Synthetic intelligence (AI) chief Nvidia is not very best, that may be a painful realization for its traders.

3 a long time in the past, the web started going mainstream and kicked off a sequence of occasions that modified the expansion trajectory of company The usa endlessly.

Wall Side road has been ready, every so often impatiently, for the next-big-thing pattern to come back alongside that may rival what the web did for companies. After an intensive wait, the synthetic intelligence (AI) revolution seems able to respond to the decision.

With AI, tool and methods are given autonomy to supervise duties that people would usually deal with. The important thing to AI’s long-term good fortune, and the supply of its apparently countless ceiling, is the capability for AI-driven tool and methods to be told with out human intervention. System finding out provides AI the possible to transform extra gifted at current duties, in addition to be told new abilities.

No corporate has benefited extra without delay from the upward thrust of AI than semiconductor goliath Nvidia (NVDA -0.21%).

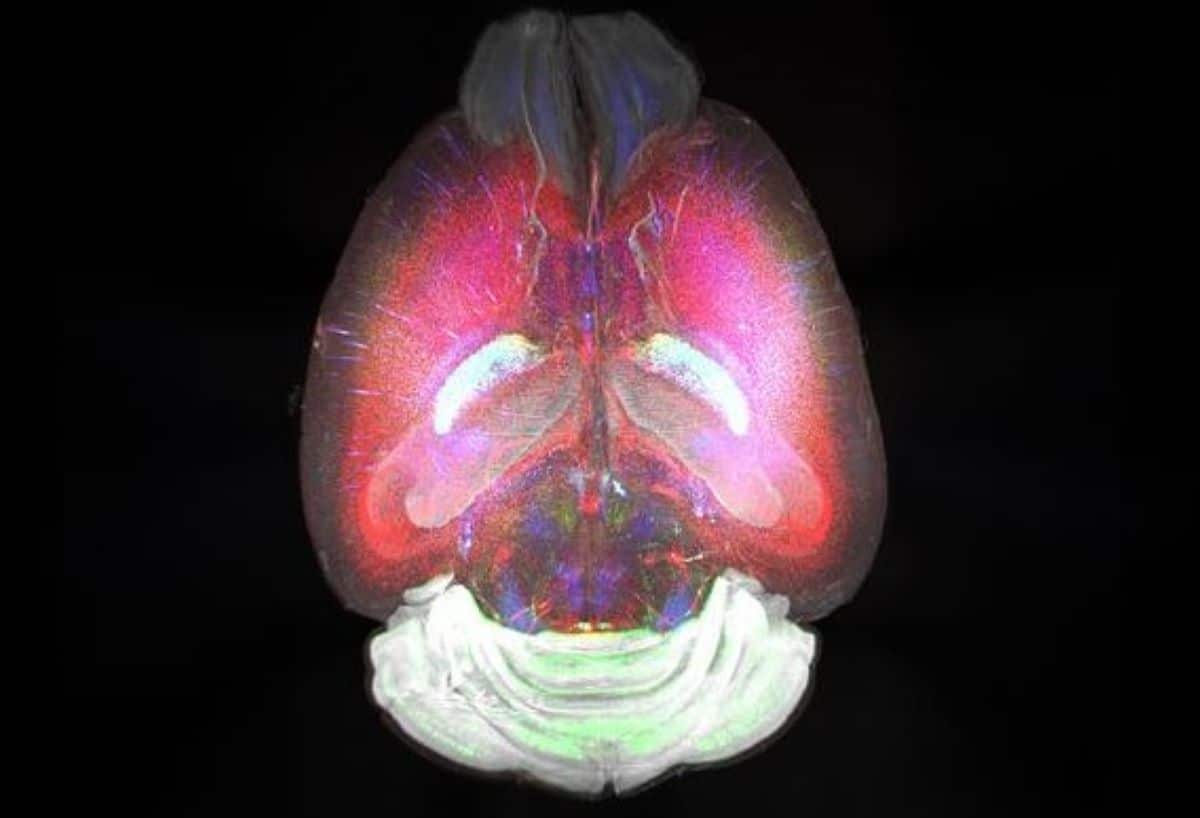

Symbol supply: Getty Pictures.

Till just lately, Nvidia’s working ramp-up have been flawless

At first of 2023, Nvidia was once wearing a $360 billion marketplace cap, which put it at the edge of being one of the influential era firms in The usa. Via June 20, 2024, not up to two weeks after finishing its historical 10-for-1 inventory cut up, Nvidia’s marketplace cap peaked at $3.46 trillion on an intra-day foundation. Traders have merely by no means witnessed a marketplace chief acquire greater than $3 trillion in price in not up to 18 months prior to.

The catalyst in the back of this probably once-in-a-lifetime transfer is the corporate’s AI graphics processing gadgets (GPUs), that have transform the usual in high-compute endeavor knowledge facilities. The semiconductor analysts at TechInsights estimate that Nvidia was once liable for all however 90,000 of the three.85 million GPUs that had been shipped to endeavor knowledge facilities in 2023.

With call for for the corporate’s chips overwhelming provide, Nvidia has been ready to dramatically building up the marketing worth of its celebrity AI-accelerating chip, the H100. In a stretch of 5 quarters, the corporate’s adjusted gross margin expanded via more or less 13.7 share issues to 78.4%.

