The period of prime rates of interest may well be over, in keeping with the Federal Reserve.

The Federal Reserve has two targets, as mandated by way of regulation. First, it targets to stay the Client Worth Index (CPI) measure of inflation expanding by way of round 2% in keeping with yr. 2d, it tries to care for complete employment within the U.S. financial system, even though it does not have a particular goal for the unemployment fee.

The CPI soared to a 40-year prime of 8% in 2022, triggering probably the most competitive campaigns to hike rates of interest within the Fed’s historical past. Fortunately, it has cooled considerably since then, which allowed the Fed to scale back the federal budget fee in September, for the primary time since March 2020.

The central financial institution’s projections level to much more cuts at the horizon, and historical past suggests a large transfer within the S&P 500 (^GSPC 0.61%) inventory marketplace index may just observe — however now not within the route you may be expecting.

Rates of interest may just fall additional in 2024, 2025, and 2026

A cocktail of inflationary pressures because of the pandemic induced the surge within the CPI all over 2022:

The federal government spent trillions of bucks to counteract the commercial affects of COVID-19 all over 2020 and 2021, which incorporated money bills to electorate within the type of stimulus tests.

The Fed decreased rates of interest to a ancient low of 0.13%, and it additionally injected trillions of bucks into the monetary gadget the use of quantitative easing.

Factories periodically close down far and wide the sector to prevent the unfold of COVID-19, which resulted in shortages of the entirety from computer systems to televisions to vehicles. That drove costs upper.

The Fed began expanding the federal budget fee in March 2022, and by way of the closing hike in August 2023, it used to be at a two-decade prime of five.33%. The function used to be to chill the financial system down after the extremely stimulative pandemic-era insurance policies, so as to scale back inflation.

It seems that to have labored. The CPI ended 2023 at 4.1%, and it got here in at an annualized fee of simply 2.5% in August 2024, which is the newest studying. That suggests it is a stone’s throw clear of the Fed’s 2% goal.

That is why the Federal Open Marketplace Committee (FOMC) selected to slash the federal budget fee by way of 50 foundation issues on the Fed’s September assembly. Consistent with the FOMC’s personal projections, extra cuts are at the manner, together with:

50 foundation issues of additional cuts by way of the tip of 2024

125 foundation issues of cuts in 2025

25 foundation issues of cuts in 2026

That can position the federal budget fee at 2.8% in 2026 — down by way of virtually part from its fresh height. The ones projections are a just right indication of what the Fed thinks presently, however they may exchange as new financial knowledge is available in.

The inventory marketplace does not at all times like fee cuts within the brief time period

Falling rates of interest can also be nice for the inventory marketplace. It will increase the borrowing energy of firms, which will assist gas their enlargement, and it reduces their pastime prices, which generally is a tailwind for his or her profits. Plus, the yield on risk-free property like money or Treasury bonds steadily falls in lockstep with rates of interest, which pushes buyers into enlargement property like shares as a substitute.

