Stocks of the most up to date inventory at the S&P 500 larger tenfold on Friday.After the marketplace’s shut, Nvidia’s 10-for-1 inventory break up, which used to be introduced in Might all the way through the corporate’s most up-to-date profits name, went into impact. However it’s going to do little to modify the corporate’s $3 trillion valuation or its underlying basics, which to this point, have traders licking their chops.“You and I do know {that a} inventory break up is solely beauty, a minimum of it’s for current shareholders,” says Paul Meeks, a veteran tech investor and industry faculty professor at army faculty The Castle. “With their investor family members regimen, Nvidia is definitely conscious they have got to stay on throwing a couple of bones available in the market” to traders.Few different corporations have embodied the brand new company hierarchy pecking order ushered in via the proliferation of AI slightly like Nvidia has. The corporate’s inventory rose 3,174% during the last 5 years and 218% in simply the remaining yr. All the way through its epic run, Nvidia’s marketplace cap soared previous the likes of Amazon and Alphabet. Prior to the 10-for-1 break up, the inventory used to be at a stratospheric $1,209.That worth used to be most probably too top for many traders, undoubtedly the retail traders the break up used to be intended to draw, consistent with Humayun Sheikh, CEO of startup Fetch.ai, which gives developer gear in particular for AI. “The inventory break up complements Nvidia’s enchantment via making stocks extra reasonably priced, thus broadening its investor base,” he mentioned.Sheikh too sees the transfer, a minimum of in part, about traders’ perceptions, announcing it used to be most probably “influenced via optics” and may boost up marketplace cap positive aspects.Nvidia’s place because the company that has cornered the marketplace on offering AI builders the entire chips and computing energy they want isn’t converting as a result of the inventory break up. Within the first quarter, Nvidia’s gross sales rose 262% yearly to $26 billion, outperforming Wall Side road’s already lofty expectancies.Nvidia’s inventory rally additionally serves as a touch at what the AI growth may nonetheless have in retailer.“Nvidia’s exchange in worth during the last yr is telling us one thing concerning the marketplace, specifically, that in all probability AI is the brand new normal function generation, just like the web or electrical energy, which can have huge productiveness implications around the economic system, and subsequently AI corporations will receive advantages very much,” mentioned NYU industry faculty professor Vasant Dhar.What may probably move flawed with Nvidia’s inventory break up? Nonetheless, traders are taking into consideration a couple of situations wherein issues may move south for them after the inventory break up, at the same time as they admit the percentages are narrow.For Meeks, the one factor that might halt Nvidia’s march to the highest is an economy-wide slowdown, which he considers not going as a result of he expects the U.S. will steer clear of a recession and that the Federal Reserve will decrease rates of interest in early 2025. If truth be told, he’s already serious about Nvidia’s efficiency will have to the economic system give a boost to.Tale continues“It would be arduous for those shares to lose their positive aspects if unexpectedly we move from wind in our face with top charges to wind at our again with low charges,” Meeks mentioned.In the meantime, Sheikh mentioned the retail traders the break up used to be intended to draw are every other imaginable, however not going, worry. Personally, retail traders would possibly hang small quantities of Nvidia inventory. However jointly, they may be able to make up a good portion of stocks. So any shocks to the gadget or surprising adjustments of their perspectives at the corporate can nonetheless have a notable impact. One want glance no additional than GameStop to grasp the outsize affect retail traders could have available on the market.Lowering the inventory to one-tenth of its worth generally is a double edged sword. “This way may enchantment to Robinhood-type traders or meme inventory fans,” Sheikh added. “On the other hand, if the narrative turns towards Nvidia and speculative investors get started promoting off, it would have an effect on the associated fee negatively.”However even supposing that unwelcome state of affairs had been to occur it wouldn’t exchange the entire marketplace developments propping up the chipmaker.“Nvidia already had an enormous run up in worth, so any tailwind from a inventory break up shall be miniscule compared to the ‘basic’ causes for its efficiency,” Dhar mentioned.This tale used to be at the start featured on Fortune.com

