(Bloomberg) — Since the start of the Covid-19 pandemic, the US commercial real estate market has been in turmoil. However, New York Community Bancorp has indicated that some lenders are just starting to feel the effects. The bank’s decision to cut its dividend and bolster reserves caused its stock to plummet by a record 38% and resulted in the KBW Regional Banking Index experiencing its worst day since the collapse of Silicon Valley Bank last March. Japanese lender Aozora Bank Ltd. added to the property concerns by warning of a loss linked to investments in US commercial real estate, leading to a drop in shares during Asia trading. The ongoing decline in commercial property values and the difficulty of predicting which specific loans might unravel are contributing to the concerns. The pandemic-induced shift to remote work and a rapid rise in interest rates have also made it more expensive for strained borrowers to refinance. Billionaire investor Barry Sternlicht warned this week that the office market is heading for more than $1 trillion in losses. For lenders, this means the potential for more defaults as some landlords struggle to pay loans or simply walk away from buildings. Harold Bordwin, a principal at Keen-Summit Capital Partners LLC in New York, emphasized that “banks’ balance sheets aren’t accounting for the fact that there’s lots of real estate on there that’s not going to pay off at maturity.”

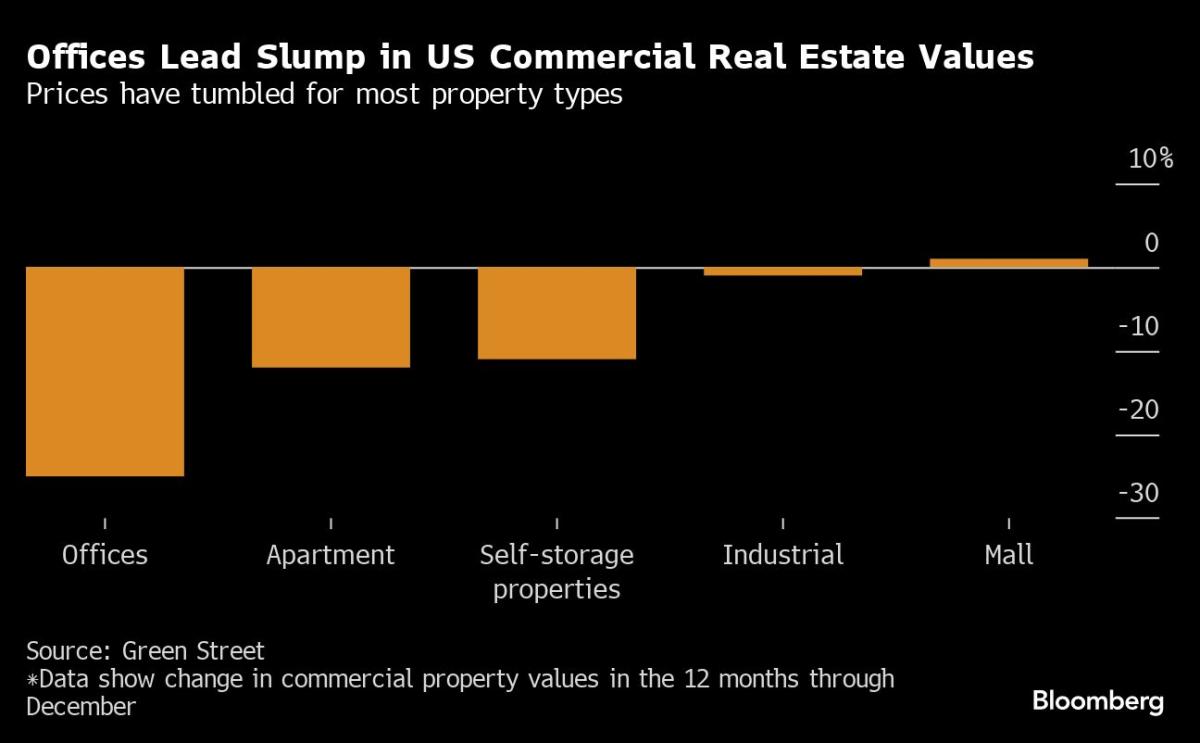

Moody’s Investors Service stated that it is reviewing whether to lower New York Community Bancorp’s credit rating to junk after Wednesday’s developments. Banks are facing approximately $560 billion in commercial real estate maturities by the end of 2025, according to Trepp, representing more than half of the total property debt coming due over that period. Regional lenders are particularly exposed to the industry, and stand to be hurt harder than their larger peers because they lack the large credit card portfolios or investment banking businesses that can insulate them. Commercial real estate loans account for 28.7% of assets at small banks, compared with just 6.5% at bigger lenders, according to a JPMorgan Chase & Co. report published in April. This exposure has prompted additional scrutiny from regulators, already on high alert following last year’s regional banking tumult. While real estate troubles, particularly for offices, have been apparent in the nearly four years since the pandemic, the property market has in some ways been in limbo: Transactions have plunged because of uncertainty among both buyers and sellers over how much buildings are worth. Now, the need to address looming debt maturities — and the prospect of Federal Reserve interest rate cuts — are expected to spark more deals that will bring clarity to just how much values have fallen. The Aon Center, the third-tallest office tower in Los Angeles, recently sold for $147.8 million, about 45% less than its previous purchase price in 2014.

” Banks — community banks, regional banks — have been really slow to mark things to market because they didn’t have to, they were holding them to maturity,” said Bordwin. “They are playing games with what is the real value of these assets.” Adding to the unease surrounding smaller lenders is the unpredictability of when and where soured real estate loans might occur, with a few defaults having the potential to wreak havoc. New York Community Bancorp specified that its increase in charge-offs were related to a co-op building and an office property. While offices are a particular area of concern for real estate investors, the company’s largest real estate exposure comes from multifamily buildings, with the bank carrying about $37 billion in apartment loans. Nearly half of those loans are backed by rent-regulated buildings, making them vulnerable to New York state regulations passed in 2019 that strictly limit landlords’ ability to raise rents. At the end of last year, the Federal Deposit Insurance Corp. took a 39% discount when it sold about $15 billion in loans backed by rent-regulated buildings. In another indication of the challenges facing these buildings, roughly 4.9% of New York City rent-stabilized buildings with securitized loans were in delinquency as of December, triple the rate for other apartment buildings, according to a Trepp analysis based on when the properties were built.

New York Community Bancorp, which acquired part of Signature Bank last year, said Wednesday that 8.3% of its apartment loans were considered criticized, meaning they have an elevated risk of default. “NYCB was a much more conservative lender when compared to Signature Bank,” said David Aviram, principal at Maverick Real Estate Partners. “Yet because loans secured by rent-stabilized multifamily properties makes up a larger percentage of NYCB’s CRE book in comparison to its peers, the change in the 2019 rent laws may have a more significant impact.” Pressure is growing on banks to reduce their exposure to commercial real estate. While some banks have held off on large loan sales due to uncertainty over the past year, they’re expected to market more debt now as the market thaws. Canadian Imperial Bank of Commerce recently started marketing loans on struggling US office properties. While US office loans make up just 1% of their total asset portfolio, CIBC’s earnings were dragged down by higher provisions for credit losses in the segment. “The percentage of loans that banks have so far been reported as delinquent are a drop in the bucket compared to the defaults that will occur throughout 2024 and 2025,” said Aviram. “Banks remain exposed to these significant risks, and the potential decline in interest rates in the next year won’t solve bank problems.”–With assistance from Sally Bakewell. (Updates with Aozora Bank real estate warning in second paragraph)Most Read from Bloomberg Businessweek©2024 Bloomberg L.P.