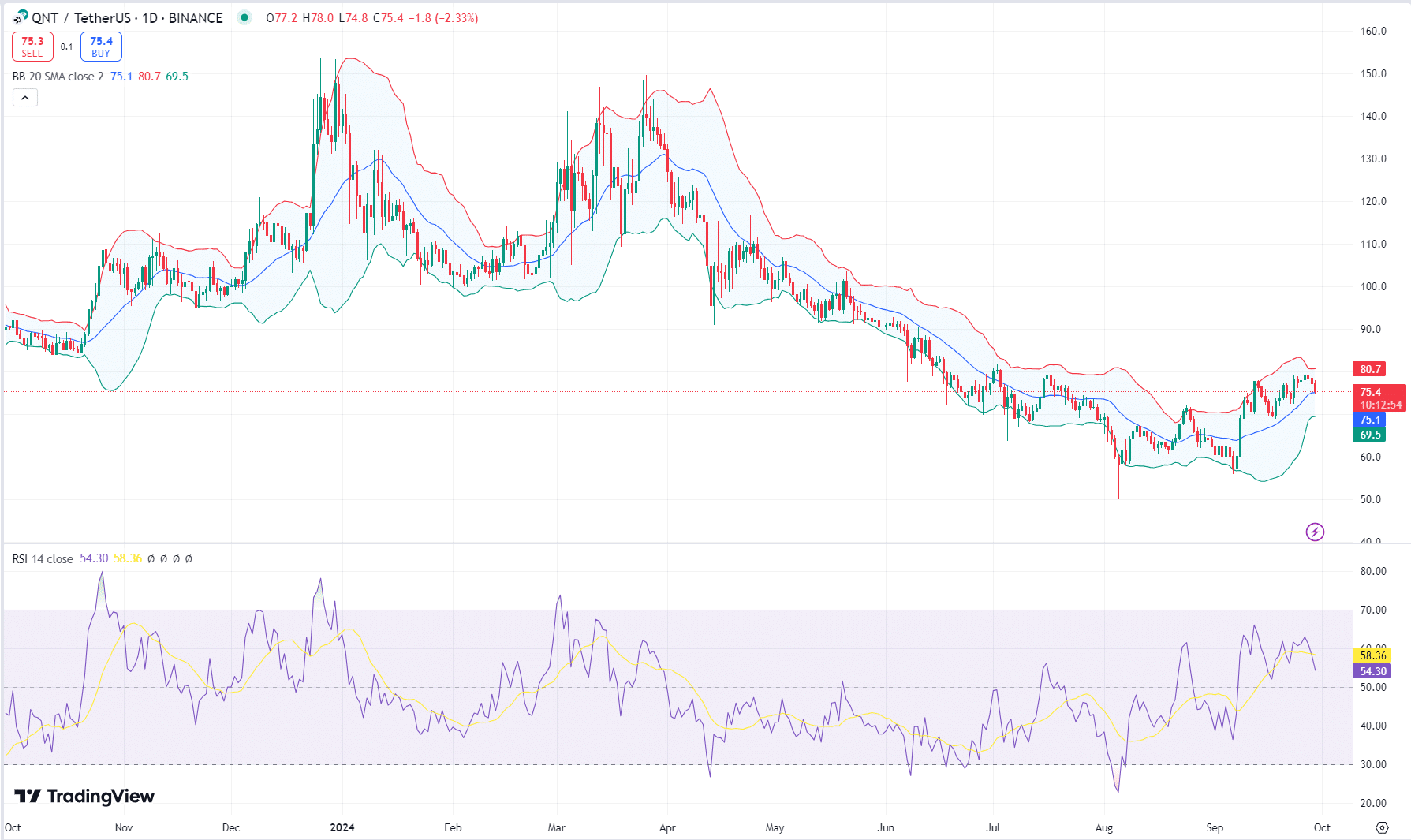

QNT struggled to wreck the $85 resistance, with improve maintaining at $75 amid blended RSI alerts.

