QNT nears a possible breakout with key resistance at $80.38, strengthened through bullish sentiment.

Blended on-chain indicators trace at wary optimism, with huge transactions appearing bullish pastime.

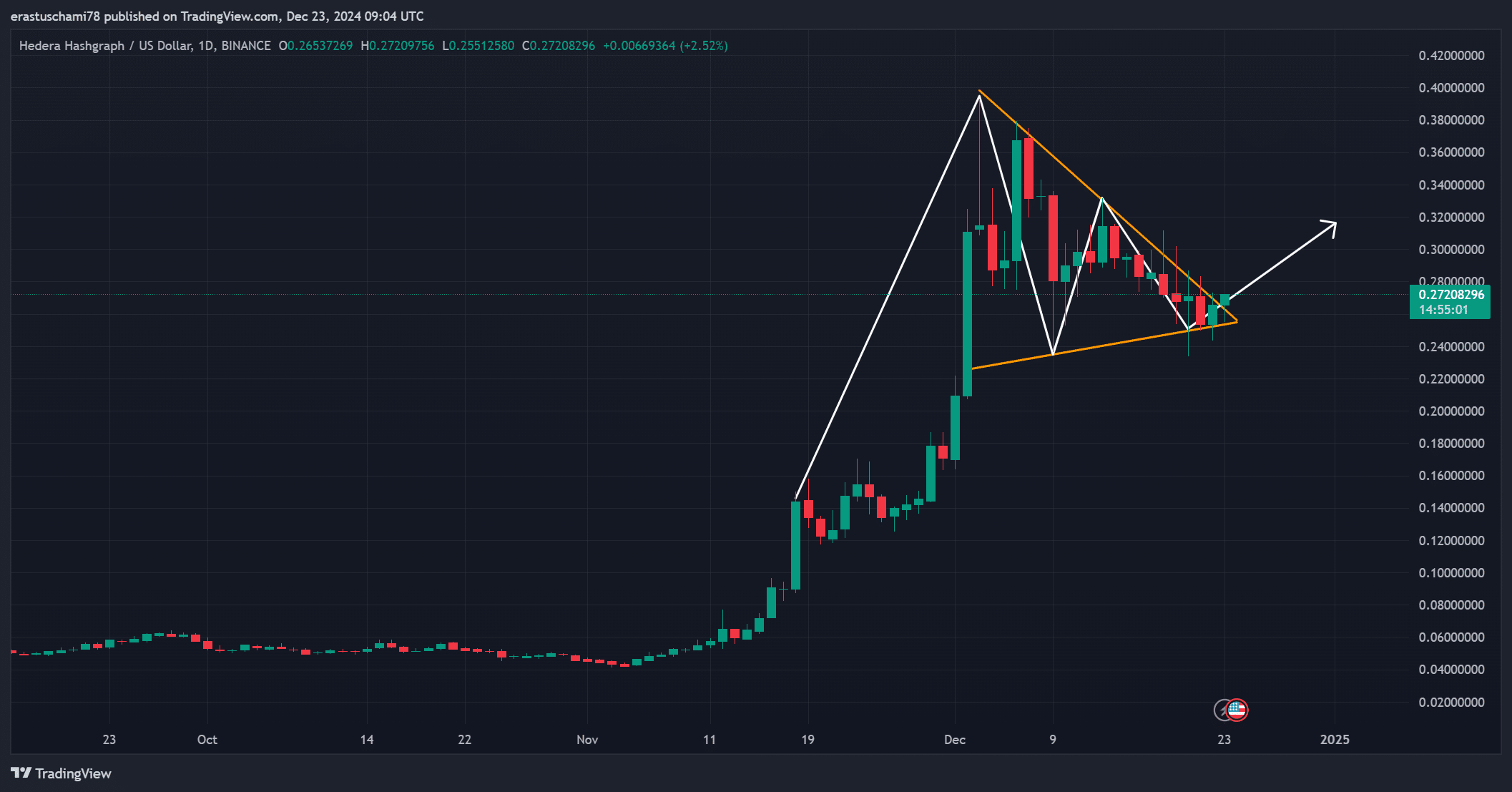

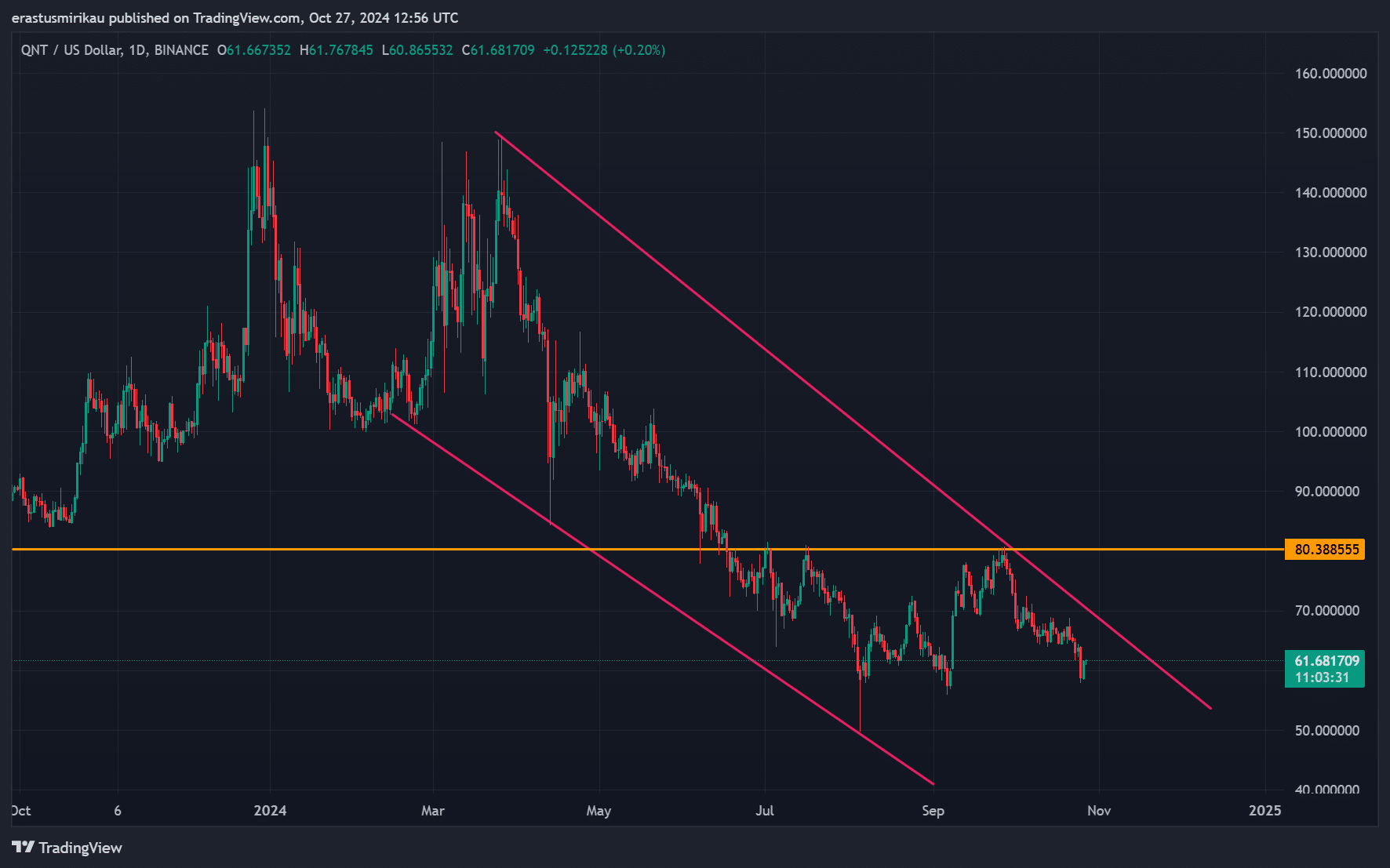

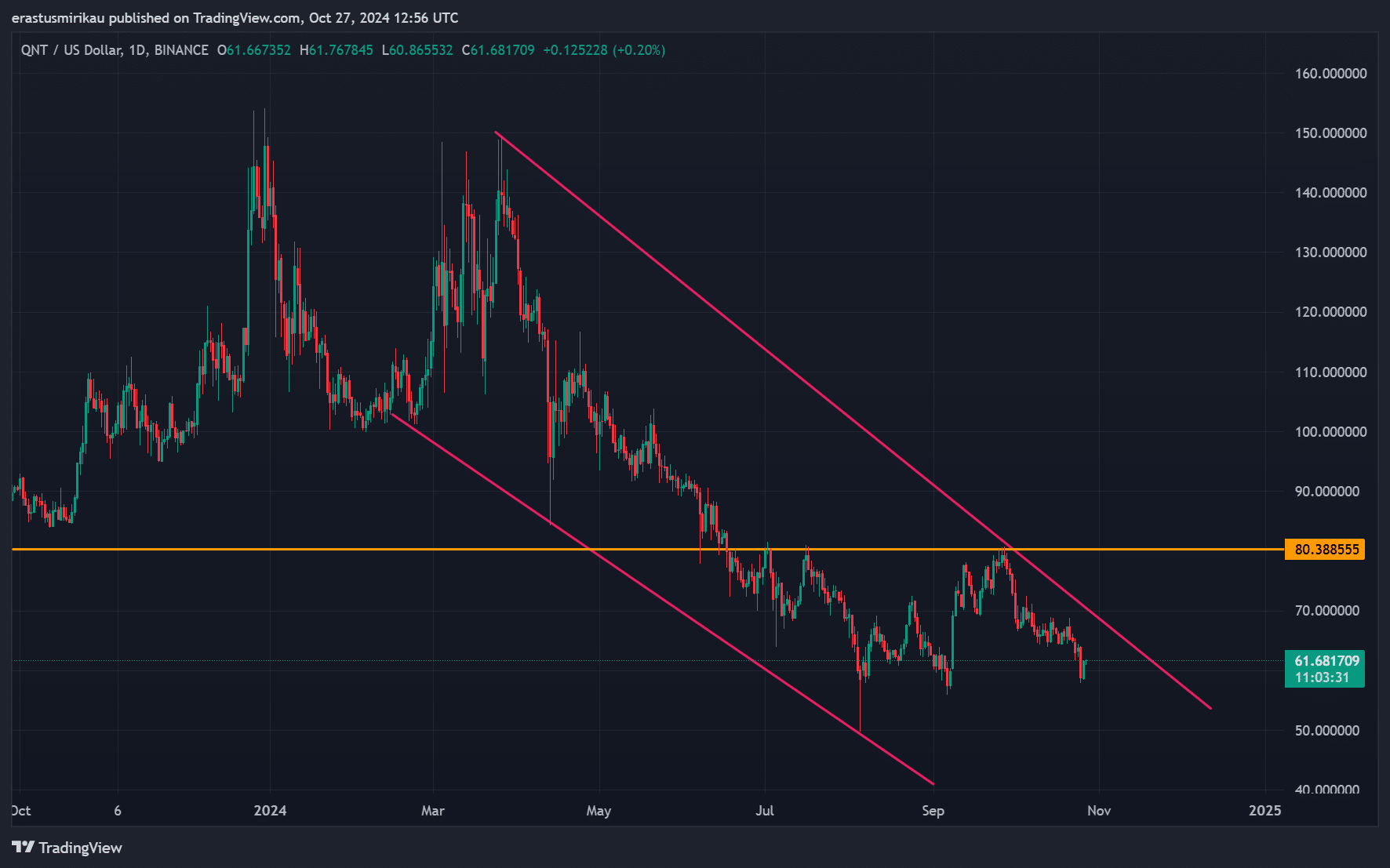

Quant [QNT] is on the point of a a very powerful breakout, buying and selling inside of a falling wedge trend that hints at a imaginable bullish reversal. This extended downtrend seems poised to finish, surroundings the level for a possible worth rally.

Recently priced at $61.65, Quant has received 3.24% at press time. The important thing resistance stage stands round $80.38, which, if breached, may just sign a renewed bullish pattern.

Moreover, crowd sentiment at 0.29 and good cash sentiment at 0.86 each replicate an positive outlook, suggesting that marketplace individuals look forward to an upward transfer. Subsequently, the impending worth motion may well be decisive for Quant.

