When companies report earnings, they can sometimes deliver strong quarterly results but fall short on guidance. This often leads to a muted investor reaction and subsequently causes shares to tumble. However, despite Palantir’s (NYSE:PLTR) latest results following this template, investors were bullish after its Q4 results.

Shares surged by 31% in Tuesday’s session as the big data company was rewarded for its strong positioning in the AI game. While there’s a perception that Palantir relies heavily on government contracts, its commercial business seems to be gaining momentum with its Artificial Intelligence Platform (AIP) taking the lead.

In Q4, revenue rose by 19.6% year-over-year to $608.35 million, surpassing the Street’s estimate by $5.55 million. Although government revenue accounted for the majority at $324 million (up 11% y/y), the commercial business is catching up. The segment’s revenue saw a 32% year-over-year increase and a 13% sequential improvement to $284 million. The U.S. commercial revenue, in particular, saw significant growth, jumping by 70% from the same period a year ago to $131 million. On the other hand, the adjusted EPS of $0.08 was in line with expectations.

Although the Q1 revenue outlook was somewhat disappointing, with the expected range between $612 and $616 million falling slightly short of the Street’s projection of $617.44 million, investors were not deterred. Wedbush’s Daniel Ives, a 5-star analyst rated in the top 4% of the Street’s stock pros, expressed confidence in Palantir’s potential.

Ives compares Palantir to companies such as Nvidia, Microsoft and Palo Alto Networks, suggesting that like these companies, Palantir is initially unappreciated by the market despite its potential for future growth.

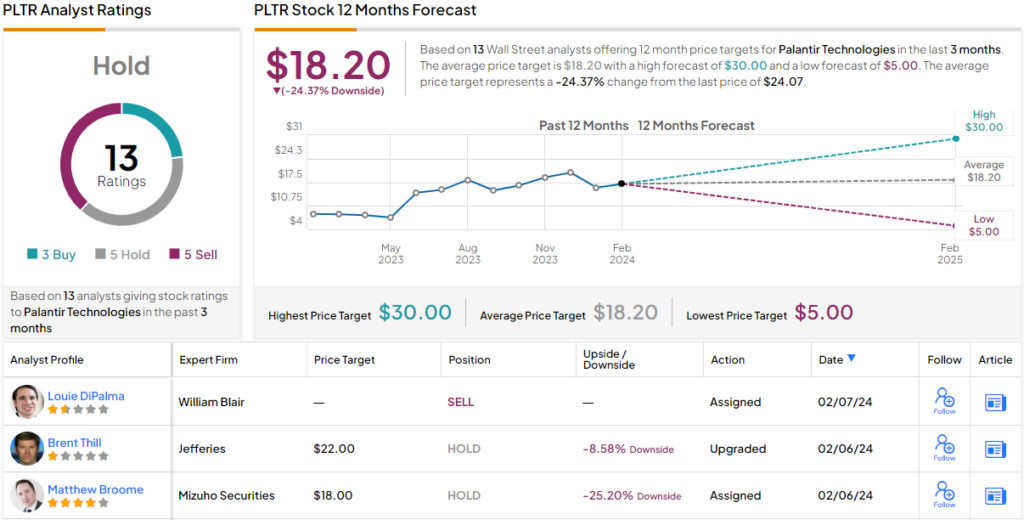

According to Ives, Palantir is an “undiscovered gem,” and he has increased his price target from $25 to a new Street-high of $30, indicating a 25% potential growth from current levels. Ives maintains an Outperform (i.e. Buy) rating. On the other hand, not all analysts on Wall Street share Ives’ bullish opinion. Despite 2 Buy ratings, there are 5 Holds and 5 Sells, resulting in an analyst consensus rating of Hold. Most analysts believe that the shares have exceeded their fair value; the average target price of $18.20 reflects a potential downside of 24% for the coming year.