Having its {hardware} be the focal point in endeavor knowledge facilities has additionally fueled ongoing innovation. In March, Nvidia presented its next-generation Blackwell platform as being in a position to accelerating compute capability in plenty of spaces, together with generative AI answers, whilst eating much less power than its predecessor. In June, CEO Jensen Huang teased the debut of its Rubin GPU structure, which shall be powered via a brand new processor, referred to as “Vera.” Rubin is about to make its debut in 2026.

The general piece of the puzzle to Nvidia’s, so far, textbook working ramp-up has been its providers expanding their capability to house powerful call for. For instance, world-leading chip-fabrication corporate Taiwan Semiconductor Production (TSM 1.56%) has boosted its chip-on-wafer-on-substrate (CoWoS) capability, which is a need for packaging high-bandwidth reminiscence in AI-accelerated knowledge facilities.

Nvidia is flawless not

This apparently textbook “recipe” because the chief of Wall Side road’s most up to date pattern in brief helped Nvidia surpass Microsoft and Apple to transform the biggest publicly traded corporate. However after a coarse couple of weeks for Nvidia and the inventory marketplace as a complete, it is transform it appears that evidently glaring that Nvidia is solely as fallible as every other corporate.

To take care of its historical run-up, Nvidia had to execute flawlessly. It had so that you could promote via all of its {hardware}, command a top-notch worth for its merchandise and tool — the CUDA platform, which is helping builders construct massive language fashions — and take care of its aggressive edge via bringing its next-gen GPU structure to marketplace on time.

Sadly, studies emerged ultimate weekend that Nvidia has knowledgeable a lot of its peak consumers (all participants of the “Magnificent Seven”) that it could be delaying the cargo of its Blackwell chip for a minimum of 3 months. This is able to push supply into the primary quarter of 2025 from an anticipated arrival date later this yr.

In line with quite a lot of studies, the prolong stems from attainable design flaws with Blackwell, in addition to capability constraints from Taiwan Semiconductor (TSMC). Even with TSMC successfully doubling its CoWoS capability, it is nonetheless nowhere close to sufficient for Nvidia to fulfill the call for of endeavor purchasers.

Blackwell’s prolong is the primary domino to fall that indicators Nvidia is not up to very best. It additionally opens the door for Nvidia’s pageant to thrive.

On July 30, Complicated Micro Gadgets (AMD -1.50%) delivered second-quarter working effects that had been welcomed with open hands via Wall Side road and traders. AMD’s knowledge heart phase gross sales surged 115% from the prior-year duration and 21% on a sequential quarterly foundation (i.e., from what was once reported for the March-ended quarter). AMD attributed this outperformance to its ramp-up of AI GPUs.

Particularly, AMD’s MI300X is significantly less expensive than Nvidia’s H100. Even if the H100 holds plenty of compute benefits over the MI300X, backlogged provide for the H100, coupled with the now-delayed Blackwell chip, provides AMD’s {hardware} much more luster.

So as to add, all 4 of Nvidia’s peak consumers had been growing AI chips to be used of their knowledge facilities. Even supposing Nvidia keeps its compute benefit, it’ll lose out on precious knowledge heart “actual property,” as its peak consumers select to put in their internally advanced (and cost-effective) chips.

Symbol supply: Getty Pictures.

Historical past suggests the Nvidia sell-off goes to irritate

To make issues worse, there hasn’t been a unmarried next-big-thing innovation, era, or pattern that is escaped an early-stage bubble in 3 a long time. Past the arrival of the web, traders have watched early bubbles burst in genome interpreting, business-to-business trade, housing, China shares, nanotechnology, 3-d printing, blockchain era, cryptocurrency, hashish, and the metaverse.

The problem with game-changing inventions and applied sciences is that traders overestimate their adoption and software. Irrespective of how massive the addressable marketplace is, it takes time for brand spanking new applied sciences to change the expansion panorama for company The usa.

For example, although maximum main companies are spending huge on AI-driven knowledge facilities, many lack a transparent blueprint as to how synthetic intelligence goes to assist them develop their gross sales and make more cash. Traders noticed the similar tale only some years in the past with the upward thrust of the metaverse, and blockchain era prior to that. All inventions want time to mature — no exceptions!

Over 3 a long time, marketplace leaders for each next-big-thing pattern have constantly declined via 80% or extra in price. On a peak-to-trough foundation, the main companies in the back of the web/networking, 3-d printing, genome interpreting, hashish, cryptocurrency, and blockchain era all plummeted via 90% or extra prior to bottoming out.

The silver lining for Nvidia is that it has more than one established segments past its AI GPU operations that can give a loftier basis than what different marketplace leaders handled when their respective bubbles burst. Nvidia’s GPUs utilized in gaming and crypto mining, coupled with its virtualization tool, must save you a complete wipeout.

Nonetheless, historical past is crystal transparent that a large pullback is so as as soon as the euphoria surrounding a next-big-thing pattern fades. Blackwell’s prolong is the primary domino to fall, and it strongly suggests the Nvidia sell-off will irritate within the coming weeks, months, or quarters.