Supply: TradingView

Supply: TradingView

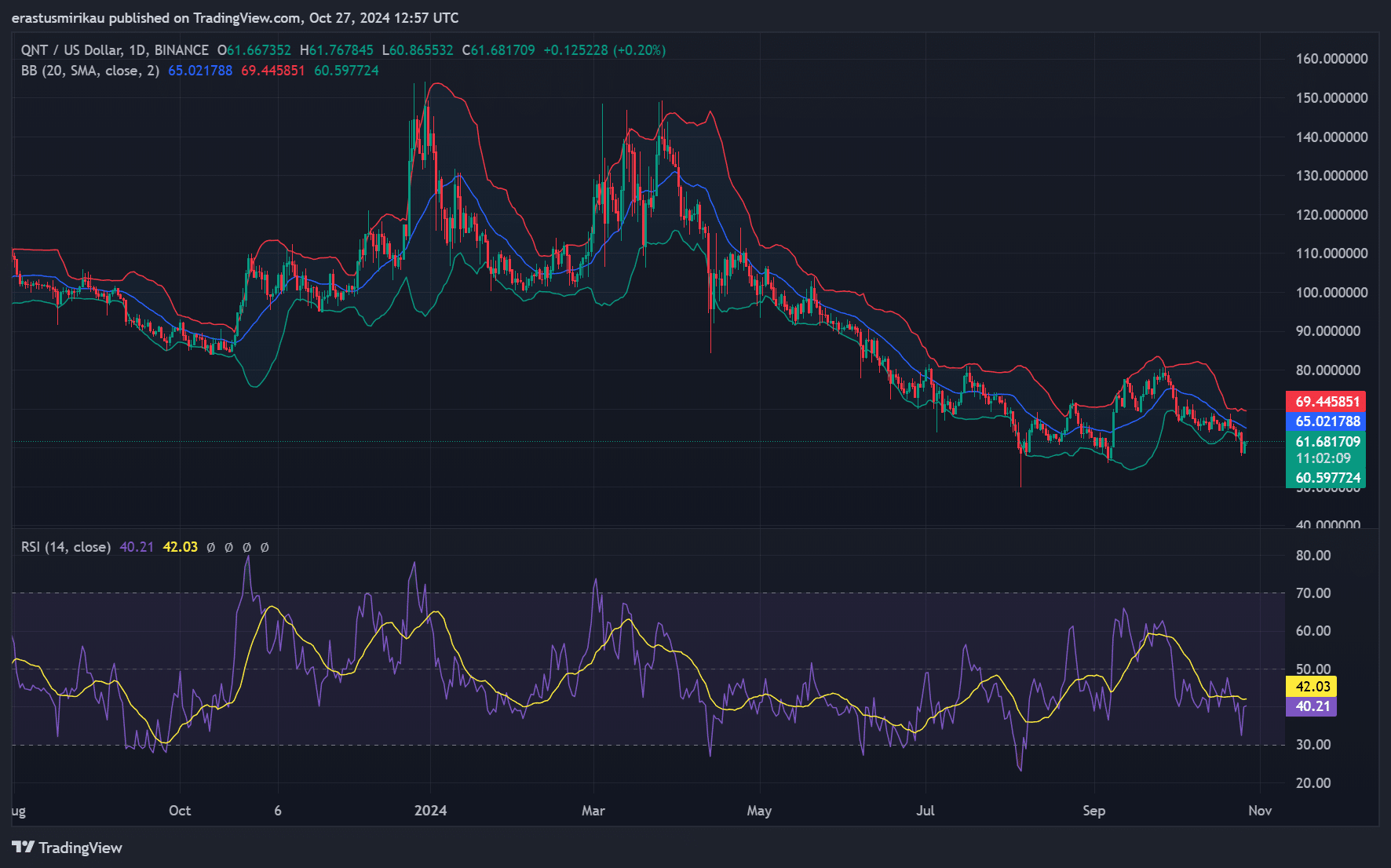

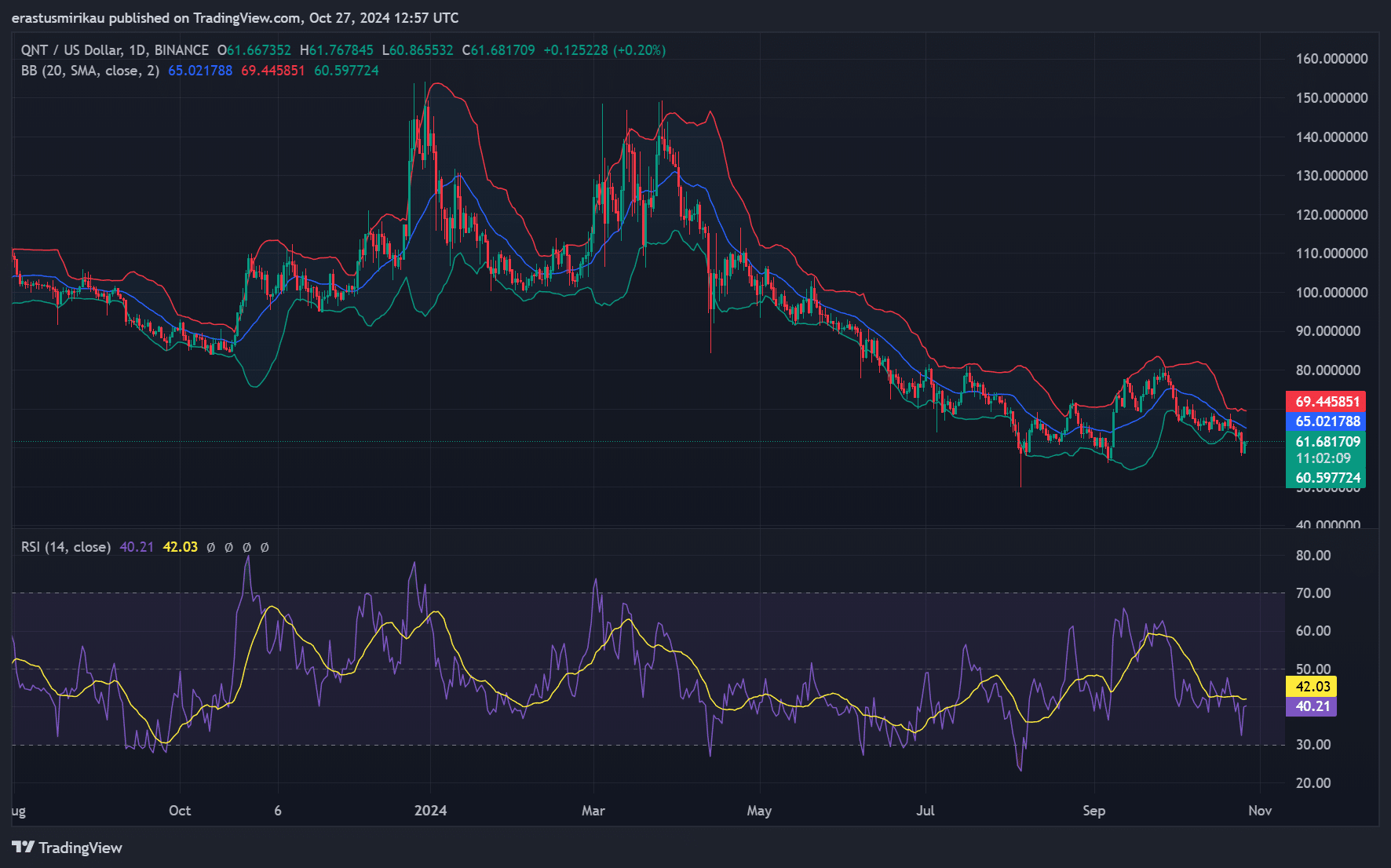

Key technical signs: Bollinger Bands, RSI upload weight to bullish sentiment

Inspecting QNT’s technical signs additional helps a possible breakout situation. The Bollinger Bands at the day-to-day chart display that Quant has been buying and selling close to the decrease band.

This place typically suggests oversold prerequisites, which incessantly result in a reversal as patrons step in.

Moreover, the Relative Power Index (RSI) these days sits at 42, indicating that Quant is solely exiting oversold territory. If the RSI continues to transport upwards, it’ll most probably draw in extra purchasing pastime, expanding the likelihood of a breakout.

Each signs recommend a marketplace gearing up for upward momentum, regardless that breaking previous resistance stays important.