On-chain signs confirmed whale accumulation and a good investment price, hinting at a possible rally.

Quant [QNT] continues to achieve the eye of each retail buyers and institutional buyers because of its sturdy bullish sentiment.

In keeping with fresh knowledge, marketplace sentiment stays constructive, elevating questions on whether or not QNT can care for its momentum or face additional demanding situations.

At press time, QNT was once buying and selling at $75.36, down 1.88% during the last 24 hours. In spite of this slight decline, many buyers are nonetheless eyeing its doable breakout, however a number of elements will resolve if QNT can maintain its upward development.

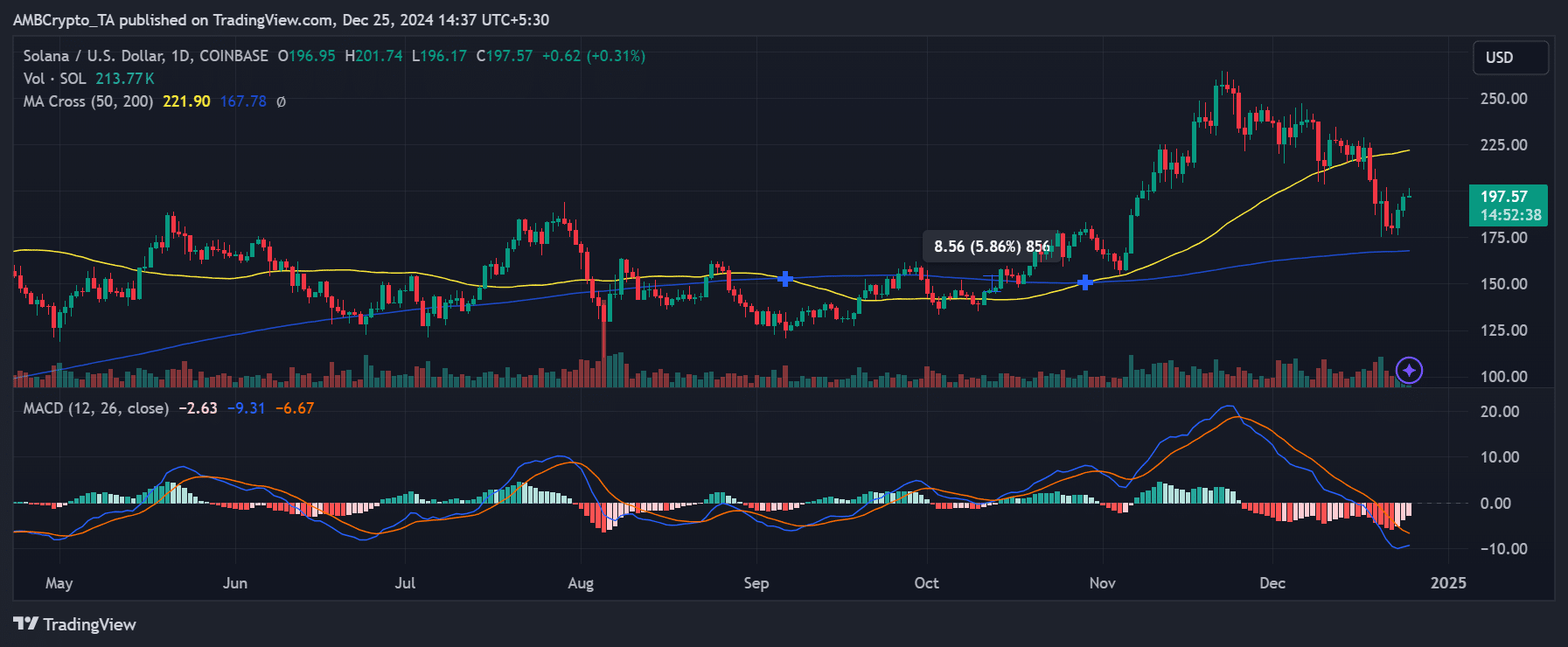

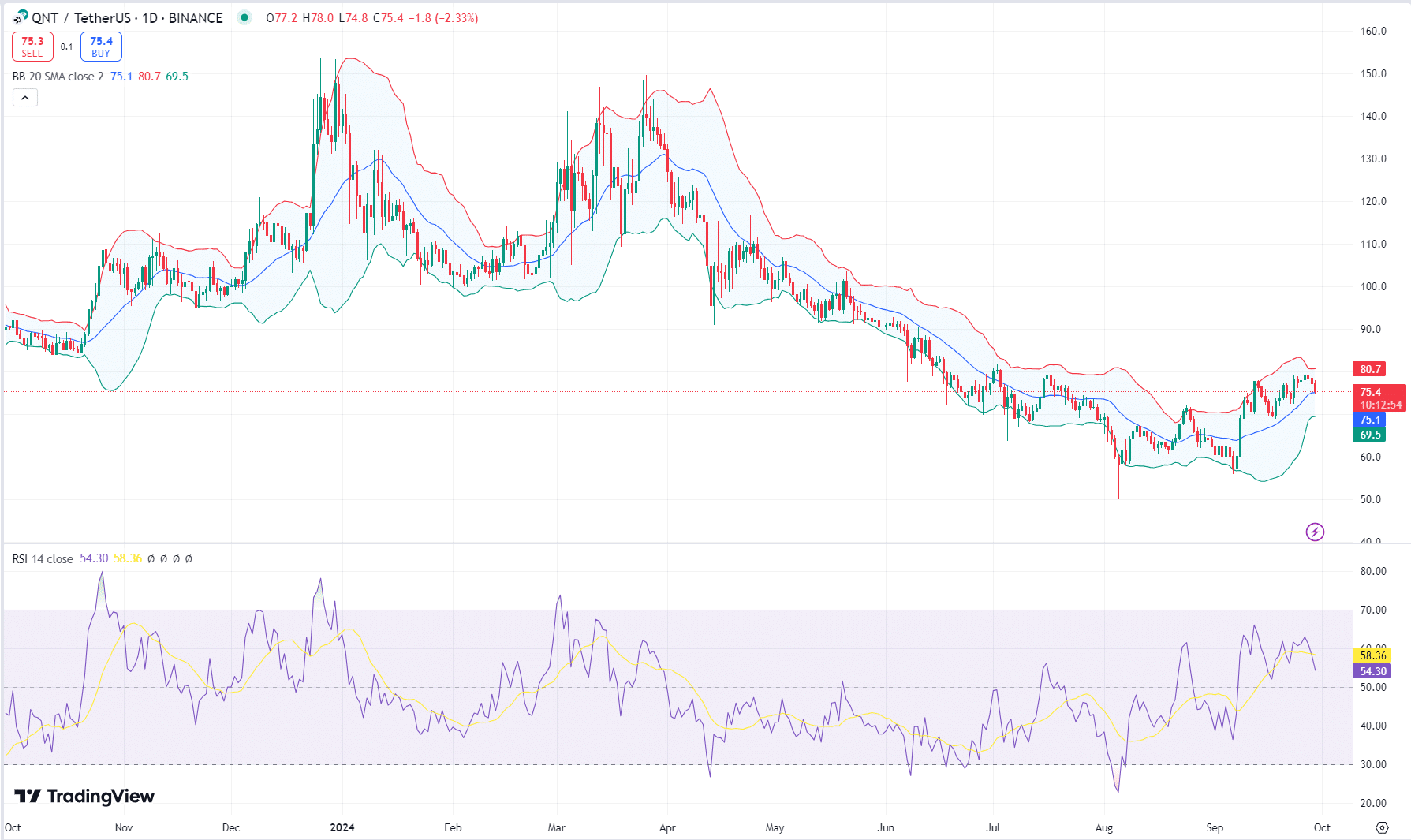

Key resistance ranges and value motion research

QNT just lately examined the $85 resistance stage after a gentle upward thrust previous in September. On the other hand, the associated fee struggled to wreck thru and retraced to the mid-$70 vary. AT press time, the 20-day easy transferring moderate (SMA) was once at $75.1, providing an important improve.

