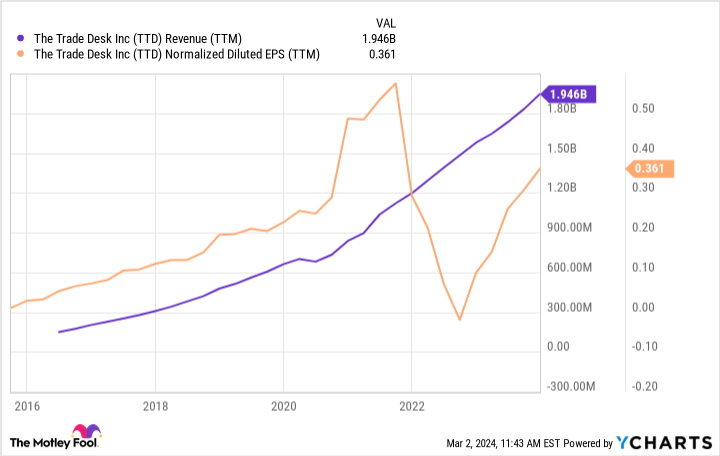

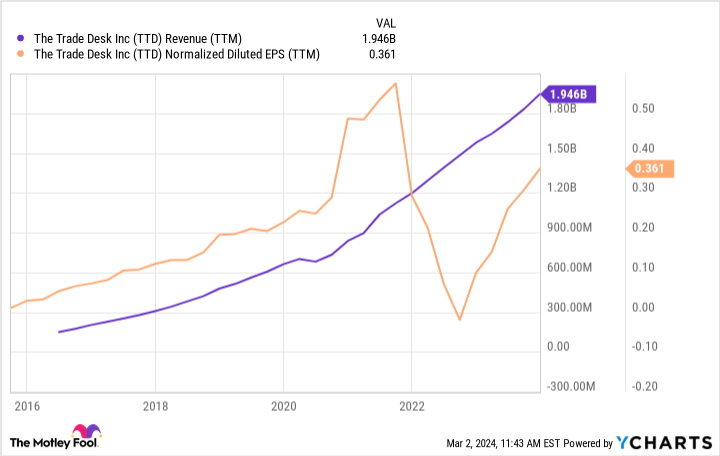

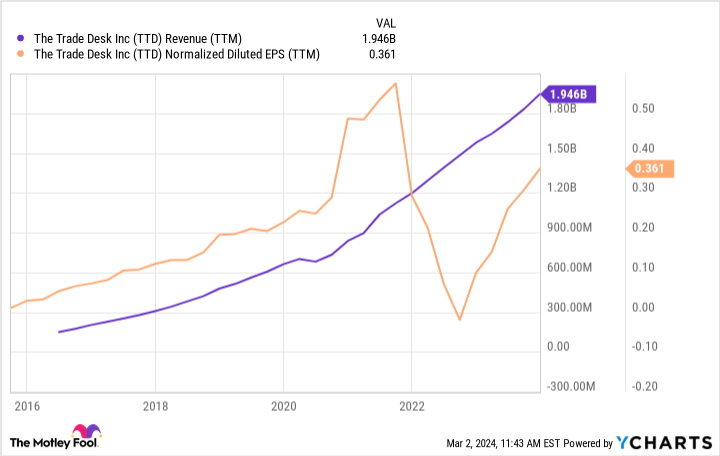

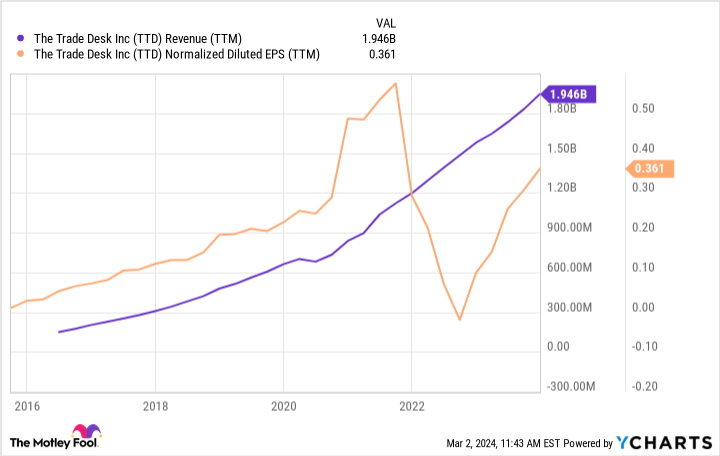

There is not any doubt that Nvidia is the inventory everybody’s speaking about presently. And I would possibly not say Nvidia does not deserve its vegetation. Then again, making an investment is infrequently about transferring in opposition to the gang, on the lookout for the gem everybody else is overlooking.So as a substitute of homing in on Nvidia like everybody else is, believe having a look at some nice expansion shares that aren’t simplest the usage of synthetic intelligence (AI) successfully, however have lost sight of basics and valuations that might arrange traders for stellar long-term funding returns.Listed here are two AI shares you wish to have to have in your radar:1. The Business DeskOk, it could be a stretch to mention that ad-tech standout The Business Table (NASDAQ: TTD) is lost sight of. In spite of everything, stocks are up over 50% during the last yr. But if used to be the closing time your Uncle Bob requested you concerning the inventory? The corporate does not get just about the hype it merits. Founder Jeff Inexperienced is a pioneer in virtual promoting and has constructed a rising and extremely winning industry with a simple proposition to advertisers:Trade giants like Meta Platforms and Alphabet perform in closed ecosystems. In different phrases, you pay them for an advert. They’ll use their knowledge, inform you how they imagine the advert carried out, and now not provide you with a lot transparency about how they arrived at those conclusions. The Business Table provides advertisers entire perception so consumers can be ok with spending cash at the platform. Roughly 95% of shoppers stick round after running with The Business Table.The Business Table makes use of AI to check ads to their perfect target market. It is an asset-light (and winning) industry type that assists in keeping rising:

