WLD’s value noticed a double-digit hike over the process the final buying and selling consultation

Futures buyers don’t seem to be satisfied about its newest value strikes despite the fact that

Worldcoin initiated but some other token release previous within the week, an episode that regularly activates vital marketplace reactions. Alternatively, the altcoin’s value reaction used to be tepid. Actually, regardless of the token release, its value motion used to be now not vital sufficient to shift general dealer sentiment undoubtedly.

This wary or unfavourable sentiment used to be in particular obtrusive within the Futures marketplace.

Worldcoin commences unlocks

Equipment for Humanity (TFH), the advance workforce at the back of the Worldcoin challenge, just lately introduced a vital alteration to the release time table of its local token, Worldcoin (WLD).

Detailed in a weblog publish dated 16 July, the unique plan used to be set for an release length of 3 years. Alternatively, this timeline has been prolonged, with 80% of the WLD tokens held via workforce participants and traders now scheduled to turn out to be obtainable over 5 years, ranging from 24 July 2024.

Below the brand new association, the unlocking of those tokens will happen step by step throughout 4 years, concluding via the top of July 2028. This prolonged time table is most probably geared toward managing marketplace provide and stabilizing the token’s value via keeping off a unexpected inflow of a giant quantity of tokens into the marketplace.

How did Worldcoin react?

Worldcoin has skilled a sequence of fluctuations in its marketplace efficiency over the last week.

To begin with, the token used to be on a downtrend for greater than seven days. Alternatively, on 24 July, coinciding with the beginning of the token release match, Worldcoin noticed a modest hike of one.32%, which nudged its value from roughly $2.1 to $2.2. Tomorrow, the token skilled a setback with a decline of over 4%, bringing it again to $2.1.