Subsequently, maintaining this stage is necessary for any more bullish continuation. If QNT stays above this threshold, it might retest the higher Bollinger Band round $80.7, offering non permanent reduction for bulls.

Moreover, the Relative Power Index (RSI) at 58.36 signifies neither an overbought nor oversold situation, suggesting room for value motion in both route.

On the other hand, if QNT falls under the $75 stage, the following important improve is close to $69.5. A smash under this improve may just sign a deeper correction, making it tougher for QNT to regain its bullish momentum.

Supply: TradingView

Supply: TradingView

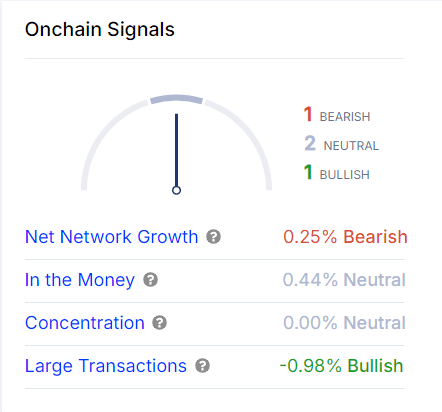

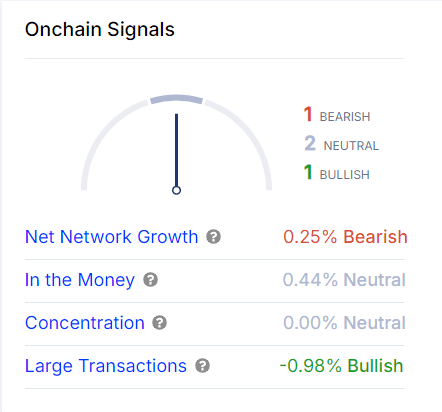

Combined alerts for community enlargement and transactions

Onchain metrics paint a blended image for QNT. Web community enlargement displayed a slight bearish sign, declining through 0.25%, indicating that fewer new individuals are becoming a member of the community.

On the other hand, massive transactions display bullish task, with a nil.98% build up, suggesting that whales and institutional buyers are amassing QNT. In consequence, this is able to result in upward power within the close to time period.

Against this, the “within the cash” metric stays impartial at 0.44%, implying that almost all present holders are neither in important benefit nor loss.

Moreover, the focus of holdings remains unchanged, reinforcing a solid outlook.

Supply: IntoTheBlock

Supply: IntoTheBlock

What can gasoline additional enlargement?

