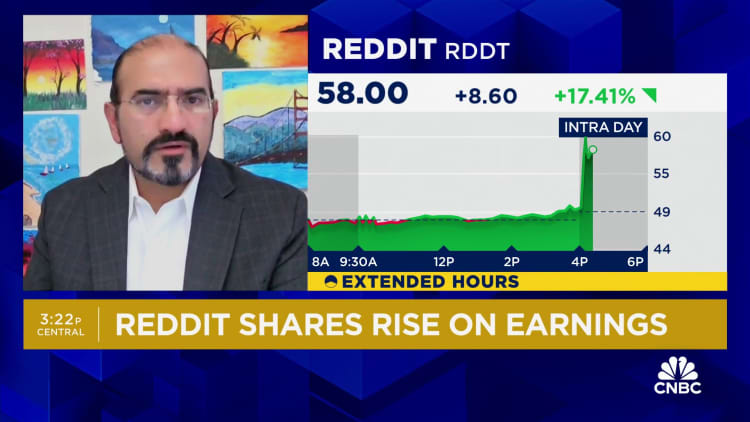

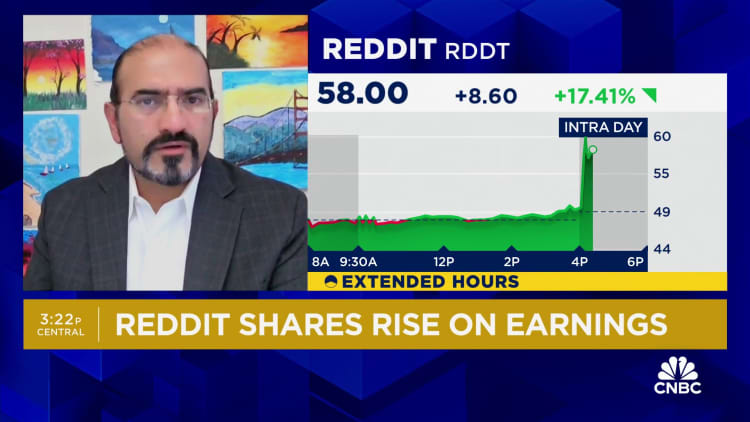

Reddit CEO Steve Huffman hugs mascot Snoo as Reddit starts buying and selling at the New York Inventory Change (NYSE) in New York on March 21, 2024. Timothy A. Clary | AFP | Getty ImagesReddit stocks rallied 14% in prolonged buying and selling on Tuesday after the corporate launched quarterly effects for the primary time since its IPO in March.Here is how the corporate did:Loss in step with percentage: $8.19 loss in step with percentage. That won’t evaluate with the $8.71 loss anticipated by way of LSEGRevenue: $243 million vs. $212.8 million anticipated by way of LSEGRevenue climbed 48% from $163.7 million a 12 months previous. The corporate reported $222.7 million in advert income for the duration, up 39% 12 months over 12 months, which is a sooner price of expansion than at its most sensible competition.Virtual promoting corporations have began rising once more at a wholesome clip after manufacturers reeled in spending to deal with inflation in 2022. Meta’s advert income jumped 27% within the first quarter, adopted by way of 24% expansion at Amazon and 13% expansion at Google father or mother Alphabet.Reddit reported a web lack of $575.1 million. Inventory-based repayment bills and comparable taxes have been $595.5 million, basically pushed by way of IPO fees.For the second one quarter, Reddit expects income of $240 million to $255 million, topping the $224 million anticipated by way of analysts, in step with LSEG. The midpoint of the steering vary suggests expansion of about 32% for the second one quarter, up from $183 million from a 12 months previous.Reddit, which hosts hundreds of thousands of on-line boards on its platform, used to be based in 2005 by way of Alexis Ohanian and Steve Huffman, the corporate’s CEO. “We see this as the start of a brand new bankruptcy as we paintings against construction the following era of Reddit,” Huffman mentioned in a unlock Tuesday.Reddit started buying and selling underneath the ticker image “RDDT” at the New York Inventory Change in March. The corporate priced its IPO at $34 in step with percentage, which valued the corporate round $6.5 billion. When tech valuations have been purple scorching in 2021, Reddit’s non-public marketplace valuation reached $10 billion.The inventory climbed previous $58 in after-hours buying and selling on Tuesday ahead of coming again a little bit. Must the inventory shut above $57.75 on Wednesday, it will be at its easiest since March 26, its fourth day of buying and selling. The stocks closed that day at $65.11, their easiest but.The corporate reported 82.7 million day-to-day energetic customers for its first quarter, up from the 76.6 million anticipated by way of StreetAccount. Moderate income in step with person international rose 8% to $2.94 from $2.72 a 12 months in the past.WATCH: Reddit stocks climb after profits

Reddit stocks jump 14% after corporate experiences income pop in debut profits document