported sturdy earnings expansion and a file backlog pushed via increased call for for AI servers.And whilst pageant is beginning to encroach on Nvidia’s GPU trade by way of AMD’s new chip and in-house chip design from mega-cap tech corporations, that may not be sufficient to knock down the corporate, in keeping with Hari.”We imagine Nvidia will stay the de facto trade usual for the foreseeable long term given its aggressive merit that spans its {hardware} and tool features in addition to the put in base and eco-system it has constructed over a couple of a long time, and the tempo at which it’s and might be innovating over the following a number of years,” Hari mentioned.Learn the unique article on Trade Insider

Goldman SachsThose investments must energy endured earnings and benefit expansion at Nvidia, particularly with its next-generation Blackwell AI chip set to be launched later this yr. Nvidia will document its income effects on Might 22 after the marketplace shut.”Notable intra-quarter knowledge issues that strengthen the view that AI spending is more likely to proceed past 2024 come with” statement from tech-focused corporations, Hari mentioned.1. TSMC reiterated its near- and long-term outlooks for the AI marketplace, and expects server AI processor earnings to greater than double year-over-year.2. Tier-1 hyperscalers like Amazon and Meta Platforms mentioned or implied that AI-related capital investments are more likely to build up in 2025 from an already increased base in 2024.3. Some AI hyperscalers and undertaking tool corporations highlighted early indicators of AI monetization.4. AMD raised its 2024 earnings steering for its AI-focused GPU chip, the Mi300 to $4 billion from $3.5 billion.5. Tremendous Micro Pc reported sturdy earnings expansion and a file backlog pushed via increased call for for AI servers.And whilst pageant is beginning to encroach on Nvidia’s GPU trade by way of AMD’s new chip and in-house chip design from mega-cap tech corporations, that may not be sufficient to knock down the corporate, in keeping with Hari.”We imagine Nvidia will stay the de facto trade usual for the foreseeable long term given its aggressive merit that spans its {hardware} and tool features in addition to the put in base and eco-system it has constructed over a couple of a long time, and the tempo at which it’s and might be innovating over the following a number of years,” Hari mentioned.Learn the unique article on Trade Insider