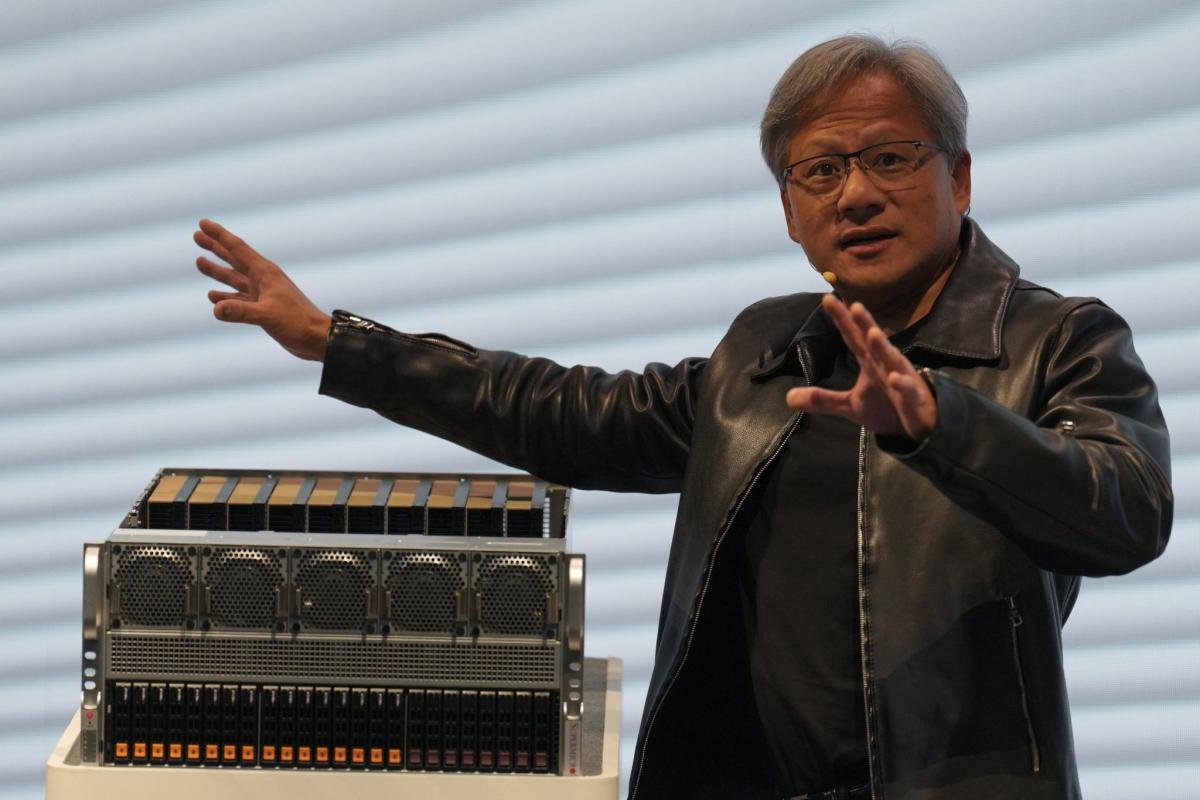

Nvidia’s inventory break up is in large part ‘beauty,’ and mammoth positive aspects may stay rolling in

:max_bytes(150000):strip_icc()/GettyImages-2205883906-edf4003dda674f7bb2cc30d27f53cb80.jpg)

![watchOS 11.4 now to be had with 3 new options for Apple Watch [U: Pulled] – 9to5Mac watchOS 11.4 now to be had with 3 new options for Apple Watch [U: Pulled] – 9to5Mac](https://9to5mac.com/wp-content/uploads/sites/6/2025/01/watchOS-11.4-hero.jpg?quality=82&strip=all&w=1600)