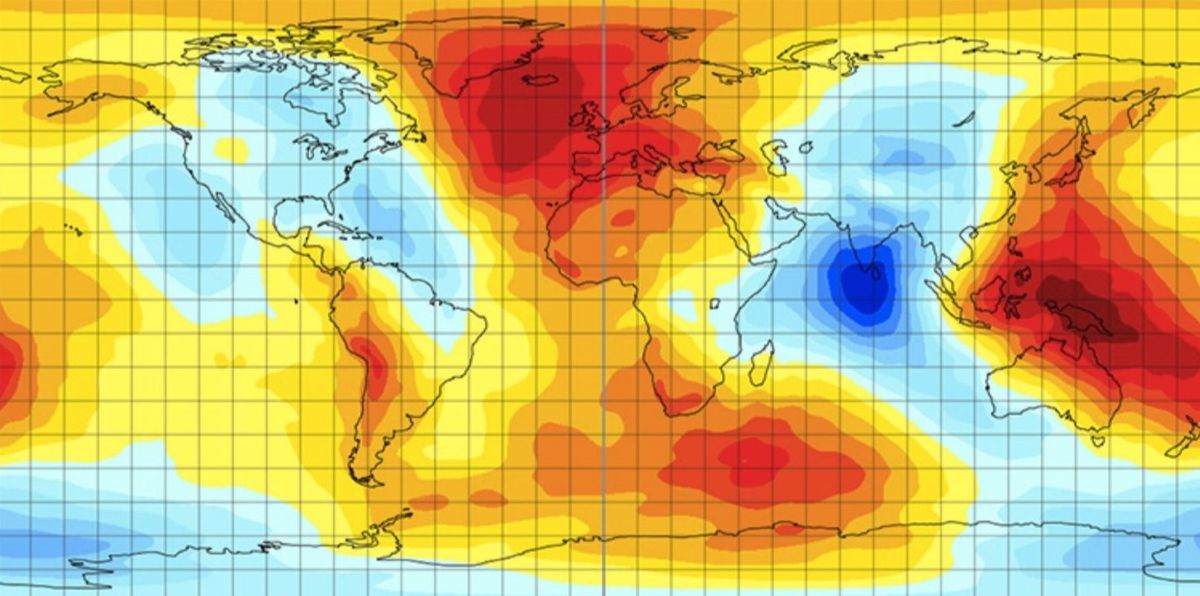

(Bloomberg) — International markets confirmed indicators of steadiness and oil costs declined as investors wagered tensions within the Heart East received’t escalate after Iran’s assault on Israel over the weekend. Ecu shares and US fairness index futures won.Maximum Learn from BloombergOil dropped on hypothesis that the battle would stay contained after Iran mentioned “the subject will also be deemed concluded,” and President Joe Biden reportedly instructed Israeli Top Minister Benjamin Netanyahu that america received’t reinforce an Israeli counterattack. Treasuries edged decrease after yields slipped within the earlier consultation.“Marketplace contributors are not at all giving up hope that the previous weekend’s occasions have been only a one-off incidence, whilst maintaining their breath for what may just occur subsequent,” mentioned Hebe Chen, an analyst at IG Markets.With traders already rattled by means of sticky inflation and the chance of higher-for-longer rates of interest, the escalation within the Heart East had injected recent volatility into markets. Many analysts are expecting oil may just surpass $100 a barrel if the battle widens and forecast a flight to Treasuries, gold and the greenback, together with additional stock-market losses.For now, consideration will go back to Wall Side road’s income season, which kicked off with disappointing numbers for giant banks on Friday and continues lately with stories from Goldman Sachs, Schwab and M&T Financial institution.There’s additionally a raft of monetary knowledge due this week, together with Chinese language expansion knowledge and Japan, Eurozone and UK inflation readings. The Global Financial Fund and Global Financial institution spring conferences shall be held in Washington.One after the other, aluminum and nickel surged following new US and UK sanctions that banned deliveries of any Russian provides after nighttime on Friday. Gold additionally won.Stocks in Asia slipped, monitoring Friday’s drop in US shares, on escalating geopolitical dangers, financial institution income and the chance of the Federal Reserve holding rates of interest larger for longer.Key occasions this week:Eurozone business manufacturing, MondayUS retail gross sales, empire production, industry inventories, MondayFederal source of revenue taxes due in america, MondayIMF and Global Financial institution spring conferences get started in Washington, Monday. The primary ministerial conferences shall be held April 17-19Canada CPI, TuesdayChina assets costs, retail gross sales, business manufacturing, GDP, TuesdayUK jobless claims, unemployment, TuesdayNew Zealand house gross sales, CPI, WednesdayEurozone CPI, WednesdayUK CPI, WednesdayAustralia unemployment, ThursdayJapan CPI, FridayIndia’s elections start, FridayStory continuesSome of the principle strikes in markets:StocksThe Stoxx Europe 600 rose 0.3% as of 8:04 a.m. London timeS&P 500 futures rose 0.6p.cNasdaq 100 futures rose 0.6p.cFutures at the Dow Jones Commercial Moderate rose 0.4p.cThe MSCI Asia Pacific Index fell 0.8p.cThe MSCI Rising Markets Index fell 0.6p.cCurrenciesThe Bloomberg Greenback Spot Index used to be little changedThe euro rose 0.1% to $1.0654The Eastern yen fell 0.5% to 153.93 according to dollarThe offshore yuan rose 0.1% to 7.2590 according to dollarThe British pound rose 0.2% to $1.2471CryptocurrenciesBitcoin rose 4% to $66,423.43Ether rose 5.4% to $3,235.58BondsThe yield on 10-year Treasuries complicated 3 foundation issues to 4.55p.cGermany’s 10-year yield complicated 4 foundation issues to two.40p.cBritain’s 10-year yield complicated 5 foundation issues to 4.18p.cCommoditiesBrent crude fell 0.6% to $89.88 a barrelSpot gold rose 0.4% to $2,354.20 an ounceThis tale used to be produced with the help of Bloomberg Automation.–With the aid of Winnie Hsu.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Oil Steadies, Shares Achieve as Iran Tensions Ease: Markets Wrap