Nvidia’s (NVDA) is dealing with an important setback in growing its next-generation AI chip, Blackwell. In step with The Knowledge, chip manufacturing has been not on time through a minimum of 3 months because of sudden design flaws. Tech giants who depend on those chips will really feel the ache of the holdup.

The extend comes as a blow to Nvidia, which unveiled the Blackwell sequence in March. CEO Jensen Huang had prime expectancies for those chips, projecting considerable revenues in 2025.

The design factor has pressured the corporate to behavior new take a look at manufacturing runs with Taiwan Semiconductor Production Corporate (TSM). This setback will push the timeline for large-scale shipments to the primary quarter of 2025.

Affect on Tech Giants

This extend is predicted to have an effect on the corporate’s main tech purchasers, together with Meta Platforms (META), Alphabet’s (GOOGL) Google, and Microsoft (MSFT), that have jointly positioned broad orders for those chips.

Those tech giants depend on complex {hardware} to energy their AI fashions and products and services. Delays within the availability of those chips may disrupt their product roadmaps and have an effect on their competitiveness within the AI race.

What Is the Prediction for Nvidia Inventory?

The chipmaker’s inventory has soared over 116% year-to-date, however analysts imagine there’s nonetheless quite a lot of gasoline left within the tank. Importantly, the knowledge middle marketplace is observed as a significant enlargement driving force for the corporate.

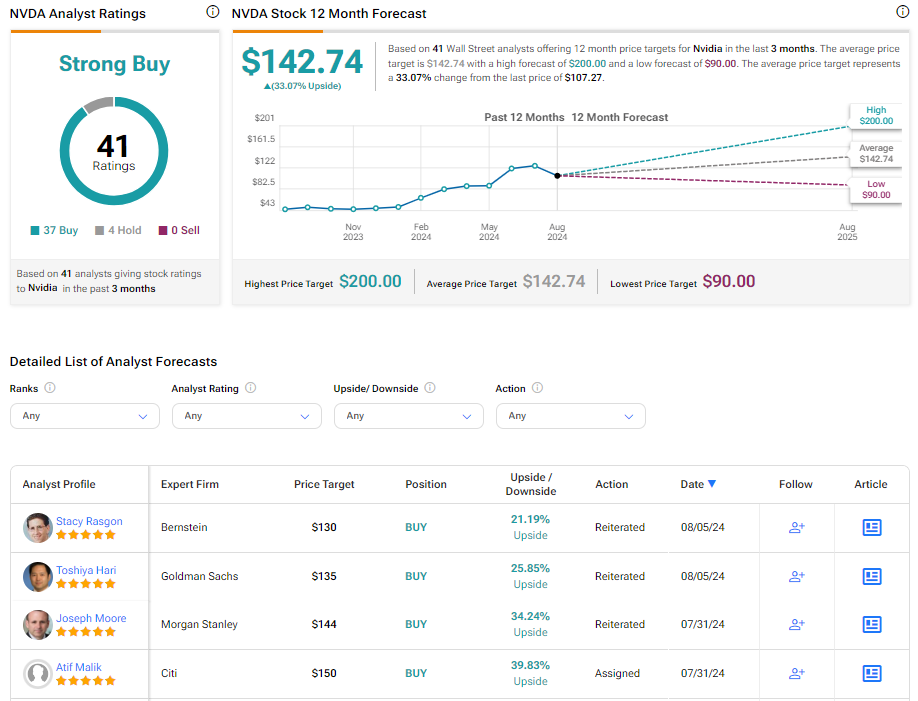

Analysts have a Robust Purchase consensus score on NVDA in response to 37 Buys and 4 Holds assigned prior to now 3 months. The analysts’ moderate value goal on Nvidia inventory is $142.74, implying 33.07% upside possible from present ranges.

See extra NVDA analyst scores

Disclosure