The SEC lawsuit aimed toward classifying XRP as safety has been brushed aside, opening new alternatives for Ripple Labs.

The new FOMC assembly and regulatory readability promise a vibrant long term for virtual sources, whilst discussions on federal reserves escalate.

At the nineteenth of March, Ripple Labs CEO, Brad Garlinghouse, broke the silence over the SEC’s case in opposition to Ripple Labs in a long-anticipated X (previously Twitter) publish.

Consistent with his announcement, the 5-year-old combat ended after a drop in fees aimed toward classifying Ripple [XRP] as a safety within the virtual sources sector.

Due to this information and the new Federal Open Marketplace Committee (FOMC) remark, XRP and the crypto marketplace face new optimism and a brighter long term.

What does this imply for XRP?

Following the SEC’s lawsuit dismissal, XRP surged 12%, pushed through greater buying and selling quantity and heightened purchasing force. Lengthy-term shifting averages signaling a powerful “purchase” counsel attainable accumulation.

In spite of fresh volatility, XRP’s criminal readability positions Ripple Labs to pursue partnerships for sustained enlargement and software. Michael Arrington’s X publish highlights XRP because the best-performing crypto over the last 12 months, 180 days, and 90 days.

Marketplace hypothesis hints at a conceivable partnership between XRP and SWIFT, the worldwide monetary infrastructure chief. This construction may just pave the way in which for secure long-term enlargement for XRP.

FOMC — What are the consequences of the FED’s selections?

Following the FOMC at the nineteenth of March assembly on financial projections has ignited debates about inflation and virtual sources. Fed Chair Jerome Powell stated considerations over the industrial outlook, making an allowance for fresh charge cuts and emerging inflation.

Consistent with Justin Harts on X,

“Central Banks Are Quietly Prepping for Financial Cave in.”

