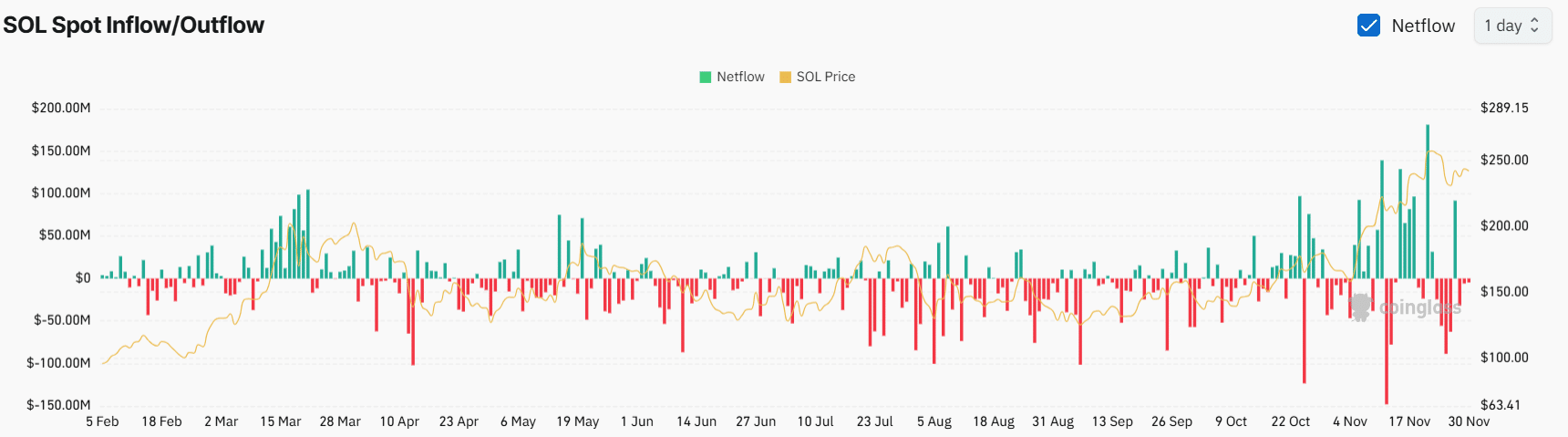

Like clockwork, Nvidia (NASDAQ: NVDA) delivered some other spherical of explosive expansion in its third-quarter income record, however traders appeared to be lacking probably the most spectacular a part of the efficiency. The corporate did not point out it within the income name or press liberate, consigning it as a substitute to the “CFO Remark” phase of its income record. By means of now, maximum traders know that the knowledge heart section is riding Nvidia’s expansion. Whilst Nvidia’s industry spans the entirety from gaming to self sufficient automobiles to visualization equipment just like the Omniverse, its luck within the information heart industry, pushed by way of the explosive expansion of AI, has stolen the narrative and now makes up nearly all of Nvidia’s income. Are You Lacking The Morning Scoop? Breakfast Information delivers all of it in a handy guide a rough, Silly, and unfastened day-to-day e-newsletter. Signal Up For Loose » Whilst general income within the fiscal 2025 1/3 quarter jumped 94% from a yr in the past to $35.1 billion, expansion within the information heart section was once even more potent, mountaineering 112% from a yr in the past to $30.8 billion. Alternatively, Nvidia breaks down its information heart income into two classes. It brings in income from “networking” and “compute.” Compute refers back to the parts that run packages on a server, comparable to processors and reminiscence chips. Networking contains parts like switches and routers that gives the connectivity and the protection wanted for the packages to run. AI working towards and inference is pushed by way of the compute parts so it is sensible that compute makes up the majority of that income. Information heart networking income within the 1/3 quarter grew simply 20% yr over yr to $3.1 billion, whilst information heart compute income was once up 132% to $27.6 billion. The information heart compute determine looks as if the most efficient mirrored image of the underlying expansion in Nvidia’s industry, even with the discrepancy between call for and provide as the corporate stated a number of occasions at the income name that the industry is provide constrained and it expects the ones constraints to proceed for the following a number of quarters, particularly at the Blackwell platform. Information heart compute income additionally grew 22% sequentially, above 17% general sequential expansion for the entire corporate. and 17% sequential expansion within the information heart. The chart underneath displays the efficiency in information heart compute income over the past a number of quarters. Information heart compute income Yr-over-year expansion Sequential expansion Greenback Quantity (in billions) Q2 2024 171% 141% N/A Q3 2024 324% 38% N/A This fall 2024 488% 27% N/A Q1 2025 478% 29% $19.4 Q2 2025 162% 17% $22.6 Q3 2025 132% 22% $27.6 Supply: Nvidia filings. (Be aware: compute income was once no longer reported in fiscal 2024) Tale Continues The information heart compute platform is on the core of Nvidia’s AI providing. It hurries up probably the most compute-intensive workloads, and it contains quite a lot of merchandise comparable to APIs, device construction kits (SDKs), its DGX Cloud, which is an AI training-as-a-service platform, and GPUs, DPUs, and AI undertaking device. All of that makes it very tough to compete with Nvidia and is helping give an explanation for why the knowledge heart industry is rising so rapid. Symbol supply: Getty Pictures. The opposite telling information level within the desk above is that whilst Nvidia’s year-over-year income expansion within the information heart compute section persevered to slow down, sequential income expansion, which is arguably a greater barometer of expansion, sped up from 17% to 22%, lifting a equivalent acceleration in general income from 15% to 17%. Sequential expansion of twenty-two% would translate to a 122% year-over-year expansion fee if the industry grew at that tempo over 4 quarters. Given the release of the brand new Blackwell platform and control’s remark about call for outstripping provide for the following a number of quarters, the corporate may just take care of a expansion fee very similar to that over the following yr. Nvidia inventory fell rather at the income record. Buyers appeared to assume steering was once underwhelming as the corporate known as for year-over-year income expansion to sluggish to 70% within the fourth quarter, with the highest line achieving $37.5 billion, plus or minus 2%. Alternatively, Nvidia has an extended historical past of topping its steering, and it looks as if a just right guess to take action once more within the fourth quarter, given the sizzling expansion from the knowledge heart compute industry and locked-in call for for its Blackwell platform. Do not be stunned to peer Nvidia best that forecast once more 3 months from now. The industry is on fireplace. It continues to ship stellar effects, and there may be little in how to sluggish it down. Before you purchase inventory in Nvidia, imagine this: The Motley Idiot Inventory Guide analyst group simply recognized what they imagine are the 10 very best shares for traders to shop for now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce may just produce monster returns within the coming years. Imagine when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $829,378!* Inventory Guide supplies traders with an easy-to-follow blueprint for luck, together with steering on development a portfolio, common updates from analysts, and two new inventory choices each and every month. The Inventory Guide provider has greater than quadrupled the go back of S&P 500 since 2002*. See the ten shares » *Inventory Guide returns as of November 25, 2024 Jeremy Bowman has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage. Nvidia’s Rising Quicker Than You Assume. This Desk Proves It. was once firstly revealed by way of The Motley Idiot

Nvidia’s Rising Quicker Than You Assume. This Desk Proves It.