Everyone seems to be at it, and it seems like no person needs to omit out. A contemporary commonplace task on Wall Boulevard has been to boost the cost goal for Nvidia (NASDAQ:NVDA) stocks. After a blowout 2023 in keeping with outstanding effects, pushed by way of its status because the undisputed main maker of AI chips, analysts have not too long ago been adjusting their fashions, and elevating goals in keeping with a trust the AI alternative has but to totally play out.

That mentioned, with out the real want for any changes, Loop Capital’s 5-star analyst, Ananda Baruah, has determined to leap proper in and take all different forecasts out.

The highest analyst not too long ago initiated protection of NVDA inventory with a Purchase ranking and a Boulevard-high $1,200 worth goal, suggesting the stocks have room for additional enlargement of 65% from present ranges. (To look at Baruah’s monitor report, click on right here)

What propels Baruah’s bullish stance? “We imagine now not handiest is there subject matter upside to Boulevard estimates in CY2024/FY2025 & CY2025/FY2026 however that we’re on the entrance finish of a three – 5 yr GPU compute & Gen AI foundational construct throughout Hyperscale,” the analyst defined. “Whilst we recognize further silicon suppliers (non-public in addition to AMD & INTC) and Hyperscale explicit inside silicon answers shall be coming on-line over the following couple of years, our paintings suggests NVDA’s biggest consumers shall be taking the entirety NVDA may give them in 2024 and 2025.”

Pushed by way of Knowledge Heart GPUs, Baruah expects respective income & EPS in CY2024/FY2025 of $132.4 billion & $30.00, in comparison to the Boulevard at $95.8 billion & $21.76. In CY2025/FY2026, Baruah sees the ones figures at $175.6 billion & $40.00, vs. consensus at a respective $110 billion & $24.84.

If that’s now not bullish sufficient, by the use of each income and GM enlargement, Baruah additionally thinks there’s “reputable upside attainable to even our above Boulevard estimates.”

Whilst the quick response is to assume Baruah may well be going overboard right here, it’s price making an allowance for that because the Generative AI alternative kicked off a yr in the past, Nvidia’s quarterly effects display a “distinct development of pronounced beats.”

The explanation why Baruah is that a lot more assured than the overall Wall Boulevard view is a relatively easy one. Mainly, Baruah thinks Nvidia is set to promote way more high-end Knowledge Heart GPUs than different analysts lately be expecting. For CY2024/FY2025, Baruah sees Nvidia monitoring against 5.0 million (and six.5 million+ for CY2025/FY2026). According to investor conversations, Baruah thinks the Boulevard is anticipating a complete of four.0–4.5 million Endeavor & Knowledge Heart GPUs throughout the similar length.

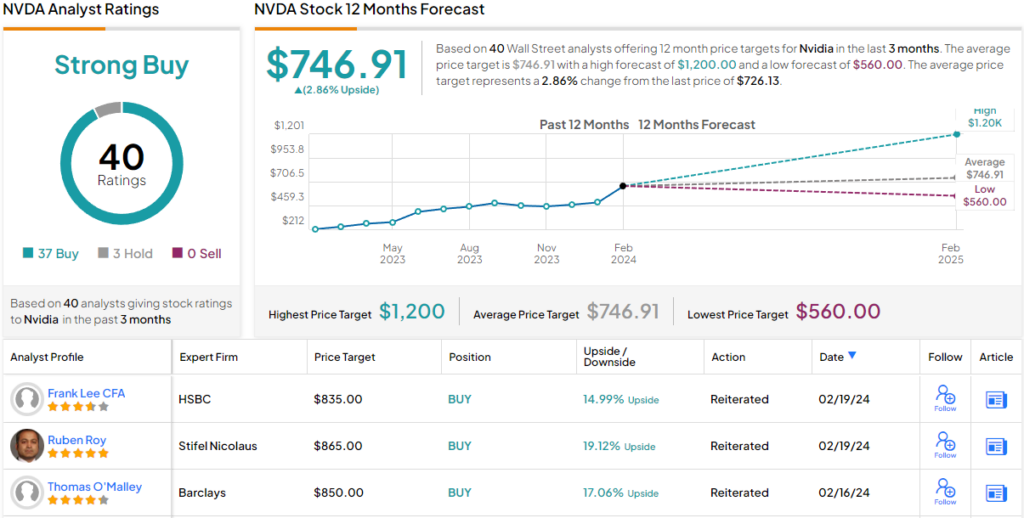

Having a look on the consensus breakdown, maximum of Baruah’s colleagues are of a bullish bent, too. According to 37 Buys vs. 3 Holds, the inventory claims a Sturdy Purchase consensus ranking. That mentioned, some seem to assume a cooling down length for the inventory is so as; the $746.91 moderate goal suggests the stocks will stay rangebound in the interim. (See Nvidia inventory forecast)

To seek out just right concepts for shares buying and selling at horny valuations, seek advice from TipRanks’ Absolute best Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analysts. The content material is meant for use for informational functions handiest. It is important to to do your individual research sooner than making any funding.