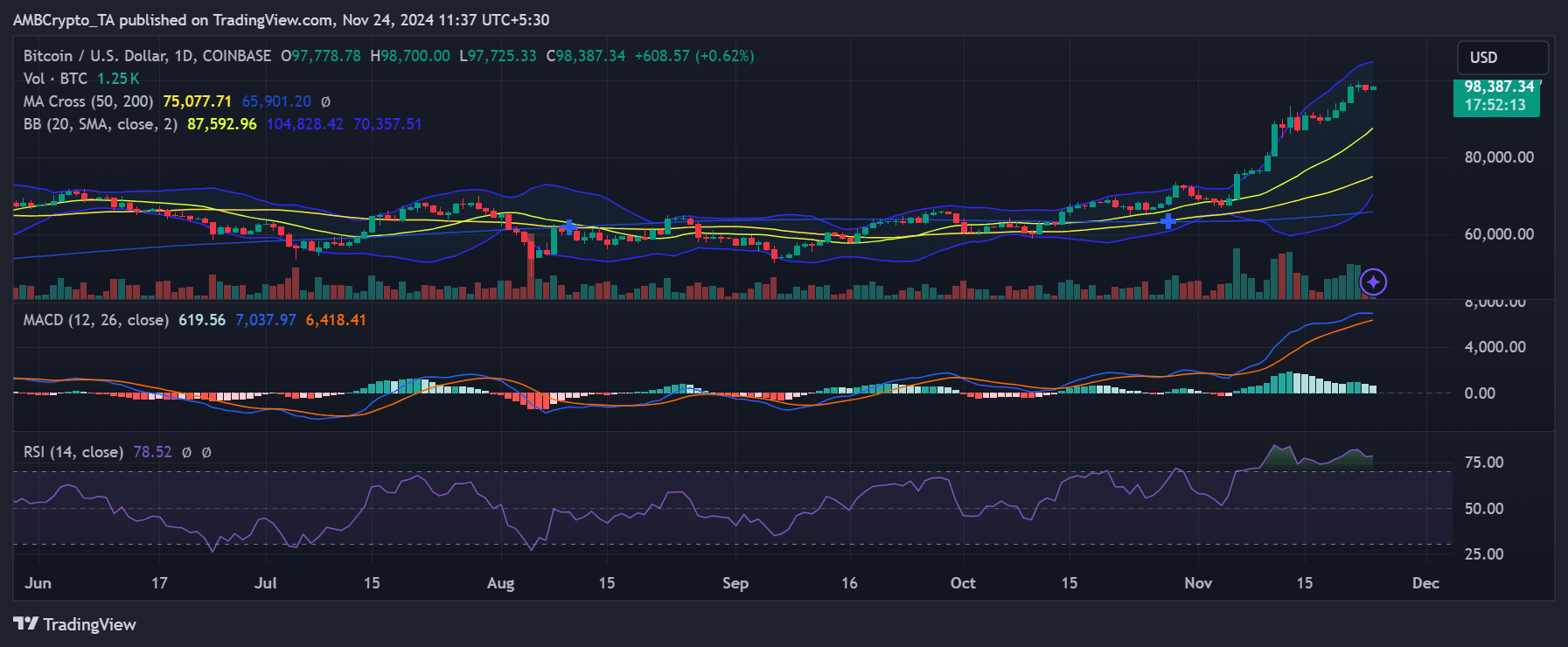

On the other hand, the underneath chart tells a unique tale. It overlays the federal budget fee with the S&P 500 index going all of the as far back as the yr 2000, and it presentations that falling rates of interest steadily foreshadow a short lived decline within the inventory marketplace:

^SPX knowledge by way of YCharts.

On the other hand, the S&P 500 at all times developments upper over the years, so buyers should not be discouraged by way of the opportunity of non permanent weak spot. The Fed normally begins reducing rates of interest when the financial system slows down or suffers an surprising surprise, which is most definitely the real reason why for the transient inventory marketplace declines within the chart (relatively than the speed cuts themselves).

All through the early 2000s, the Fed slashed charges for the reason that dot-com tech bubble burst, which plunged the financial system right into a recession. Then, in 2008, the Fed used to be reducing as a result of the worldwide monetary disaster. In the end, the cuts in 2020 have been induced by way of the pandemic.

In different phrases, since there is not any instant signal of an financial disaster presently, the Fed’s fresh fee reduce may just if truth be told be a tailwind for the S&P 500. In truth, the index set a brand new document prime a couple of days in the past.

However there are some indicators of financial weak spot

The unemployment fee used to be at 3.7% in the beginning of 2024, but it surely has ceaselessly climbed all through the yr with the newest studying (September) coming in at 4.1%. If the roles marketplace deteriorates additional, it will cause a slowdown in client spending, which might have destructive penalties for the wider financial system.

In that state of affairs, Wall Side road analysts would most likely scale back their long term profits forecasts for company The usa, which might virtually no doubt result in a decline within the S&P 500 — particularly because the index is buying and selling at a traditionally dear valuation presently. That suggests the inventory marketplace could be falling on the similar time the Fed is reducing rates of interest as soon as once more.

However that is not a reason why for buyers to promote shares. In truth, if the S&P 500 does fall within the close to long term, it is most definitely an ideal purchasing alternative in keeping with its long-term upward pattern.