Supply: TradingView

Supply: TradingView

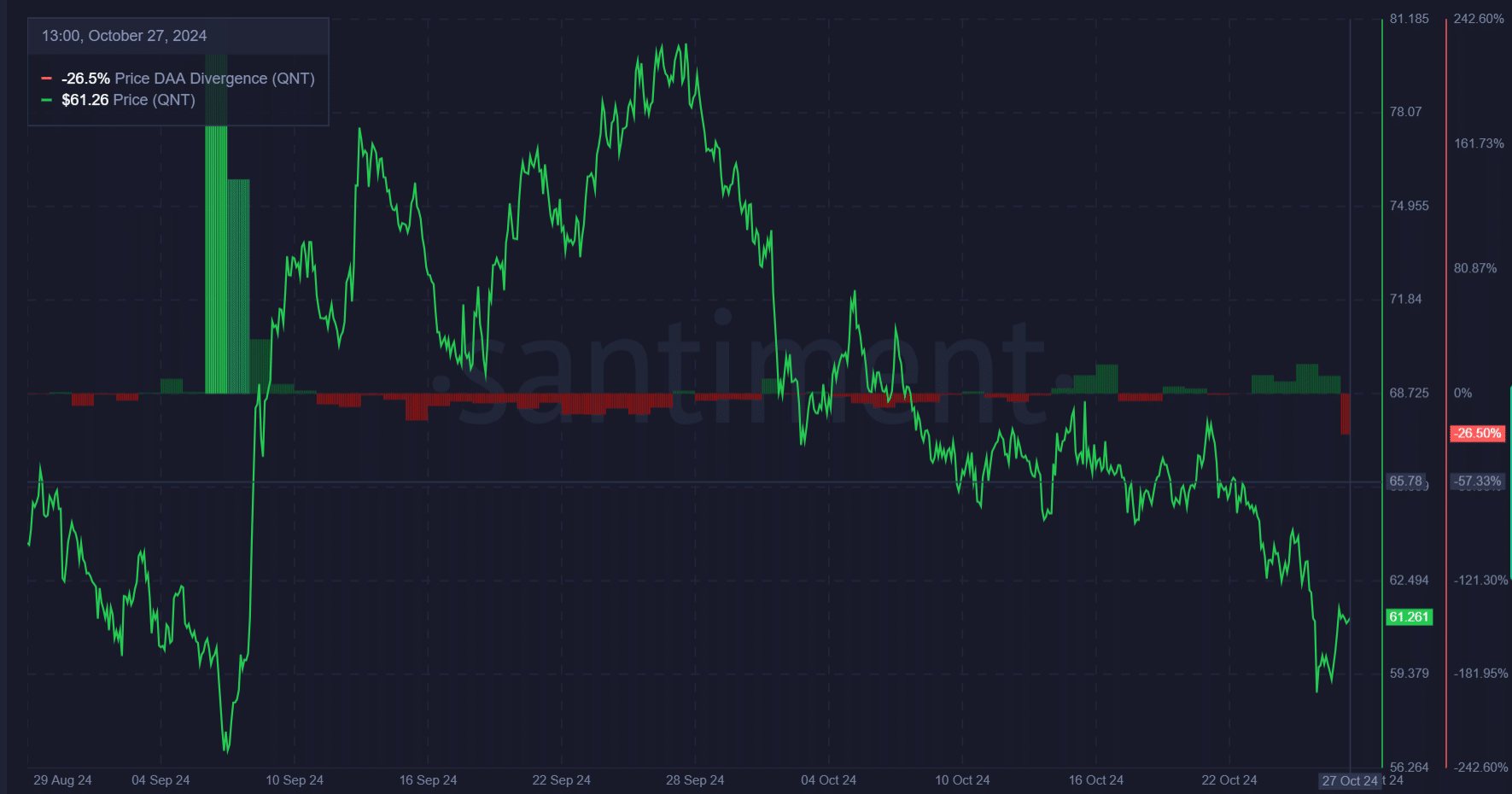

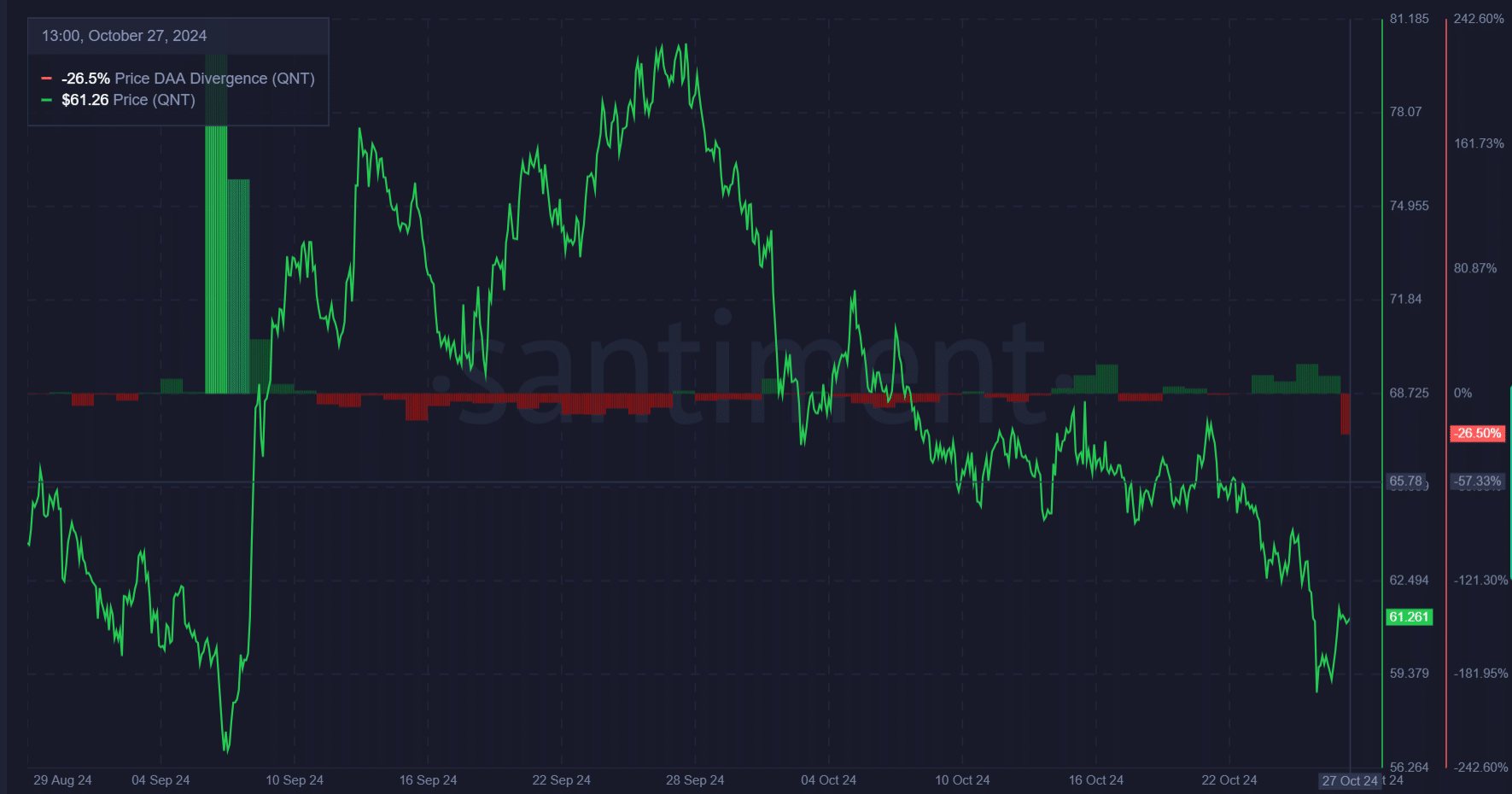

QNT worth and DAA divergence: Is a community spice up wanted?

Apparently, QNT’s worth motion presentations a divergence with Day by day Lively Addresses (DAA), a key on-chain metric. With DAA divergence at -26.5%, the present community process lags at the back of the hot worth building up.

This divergence incessantly signifies that even supposing worth presentations energy, community engagement must catch as much as maintain a rally.

Subsequently, a narrowing of this hole between DAA and value may just enhance bullish momentum. Aligning worth and DAA developments would foster a extra cast basis for QNT’s possible breakout and scale back the chance of a short-lived rally.

