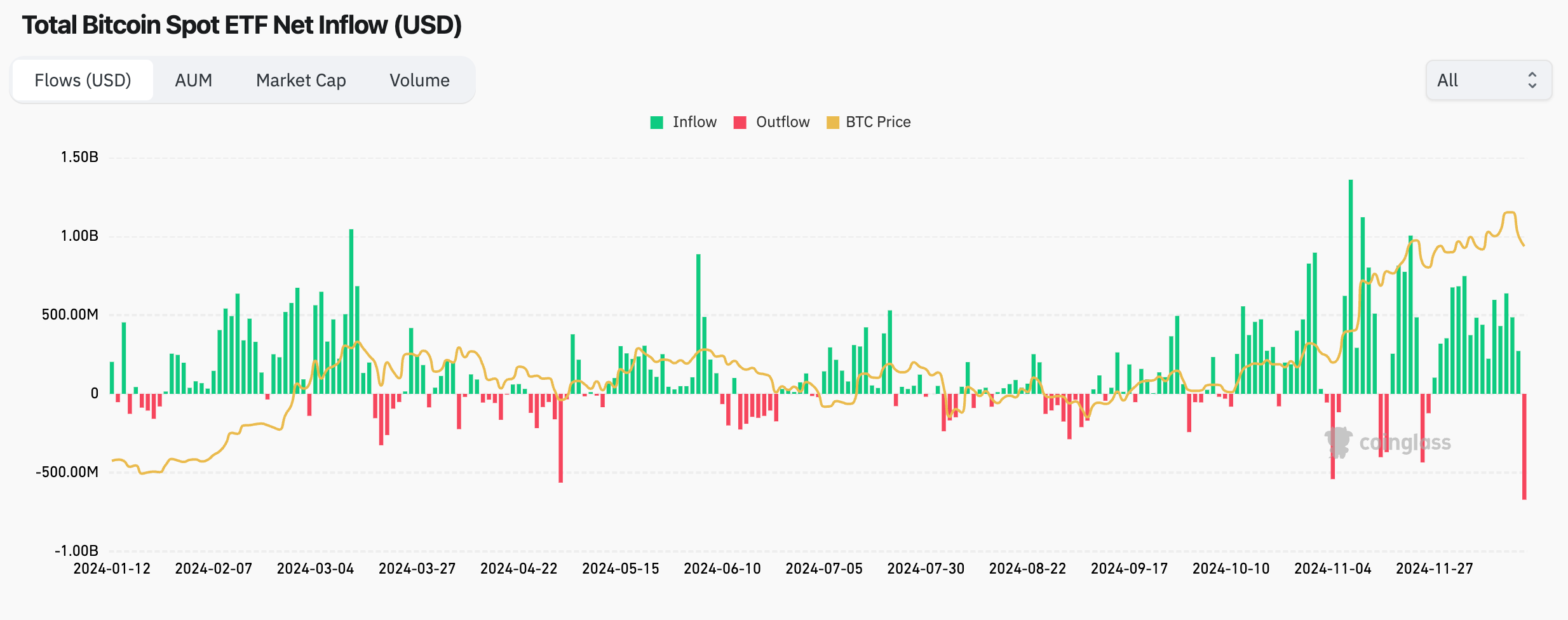

Crypto asset buying and selling company QCP Capital urged that if spot Ethereum exchange-traded finances are authorized within the U.S., the cost of ether may just rally 60% within the coming weeks to round $6,000 — if the spot Bitcoin ETFs are the rest to head through.Bitcoin rose 66% from round $44,500 to a top of $73,800 within the two months following the Safety and Change Fee’s approval of spot Bitcoin ETFs on January 10, consistent with The Block’s value web page.The SEC has ultimate cut-off dates on Thursday and Friday to make a decision whether or not to approve or deny the packages for spot Ethereum ETFs submitted through VanEck and Ark Make investments, respectively. Invesco, Constancy, BlackRock, Grayscale, Franklin Templeton, and Bitwise also are some of the spot Ethereum ETF candidates filing last-minute adjustments to their filings this week.“All eyes are at the ETH ETF closing date later as of late. With Friday implied volatility above 100%, the marketplace is anticipating fireworks,” the analysts wrote within the Telegram channel QCP Broadcast this morning. “VanEck’s ETF has been indexed through the DTCC. We expect an approval is now extremely most likely with buying and selling anticipated as early as subsequent week.”Implied volatility right here refers back to the marketplace’s forecast of ether’s doable value motion over a specified duration derived from the costs of choices at the cryptocurrency. QCP’s view mirrors that of analysts at analysis and brokerage company Bernstein, who additionally hang crypto positions. They mentioned previous this week that given the sustained call for influx noticed through the spot Bitcoin ETFs post-approval, they’d be expecting identical value motion for ether.“On the other hand, ETH loose flow and provide appears much more horny than bitcoin…constrained through sticky traders and software locking provide in monetary good contracts,” the Bernstein analysts added.Ether buying and selling metrics spikeAggregated open hobby in ether choices and futures additionally spiked this week along a document Ethereum futures ETF buying and selling quantity of $48 million on Tuesday.The Grayscale Ethereum Agree with (ETHE) bargain to internet asset price (NAV) additionally narrowed to its lowest degree in over two years this week, hitting -6.7% after Bloomberg ETF analysts Eric Balchunas and James Seyffart dramatically raised their odds of spot Ethereum ETF approvals from 25% to 75% on Monday amid indicators of a 180 from the SEC.On the other hand, an important value correction for ether may well be at the playing cards as a substitute if the SEC denies the packages amid the new-found optimism.

Disclaimer: The Block is an unbiased media outlet that delivers information, analysis, and information. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in different corporations within the crypto area. Crypto substitute Bitget is an anchor LP for Foresight Ventures. The Block continues to perform independently to ship goal, impactful, and well timed details about the crypto business. Listed below are our present monetary disclosures.

© 2023 The Block. All Rights Reserved. This newsletter is supplied for informational functions simplest. It isn’t presented or meant for use as felony, tax, funding, monetary, or different recommendation.

QCP Capital predicts spot Ethereum ETF approvals may just power costs upper