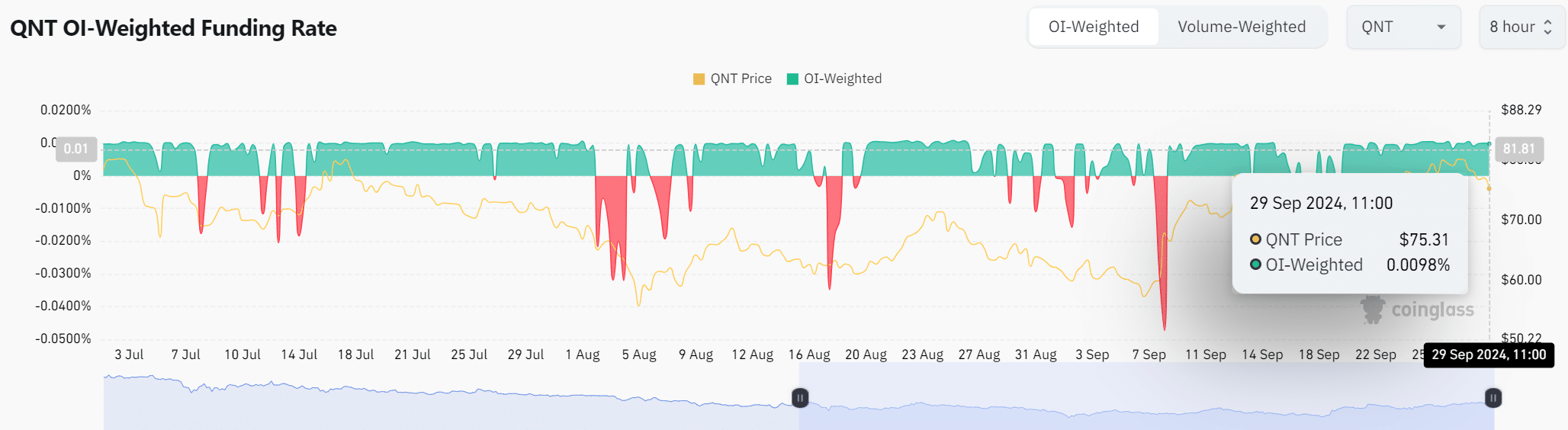

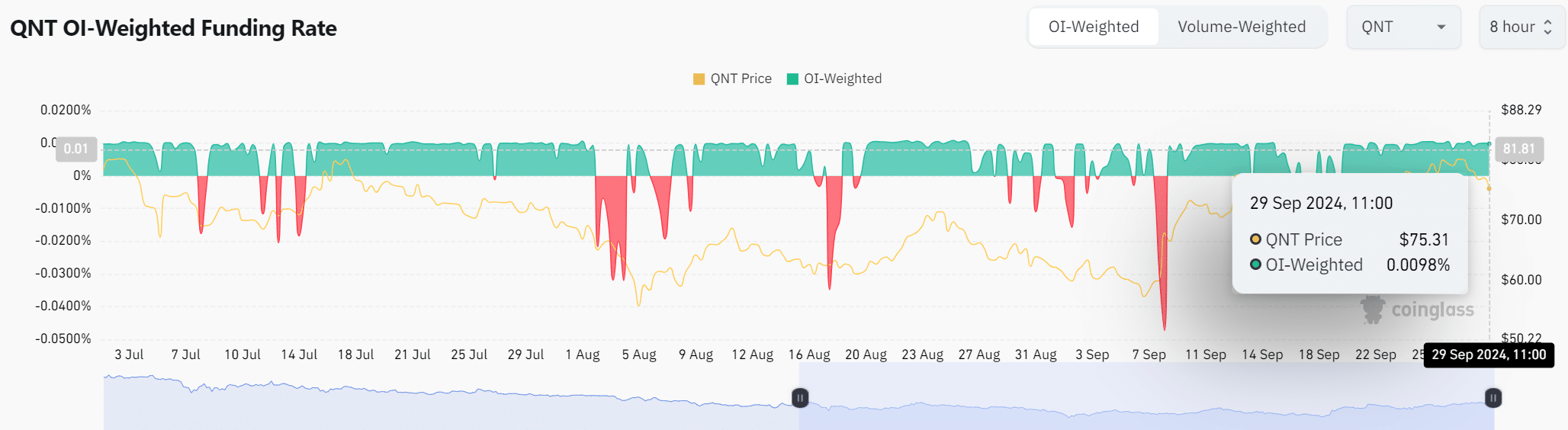

In the meantime, QNT’s OI-Weighted Investment Price printed a somewhat sure development, status at 0.0098% as of the twenty ninth of September.

This slight uptick signaled rising self assurance amongst lengthy positions, and in consequence, futures buyers might push QNT upper within the quick time period.

Learn Quant’s [QNT] value prediction 2023–2024

If the OI-Weighted Investment Price continues to enhance, lets see a bullish rally pushed through derivatives buying and selling.

Supply: Coinglass

Supply: Coinglass

Whilst QNT presentations doable for upward momentum, keeping up the $75 improve stage is significant. The following couple of classes will divulge whether or not QNT can smash the $85 resistance or face every other consolidation section.

Earlier: Will Cardano fall through 20% quickly? Marketplace sentiment says…

Subsequent: Ripple value prediction: What’s subsequent after XRP jumps 7% in 12 hours?