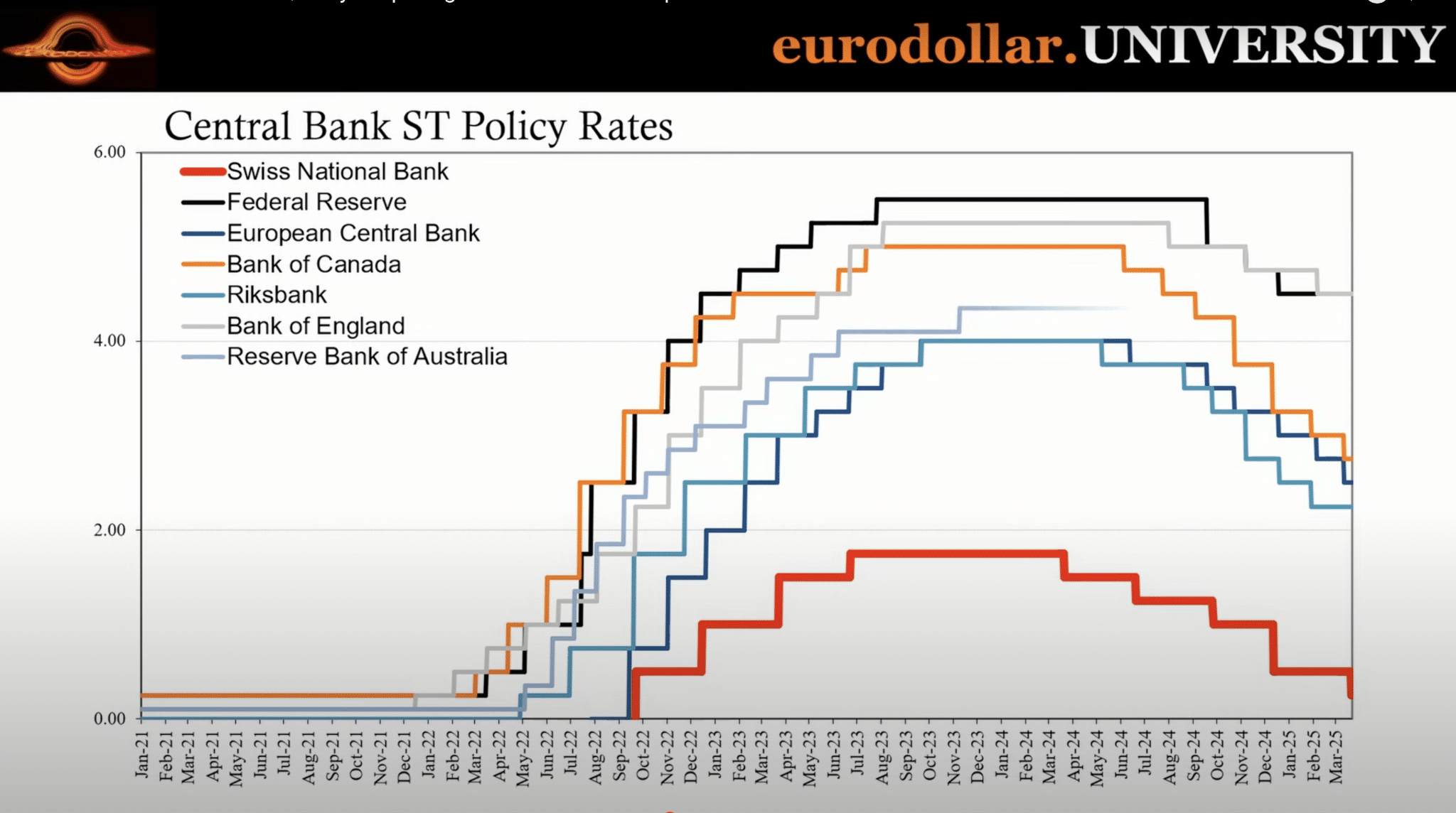

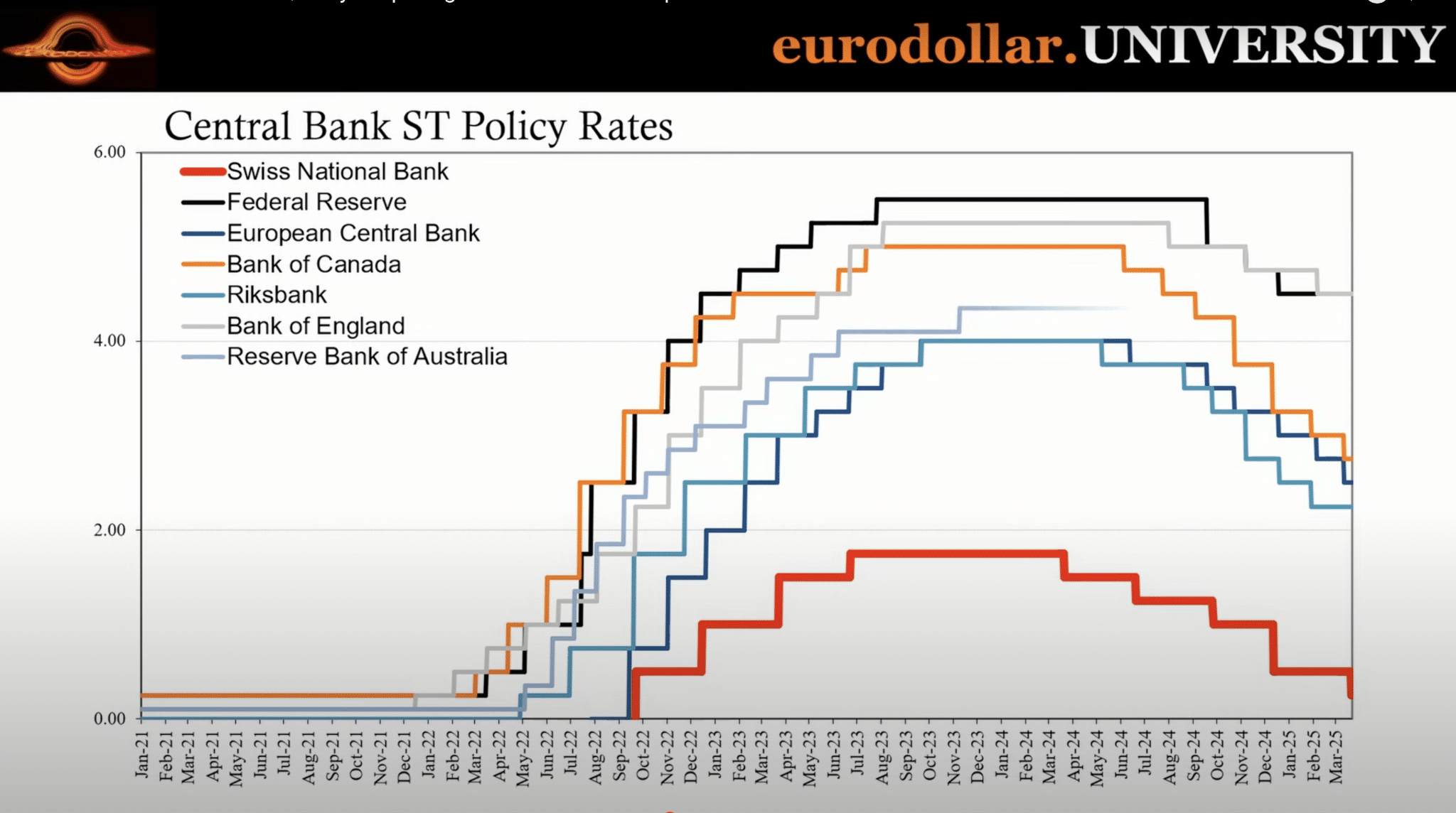

The Central Financial institution Quick-term (ST) Coverage Charges from primary international establishments, together with the Federal Reserve, spotlight ongoing financial uncertainties and inflationary pressures.

Supply: X

Supply: X

Virtual assets- A hedge in opposition to inflation?

Amid international financial uncertainties and Trump price lists, virtual sources like Bitcoin [BTC] and XRP are gaining consideration as hedges in opposition to inflation. Establishments are exploring exchange-traded budget (ETFs) to bridge virtual sources with conventional finance (TradFi).

As crypto adoption and public belief reinforce, governments face mounting force to create transparent regulatory frameworks for blockchain generation, cryptocurrencies, and similar merchandise. Consistent with WatchGuru, President Donald Trump has recommended Congress to move stablecoin regulation.

XRP’s newfound criminal readability has reinforced its place in federal reserves and secured cross-border bills, addressing emerging considerations over inflation and financial instability.

Following fresh international financial uncertainties and Trump price lists, virtual sources together with Bitcoin and XRP have entered the controversy as hedges in opposition to inflation insurance policies. Establishments are making an allowance for exchange-traded budget (ETFs) as virtual sources merging with conventional finance (TradFi).

As crypto adoption and certain public belief develop, governments face force to determine transparent regulatory frameworks referring to blockchain generation, its merchandise, and cryptocurrencies.

Particularly, in his pre-recorded speech on the Virtual Asset Summit, President Donald Trump known as on Congress to move crypto stablecoin regulation.

Undoubtedly XRP’s freedom has opened the door for crypto’s stance in federal reserves, and protected cross-border bills, as fears of inflation and financial uncertainty upward thrust.

Earlier: Hyperliquid whales quick Bitcoin as institutional buyers stay purchasing – Defined

Subsequent: TRON meets Solana – All about Justin Solar’s newest crypto energy play

:max_bytes(150000):strip_icc()/GettyImages-2224487383-63838dbfa1fb4b33bd1894fca6dd3b70.jpg)