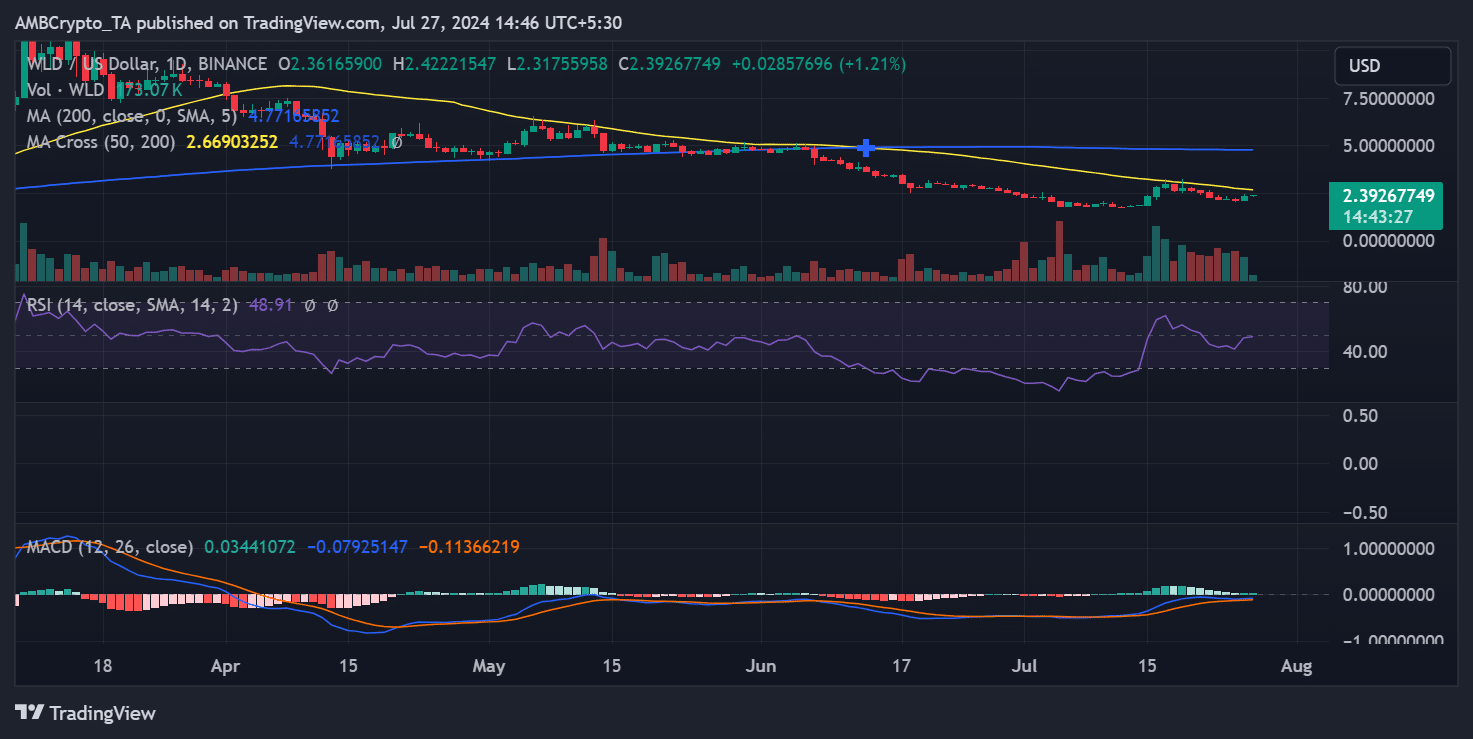

Regardless of those fluctuations, a vital certain shift took place on 26 July. In keeping with AMBCrypto’s research, WLD’s value jumped via 11.74%, attaining the $2.3 stage. This uptrend endured moderately, bringing the associated fee to about $2.4, with an extra build up of over 1%.

Regardless of those good points, then again, the craze has now not but became bullish.

Technical research additional highlighted that its temporary shifting reasonable (yellow line) nonetheless posed as a direct resistance at roughly $2.7 to $3. Overcoming those ranges could be a very powerful for the token to ascertain a extra powerful bullish development.

Supply: TradingView

Supply: TradingView

Moreover, the Relative Power Index (RSI), soaring across the impartial line, urged that the asset used to be at the cusp of getting into bullish territory – Contingent at the sustainability of new certain developments.

WLD buyers display unfavourable sentiment

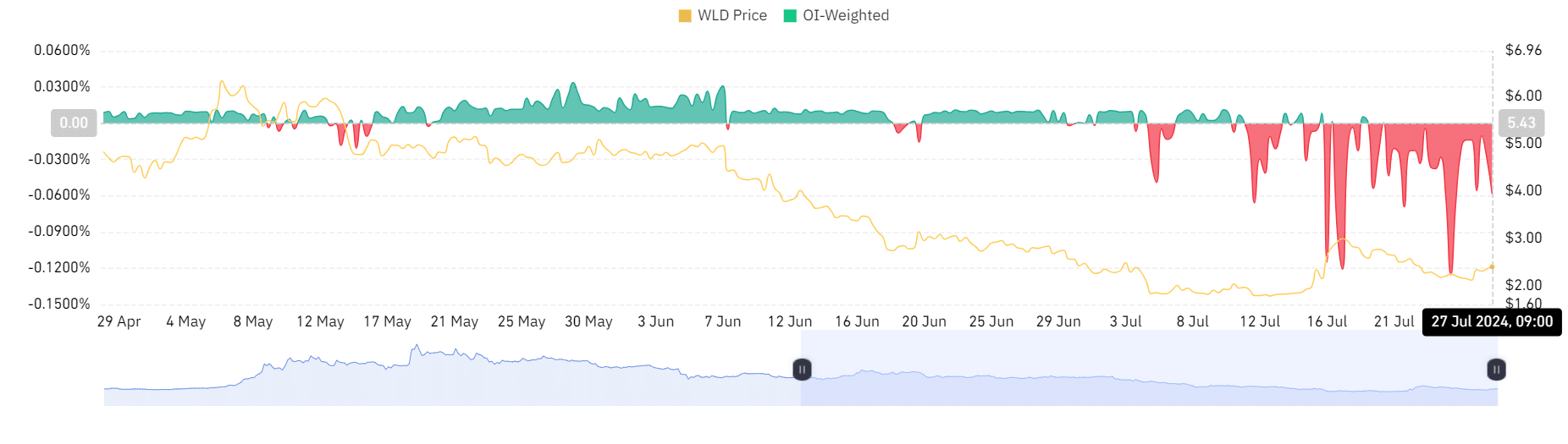

An research of Worldcoin (WLD) buying and selling metrics on Coinglass printed bearish sentiment amongst buyers, as indicated via the existing lengthy/quick ratio and investment fee developments.

In particular, the lengthy/quick ratio urged that there were extra quick positions than lengthy positions on Worldcoin. Merely put, buyers are having a bet on a decline within the token’s value quite than a hike.

Supply: Coinglass

Supply: Coinglass

– Is your portfolio inexperienced? Take a look at the Worldcoin Benefit Calculator

After all, the investment fee for WLD has been trending under 0, with the click time fee at roughly -0.058%.

A unfavourable investment fee normally implies that shorts are paying longs to stay their positions open, which is commonplace in markets the place there’s a consensus that costs will drop. This situation perceived to point out that dealers are dominating the marketplace, exerting downward power at the token’s value.