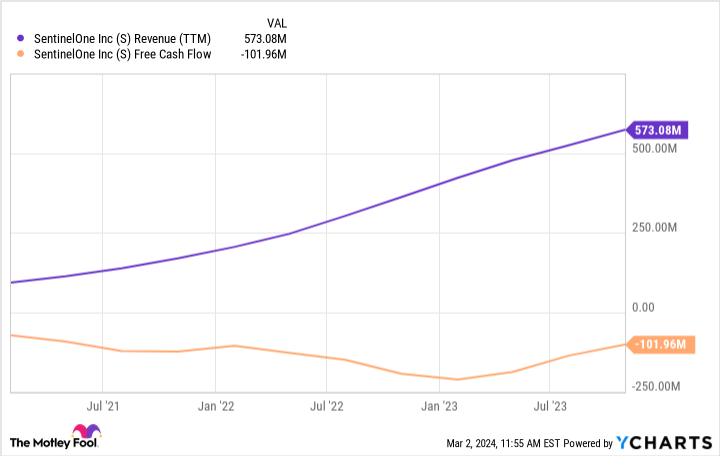

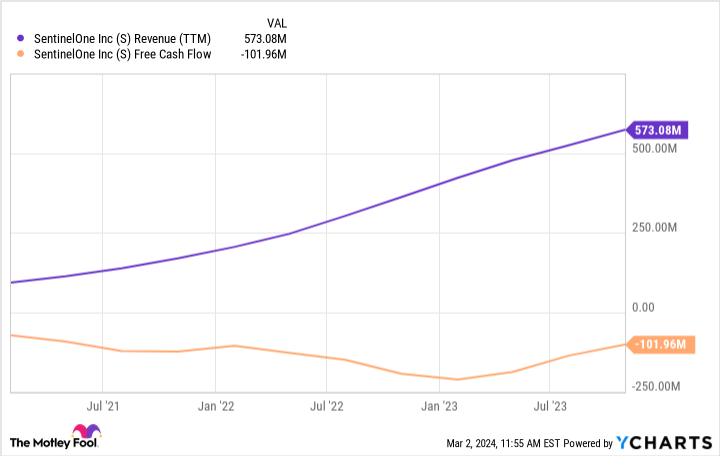

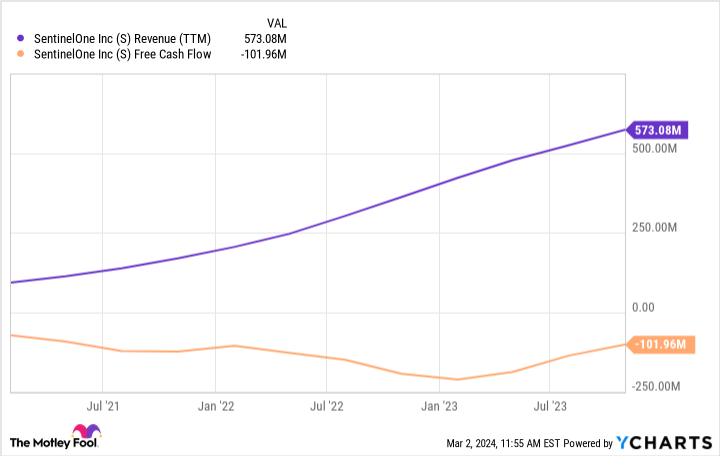

Lengthy-term expansion may just come from a mixture of manufacturers diversifying clear of the main advert platforms, plus a broader shift of promoting budgets from print and broadcast media to on-line. Analysts imagine the corporate’s profits will develop by means of a mean of 23% yearly over the following 3 to 5 years. That is cast expansion for lately’s ahead P/E ratio of 56.Tale continuesThe Business Table is a possible blue-chip generation inventory within the making.2. SentinelOneCybersecurity is on the epicenter of the fashionable economic system. It does not take lengthy to seek out information of a vital breach. Healthcare large UnitedHealth Workforce used to be only recently hacked, as an example, and is attempting to keep an eye on the fallout from that. Incidents like this may occasionally more than likely be sure that safety stays a top precedence for company budgets for years yet to come. Why now not put your cash on SentinelOne (NYSE: S), arguably one of the crucial cutting edge shares within the area?SentinelOne began in endpoint safety, securing units hooked up to a community. Then again, since then the corporate has expanded to different spaces like cloud and identification safety.SentinelOne’s tech works like this: Synthetic intelligence organizes the whole thing your software does into tendencies and tales. When one thing seems out of line — growth, it seizes it and addresses the risk if important. It is independent and proactive coverage.The corporate’s product has gotten a large number of accolades from third-party tech evaluators like Gartner, and SentinelOne is hastily rising its industry, too:

