Rivian (RIVN) launched its second-quarter income after the marketplace closed on Tuesday because the EV maker aggressively cuts prices. CEO RJ Scaringe known as the quarter a “defining one” as Rivian eyes its first gross benefit via the tip of the yr. Right here’s a breakdown of Rivian’s Q2 2024 income.

Rivian moment quarter income preview

After handing over 13,790 automobiles in Q2, up somewhat from the primary 3 months of 2024, Rivian expects output to ramp up in the second one part of the yr.

Because of a deliberate shutdown at its Commonplace, IL manufacturing unit in April, Rivian’s manufacturing slipped from over 17,500 in This fall 2023 to 13,980 in Q1, with simply 9,612 in-built the second one quarter of 2024.

Rivian has offered drastic charge financial savings measures, together with production upgrades and provider contracts. Over 100 steps from the battery-making procedure, 50 elements from the frame store, and 500 portions from design were eradicated.

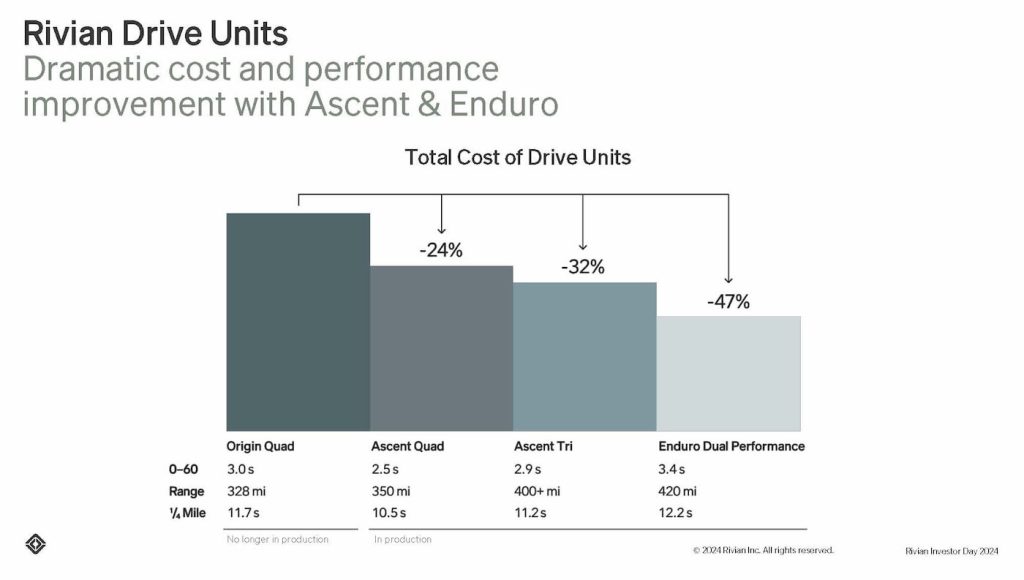

With its new in-house power gadgets, Rivian cuts 47% of the prices in comparison to its Starting place Quad motor. Rivian expects the rage to proceed as new tech rolls out.

We posted an income preview the previous day on what to anticipate from Rivian’s Q2 file. Rivian misplaced any other $1.4 billion in Q1 however expects to succeed in its first sure gross benefit via the tip of the yr.

(Supply: Rivian)

(Supply: Rivian)

In keeping with Estimize, Rivian is anticipated to file a lack of $1.17 in step with percentage on income of $1.18 billion in Q2. Wall Side road expects somewhat much less, with a lack of $1.24 in step with percentage on income of $1.15 billion.

Rivian Q2 2024 income breakdown

Rivian made “important development using higher charge potency, bettering its merchandise, additional strengthening its stability sheet, validating the differentiated nature of its generation stack, and setting up new industry alternatives” in Q2.

(Supply: Rivian)

(Supply: Rivian)

CEO RJ Scaringe mentioned the second one quarter used to be a “defining one for Rivian.” Rivian reported income of $1.158 billion, assembly Wall St expectancies.

Rivian’s gross loss higher somewhat year-over-year to $451 million in comparison to $412 million in Q2 2023.

Rivian Q2 2024 income: $1.158 billion vs $1.15 billion anticipated

Rivian Q2 2024 EPS: (-$1.13) vs (-$1.15) anticipated

The EV maker mentioned decrease promoting costs and not more potency because of the plant shutdown led to raised losses. In consequence, Rivian posted a web lack of $1.46 billion, about flat from the $1.48 billion Q1 loss.

Rivian misplaced $32,705 on each automobile in-built Q2, an growth from the $38,784 loss in Q1 however nonetheless upper than the $30,500 loss in Q3 2023.

Rivian ended Q2 with $7.87 billion in money and equivalents. Together with its revolving credit score facility, Rivian had $9.18 billion in liquidity.