Supply: Santiment

Supply: Santiment

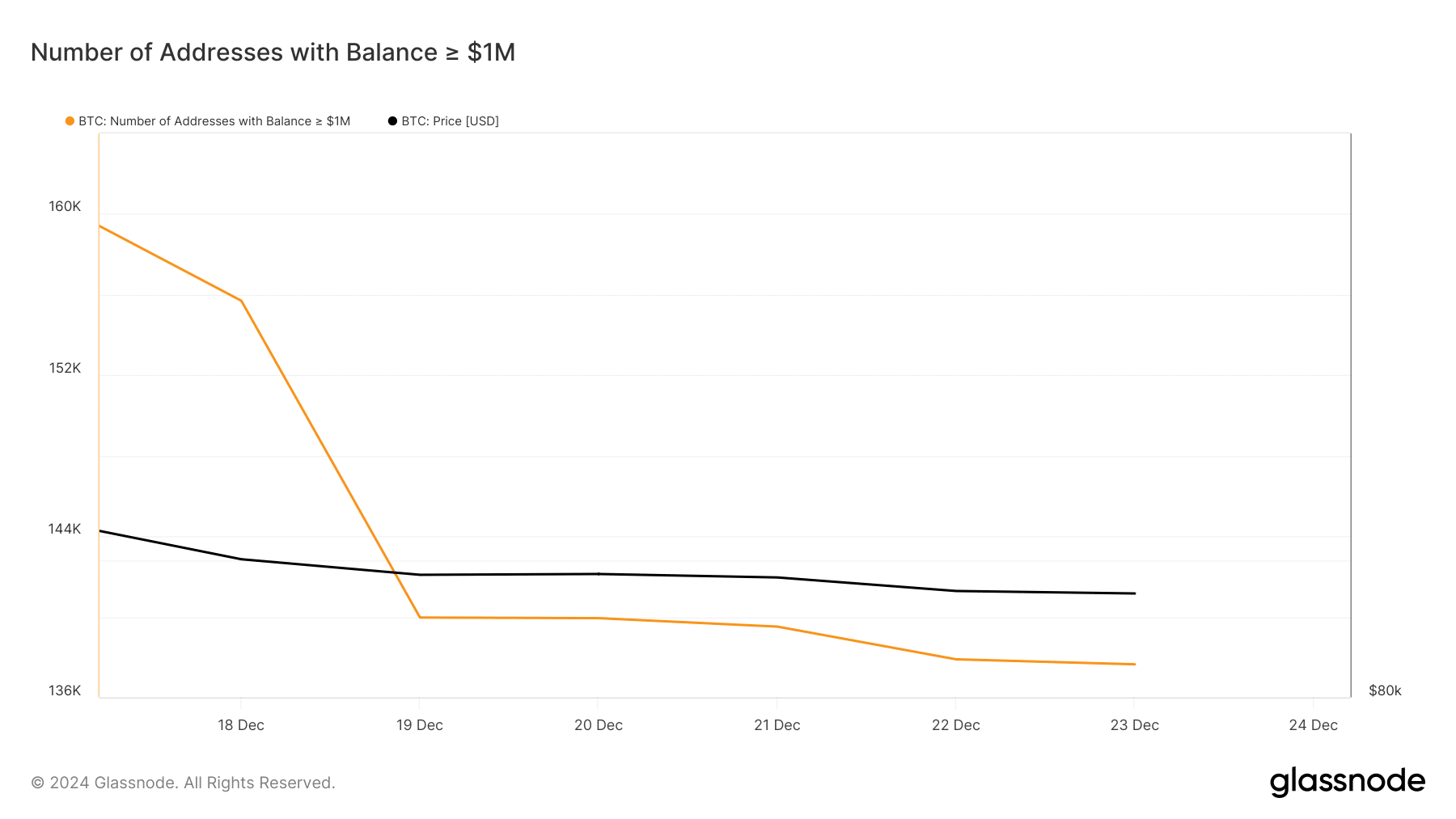

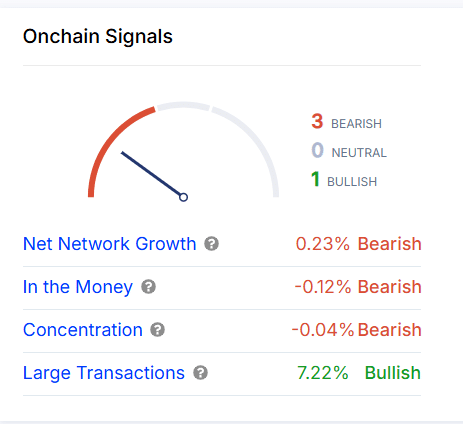

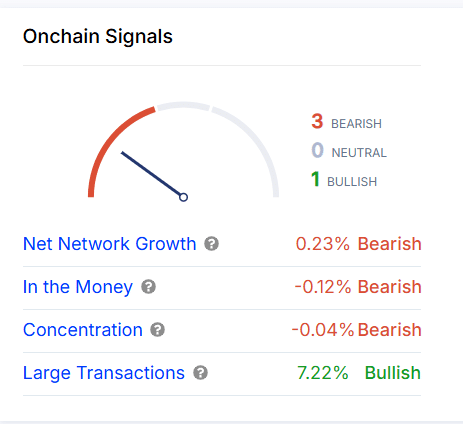

On-chain indicators: Blended signs, however huge transactions bullish

Inspecting different on-chain indicators provides a combined outlook. Metrics corresponding to internet community expansion (+0.23%), in-the-money addresses (-0.12%), and focus (-0.04%) point out delicate bearish inclinations.

On the other hand, huge transactions—up through 7.22%—display notable bullish pastime, suggesting that higher holders are collecting. As a result, this is able to create a solid reinforce base, doubtlessly paving the best way for a extra powerful worth motion if different metrics reinforce.

Supply: IntoTheBlock

Supply: IntoTheBlock

Learn Quant’s [QNT] Value Prediction 2024–2025

With crowd sentiment, good cash, and technical signs supporting an positive outlook, QNT seems poised for a breakout.

A a hit transfer above $80.38 may just ignite a rally, sparking renewed pastime around the marketplace. On the other hand, aligning on-chain process with worth beneficial properties can be very important for maintaining any bullish pattern.

Earlier: Is GOAT the following billion-dollar memecoin? Early marketplace surge indicators…

Subsequent: Ethereum faces key week as election nears – Will $3K be in sight?