Lengthy-term expansion may just come from a mixture of manufacturers diversifying clear of the main advert platforms, plus a broader shift of promoting budgets from print and broadcast media to on-line. Analysts imagine the corporate’s profits will develop by means of a mean of 23% yearly over the following 3 to 5 years. That is cast expansion for lately’s ahead P/E ratio of 56.Tale continuesThe Business Table is a possible blue-chip generation inventory within the making.2. SentinelOneCybersecurity is on the epicenter of the fashionable economic system. It does not take lengthy to seek out information of a vital breach. Healthcare large UnitedHealth Workforce used to be only recently hacked, as an example, and is attempting to keep an eye on the fallout from that. Incidents like this may occasionally more than likely be sure that safety stays a top precedence for company budgets for years yet to come. Why now not put your cash on SentinelOne (NYSE: S), arguably one of the crucial cutting edge shares within the area?SentinelOne began in endpoint safety, securing units hooked up to a community. Then again, since then the corporate has expanded to different spaces like cloud and identification safety.SentinelOne’s tech works like this: Synthetic intelligence organizes the whole thing your software does into tendencies and tales. When one thing seems out of line — growth, it seizes it and addresses the risk if important. It is independent and proactive coverage.The corporate’s product has gotten a large number of accolades from third-party tech evaluators like Gartner, and SentinelOne is hastily rising its industry, too:

SentinelOne continues to be early in its industry lifestyles. The corporate is simplest doing about $573 million in annual income and is not winning but. Then again, that is all converting rapid. Analysts imagine income will hit $1 billion in two years, whilst loose money go with the flow is readily heading towards sure territory. The industry has an incredible $800 million money hoard to stay making an investment in expansion and 0 debt.In case you worth the inventory on gross sales, its price-to-sales ratio (P/S) of 10 is just about part that of its arch-rival CrowdStrike Holdings. Since CrowdStrike is winning, one may just argue that SentinelOne may just shut that hole within the shares’ valuations as soon as it follows go well with. There is a lot to love between that possible catalyst and a wholesome expansion outlook.Must you make investments $1,000 in The Business Table presently?Before you purchase inventory in The Business Table, believe this:The Motley Idiot Inventory Guide analyst group simply recognized what they imagine are the 10 easiest shares for traders to shop for now… and The Business Table wasn’t one among them. The ten shares that made the reduce may just produce monster returns within the coming years.Inventory Guide supplies traders with an easy-to-follow blueprint for good fortune, together with steering on construction a portfolio, common updates from analysts, and two new inventory choices every month. The Inventory Guide provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Guide returns as of February 26, 2024Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Justin Pope has positions in SentinelOne. The Motley Idiot has positions in and recommends Alphabet, CrowdStrike, Meta Platforms, Nvidia, and The Business Table. The Motley Idiot recommends Gartner and UnitedHealth Workforce. The Motley Idiot has a disclosure coverage.Omit Nvidia: 2 Tech Shares to Purchase As a substitute used to be firstly printed by means of The Motley Idiot

SentinelOne continues to be early in its industry lifestyles. The corporate is simplest doing about $573 million in annual income and is not winning but. Then again, that is all converting rapid. Analysts imagine income will hit $1 billion in two years, whilst loose money go with the flow is readily heading towards sure territory. The industry has an incredible $800 million money hoard to stay making an investment in expansion and 0 debt.In case you worth the inventory on gross sales, its price-to-sales ratio (P/S) of 10 is just about part that of its arch-rival CrowdStrike Holdings. Since CrowdStrike is winning, one may just argue that SentinelOne may just shut that hole within the shares’ valuations as soon as it follows go well with. There is a lot to love between that possible catalyst and a wholesome expansion outlook.Must you make investments $1,000 in The Business Table presently?Before you purchase inventory in The Business Table, believe this:The Motley Idiot Inventory Guide analyst group simply recognized what they imagine are the 10 easiest shares for traders to shop for now… and The Business Table wasn’t one among them. The ten shares that made the reduce may just produce monster returns within the coming years.Inventory Guide supplies traders with an easy-to-follow blueprint for good fortune, together with steering on construction a portfolio, common updates from analysts, and two new inventory choices every month. The Inventory Guide provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Guide returns as of February 26, 2024Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Justin Pope has positions in SentinelOne. The Motley Idiot has positions in and recommends Alphabet, CrowdStrike, Meta Platforms, Nvidia, and The Business Table. The Motley Idiot recommends Gartner and UnitedHealth Workforce. The Motley Idiot has a disclosure coverage.Omit Nvidia: 2 Tech Shares to Purchase As a substitute used to be firstly printed by means of The Motley Idiot

/cdn.vox-cdn.com/uploads/chorus_asset/file/25744393/BU024_234EV.jpg)