Rivian R1T (left) and R1S (proper) electrical automobiles (Supply: Rivian)

Rivian R1T (left) and R1S (proper) electrical automobiles (Supply: Rivian)

The stability contains $1 billion from Volkswagen as a part of its fresh partnership. Rivian signed a handle Volkswagen in June to make use of its instrument experience to create a next-gen EV structure. Volkswagen will make investments as much as $5 billion, $3 billion of which can cross to Rivian and $2 billion to the three way partnership. Alternatively, the investments are in line with hitting positive milestones.

Q3 ’22Q4 ’22Q1 ’23Q2 ’23Q3 ’23Q4 ’23Q1 ’24Q2 ’24Rivian loss in step with automobile$139,277$124,162$67,329$32,594$30,500$43,372$38,784$32,705Rivian loss in step with automobile via quarter

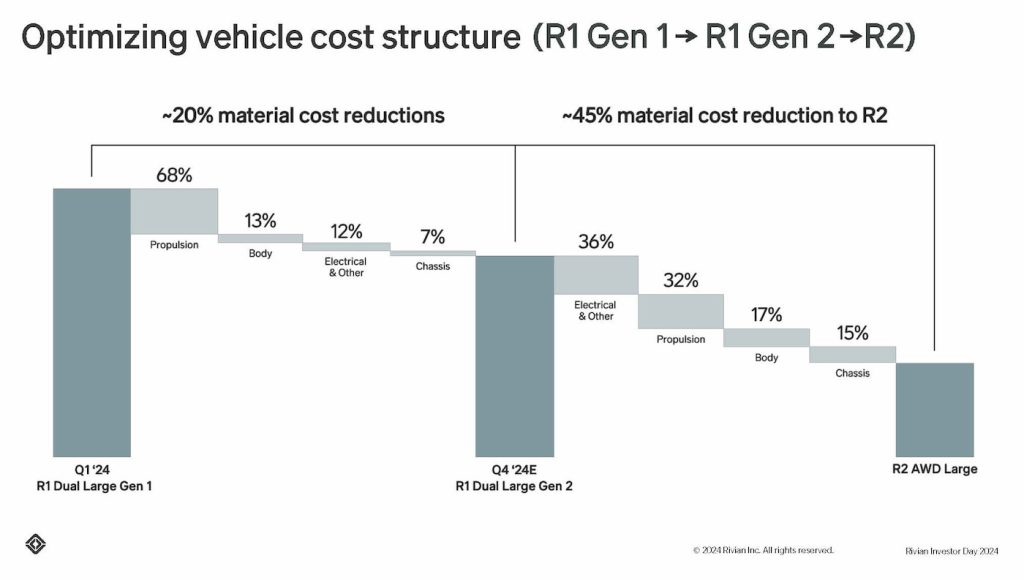

After launching its second-gen R1 fashions previous this summer season, Rivian expects a 20% subject material charge relief in comparison to the primary technology.

Following the upgrades, Rivian expects its R1 manufacturing line price to be 30% extra environment friendly, which must assist ramp up output into the tip of 2024.

Manufacturing at Rivian’s Commonplace, IL plant (Supply: Rivian)

Manufacturing at Rivian’s Commonplace, IL plant (Supply: Rivian)

Having a look forward

Rivian is assured it’ll succeed in a good gross benefit in This fall 2024. The corporate is beginning to see affects from upgrades at its Commonplace, IL plant and expects to look extra ends up in the second one part of the yr.

The corporate reaffirmed that it’s on course to construct 57,000 automobiles this yr and earn $2.7 billion in adjusted EBITDA.

Rivian R2 (Supply: Rivian)

Rivian R2 (Supply: Rivian)

Having a look additional out, Rivian expects the momentum to boost up with the lower-cost R2 launching in early 2026. Beginning at $45,000, Rivian’s R2 is anticipated to open up an enormous marketplace.

In keeping with Rivian’s Vice President of Production Tim Fallon, the R2 has “neatly over 100,000” pre-orders and continues to climb.

Rivian’s next-gen R2, R3, and R3X (Supply: Rivian)

Rivian’s next-gen R2, R3, and R3X (Supply: Rivian)

Scaringe lately defined that R2 is “worlds other” than the Tesla Style Y, the benchmark within the EV business.

When R2 manufacturing starts in early 2026, Rivian expects plant output to achieve 215,000 gadgets yearly, up from round 150,000. The R2 will account for approximately 155,000, with the R1S and R1T at about 85,000.

Take a look at again for more information following Rivian’s income name with traders at 5 pm ET. We’ll stay you up to date on the most recent beneath.

FTC: We use source of revenue incomes auto associate hyperlinks. Extra.